Analyzing The Potential Economic Fallout Of Resuming Trump Tariffs On Europe

Table of Contents

Impact on Transatlantic Trade Relations

The reintroduction of Trump-era tariffs would severely damage already fragile transatlantic trade relations. The economic interdependence between the US and the EU makes this a particularly high-stakes situation.

Increased Trade Barriers and Retaliation

The most immediate consequence would be a surge in trade barriers. The EU is highly likely to retaliate with its own tariffs, escalating into a full-blown trade war. This tit-for-tat scenario will have devastating consequences:

- Increased costs for consumers on both sides of the Atlantic: Higher prices on imported goods would reduce consumer purchasing power and stifle economic growth. This impact would be felt most acutely by lower-income households.

- Disruption of established supply chains and reduced trade volume: Businesses relying on seamless transatlantic trade would face significant disruptions, leading to production delays, shortages, and ultimately, reduced trade volume. The intricate web of global supply chains would be severely tangled.

- Negative impact on businesses reliant on transatlantic trade: Many businesses, particularly SMEs, are heavily reliant on transatlantic trade. Tariffs would severely impact their profitability, potentially leading to bankruptcies and job losses.

Erosion of Trust and International Cooperation

Beyond the immediate economic consequences, renewed tariffs would severely erode the already strained trust between the US and EU. This damage extends far beyond trade:

- Decreased political cooperation on global issues: A trade war would make it significantly harder for the US and EU to cooperate on crucial global issues like climate change, security, and pandemic preparedness.

- Weakening of multilateral trade agreements and institutions: The re-imposition of tariffs undermines the World Trade Organization (WTO) and other multilateral agreements, further destabilizing the global trading system.

- Increased uncertainty for investors and businesses: The unpredictable nature of a trade war creates significant uncertainty for investors and businesses, discouraging investment and hindering economic growth. This uncertainty acts as a significant barrier to long-term planning.

Sector-Specific Analysis of Economic Fallout

The impact of renewed Trump tariffs on Europe wouldn't be uniform; some sectors would be hit harder than others.

Impact on the Automotive Industry

The automotive industry, a major player in transatlantic trade, would be particularly vulnerable.

- Increased prices for automobiles: Tariffs on imported vehicles would lead to higher prices for consumers, reducing demand and potentially impacting sales.

- Job losses in both the US and EU automotive sectors: Reduced demand and increased production costs could lead to job losses across the automotive value chain in both regions.

- Potential shifts in global automotive production: Companies might relocate production to avoid tariffs, potentially reshaping the global automotive landscape.

Consequences for Agricultural Exports

European agricultural exports, including wine, cheese, and agricultural machinery, would face significant challenges.

- Reduced exports for European farmers: Tariffs would make European agricultural products less competitive in the US market, leading to reduced exports and potential financial hardship for farmers.

- Price increases for consumers in the US: American consumers would face higher prices for imported European agricultural products.

- Potential for farm bankruptcies in Europe: Reduced export revenues could push some European farms into bankruptcy, particularly smaller, family-run operations.

Effect on the Steel and Aluminum Industries

The steel and aluminum industries, already subject to previous tariffs, would face renewed pressure.

- Increased production costs: Higher tariffs would increase production costs for manufacturers reliant on imported steel and aluminum.

- Potential job losses in the steel and aluminum industries: Reduced competitiveness and increased costs could lead to job losses in these industries.

- Implications for downstream industries that utilize steel and aluminum: The increased costs would ripple through the economy, impacting downstream industries that utilize steel and aluminum in their production processes.

Macroeconomic Implications and Global Uncertainty

The consequences of renewed tariffs extend beyond individual sectors, impacting the global economy.

Global Economic Slowdown

A trade war between the US and EU could trigger a global economic slowdown.

- Increased inflation in both the US and EU: Tariffs would increase the price of goods, contributing to inflation and potentially eroding purchasing power.

- Reduced consumer spending and investment: Economic uncertainty would likely lead to reduced consumer spending and business investment, further dampening economic growth.

- Potential for a global recession: In a worst-case scenario, a protracted trade war could trigger a global recession.

Currency Fluctuations and Market Volatility

The economic uncertainty would also lead to significant volatility in currency and stock markets.

- Increased volatility in currency markets: Uncertainty about the future of transatlantic trade relations would likely lead to significant fluctuations in currency exchange rates.

- Negative impact on investor confidence: The prospect of a trade war would likely damage investor confidence, leading to capital flight and reduced investment.

- Potential for capital flight: Investors might move their capital to more stable markets, exacerbating the negative economic consequences.

Conclusion

The re-imposition of Trump tariffs on Europe carries substantial risks, threatening to disrupt transatlantic trade, damage international cooperation, and trigger significant economic fallout across various sectors. The potential for retaliatory tariffs and the ensuing trade war could lead to a global economic slowdown, increased inflation, and reduced investment. Understanding these potential consequences is crucial for mitigating the risks and fostering more stable and predictable trade relationships.

