Analyzing Trump's Proposal: Can Tariffs Fund The Government?

Table of Contents

1. The Mechanics of Tariffs and Government Revenue

How Tariffs Generate Revenue

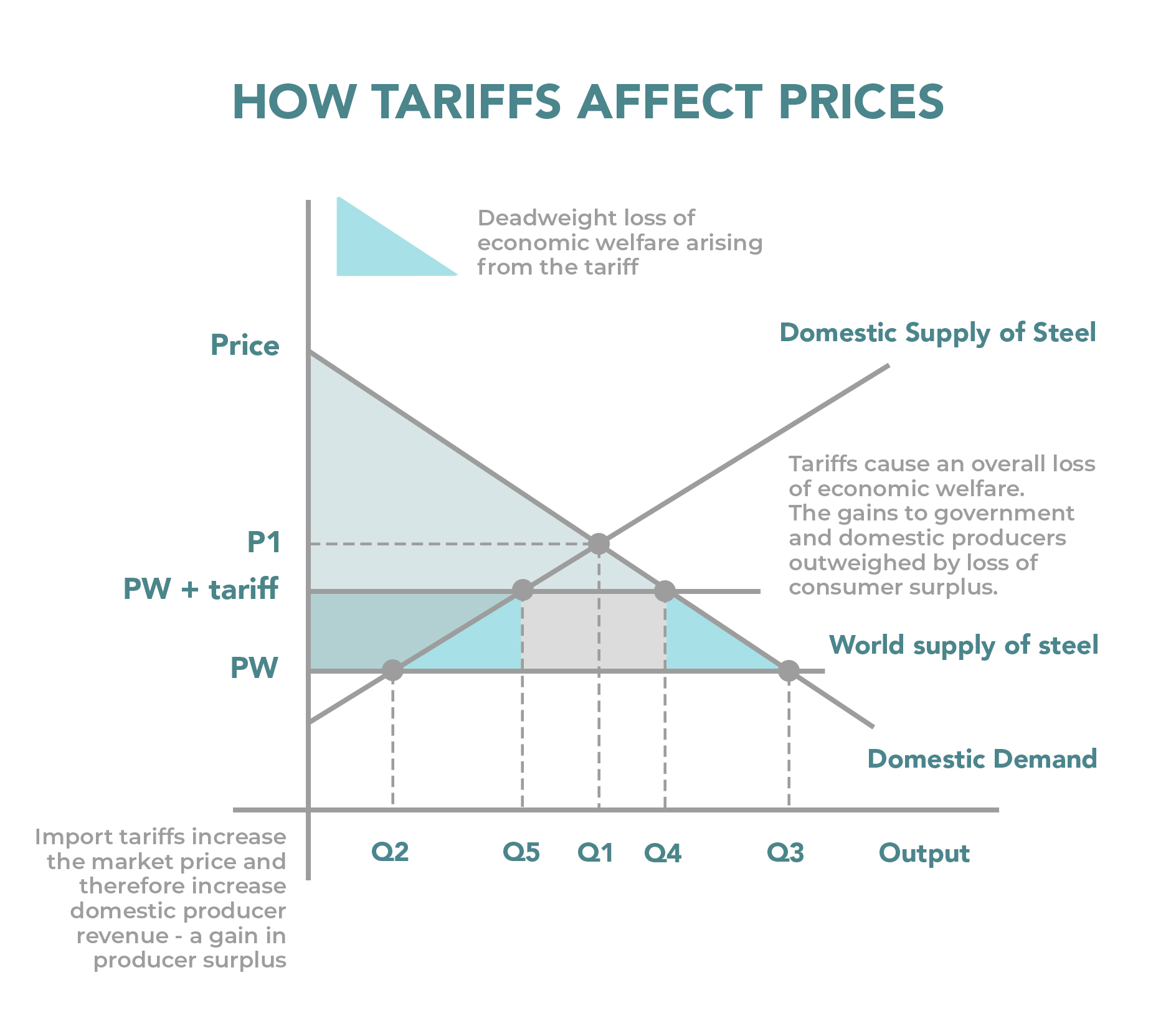

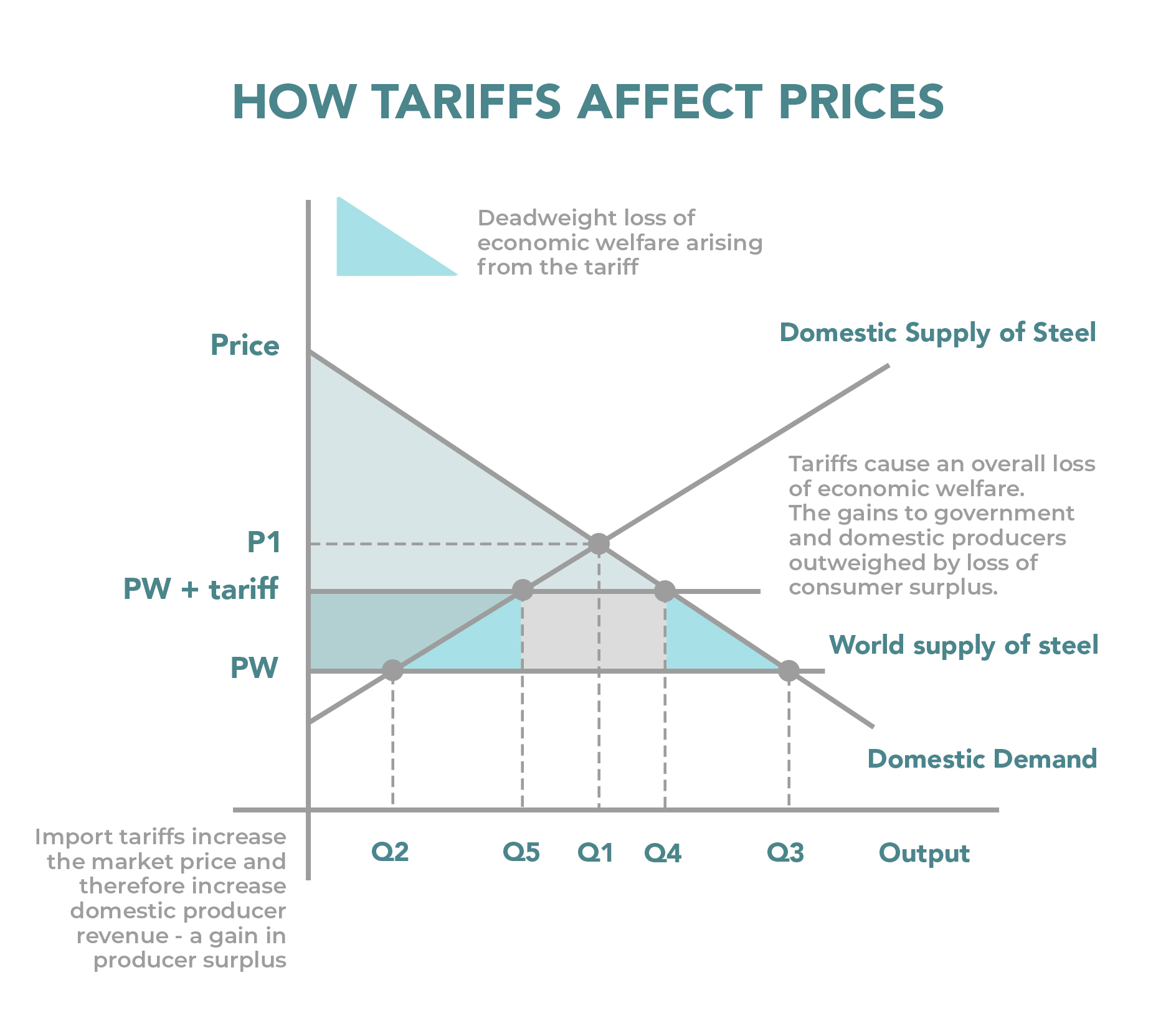

Tariffs, essentially taxes on imported goods, are a long-standing source of government revenue. Known as import tariffs or customs duties, these taxes increase the price of foreign products, making domestically produced goods more competitive. The revenue generated flows directly into the government's coffers, potentially contributing to its budget. Keywords like "tariff revenue," "government funding," and "import tariffs" are crucial here for SEO purposes.

- Tariffs as Revenue vs. Protection: It's crucial to differentiate between tariffs implemented primarily as a revenue-generating tool and those used as a protectionist measure to shield domestic industries from foreign competition. While both generate revenue, their underlying economic goals differ significantly.

- Historical Examples: Historically, tariffs have played a significant role in government funding. The US, for example, relied heavily on tariffs during the 19th century. However, their contribution has diminished over time as other revenue sources, such as income tax, have become more dominant.

