Analyzing The U.S. Dollar's Performance: A Comparison To Nixon's Presidency

Table of Contents

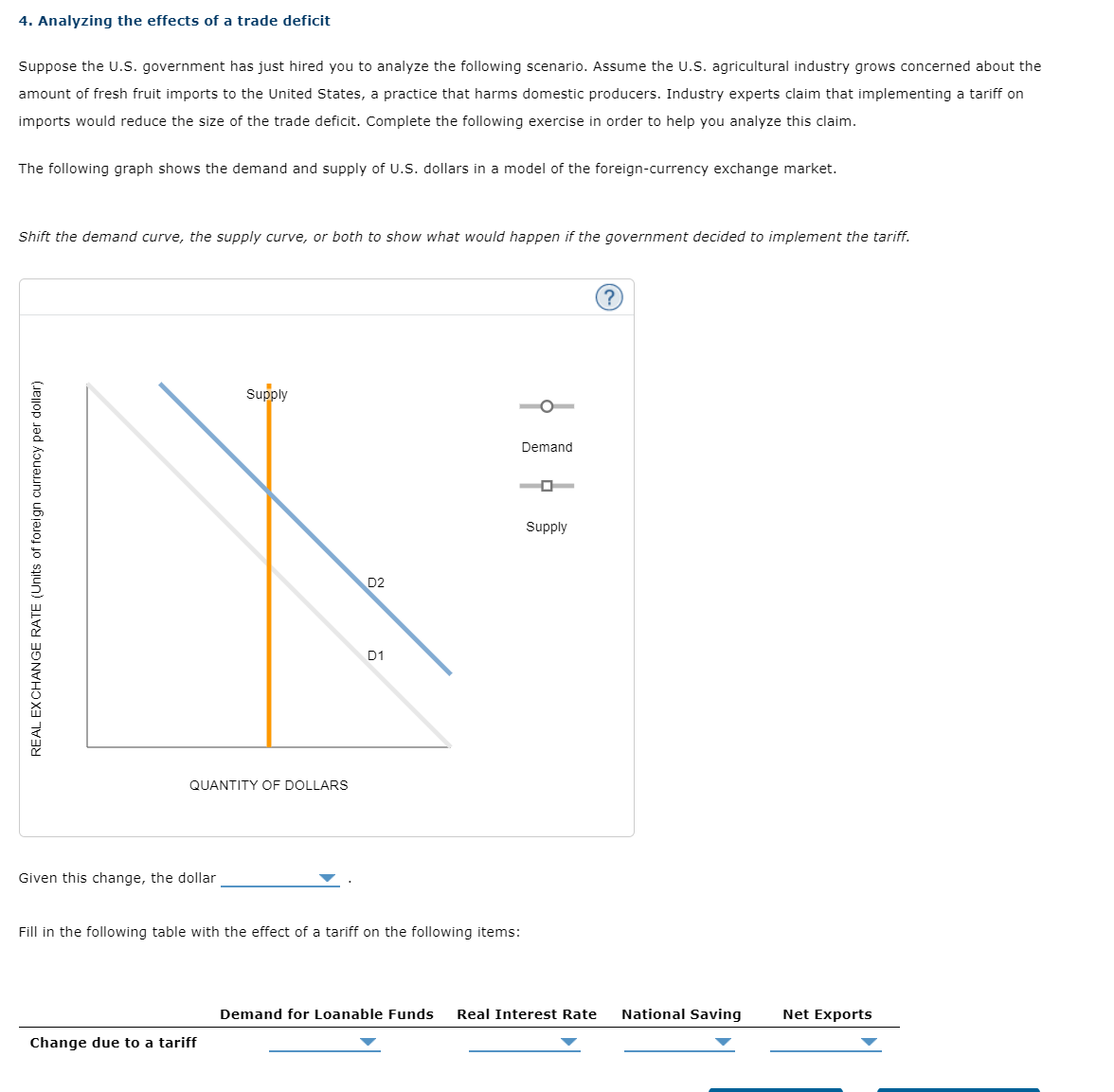

The Bretton Woods System and its Collapse under Nixon (1971)

The Bretton Woods system, established in 1944, pegged the value of most currencies to the U.S. dollar, which in turn was convertible to gold at a fixed rate. This system provided a relatively stable international monetary system, fostering post-war economic growth. However, the system was inherently flawed. The U.S., facing growing economic pressures, found it increasingly difficult to maintain the gold standard.

