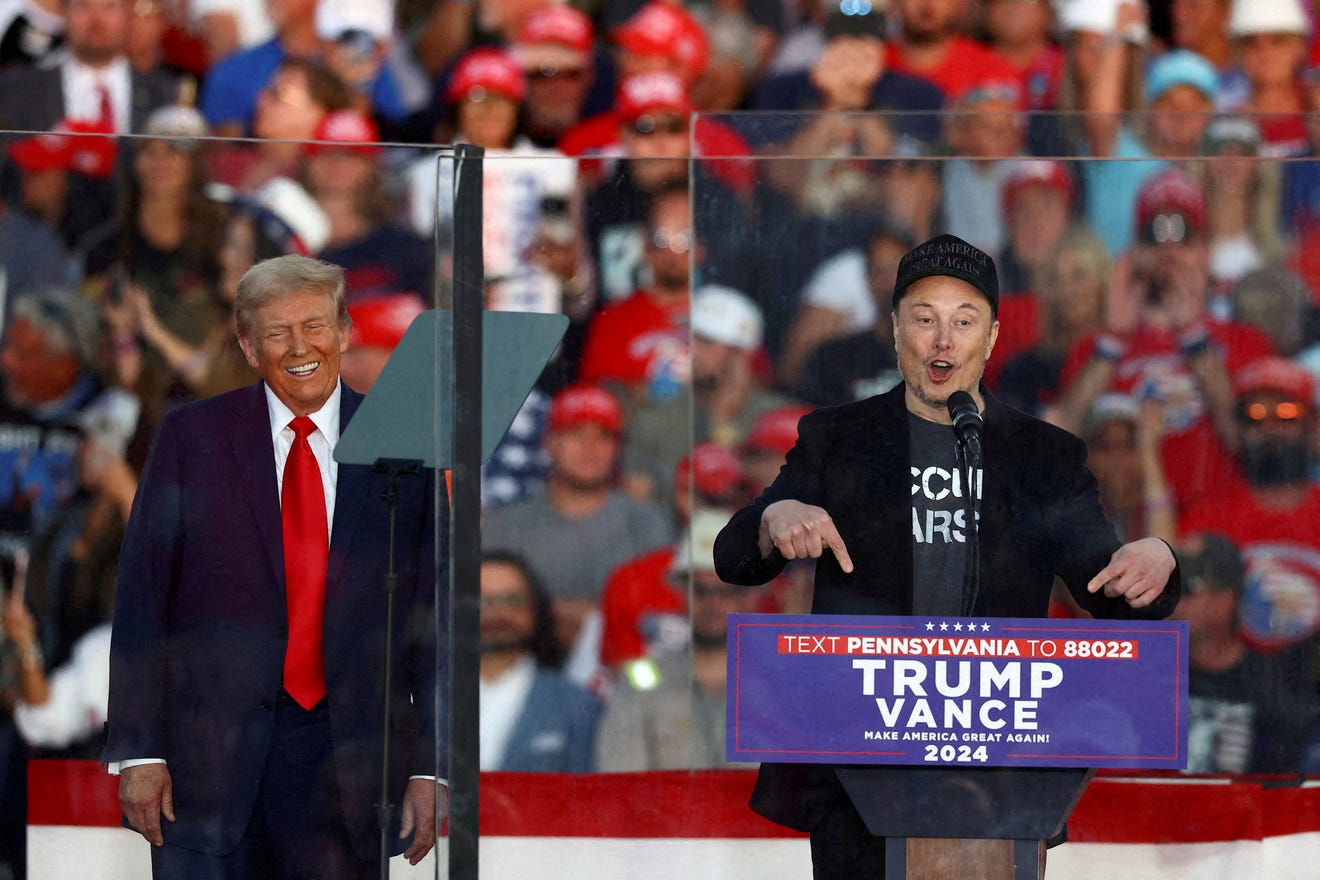

Analyzing The Impact Of Trump's Presidency On Elon Musk's Fortune (First 100 Days)

Table of Contents

The Early Economic Climate and its Effect on Tesla

The first 100 days of the Trump administration set the stage for a period of significant economic change, directly impacting Tesla and, consequently, Elon Musk's net worth. Understanding this period requires examining both regulatory shifts and the influence of tax cuts.

Regulatory Changes and their Influence on Tesla's Stock

Trump's campaign promises of deregulation resonated within certain sectors, and the automotive industry was no exception. The potential loosening of environmental regulations, particularly concerning emissions standards, held both promise and peril for Tesla. While some speculated that reduced regulatory burdens could lower Tesla's production costs, others worried about the potential impact on consumer perception of Tesla's environmentally friendly image.