- Limitations of Tariffs as a Sustainable Source: Tariffs have inherent limitations. High tariffs can lead to retaliatory measures from other countries, harming export industries and reducing overall revenue. Moreover, they are inherently volatile, susceptible to fluctuations in global trade and economic conditions.

2. Analyzing Trump's Specific Tariff Proposals

Target Industries and Projected Revenue

Trump's tariff proposals targeted specific industries, particularly those in China, aiming to generate substantial revenue and address the perceived trade imbalance. Analyzing the projected revenue requires examining the import volumes and specific tariff rates applied to each targeted product. Keywords such as "Trump tariffs," "trade war," and "specific tariff rates" are vital for SEO here.

- Retaliatory Tariffs: One major challenge was the potential for retaliatory tariffs from affected countries, negating the intended revenue gains and potentially harming US export sectors.

- Consumer Price Increases: Increased tariffs directly translate to higher prices for consumers, potentially reducing purchasing power and impacting consumer spending.

- Impact on Domestic Industries: The impact on domestic industries is complex. While tariffs can protect some sectors, they can also increase input costs for others, potentially hurting production and competitiveness.

3. Economic Consequences and Counterarguments

The Trade Deficit and its Relation to Tariffs

The relationship between trade deficits and tariffs is complex and often debated. Many believed that Trump's tariffs could help reduce the US trade deficit, but this isn’t necessarily the case. Keywords such as "trade deficit," "balance of trade," and "economic impact of tariffs" are critical for this section.

- Addressing Trade Imbalances: While tariffs can theoretically reduce imports, they might also trigger retaliatory tariffs, shrinking exports and potentially worsening the trade imbalance.

- Negative Economic Consequences: The imposition of tariffs can lead to reduced international trade, slower economic growth, and increased prices for consumers. These are significant negative consequences that need careful consideration.

- Alternative Funding Approaches: The reliance on tariffs as a primary funding source overlooks alternative approaches, such as adjusting government spending or exploring other revenue streams.

4. The Feasibility of Tariffs as a Primary Funding Source

Comparing Tariff Revenue to Government Spending

The most crucial question is whether tariff revenue can realistically match government spending. A comparison of potential tariff revenue with the overall government budget reveals the limitations of this approach. Keywords like "government budget," "fiscal policy," "sustainable funding," and "revenue generation" are vital for SEO in this context.

- Limitations of Tariff Reliance: Relying solely on tariffs for government funding is inherently unsustainable and risky due to their volatility and vulnerability to international trade relations.

- Diversification of Revenue Sources: A healthy fiscal policy requires diversification of revenue sources, reducing reliance on any single, potentially unstable, stream.

- Political Ramifications: Heavy reliance on tariffs carries significant political ramifications, potentially triggering trade wars and international tensions.

Conclusion

The analysis demonstrates that while tariffs can generate revenue and have played a historical role in government funding, they are an unreliable and ultimately insufficient mechanism to fund the US government comprehensively. The economic consequences, including retaliatory tariffs, increased consumer prices, and potential harm to domestic industries, outweigh the potential benefits. Reliance on tariffs as a primary funding source is neither sustainable nor advisable. Instead, a diversified approach involving prudent spending, efficient tax policies, and other revenue streams offers a far more stable and sustainable path to funding government operations. We encourage further research on "government funding through tariffs," exploring the viability of tariff-funded government, and engaging in informed discussions on this critical issue.

Featured Posts

-

Processo Becciu Ultime Notizie Sui Fondi 8xmille

May 01, 2025

Processo Becciu Ultime Notizie Sui Fondi 8xmille

May 01, 2025 -

Royals Defeat Guardians 4 3 Garcia Homer And Witts Key Hit

May 01, 2025

Royals Defeat Guardians 4 3 Garcia Homer And Witts Key Hit

May 01, 2025 -

Six Nations 2025 A New Era For French Rugby

May 01, 2025

Six Nations 2025 A New Era For French Rugby

May 01, 2025 -

Kshmyr Brtanwy Arkan Parlymnt Ky Janb Se Msyle Ke Hl Ky Hmayt Ka Aelan

May 01, 2025

Kshmyr Brtanwy Arkan Parlymnt Ky Janb Se Msyle Ke Hl Ky Hmayt Ka Aelan

May 01, 2025 -

France Wins Six Nations Englands Victory Scotland And Irelands Disappointing Performances

May 01, 2025

France Wins Six Nations Englands Victory Scotland And Irelands Disappointing Performances

May 01, 2025