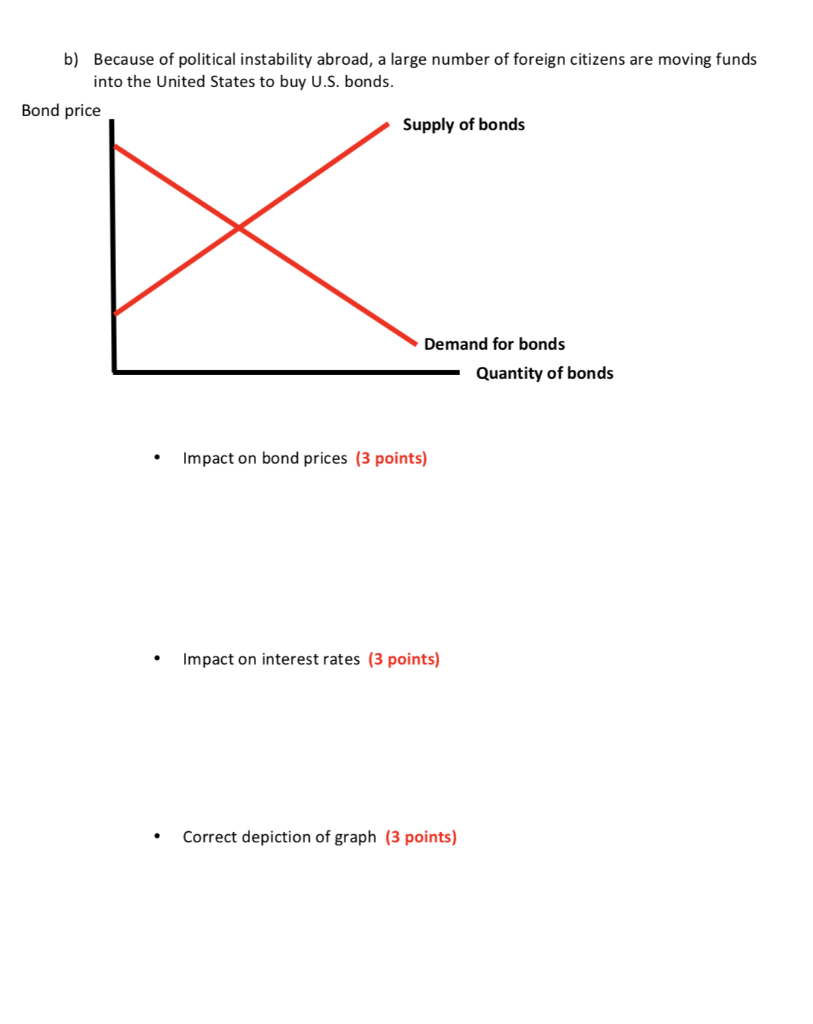

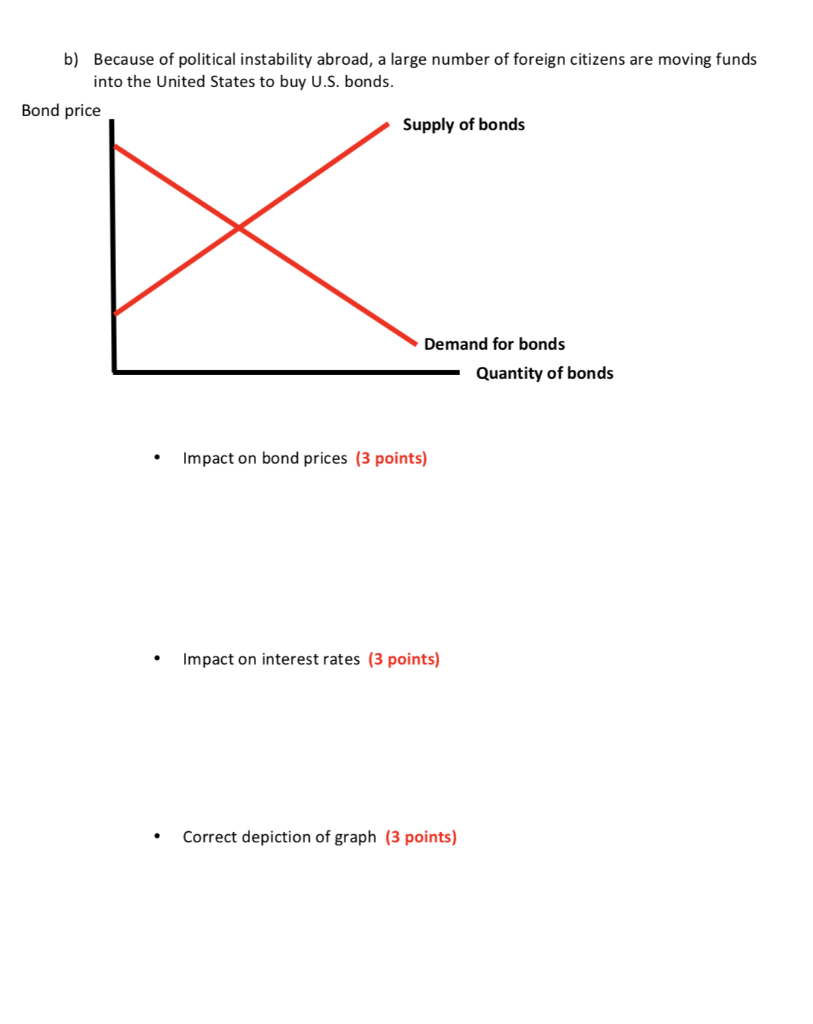

Analyzing The Bond Market's Response To Tariff Increases

Table of Contents

Impact of Tariffs on Bond Yields

Tariffs introduce considerable uncertainty into the economic outlook, significantly impacting bond yields. This uncertainty stems from the potential for disrupted supply chains, retaliatory measures, and decreased global trade.

Increased Uncertainty and Risk Aversion

Tariffs trigger a flight-to-safety phenomenon. Investors, facing increased economic uncertainty and reduced risk appetite, often seek the perceived safety of government bonds. This surge in demand for government bonds typically drives down yields, as prices rise inversely to yield.

- Flight-to-safety: Investors move capital from riskier assets (stocks, corporate bonds) to safer havens like U.S. Treasury bonds or German Bunds.

- Decreased risk appetite: Uncertainty about future economic growth dampens investor confidence, leading to a preference for lower-risk, fixed-income investments.

- Impact on yield curve: The impact on short-term versus long-term yields can vary. Short-term yields might be less affected if the central bank intervenes, while long-term yields could reflect longer-term growth concerns. For example, the imposition of significant tariffs could lead to a flattening or even inversion of the yield curve.

Historical examples, such as the 2018 trade war between the US and China, showed a notable shift towards government bonds as uncertainty grew, resulting in lower yields for these instruments.

Inflationary Pressures and Yield Curve Shifts

While a flight-to-safety can initially lower yields, tariffs can also exert inflationary pressure. Increased tariffs on imported goods lead to higher prices for consumers, potentially sparking inflation. This, in turn, may prompt central banks to raise interest rates to combat inflation. Higher interest rates typically result in higher bond yields, particularly for longer-term bonds.

- Inflation-interest rate relationship: Higher inflation typically leads to higher interest rates, as central banks aim to cool down the economy.

