Analyzing The Effectiveness Of Minnesota's Film Tax Credit Program

Table of Contents

Economic Impact of Minnesota Film Tax Credits

The economic impact of Minnesota's film tax credit program extends beyond the immediate spending by film productions. It creates a ripple effect, stimulating various sectors of the local economy. The program acts as an economic stimulus, injecting funds into local businesses and generating tax revenue for the state. Key areas experiencing benefits include:

-

Increased spending in local businesses: Film productions require a vast array of goods and services, from catering and transportation to equipment rentals and hotel accommodations. This increased spending directly benefits local businesses, creating a significant economic multiplier effect. Think of the increased revenue for local restaurants, hotels, and transportation companies during a major film shoot.

-

Revenue generation for the state: While the program offers tax credits, it doesn't necessarily equate to a net loss for the state. The increased economic activity spurred by film productions generates additional tax revenue through sales taxes, income taxes, and other sources, offsetting some or all of the tax credits provided. Analyzing the net fiscal impact requires careful consideration of these offsetting factors.

-

Comparison to other states: Examining similar programs in other states provides valuable context. Comparing the economic impact per dollar spent on tax credits in Minnesota to that of states like California or Georgia can reveal the relative effectiveness of Minnesota's approach. This comparative analysis helps in identifying best practices and areas for improvement.

-

Tax credits claimed vs. economic return: A crucial element in evaluating the program's success is to analyze the ratio between the total amount of tax credits claimed by film productions and the overall economic return generated by these productions. A comprehensive study examining this ratio is vital to determine the program's overall efficiency and effectiveness.

Job Creation and Workforce Development through Film Tax Credits

Beyond the economic benefits, Minnesota's film tax credit program plays a crucial role in job creation and workforce development within the state. This program stimulates:

-

Direct and indirect job creation: The program directly creates jobs for film crews—including directors, producers, cinematographers, and actors—as well as indirect jobs in support services like catering, transportation, and equipment rental.

-

Workforce development: The influx of film production work provides valuable on-the-job training and skills development for aspiring professionals in the Minnesota film industry. This creates a skilled workforce capable of handling larger and more complex productions.

-

Statistics on job creation: Analyzing employment data in the film industry before and after the implementation of the tax credit program, or significant amendments to it, reveals the program's direct contribution to employment growth. This should account for both full-time and part-time positions.

-

Industry training programs: The program may also support or initiate training programs to enhance the skills of the local workforce, ensuring that Minnesota possesses the necessary talent pool to attract larger-scale productions. This could include partnerships with local colleges and universities.

Impact on Film Production in Minnesota

The primary goal of Minnesota's film tax credit program is to attract more film productions to the state. Analyzing its success requires considering:

-

Increased film production: The program aims to increase the number of film productions choosing Minnesota as a filming location. Comparing the number of film permits issued before and after the program’s implementation is a crucial metric to assess its effectiveness. This should differentiate between feature films, television series, commercials, and independent productions.

-

Diversity of productions: Does the program attract a diverse range of productions, or does it primarily benefit specific genres or production scales? This analysis helps to determine if the program is broadening the scope of the state's film industry.

-

Geographic distribution: Does the program's benefits reach across the state, or is filming activity concentrated in specific regions? Analyzing geographic distribution can help identify potential areas for further investment or program adjustments to distribute the economic benefits more evenly.

Analyzing the Cost-Effectiveness of Minnesota's Film Tax Credit Program

A critical aspect of evaluating any government program is assessing its cost-effectiveness. This necessitates a thorough:

-

Return on Investment (ROI) analysis: A comprehensive cost-benefit analysis, including an ROI calculation, is essential to determine whether the economic benefits generated by the program outweigh its costs to the state government. This should consider both direct and indirect economic impacts.

-

Program efficiency: Are there any inefficiencies or unintended consequences within the current program structure? Identifying these can help refine the program to maximize its impact and minimize unnecessary expenditures. For instance, are there any loopholes that are being exploited?

-

Potential for improvement: The analysis should include recommendations for streamlining the application process, enhancing transparency, and optimizing the criteria for awarding tax credits. This ensures the program’s efficiency and effectiveness in achieving its objectives.

Conclusion: Evaluating the Future of Minnesota's Film Tax Credit Program

This analysis of Minnesota's film tax credit program reveals both successes and areas for potential improvement. While the program demonstrably stimulates economic activity, creates jobs, and attracts film productions to the state, a comprehensive cost-benefit analysis is crucial for determining its long-term sustainability and effectiveness. Further research, focusing on a robust ROI analysis and a thorough examination of program efficiency, is needed to fully gauge the program’s overall impact. To learn more about the ongoing debate surrounding the effectiveness of Minnesota’s film tax credit program, visit [link to relevant government resource or study].