Several factors contributed to the system's collapse:

- Fixed exchange rates and their limitations: The fixed exchange rates lacked flexibility to adjust to changing economic realities, leading to imbalances.

- Growing U.S. trade deficits: The U.S. experienced persistent trade deficits, fueled partly by the costs of the Vietnam War and burgeoning domestic spending.

- The impact of the Vietnam War on the U.S. economy: The war placed a significant strain on the U.S. economy, increasing inflation and weakening the dollar.

- Nixon's closure of the gold window (1971): In a decisive move, President Nixon unilaterally closed the gold window, effectively ending the convertibility of the dollar to gold. This marked the end of the Bretton Woods system and ushered in an era of floating exchange rates. This decision had a profound impact on the U.S. dollar's value and global financial markets.

The U.S. Dollar's Performance Post-Bretton Woods

The shift to a floating exchange rate system introduced increased volatility into the global currency markets. The U.S. dollar's value since 1971 has been subject to significant fluctuations, influenced by a complex interplay of economic and political factors.

- Major economic events impacting the dollar's value: The oil crises of the 1970s, various recessions (including the 2008 financial crisis), and global pandemics like COVID-19 have all significantly affected the dollar's value.

- The role of interest rates and monetary policy: The Federal Reserve's monetary policy decisions, including interest rate adjustments, play a crucial role in influencing the dollar's strength. Higher interest rates generally attract foreign investment, strengthening the dollar.

- The influence of global economic factors: Global economic growth, inflation rates in other countries, and geopolitical events all impact the demand for and supply of U.S. dollars, affecting its exchange rate against other major currencies.

Current State of the U.S. Dollar

Currently, the U.S. dollar remains the world's dominant reserve currency, though its position is increasingly challenged by other major economies. The dollar's strength fluctuates, affected by several crucial factors.

- Current exchange rates against major currencies: The dollar's value is constantly changing against other major currencies like the euro, the yen, and the British pound. Analyzing these exchange rates provides insights into the dollar's relative strength.

- Factors impacting the dollar's current value: Inflation in the U.S., geopolitical instability (e.g., the war in Ukraine), and the Federal Reserve's monetary policy are all significant factors currently influencing the dollar's performance.

- Potential future trends and predictions for the U.S. dollar: Predicting future trends is challenging, but analyzing current economic conditions and potential risks can provide some insights into the likely trajectory of the dollar's value. Factors like the pace of U.S. economic growth and global geopolitical stability will be key.

Comparing Then and Now: Key Similarities and Differences

Comparing the economic climate during Nixon's era and the present reveals both striking similarities and significant differences in the factors affecting the U.S. dollar.

- Similarities in global economic pressures: Both eras witnessed significant global economic pressures, including trade imbalances and inflationary concerns. The interconnectedness of the global economy amplifies these pressures today.

- Differences in the global financial system's structure: The global financial system is far more complex and interconnected now compared to the 1970s. The emergence of new global players and financial instruments makes today's system more volatile.

- The evolution of monetary policy and its impact: Monetary policy tools and their applications have evolved considerably. The Federal Reserve now has a more sophisticated toolkit to manage inflation and economic growth, influencing the dollar's performance.

Conclusion

Analyzing the U.S. dollar's performance, from the era of Bretton Woods to the present, reveals a complex interplay of economic and political factors shaping its value and global role. While similarities exist in the underlying economic pressures, the global financial system's structure and monetary policy tools have undergone significant changes. The dollar's position as the world's dominant reserve currency remains, but challenges and volatility are ever-present. Stay informed on the evolving landscape of the U.S. dollar by continuing your research into global economics and monetary policy. Understanding the U.S. dollar's performance is crucial for navigating the complexities of the modern financial world.

Featured Posts

-

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 28, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 28, 2025 -

Le Bron James And Richard Jefferson Espn News Discussion

Apr 28, 2025

Le Bron James And Richard Jefferson Espn News Discussion

Apr 28, 2025 -

Bubba Wallace Balancing Racing And Fatherhood

Apr 28, 2025

Bubba Wallace Balancing Racing And Fatherhood

Apr 28, 2025 -

Luigi Mangione A Look At His Supporters Key Concerns And Goals

Apr 28, 2025

Luigi Mangione A Look At His Supporters Key Concerns And Goals

Apr 28, 2025 -

U S Dollar Faces Potential For Steepest Decline Since Nixon Era

Apr 28, 2025

U S Dollar Faces Potential For Steepest Decline Since Nixon Era

Apr 28, 2025