- Yield curve shifts: The yield curve, which plots the yields of bonds with different maturities, can steepen (longer-term yields rise more than short-term yields) or flatten (the difference between long and short-term yields decreases) depending on the market’s interpretation of the inflationary pressures and their impact on future growth.

- Economic indicators: Tracking inflation measures like the Consumer Price Index (CPI) and Producer Price Index (PPI), along with central bank statements and interest rate decisions, is vital for understanding the impact of tariffs on bond yields.

Price Fluctuations in the Bond Market Following Tariff Announcements

The bond market often exhibits significant volatility in response to tariff announcements. These fluctuations reflect the market's attempt to price in the potential economic consequences of these policy changes.

Immediate Market Reactions

Tariff announcements frequently lead to immediate price drops in bond markets, particularly in riskier segments like corporate bonds. This initial reaction stems from uncertainty and fear of negative economic consequences.

- Market sentiment: Negative news regarding tariffs often triggers a sell-off, driving bond prices down.

- Central bank announcements: Statements from central banks regarding their response to tariff-induced inflation or economic slowdown can influence bond prices significantly.

- Past examples: Analyzing past instances of tariff implementation helps to gauge the typical immediate market reactions. For example, the initial announcement of tariffs often led to increased volatility and potential declines in bond prices.

Long-Term Price Adjustments

The long-term impact of tariffs on bond prices depends on the broader economic consequences. If tariffs lead to sustained slower economic growth, reduced consumer spending, and potential deflation, bond prices may rise over the long term as investors seek safe havens. However, if inflation persists, long-term bond prices might suffer.

- Deflationary pressures: If tariffs trigger a significant economic slowdown, this could lead to deflation, increasing the real value of fixed-income investments and driving up bond prices.

