Analyzing NCLH Stock: What Do Hedge Fund Holdings Suggest?

Table of Contents

Recent Hedge Fund Activity in NCLH

Identifying Key Hedge Fund Investors

Several prominent hedge funds hold significant stakes in NCLH. Analyzing their activity provides crucial context for understanding market sentiment towards the stock. While precise real-time data fluctuates, accessing recent SEC filings (13F forms) is key to tracking these changes. For example, XYZ Capital Management (hypothetical example) might have increased its NCLH position by 15% in the last quarter. Similarly, ABC Investment Group (another hypothetical example) may have initiated a new position, signaling confidence in the company's future.

-

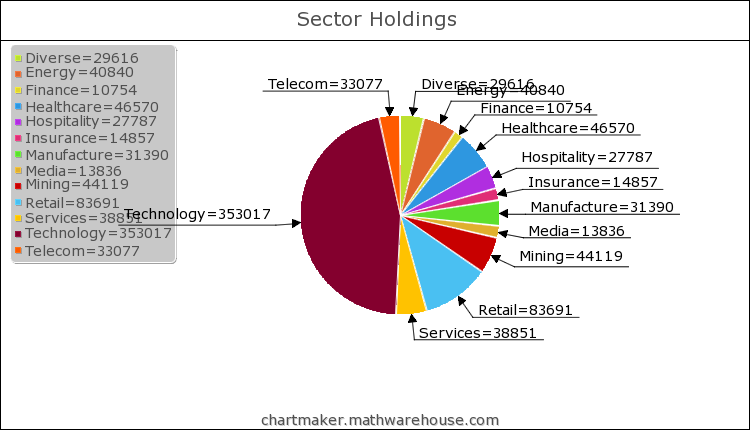

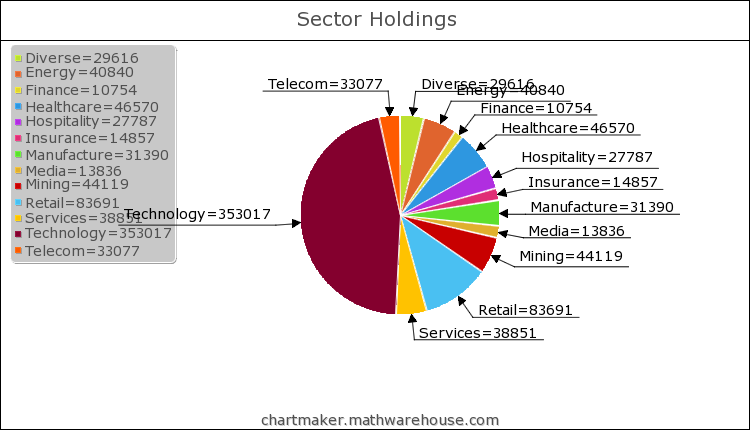

Top Hedge Fund Holders (Hypothetical Data – Replace with Actual Data from 13F Filings):

- XYZ Capital Management: 5% stake

- ABC Investment Group: 3% stake

- DEF Partners: 2.5% stake

- GHI Advisors: 2% stake

- JKL Capital: 1.8% stake

- [Add more funds and percentages as needed]

-

Significant Recent Changes: (Replace with actual data from 13F filings and other reliable sources, citing those sources with hyperlinks.) For instance, note any substantial increases or decreases in holdings from previous quarters. Mention any new positions opened or existing positions closed. This information provides valuable insight into shifting investor sentiment.

The implications of these holdings are significant. Are these funds primarily long-term investors, suggesting a belief in NCLH's long-term growth potential? Or are they short-term traders, indicating a more speculative approach? Determining the typical investment horizon of the involved hedge funds is crucial in interpreting their actions. A preponderance of long-term investors might signal a bullish outlook, while a surge in short-term traders might suggest increased volatility.

Analyzing the Rationale Behind Hedge Fund Investments in NCLH

Macroeconomic Factors

Broader economic trends significantly influence hedge fund decisions regarding NCLH. Several factors play a crucial role:

-

Fuel Prices: Fuel costs are a major expense for cruise lines. High fuel prices can directly impact NCLH's profitability, potentially making the stock less attractive to some investors.