Featured Posts

-

Ukraine Conflict North Korea Acknowledges Sending Troops To Russia

Apr 29, 2025

Ukraine Conflict North Korea Acknowledges Sending Troops To Russia

Apr 29, 2025 -

Examining The Economic Impact Of Film Tax Credits On Minnesota

Apr 29, 2025

Examining The Economic Impact Of Film Tax Credits On Minnesota

Apr 29, 2025 -

Minnesota Film Industry A Look At The Influence Of Tax Credits

Apr 29, 2025

Minnesota Film Industry A Look At The Influence Of Tax Credits

Apr 29, 2025 -

Increased Rent In La After Fires Landlords Under Scrutiny

Apr 29, 2025

Increased Rent In La After Fires Landlords Under Scrutiny

Apr 29, 2025 -

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025

Latest Posts

-

Open Ai Faces Ftc Probe Examining The Future Of Ai Accountability

Apr 29, 2025

Open Ai Faces Ftc Probe Examining The Future Of Ai Accountability

Apr 29, 2025 -

Secret Service Ends Probe Of Cocaine Found At White House

Apr 29, 2025

Secret Service Ends Probe Of Cocaine Found At White House

Apr 29, 2025 -

Ftc Probes Open Ai Implications For Ai Development And Regulation

Apr 29, 2025

Ftc Probes Open Ai Implications For Ai Development And Regulation

Apr 29, 2025 -

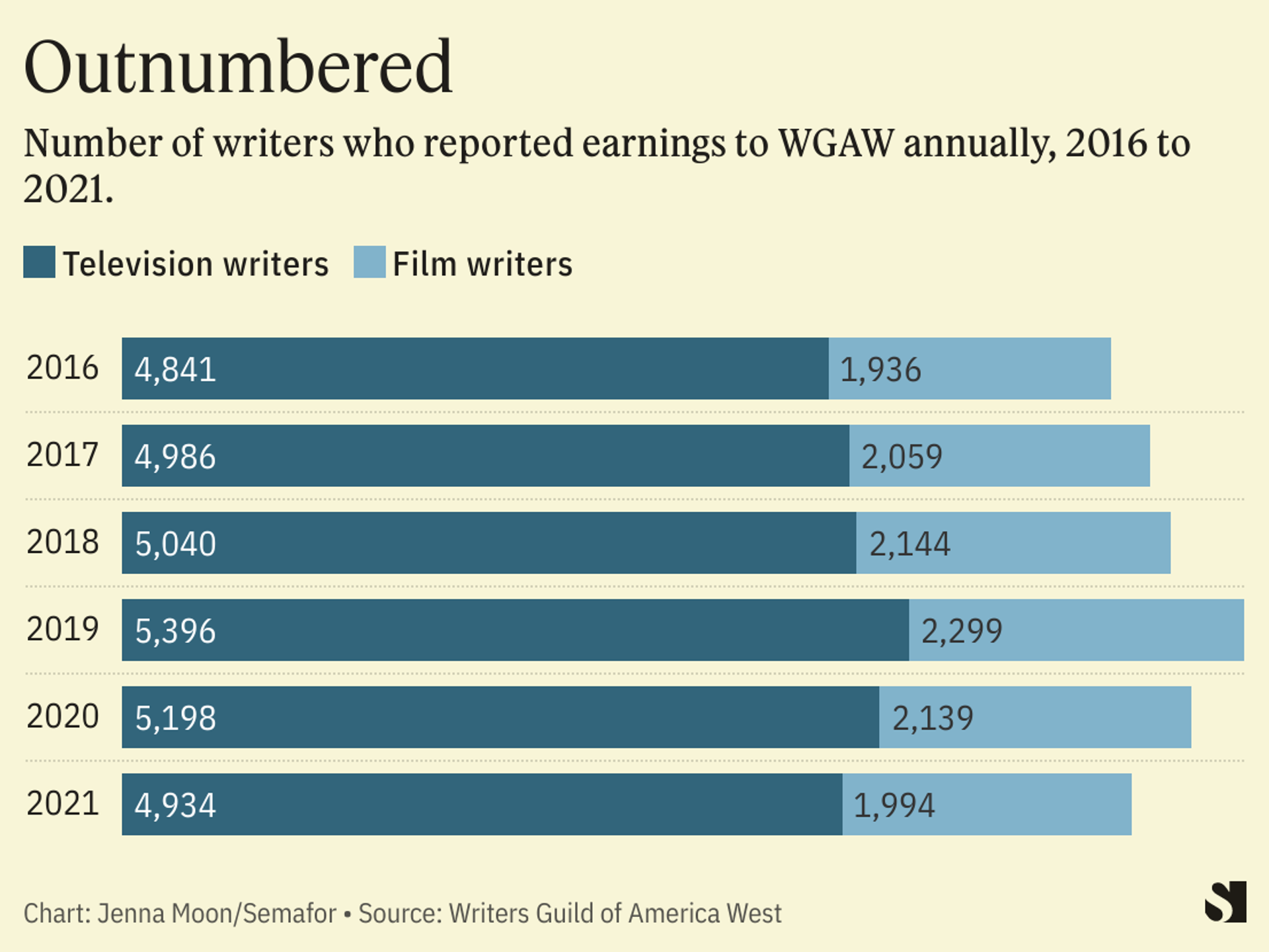

Double Strike Cripples Hollywood Actors And Writers Demand Fair Treatment

Apr 29, 2025

Double Strike Cripples Hollywood Actors And Writers Demand Fair Treatment

Apr 29, 2025 -

Actors And Writers Strike Hollywood Production Grinds To A Halt

Apr 29, 2025

Actors And Writers Strike Hollywood Production Grinds To A Halt

Apr 29, 2025