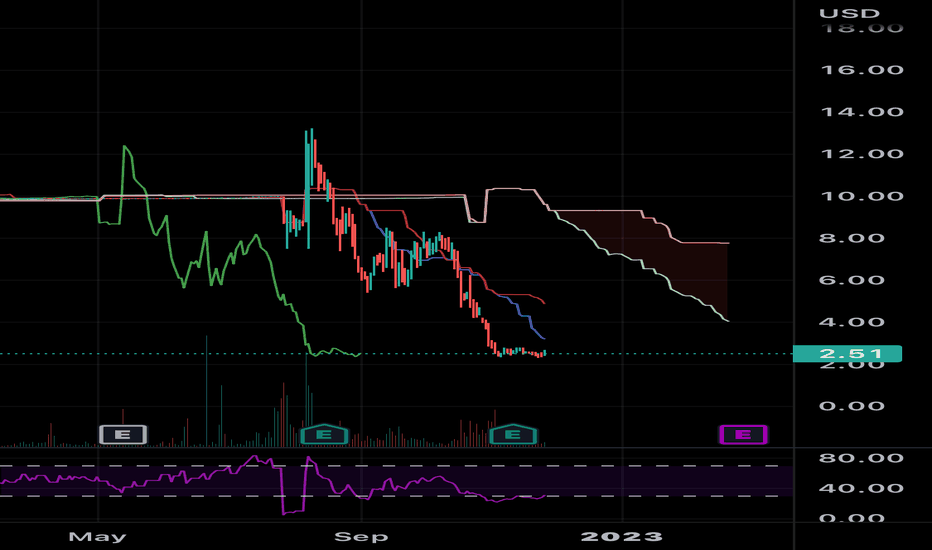

Analyzing The D-Wave Quantum (QBTS) Stock Decline On Monday

Table of Contents

Potential Factors Contributing to the QBTS Stock Decline

Several factors likely contributed to the QBTS stock decline on Monday. Analyzing these elements is crucial for understanding the current market sentiment surrounding D-Wave Quantum.

Market Sentiment and Overall Tech Stock Performance: Monday's downturn in QBTS stock wasn't isolated. The broader technology sector experienced a significant pullback, with major market indices like the Nasdaq experiencing considerable losses. This general tech stock downturn significantly impacted investor confidence, leading to widespread selling across the sector.

- Nasdaq Decline: The Nasdaq Composite Index experienced a [insert percentage]% drop on Monday, reflecting a negative market sentiment across the technology sector.

- [Insert relevant news headline about a tech sector downturn]. This news likely further fueled investor concerns and contributed to the selling pressure.

- Investor Sentiment: Reports indicated a decline in investor confidence due to [mention specific reasons, e.g., rising interest rates, inflation concerns]. This broader negative sentiment spilled over into the quantum computing sector, affecting QBTS.

Lack of Recent Positive News or Catalysts: The absence of recent positive news or significant developments regarding D-Wave Quantum's technology or business might have created a vacuum, leading to selling pressure. Without fresh catalysts to excite investors, the stock became vulnerable to market fluctuations.

- Financial Reports: The most recent financial report may have underperformed expectations, leading to investor disappointment and selling.

- Product Development: A lack of significant announcements regarding new product launches or technological advancements could have dampened investor enthusiasm.

- Strategic Partnerships: The absence of new strategic partnerships or collaborations could have contributed to the negative sentiment.

Speculative Trading and Short Selling: Speculative trading and short-selling likely played a significant role in exacerbating the QBTS stock decline. Short-selling, where investors bet against a stock's price, can amplify downward pressure, particularly in a volatile market.

- Short Interest: High short interest in QBTS prior to Monday's decline could have amplified the downward movement as short-sellers profited from the drop.

- Speculative Trading: Increased speculative trading activity around QBTS, potentially driven by [mention any relevant factors like social media trends or analyst predictions], could have further contributed to the volatility.

- Price Volatility: The inherent volatility of a stock in the early-stage quantum computing sector makes it susceptible to significant price swings based on speculation and market sentiment.

Analyzing the Long-Term Implications for D-Wave Quantum (QBTS)

While Monday's decline was significant, it's crucial to analyze the long-term implications for D-Wave Quantum and its place in the evolving quantum computing landscape.

