Analyzing Palantir's High P/E Ratio: Past Performance And Future Prospects

Table of Contents

Palantir's Past Performance and Revenue Growth

Revenue Trajectory and Growth Rate

Palantir's revenue growth has shown a fluctuating but generally upward trend. Analyzing Palantir's revenue growth reveals periods of significant acceleration and some periods of deceleration, reflecting the cyclical nature of large government contracts and the ramp-up of commercial partnerships.

- 2020: Experienced substantial revenue growth, driven by increased demand for its data analytics platforms.

- 2021: Continued growth, but at a slightly slower pace compared to 2020.

- 2022: Showed further growth, indicating continued market acceptance of Palantir's offerings.

This growth is attributable to key contracts secured with both government and commercial clients. Analyzing Palantir revenue growth over the long term shows a consistent trend of expansion, although the pace of this expansion has varied from year to year. Key factors impacting Palantir revenue growth include the successful onboarding of new clients and expansion of existing contracts. Understanding this trajectory is crucial to assessing Palantir's overall financial performance.

Profitability and Margin Analysis

Examining Palantir's profitability reveals a complex picture. While revenue has been growing steadily, profitability has lagged, a key factor contributing to its high P/E ratio. The company has focused on significant growth investments, impacting short-term profitability metrics.

- Gross Margin: Generally strong, reflecting the high value and specialized nature of Palantir's offerings.

- Operating Margin: Has historically been negative, primarily due to substantial investments in research and development, sales and marketing, and general administrative expenses.

- Net Income: Has fluctuated, reflecting the interplay between revenue growth and significant operating expenses.

Palantir's profitability, or lack thereof in certain periods, significantly influences its valuation. Cost-cutting measures and a focus on efficiency are likely to play a significant role in shaping future profitability and the sustainability of Palantir's high growth trajectory.

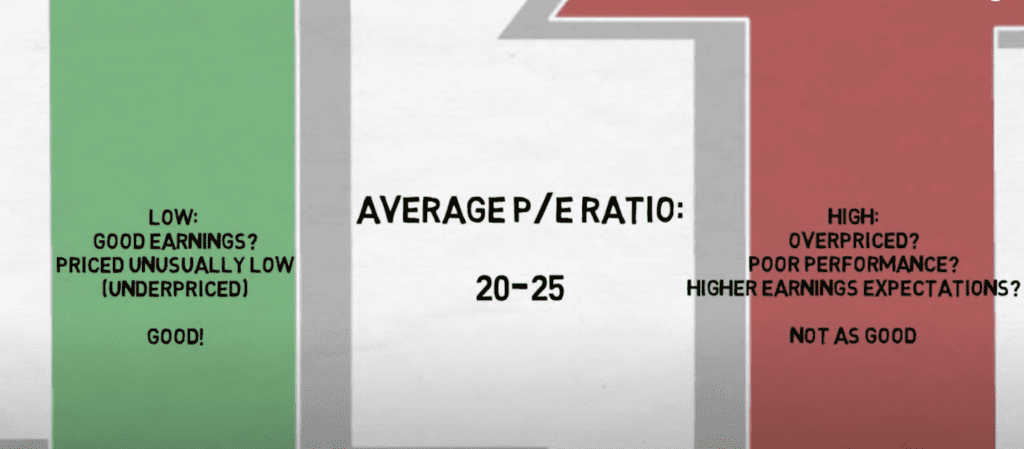

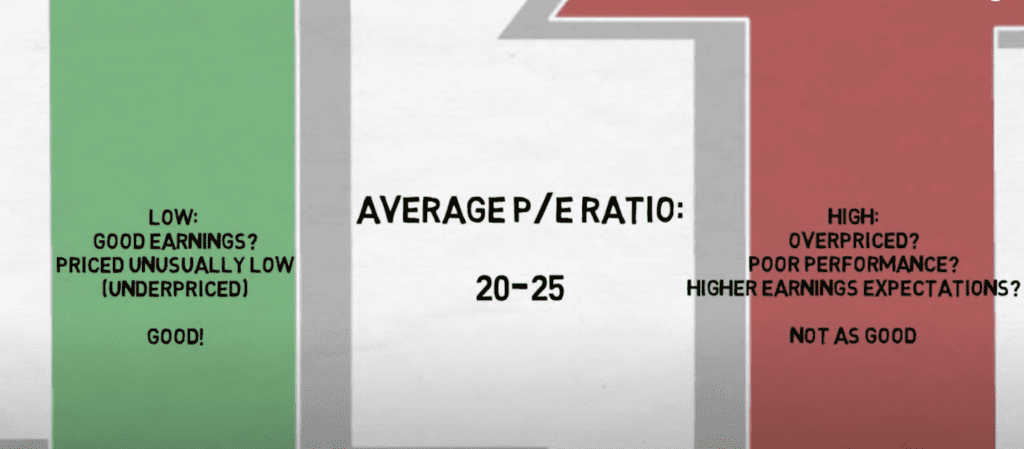

Understanding Palantir's High P/E Ratio

Valuation Metrics and Comparisons

Palantir's high P/E ratio stands out compared to many industry peers. This elevated valuation is not unusual for companies with high growth potential but carries inherent risk.

