Analyzing The Growth Trajectory Of Canada's Leading Natural Gas Producer

Table of Contents

Production Capacity and Expansion Strategies

Canadian Natural Resources boasts a substantial natural gas production capacity, a testament to its extensive exploration and development activities. CNRL’s strategic focus on expanding its existing assets and acquiring new ones has significantly fueled its growth. The company's exploration and development projects are geographically diverse, mitigating risk and capitalizing on opportunities across various regions. This diversified approach contributes to a robust and resilient production base.

- Horizon Oil Sands Expansion Project: This project is projected to increase natural gas production by 15%, further solidifying CNRL's position as a market leader. The expansion leverages existing infrastructure, optimizing efficiency and reducing environmental impact.

- Acquisition of [Hypothetical Company Name]: The recent acquisition of [Hypothetical Company Name] added 500 million cubic meters of proven natural gas reserves, immediately boosting CNRL's production capacity and expanding its geographic footprint into [Hypothetical Region].

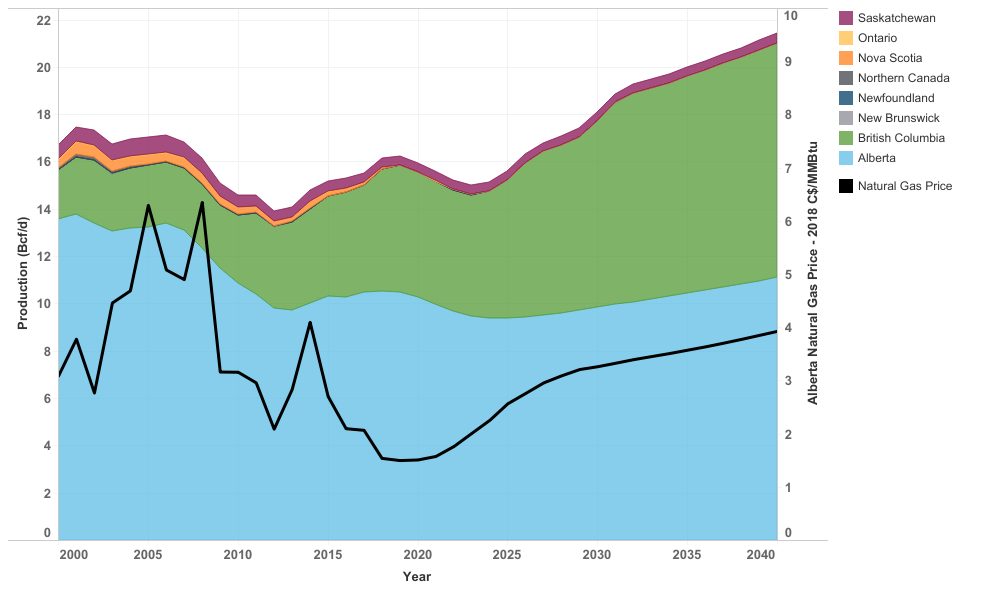

[Insert chart/graph illustrating CNRL's production growth over the past 5-10 years, clearly labelled and with a data source citation]. This visual representation clearly showcases the consistent upward trend in Canadian natural gas production by CNRL. The geographic distribution of CNRL's assets is also crucial; its operations span across Alberta, British Columbia, and Saskatchewan, enabling diversification and resilience against regional fluctuations in natural gas demand. This strategic diversification is a key element of its success in Canadian natural gas production.

Market Dynamics and Pricing

The natural gas market is inherently volatile, influenced by global supply and demand dynamics, economic growth, and geopolitical events. Fluctuating natural gas prices significantly impact CNRL's revenue and profitability. However, the company has implemented sophisticated strategies to mitigate price volatility. These strategies include:

- Hedging: CNRL employs various hedging techniques, such as futures contracts and options, to lock in prices for a portion of its future production, reducing exposure to price swings.

- Long-term Contracts: Securing long-term contracts with buyers provides price certainty and stable revenue streams, mitigating the impact of short-term price fluctuations.