Call to Action: Further research and analysis are needed to fully understand the potential ramifications of resuming Trump tariffs on Europe. By engaging in informed discussions and advocating for responsible trade policies, we can collectively work to avoid the devastating economic consequences of such a decision. Let's continue the conversation about the potential impact of Trump Tariffs on Europe and work towards a future of greater economic cooperation and stability.

Featured Posts

-

Los Angeles Dodgers Set To Bid On Top Mlb Free Agent Report Claims

May 13, 2025

Los Angeles Dodgers Set To Bid On Top Mlb Free Agent Report Claims

May 13, 2025 -

Epic City Development Halted Abbotts Warning And Developer Response

May 13, 2025

Epic City Development Halted Abbotts Warning And Developer Response

May 13, 2025 -

Nhl Draft Lottery Islanders Win Sharks Get Second Pick

May 13, 2025

Nhl Draft Lottery Islanders Win Sharks Get Second Pick

May 13, 2025 -

Lywnardw Dy Kapryw W Adryn Brwdy Ahtmal Hdwr Dr Fylm Jdyd Aywl Knywl

May 13, 2025

Lywnardw Dy Kapryw W Adryn Brwdy Ahtmal Hdwr Dr Fylm Jdyd Aywl Knywl

May 13, 2025 -

Porsche Grand Prix Final Sabalenka Vs Ostapenko

May 13, 2025

Porsche Grand Prix Final Sabalenka Vs Ostapenko

May 13, 2025

Latest Posts

-

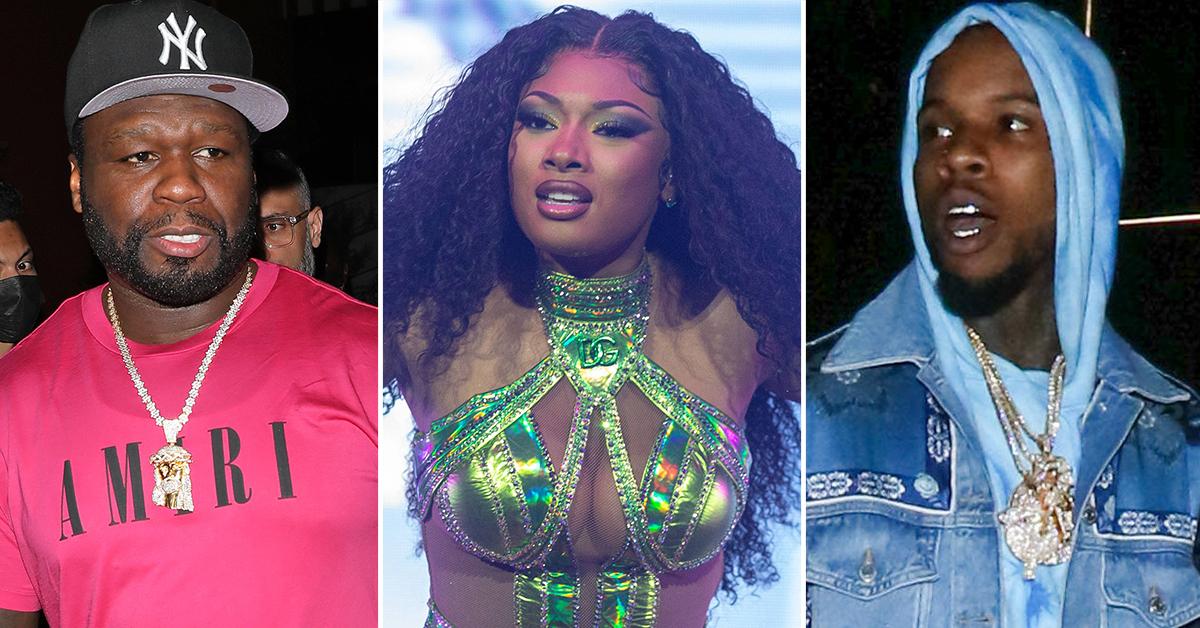

Hip Hop Reacts Tory Lanez And 50 Cent On Megan Thee Stallions Guilty Verdict Prediction

May 13, 2025

Hip Hop Reacts Tory Lanez And 50 Cent On Megan Thee Stallions Guilty Verdict Prediction

May 13, 2025 -

50 Cent And Tory Lanez Weigh In On Predicted Megan Thee Stallion Guilty Verdict

May 13, 2025

50 Cent And Tory Lanez Weigh In On Predicted Megan Thee Stallion Guilty Verdict

May 13, 2025 -

Megan Thee Stallion Case Tory Lanez And 50 Cents Reactions To The Verdict Prediction

May 13, 2025

Megan Thee Stallion Case Tory Lanez And 50 Cents Reactions To The Verdict Prediction

May 13, 2025 -

Record Number Of Bike Thefts Reported In The Netherlands

May 13, 2025

Record Number Of Bike Thefts Reported In The Netherlands

May 13, 2025 -

Tory Lanez And 50 Cent Respond To Megan Thee Stallions Guilty Verdict Prediction

May 13, 2025

Tory Lanez And 50 Cent Respond To Megan Thee Stallions Guilty Verdict Prediction

May 13, 2025