The Future of Quantum Computing and QBTS' Position: The long-term prospects for quantum computing remain positive, despite the recent QBTS stock decline. The technology holds immense potential across various sectors, and D-Wave Quantum's position as a pioneer in the field offers considerable long-term potential.

- Quantum Computing Market: The quantum computing market is expected to experience substantial growth in the coming years, presenting opportunities for companies like D-Wave Quantum.

- Competitive Landscape: While competition exists, D-Wave Quantum's unique approach and established position in the market give it a competitive edge.

- Future Growth Potential: Successful product development, strategic partnerships, and technological breakthroughs could drive significant future growth.

Investor Reaction and Potential Recovery: Investor reaction to the decline will be crucial in determining the potential for a QBTS stock recovery. Positive news, technological advancements, or a shift in overall market sentiment could trigger a rebound.

- Stock Recovery: A positive earnings report, successful product launch, or strategic partnership could lead to a rapid recovery in QBTS's stock price.

- Investor Reaction: How investors react to future news releases will greatly influence the stock's trajectory.

- Market Outlook: The overall market outlook for the technology sector will also impact the recovery of QBTS stock.

Recommendations for Investors Following the QBTS Stock Decline

Navigating the volatility of QBTS stock requires careful consideration of risk and a well-defined investment strategy.

Risk Assessment and Diversification: Investing in early-stage technology companies like D-Wave Quantum inherently involves high risk. Diversifying investments across different asset classes is crucial for mitigating this risk.

- Risk Management: Thoroughly assess your risk tolerance before investing in QBTS or any other high-risk technology stock.

- Portfolio Diversification: Diversify your investment portfolio to reduce overall risk exposure.

- Investment Strategy: Develop a long-term investment strategy that aligns with your risk profile and financial goals.

Long-Term vs. Short-Term Investment Strategy: Whether a long-term or short-term approach is suitable for QBTS depends on your individual risk tolerance and investment horizon.

- Long-Term Investment: A long-term investment strategy may be appropriate for investors with a high risk tolerance and a long investment horizon, believing in the long-term potential of quantum computing.

- Short-Term Trading: Short-term trading in QBTS stock carries significant risk and is only suitable for sophisticated investors comfortable with high volatility.

- Investment Horizon: Consider your individual investment horizon and align your strategy accordingly.

Conclusion:

Monday's D-Wave Quantum (QBTS) stock decline resulted from a confluence of factors including negative market sentiment, a lack of recent positive catalysts, and the potential impact of speculative trading. While the short-term outlook may seem uncertain, the long-term prospects for quantum computing and D-Wave Quantum remain promising. Investors should carefully assess their risk tolerance, diversify their portfolios, and develop a well-defined investment strategy before making any decisions regarding QBTS stock. Continue monitoring the D-Wave Quantum stock performance and stay informed about developments in the dynamic quantum computing investment landscape. Understanding the intricacies of D-Wave Quantum stock analysis is key to making informed investment decisions in this exciting but volatile sector.