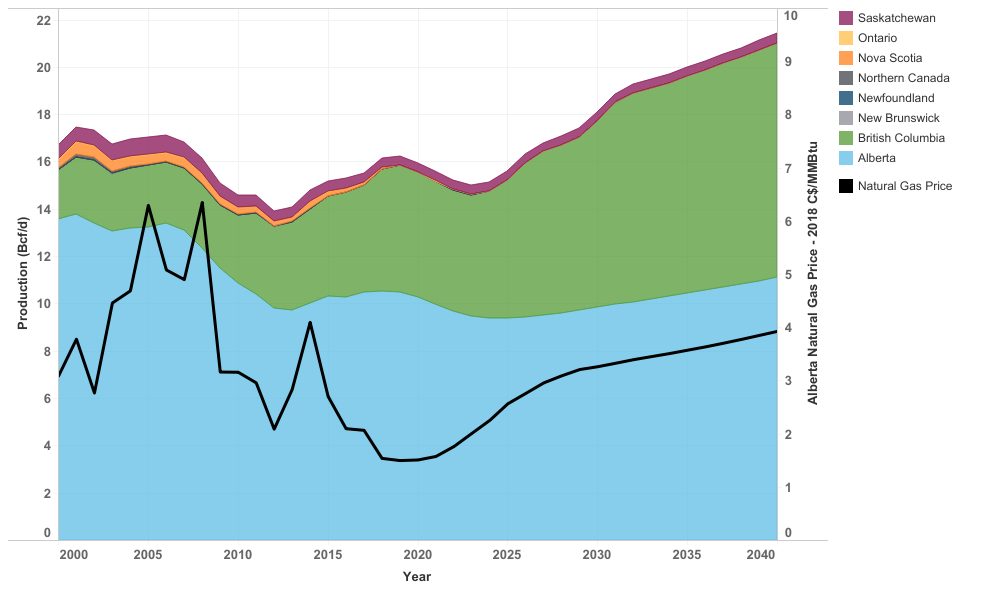

[Insert a chart/graph illustrating natural gas price trends over the past few years and CNRL's revenue performance in relation to these trends]. The impact of LNG export growth on domestic natural gas pricing is a crucial factor for CNRL. Increased LNG exports can potentially tighten domestic supply and push prices higher, benefiting CNRL's profitability. Analyzing CNRL's hedging strategies reveals a proactive approach to managing risk and ensuring financial stability in a dynamic market environment. Key competitors, while not explicitly named here, are acknowledged as factors that influence market share and pricing.

Environmental, Social, and Governance (ESG) Factors

Increasingly, ESG factors are influencing investor decisions and shaping the energy industry. CNRL demonstrates a strong commitment to sustainable practices and social responsibility, integrating ESG considerations into its business strategy. Key initiatives include:

- Carbon Capture and Storage (CCS): CNRL invests significantly in CCS technologies to reduce greenhouse gas emissions from its operations, aligning with global efforts to combat climate change.

- Investment in Renewable Energy Projects: The company is actively exploring and investing in renewable energy projects, diversifying its energy portfolio and reducing its carbon footprint.

CNRL's proactive approach to ESG strengthens its long-term sustainability and enhances its reputation among investors and stakeholders concerned about responsible resource management. Regulatory changes related to environmental protection and greenhouse gas emissions will undoubtedly impact CNRL's operations; the company's commitment to proactive compliance helps to mitigate potential risks. This commitment to ESG investing is paramount to maintaining a strong reputation and attracting socially responsible investors.

Future Growth Projections and Opportunities

Forecasts suggest continued growth for CNRL's natural gas production in the coming years, driven by several factors. This optimistic outlook is supported by:

- Technological Advancements: Continued investment in advanced technologies for exploration, extraction, and processing will enhance efficiency and production capacity.

- Emerging Markets: Expanding into new markets, both domestically and internationally, offers significant growth opportunities.

However, challenges remain. Geopolitical instability and technological disruptions can impact the natural gas market. Careful management of these risks will be crucial for maintaining CNRL's growth trajectory. The long-term outlook for CNRL's natural gas business remains positive, driven by consistent demand and strategic investments in expansion and innovation. This forecast takes into account the current market conditions, including potential disruptions and regulatory changes. The projected growth path indicates a promising future for the company in the natural gas sector.