- Easing of emissions standards: Early indications suggested a potential rollback of stricter emission targets, which could have lowered Tesla's production costs but might have also negatively influenced investor sentiment regarding Tesla’s brand positioning.

- State-level regulations: It’s crucial to remember that state-level regulations related to electric vehicle adoption and infrastructure played a substantial role, often counteracting potential federal deregulation effects. California, a key market for Tesla, maintained strong environmental regulations.

- Tesla Stock Price Fluctuations: During this period, Tesla's stock price exhibited volatility, reflecting the uncertainty surrounding the potential regulatory changes under the Trump administration. Analyzing the stock charts from this period shows a mix of gains and losses, demonstrating the complex interplay of market sentiment and policy shifts. ("Tesla stock price" data visualization would be included here).

Impact of Tax Cuts on Tesla and SpaceX

The Trump administration's significant tax cuts, particularly the reduction in the corporate tax rate, presented a potential boon for both Tesla and SpaceX. Lower corporate tax rates could translate to increased profitability and, consequently, a higher valuation for both companies.

- Corporate Tax Rate Reduction: The reduction from 35% to 21% was a significant change. For Tesla and SpaceX, this meant increased retained earnings available for reinvestment in research, development, and expansion.

- Impact on Elon Musk's Wealth: The direct impact of these tax cuts on Elon Musk's overall wealth is complex to isolate, but increased company profitability undoubtedly contributed positively to his net worth. ("Tax cuts" and their effect on corporate profits data would be included here).

- SpaceX Funding: The tax cuts could have indirectly benefited SpaceX by increasing the profitability of other businesses involved in space exploration, potentially increasing overall investment in the sector.

Geopolitical Shifts and their Ripple Effects on Musk's Businesses

Beyond domestic policy, Trump's approach to international trade and space exploration significantly impacted Musk's businesses.

International Trade Policy and its Impact on Tesla's Global Operations

Trump's "America First" trade policy, characterized by tariffs and trade disputes, created both challenges and opportunities for Tesla's global operations. Increased tariffs on imported goods could raise Tesla's production costs, while trade tensions could disrupt its supply chains.

- Tariffs and Supply Chain Disruptions: Tariffs on materials sourced from specific countries, particularly China, could have increased Tesla's manufacturing costs, impacting its profitability. The impact varied depending on the specific component and its sourcing country.

- Global Expansion Challenges: Navigating trade wars and shifting geopolitical landscapes added complexity to Tesla's ambitious global expansion plans. Tesla faced challenges adjusting its strategy in response to changing international trade relations. (Case studies of specific countries and their impact on Tesla's sales would be included here).

- Shifting Market Dynamics: The introduction of tariffs could have resulted in increased sales in some markets (e.g., due to competition becoming less price competitive) and slower growth in others.

Changes in Space Exploration Policy and SpaceX's Prospects

Trump's administration, while supporting space exploration, also prioritized cost-effectiveness and potentially shifted the focus from certain long-term projects. This created uncertainty for SpaceX, a company heavily reliant on government contracts.

- NASA Funding and Contracts: The impact of Trump's policy on NASA funding and SpaceX contracts was varied. While some projects received increased funding, others faced budgetary constraints. Data on government contracts awarded to SpaceX during this period needs to be analyzed to properly understand the effect.

- Commercial Space Travel Emphasis: The Trump administration's emphasis on commercial space travel may have inadvertently created new opportunities for SpaceX, albeit with increased competition from other private space companies.

- Long-term Implications: The overall impact on SpaceX's long-term trajectory is complex and will likely unfold over many years, making a definitive assessment during the first 100 days alone difficult.

Conclusion: Summarizing the First 100 Days and Looking Ahead

Analyzing the impact of Trump's presidency on Elon Musk's fortune during the first 100 days reveals a complex picture. While tax cuts offered potential benefits, regulatory changes and international trade policies created uncertainty and potential challenges for both Tesla and SpaceX. The net effect on Musk's net worth during this initial period is difficult to definitively quantify, with factors both aiding and hindering his financial standing. The long-term implications of these early trends will continue to unfold, shaping the future of Musk's business ventures and influencing his overall wealth. To further understand this dynamic relationship, continue researching "Analyzing the impact of Trump's presidency," focusing on "Elon Musk net worth analysis" and the broader context of the "Trump era business" environment by seeking additional resources and in-depth analyses.