Featured Posts

-

Analiza Tadica Rizici Rusenja Daytonskog Sporazuma Za Sarajevo

May 20, 2025

Analiza Tadica Rizici Rusenja Daytonskog Sporazuma Za Sarajevo

May 20, 2025 -

Ftcs Monopoly Trial Against Meta A Shift In Strategy

May 20, 2025

Ftcs Monopoly Trial Against Meta A Shift In Strategy

May 20, 2025 -

Sche Odna Ditina V Rodini Lourens Radisna Novina

May 20, 2025

Sche Odna Ditina V Rodini Lourens Radisna Novina

May 20, 2025 -

Nyt Mini Crossword Answers March 16 2025 Helpful Hints

May 20, 2025

Nyt Mini Crossword Answers March 16 2025 Helpful Hints

May 20, 2025 -

Robin Roberts And The Gma Layoffs Decoding Her Fancy Message

May 20, 2025

Robin Roberts And The Gma Layoffs Decoding Her Fancy Message

May 20, 2025

Latest Posts

-

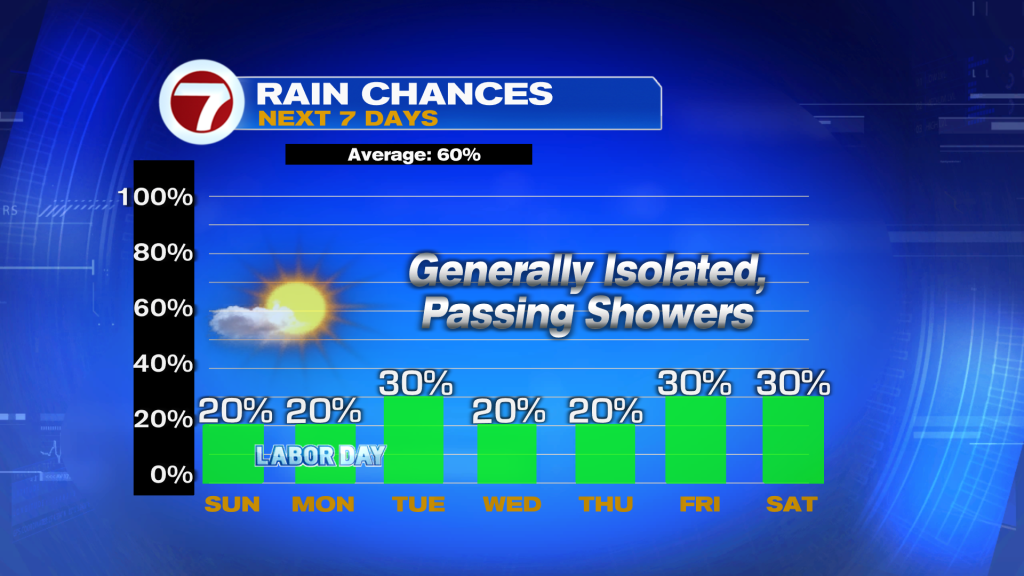

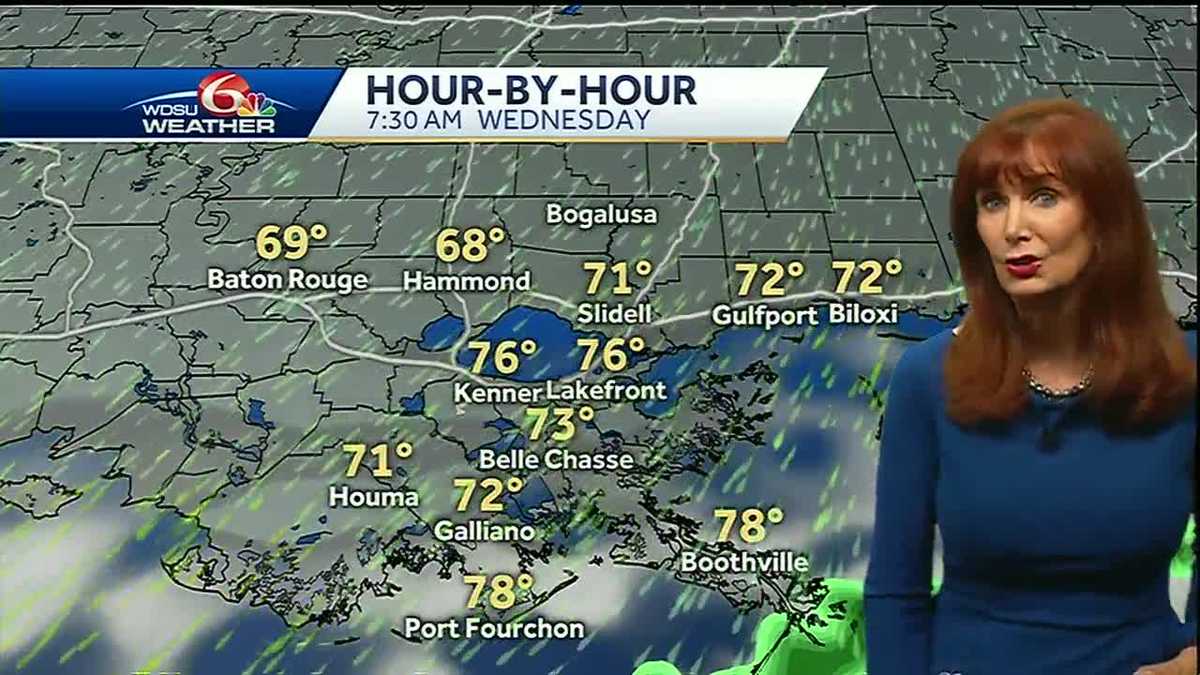

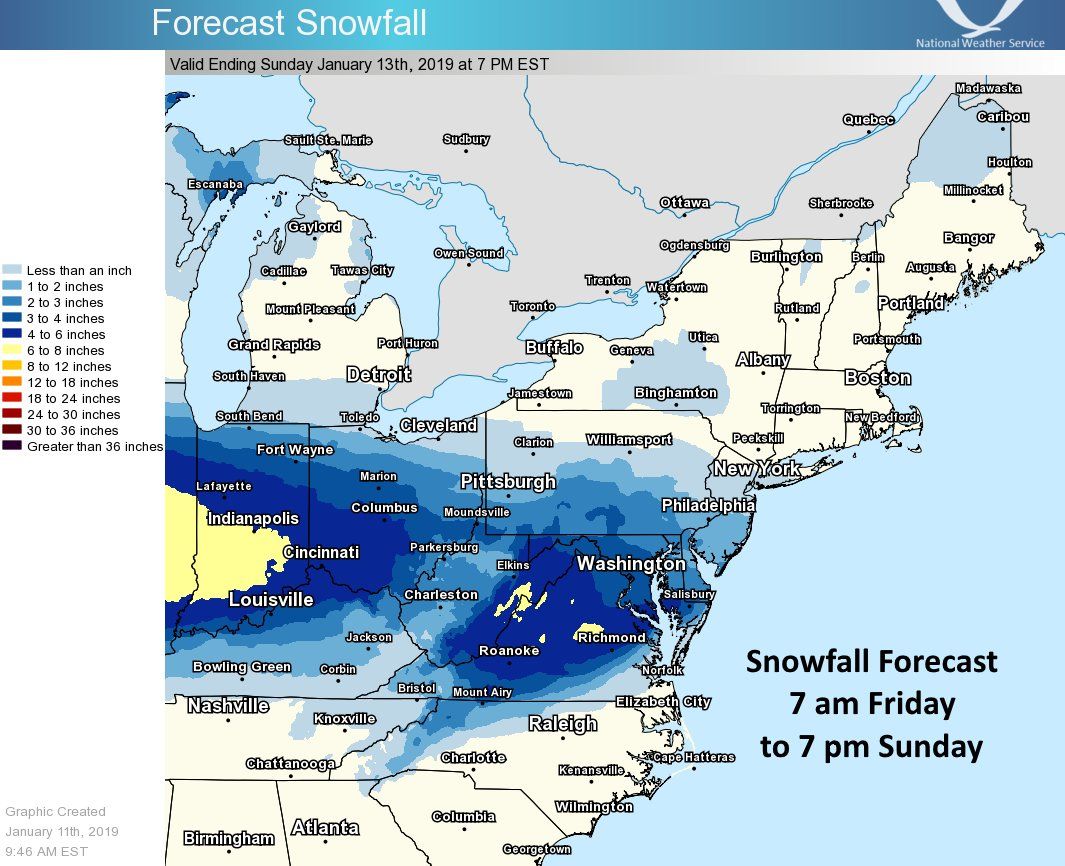

Preparing For The Upcoming Drier Weather

May 20, 2025

Preparing For The Upcoming Drier Weather

May 20, 2025 -

Is Drier Weather In Sight Your Regional Forecast

May 20, 2025

Is Drier Weather In Sight Your Regional Forecast

May 20, 2025 -

Drier Weather Is In Sight What To Expect

May 20, 2025

Drier Weather Is In Sight What To Expect

May 20, 2025 -

Checking For Rain The Latest Hourly And Daily Updates

May 20, 2025

Checking For Rain The Latest Hourly And Daily Updates

May 20, 2025 -

Rain Predictions The Most Up To Date Forecast

May 20, 2025

Rain Predictions The Most Up To Date Forecast

May 20, 2025