Conclusion: Investing in Canada's Leading Natural Gas Producer's Future Growth

This analysis has highlighted the key factors driving the growth trajectory of Canadian Natural Resources, a prominent player in Canada's natural gas sector. CNRL’s robust production capacity, strategic expansion strategies, effective management of market dynamics, and commitment to ESG principles all contribute to its sustained success. The company's future prospects are promising, with significant opportunities for continued growth fueled by technological advancements and expanding markets. Investors looking for exposure to Canada's leading natural gas producer should consider Canadian Natural Resources given its robust growth trajectory and promising future prospects in the Canadian natural gas market.

Featured Posts

-

Flyttar Thomas Mueller Till Mls Analys Av Oevergangsryktena

May 12, 2025

Flyttar Thomas Mueller Till Mls Analys Av Oevergangsryktena

May 12, 2025 -

The Next Pope Exploring The Contenders For The Papacy

May 12, 2025

The Next Pope Exploring The Contenders For The Papacy

May 12, 2025 -

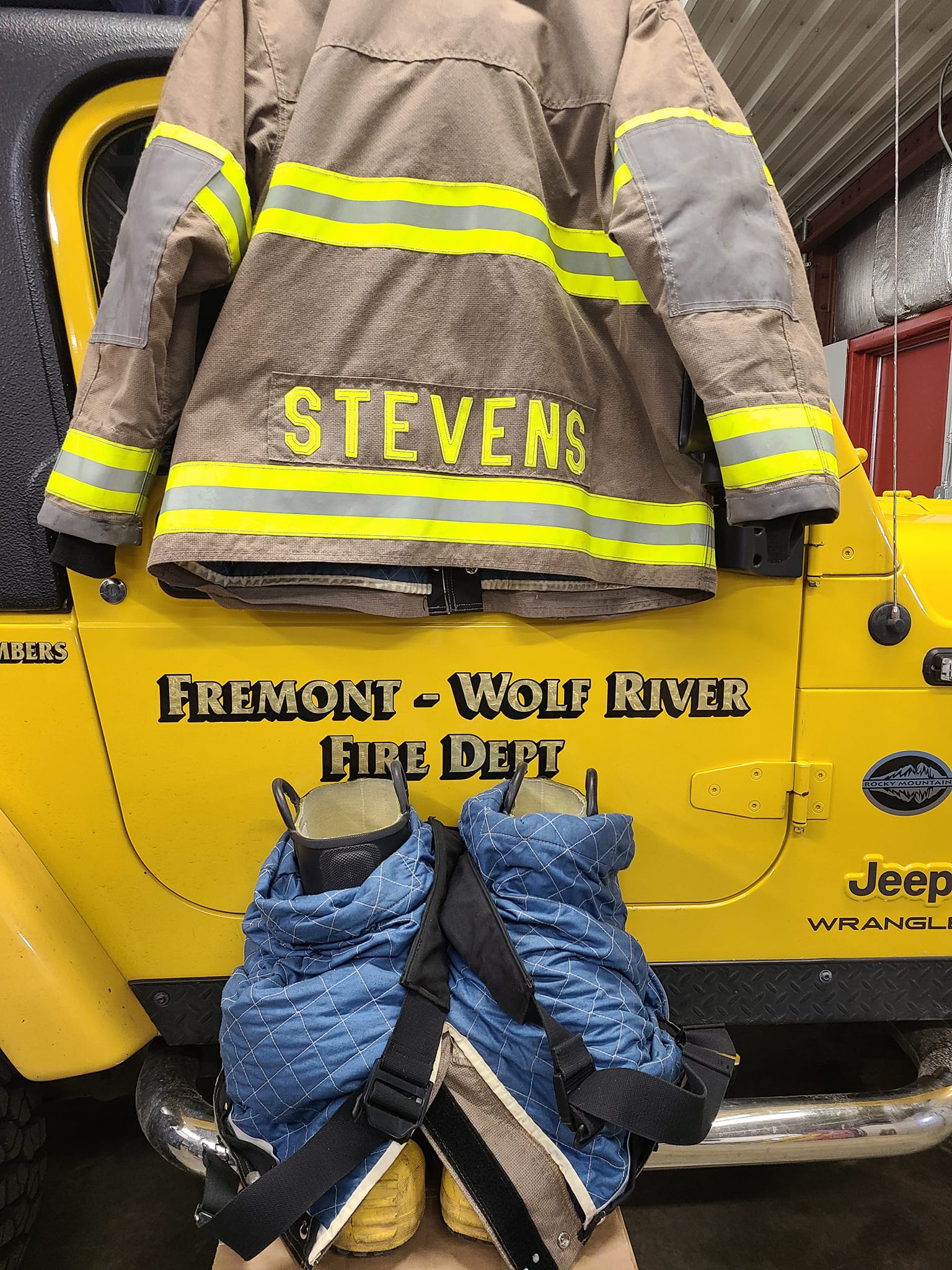

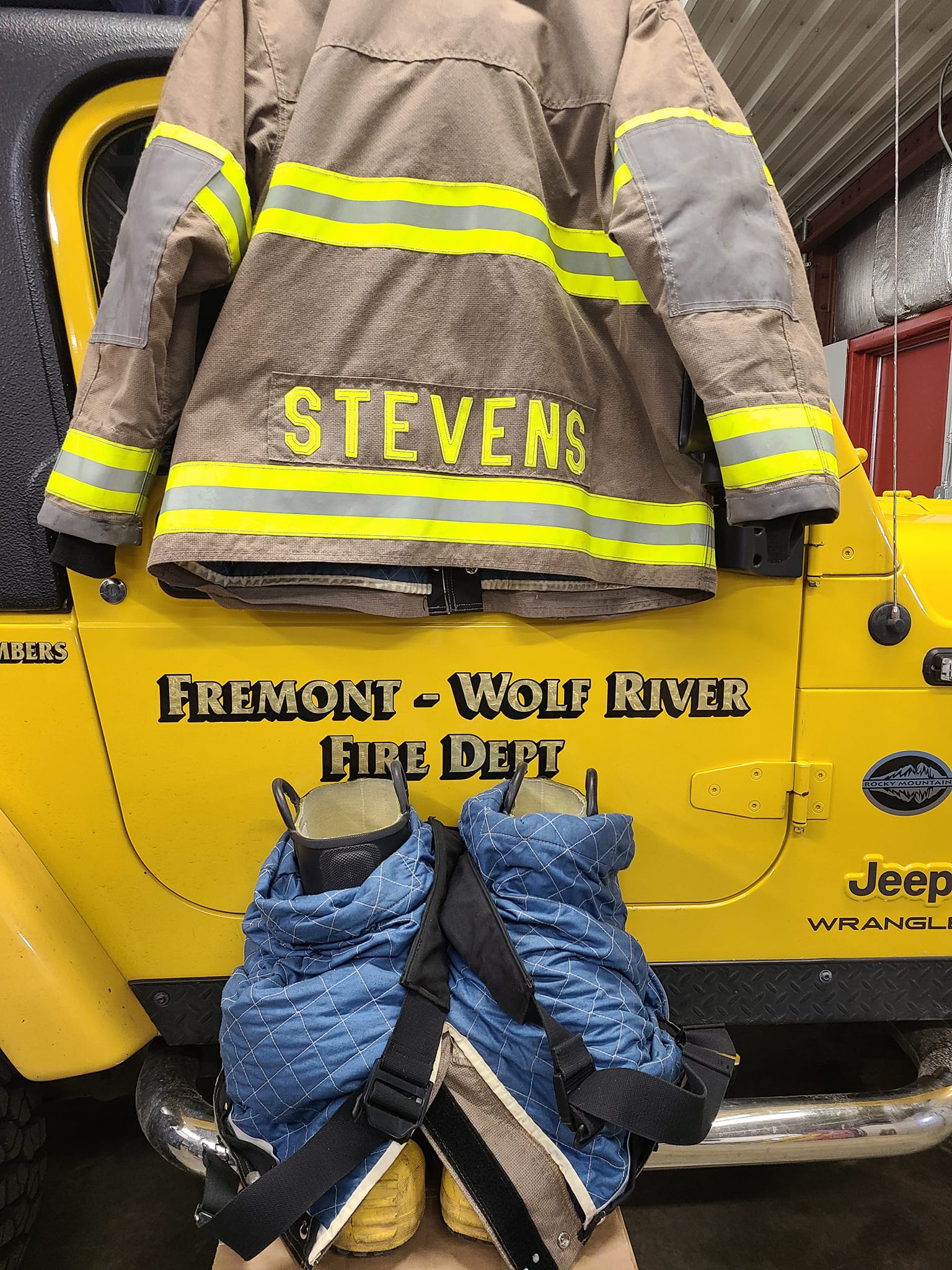

Remembering A Hero Fremont Wolf River Firefighter Honored At National Memorial

May 12, 2025

Remembering A Hero Fremont Wolf River Firefighter Honored At National Memorial

May 12, 2025 -

Payton Pritchard Nba Sixth Man Award Winner Va Hero Of The Week

May 12, 2025

Payton Pritchard Nba Sixth Man Award Winner Va Hero Of The Week

May 12, 2025 -

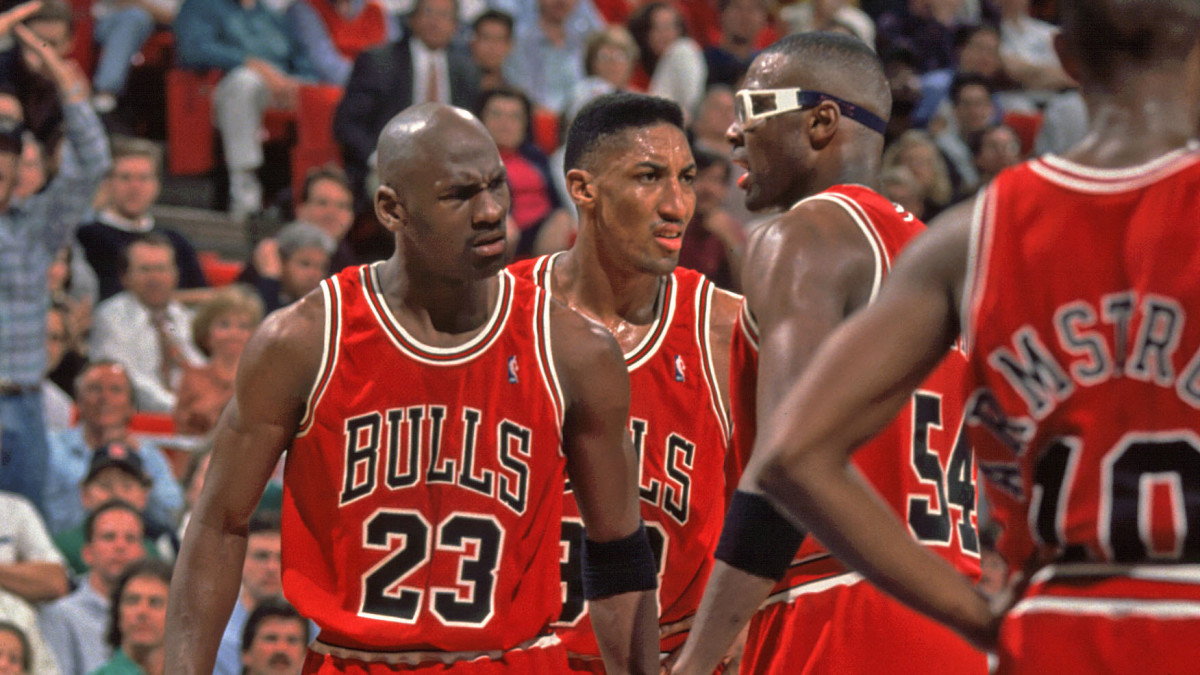

Chicago Bulls And New York Knicks Injury Updates Whos In And Whos Out

May 12, 2025

Chicago Bulls And New York Knicks Injury Updates Whos In And Whos Out

May 12, 2025

Latest Posts

-

Remembering A Hero Fremont Wolf River Firefighter Honored At National Memorial

May 12, 2025

Remembering A Hero Fremont Wolf River Firefighter Honored At National Memorial

May 12, 2025 -

New Music Jessica Simpson Receives Support From Eric Johnson

May 12, 2025

New Music Jessica Simpson Receives Support From Eric Johnson

May 12, 2025 -

National Fallen Firefighters Memorial Honoring Fremonts Wolf River Firefighter

May 12, 2025

National Fallen Firefighters Memorial Honoring Fremonts Wolf River Firefighter

May 12, 2025 -

Jessica Simpson Credits Eric Johnson For New Music

May 12, 2025

Jessica Simpson Credits Eric Johnson For New Music

May 12, 2025 -

Fremont Wolf River Firefighter Honored National Fallen Firefighters Memorial

May 12, 2025

Fremont Wolf River Firefighter Honored National Fallen Firefighters Memorial

May 12, 2025