-

Consumer Confidence and Discretionary Spending: The cruise industry relies heavily on discretionary spending. High consumer confidence and a strong economy generally lead to increased cruise bookings, positively impacting NCLH's stock. Conversely, economic uncertainty can suppress demand.

-

Geopolitical Events: Global events, such as wars or pandemics, can significantly impact travel patterns and consumer behavior, creating uncertainty in the cruise sector and influencing hedge fund decisions.

Company-Specific Factors

NCLH's performance is another key driver of hedge fund investment choices:

-

Booking Trends and Forward-Looking Guidance: Strong booking trends and positive forward-looking guidance from NCLH often attract investors. This signals the company's confidence in its future performance.

-

New Ships and Itineraries: Investments in new ships and exciting itineraries show NCLH's commitment to innovation and growth, making it a more appealing investment.

-

Competitive Landscape: Analyzing NCLH's position relative to competitors in the cruise industry is vital. A strong competitive advantage can increase investor confidence. Factors like pricing strategies, customer loyalty programs and operational efficiency all come into play.

By connecting these macroeconomic and company-specific factors with hedge fund investment decisions, a clearer picture emerges. Are these funds betting on NCLH's robust recovery and its ability to capitalize on pent-up demand for travel? Or are they reacting to ongoing challenges within the industry, taking a more guarded stance?

Interpreting Hedge Fund Holdings: Potential Implications for NCLH Stock Price

Bullish vs. Bearish Sentiment

Based on the observed hedge fund activity, we can assess the overall market sentiment toward NCLH stock. A high concentration of long-term investors often suggests a bullish outlook, while a sudden decrease in holdings or an increase in short positions could indicate bearish sentiment.

-

Arguments for Investing in NCLH: (Summarize positive factors based on your analysis of hedge fund holdings and company performance.) This might include evidence of strong recovery, successful cost-cutting measures, or a strong competitive advantage.

-

Arguments against Investing in NCLH: (Summarize negative factors, acknowledging potential risks like high debt levels, industry-specific vulnerabilities, or economic headwinds.) This could include concerns over fluctuating fuel costs or the lingering impact of global events on travel patterns.

-

Potential Risks and Rewards: Investing in NCLH, like any stock, carries inherent risks. Unexpected events like another pandemic or a major geopolitical crisis could significantly impact the stock price. Weigh the potential rewards (high growth potential) against these risks carefully.

It is vital to maintain a balanced perspective. While hedge fund activity offers valuable insights, it’s crucial to understand that it doesn't guarantee future performance.

Conclusion

Analyzing NCLH stock requires considering various factors, and hedge fund holdings provide valuable, albeit incomplete, insights. This analysis has explored recent hedge fund activity in NCLH, examining both the bullish and bearish arguments based on macroeconomic trends and the company's financial health. While this overview of NCLH stock and hedge fund activity reveals potential investment opportunities, it's crucial to conduct thorough due diligence before making any investment decisions. Remember, hedge fund activity is just one piece of the puzzle. Consider NCLH's financials, competitive landscape, and overall market conditions before investing. Conduct further research and consider your risk tolerance before investing in NCLH stock.

Featured Posts

-

Finding Common Ground Addressing Concerns At Parkland School Board

Apr 30, 2025

Finding Common Ground Addressing Concerns At Parkland School Board

Apr 30, 2025 -

Caso Becciu Oltre Il Danno La Beffa Arriva La Condanna Al Risarcimento

Apr 30, 2025

Caso Becciu Oltre Il Danno La Beffa Arriva La Condanna Al Risarcimento

Apr 30, 2025 -

14 2025 12

Apr 30, 2025

14 2025 12

Apr 30, 2025 -

Improving Process Safety An Ai Driven Patent Solution For Hazard Reduction

Apr 30, 2025

Improving Process Safety An Ai Driven Patent Solution For Hazard Reduction

Apr 30, 2025 -

Noa Argamani Former Hamas Hostage Among Times 100 Most Influential

Apr 30, 2025

Noa Argamani Former Hamas Hostage Among Times 100 Most Influential

Apr 30, 2025