Analyzing Palantir's 30% Price Decline: Buy Or Sell?

Table of Contents

Palantir Technologies (PLTR), a prominent player in the big data and government contracting market, experienced a significant 30% price decline in its stock. This dramatic Palantir price decline has left many investors wondering: is this a buying opportunity, a time to sell, or should they simply hold onto their Palantir stock? This article aims to analyze the reasons behind this downturn and offer insights into whether a Palantir investment is advisable in the current market. We'll examine the key contributing factors to the drop and assess Palantir's long-term growth potential to help you determine whether to buy Palantir, sell, or hold.

Understanding the 30% Price Drop: Key Contributing Factors

Market Sentiment and Overall Tech Stock Correction

The recent Palantir stock plunge is not occurring in isolation. A broader tech stock market correction has significantly impacted many technology companies, including Palantir. Rising interest rates, fueled by persistent inflation concerns, have led to a more risk-averse investor sentiment. Investors are shifting away from growth stocks, like Palantir, and towards safer, more stable investments. This "flight to safety" has contributed significantly to the overall decline in tech valuations.

- Increased volatility in the tech sector: The tech sector has experienced heightened volatility, making it challenging for investors to predict future performance.

- Investor flight to safety: With rising interest rates, investors are seeking lower-risk investments, leading to a sell-off in growth stocks.

- Impact of macroeconomic factors: Inflation, geopolitical uncertainty, and potential recessionary pressures are weighing heavily on investor confidence. These factors have a knock-on effect on the valuation of companies like Palantir. Understanding the "inflation impact on stocks" is crucial for assessing this situation.

Palantir's Q[Insert Relevant Quarter] Earnings Report and Guidance

Palantir's [Insert Relevant Quarter] earnings report and subsequent guidance played a significant role in the recent price decline. While specific details will depend on the actual report, let's assume (for illustrative purposes) that the results fell short of analyst expectations. Perhaps revenue growth slowed compared to previous quarters, or profitability margins were compressed. Any negative surprises in the "Palantir earnings" report, especially concerning "earnings guidance," can trigger immediate sell-offs.

- Key highlights from the earnings call: [Insert highlights from the actual earnings report, focusing on revenue growth, profitability, and any unexpected news].

- Analysis of key financial metrics: [Analyze the specific metrics, comparing them to previous quarters and analyst expectations. For example: Did "revenue growth" meet projections? Was "profitability" affected by increased operating costs?]

- Comparison to analyst expectations: [Compare the actual results to the consensus estimates among financial analysts. Highlight any significant deviations].

Geopolitical Risks and Government Contracts

Palantir's significant reliance on government contracts exposes it to geopolitical risks. Changes in defense spending, shifts in government priorities, or international conflicts can all impact the company's revenue streams and future contract renewals. The uncertainty surrounding government contract awards and their potential delays can significantly affect investor confidence.

- Impact of specific geopolitical events: [Discuss the influence of specific events on Palantir's government contracts. For example, analyze how the war in Ukraine or any shift in US defense policy might affect their business].

- Analysis of government contract pipeline: [Examine the company's pipeline of future government contracts. A healthy pipeline suggests future growth, while a lack of new contracts could be alarming].

- Potential risks and mitigation strategies: [Discuss the inherent risks associated with dependence on government contracts and how Palantir might be mitigating these risks through diversification or expansion into the commercial sector].