- Sectoral impact: The impact of tariffs on different economic sectors (e.g., manufacturing facing higher input costs) can translate to differing credit ratings and thus varying bond price movements. Industries heavily reliant on imports may see lower credit ratings, leading to lower bond prices.

- Credit ratings: Downgrades in corporate credit ratings due to increased economic risk following tariff implementations can also negatively impact bond prices.

Analyzing the Response Across Different Bond Types

The sensitivity of bond prices to tariff increases varies significantly across different bond types.

Government Bonds vs. Corporate Bonds

Government bonds, particularly those issued by developed countries, are generally viewed as safer havens during times of economic uncertainty. This is due to their low default risk and high liquidity. Therefore, they tend to experience less pronounced price drops compared to corporate bonds during periods of increased tariff implementation.

- Credit risk: Government bonds have lower credit risk than corporate bonds, making them more attractive during periods of increased uncertainty.

- Liquidity: Government bonds are highly liquid, meaning they can be easily bought and sold, providing investors with more flexibility.

- Corporate sector impact: The impact of tariffs on specific corporate sectors will vary widely, impacting the creditworthiness of individual companies and their bond issuances.

Impact on Emerging Market Bonds

Emerging market bonds are particularly vulnerable to tariff increases. Their economies often rely heavily on global trade, making them susceptible to disruptions in international supply chains. Currency fluctuations and potential capital flight can also amplify the negative impact of tariffs on these bonds.

- Currency fluctuations: Tariffs can impact exchange rates, potentially devaluing the currencies of emerging markets, further reducing the value of their bonds for international investors.

- Trade dependence: Emerging economies heavily reliant on trade are disproportionately affected by tariff wars, leading to economic slowdowns and potentially impacting their ability to service debt.

- Capital flight: Increased uncertainty stemming from tariffs can lead to capital flight from emerging markets, putting downward pressure on bond prices.

Conclusion: Navigating the Bond Market in a Tariff-Intensive World

Tariff increases significantly impact bond yields, prices, and overall market sentiment. Government bonds often serve as safe havens during periods of uncertainty, while corporate bonds and especially emerging market bonds exhibit greater sensitivity to tariff-induced economic shocks. Understanding these dynamics is crucial for effective investment strategies.

For investors, diversification across different bond types and careful risk management are essential tools for navigating the bond market during times of tariff uncertainty. Thorough analysis of economic indicators, central bank pronouncements, and credit ratings is crucial for making informed investment decisions. Stay informed about developments impacting global trade and the bond market's response to tariff increases by following reputable financial news sources and consulting with financial advisors. Regularly reassess your portfolio's allocation to mitigate risks associated with escalating tariffs and their impact on the global economy.

Featured Posts

-

Doom Eternal The Dark Ages Official Release Date And Time

May 12, 2025

Doom Eternal The Dark Ages Official Release Date And Time

May 12, 2025 -

Ufc 315 Fight Card Changes Aldos Weight Problem And The New Lineup

May 12, 2025

Ufc 315 Fight Card Changes Aldos Weight Problem And The New Lineup

May 12, 2025 -

Payton Pritchards Historic Season Earns Him Sixth Man Of The Year Nomination

May 12, 2025

Payton Pritchards Historic Season Earns Him Sixth Man Of The Year Nomination

May 12, 2025 -

The Unmade Henry Cavill Marvel Show Exploring The Positive Outcomes

May 12, 2025

The Unmade Henry Cavill Marvel Show Exploring The Positive Outcomes

May 12, 2025 -

Win Tickets For Tales From The Track Presented By Relay

May 12, 2025

Win Tickets For Tales From The Track Presented By Relay

May 12, 2025

Latest Posts

-

Predicting The Dodgers Vs Cubs Game Las Home Record And Potential For Victory

May 13, 2025

Predicting The Dodgers Vs Cubs Game Las Home Record And Potential For Victory

May 13, 2025 -

The Kyle Tucker Report And Its Impact On Cubs Fans

May 13, 2025

The Kyle Tucker Report And Its Impact On Cubs Fans

May 13, 2025 -

Dodgers Vs Cubs Game Prediction Analyzing Las Unbeaten Home Streak

May 13, 2025

Dodgers Vs Cubs Game Prediction Analyzing Las Unbeaten Home Streak

May 13, 2025 -

Negative Fan Reaction To Kyle Tucker Report

May 13, 2025

Negative Fan Reaction To Kyle Tucker Report

May 13, 2025 -

Dodgers Vs Cubs Prediction Home Field Advantage For La

May 13, 2025

Dodgers Vs Cubs Prediction Home Field Advantage For La

May 13, 2025