Featured Posts

-

Harry Styles On That Awful Snl Impression His Honest Reaction

May 10, 2025

Harry Styles On That Awful Snl Impression His Honest Reaction

May 10, 2025 -

Hyatt Hotel Project Historic Broad Street Diner To Be Demolished

May 10, 2025

Hyatt Hotel Project Historic Broad Street Diner To Be Demolished

May 10, 2025 -

Stephen Kings 2025 A Look At The Monkey And Its Potential Impact

May 10, 2025

Stephen Kings 2025 A Look At The Monkey And Its Potential Impact

May 10, 2025 -

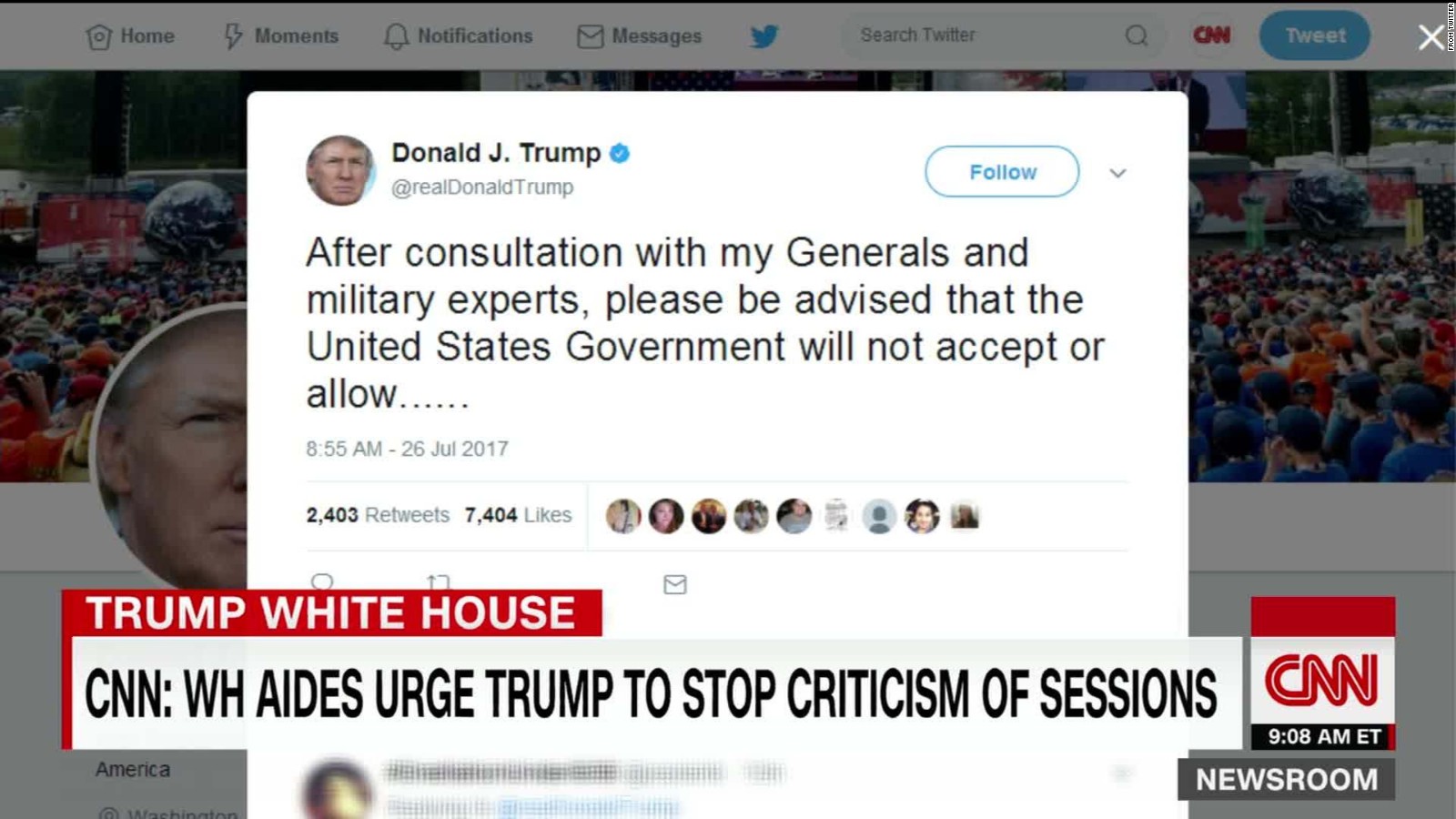

The Transgender Military Ban Unpacking Trumps Controversial Decision

May 10, 2025

The Transgender Military Ban Unpacking Trumps Controversial Decision

May 10, 2025 -

Hurun Report 2025 Elon Musk Still Tops Global Rich List Despite Significant Losses

May 10, 2025

Hurun Report 2025 Elon Musk Still Tops Global Rich List Despite Significant Losses

May 10, 2025