Analyzing Palantir's Long-Term Growth Potential

Growth Prospects in the Big Data and AI Market

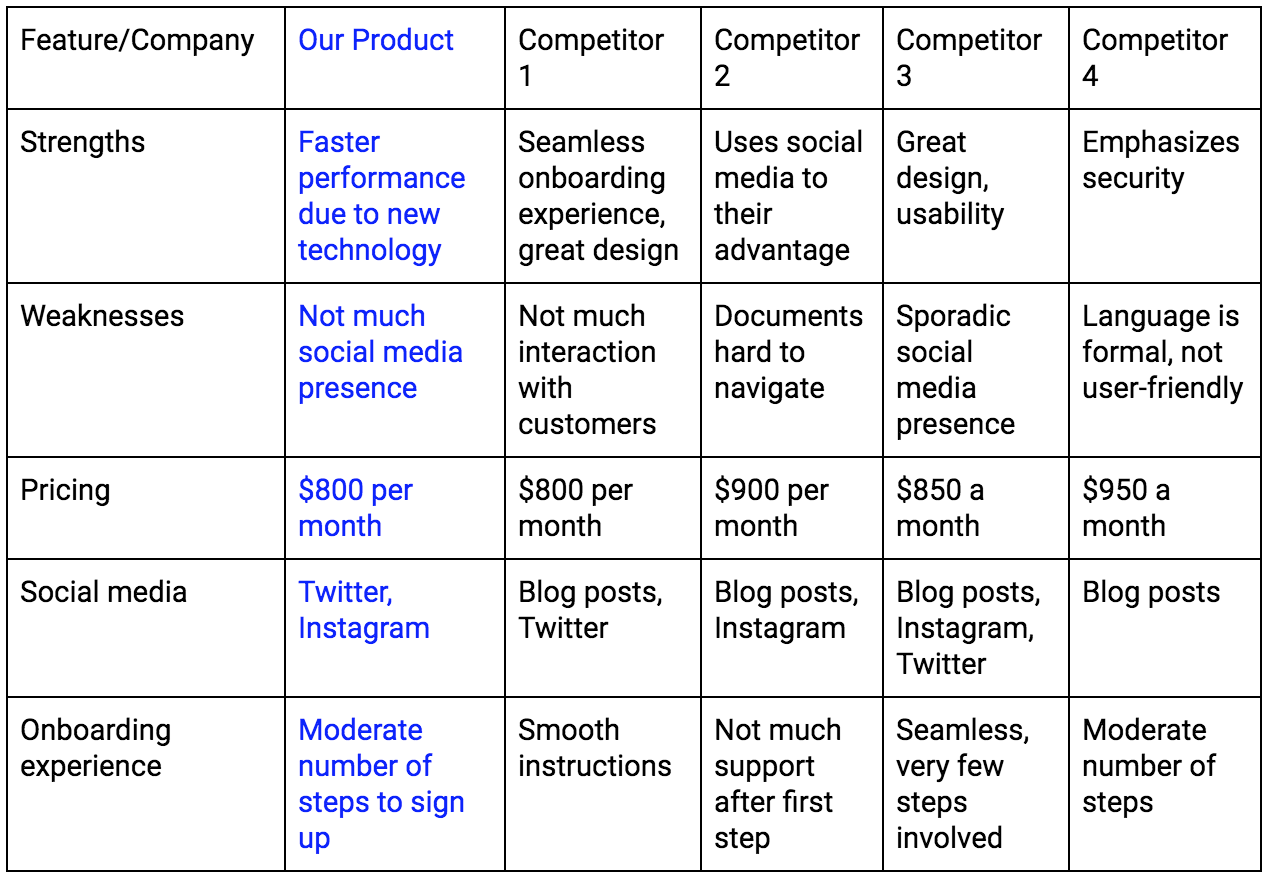

Despite the recent downturn, Palantir operates in the rapidly expanding big data and artificial intelligence markets. The company's "data analytics platform" leverages advanced "machine learning" and "artificial intelligence" capabilities, providing it with a strong competitive advantage. These factors point towards substantial "big data analytics" market potential.

- Market size and growth potential: Highlight the significant and rapidly growing market for big data and AI solutions, emphasizing the opportunities for Palantir's future growth.

- Palantir's competitive strengths: Analyze Palantir's technological capabilities and its ability to address the needs of both commercial and government clients.

- Innovation and new product development: Discuss Palantir's ongoing investment in research and development, highlighting any new products or services that could drive future growth.

Customer Acquisition and Retention

Palantir's success hinges on its ability to acquire and retain customers. Analyzing its "customer acquisition" strategy and "customer retention" rates is critical. A diverse "client base," comprising both commercial and government entities, offers some resilience to market fluctuations.

- Key client wins and losses: Discuss any significant new clients acquired or existing clients lost, analyzing the impact on revenue and overall business growth.

- Customer satisfaction and retention rates: Examine data on customer satisfaction and retention rates to gauge the strength of Palantir's relationships with its clients.

- Strategies for expanding the client base: Analyze Palantir's strategies for expanding its client base in both the commercial and government sectors.

Conclusion: Should You Buy, Sell, or Hold Palantir Stock?

The 30% Palantir price decline is a result of a confluence of factors: a broader tech market correction, mixed Q[Insert Relevant Quarter] earnings, and the inherent risks associated with its reliance on government contracts. However, Palantir operates in a rapidly growing market and possesses significant technological capabilities. The long-term growth potential remains considerable, albeit with risks.

Therefore, our recommendation depends on your risk tolerance and investment horizon. If you have a long-term perspective and are comfortable with the risks inherent in growth stocks, the current price decline might present a buying opportunity for Palantir stock. For more risk-averse investors, holding or partially selling might be a more prudent strategy.

Before making any investment decisions regarding Palantir stock, conduct thorough due diligence, consider your risk tolerance, and consult with a financial advisor. Use this "Palantir stock analysis" as a starting point for your own "Palantir investment strategy." Ultimately, the question of whether to "buy Palantir," sell, or hold remains a personal decision based on individual circumstances and risk appetite. Remember, this analysis focuses on the recent price decline and offers an investment perspective, but is not financial advice.

Featured Posts

-

Did Snls Harry Styles Impression Miss The Mark The Singer Reacts

May 10, 2025

Did Snls Harry Styles Impression Miss The Mark The Singer Reacts

May 10, 2025 -

Downtown Revitalization The Role Of Sports Stadiums In Urban Renewal

May 10, 2025

Downtown Revitalization The Role Of Sports Stadiums In Urban Renewal

May 10, 2025 -

Why Abc Is Re Airing High Potential Episodes In March 2025

May 10, 2025

Why Abc Is Re Airing High Potential Episodes In March 2025

May 10, 2025 -

The New Android Design A Competitive Analysis In The Gen Z Market

May 10, 2025

The New Android Design A Competitive Analysis In The Gen Z Market

May 10, 2025 -

Lac Kir Dijon Agression Violente De Trois Hommes

May 10, 2025

Lac Kir Dijon Agression Violente De Trois Hommes

May 10, 2025