- Peer Comparison: A comparison of Palantir's P/E ratio with established players in the data analytics and software sectors reveals a higher multiple, reflecting the market's expectation of future growth and the unique nature of Palantir's offerings.

- Factors Contributing to High Valuation: Investors are betting on Palantir's ability to capitalize on the growing demand for advanced data analytics and its potential for significant long-term growth. This expectation of future growth justifies, at least in part, the higher P/E ratio. However, substantial risks are also associated with this valuation.

Analyzing Palantir valuation requires a comprehensive understanding of both the upside potential and the inherent risks involved in investing in a high-growth, albeit currently unprofitable, technology company.

Growth Expectations and Future Projections

Market analysts offer diverse projections for Palantir's future growth, which play a crucial role in justifying (or questioning) its high P/E ratio.

- Analyst Target Prices: Vary widely, indicating a significant degree of uncertainty surrounding Palantir's future performance. Some analysts remain bullish, while others express more cautious optimism.

- Consensus Growth Forecasts: While growth is expected, there is no universal agreement on the rate or sustainability of this growth. Factors like competition and macroeconomic conditions could significantly influence future performance.

- Potential Risks to Future Growth: These include intense competition in the data analytics market, dependence on government contracts, and the need to consistently deliver innovative products and services. These risks need careful consideration when assessing Palantir's stock valuation.

Key Factors Influencing Palantir's Future Prospects

Government Contracts and Commercial Partnerships

Palantir's revenue stream is a mix of government and commercial contracts. This balance significantly influences its future prospects.

- Government Contracts: A substantial portion of Palantir's revenue comes from government contracts, creating sensitivity to changes in government spending priorities and geopolitical factors.

- Commercial Partnerships: The expansion of its commercial partnerships is crucial for diversifying its revenue streams and reducing its reliance on government contracts. Successful partnerships will be essential for sustained growth.

A key consideration for investors is Palantir's ability to successfully navigate the dynamics of both government and commercial markets.

Competition and Market Landscape

Palantir operates in a competitive data analytics market with established players and emerging competitors.

- Key Competitors: Palantir faces competition from large technology companies as well as specialized analytics firms. Understanding the competitive landscape is vital in assessing Palantir's long-term viability.

- Competitive Advantages: Palantir's proprietary technology, established client relationships, and expertise in complex data analysis provide crucial competitive advantages.

- Threats from Emerging Technologies: The rapid pace of technological advancements presents both opportunities and threats. Palantir's ability to adapt and innovate will be critical for long-term success.

Technological Innovation and Product Development

Palantir's commitment to technological innovation and product development is paramount for sustaining its high valuation.

- Investments in R&D: Significant investment in research and development is vital for maintaining a technological edge and introducing new products and services.

- New Product Launches: The successful launch of new products and features will drive future growth and strengthen Palantir's position in the market.

- AI and Machine Learning: Palantir's investments in AI and machine learning are key for staying competitive and delivering advanced analytical capabilities to its clients.

Conclusion

Analyzing Palantir's high P/E ratio requires a balanced assessment of its past performance and future prospects. While Palantir has demonstrated revenue growth and holds significant technological advantages, profitability remains a concern. The company's dependence on government contracts and the competitive landscape also pose risks. Whether the high P/E ratio is justified depends heavily on the successful execution of its growth strategy, the diversification of its revenue streams, and its ability to maintain a technological edge. Ultimately, understanding Palantir's high P/E ratio requires careful consideration of its past performance and future prospects. Conduct your own due diligence and carefully analyze Palantir's financial statements and market positioning before making any investment decisions related to Palantir's High P/E Ratio.

Featured Posts

-

Isabela Merced On Playing Hawkgirl A Positive Shift From Madame Web

May 07, 2025

Isabela Merced On Playing Hawkgirl A Positive Shift From Madame Web

May 07, 2025 -

Who Wants To Be A Millionaire Celebrity Special Behind The Scenes Of The Thrilling Show

May 07, 2025

Who Wants To Be A Millionaire Celebrity Special Behind The Scenes Of The Thrilling Show

May 07, 2025 -

Podcast Stan Wyjatkowy Onetu I Newsweeka Wydania Dwa Razy W Tygodniu

May 07, 2025

Podcast Stan Wyjatkowy Onetu I Newsweeka Wydania Dwa Razy W Tygodniu

May 07, 2025 -

Golden States Strategic Communication Early Advantage Against Houston

May 07, 2025

Golden States Strategic Communication Early Advantage Against Houston

May 07, 2025 -

D Day

May 07, 2025

D Day

May 07, 2025

Latest Posts

-

76

May 08, 2025

76

May 08, 2025 -

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025 -

2 0 76

May 08, 2025

2 0 76

May 08, 2025 -

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025 -

76 2 0

May 08, 2025

76 2 0

May 08, 2025