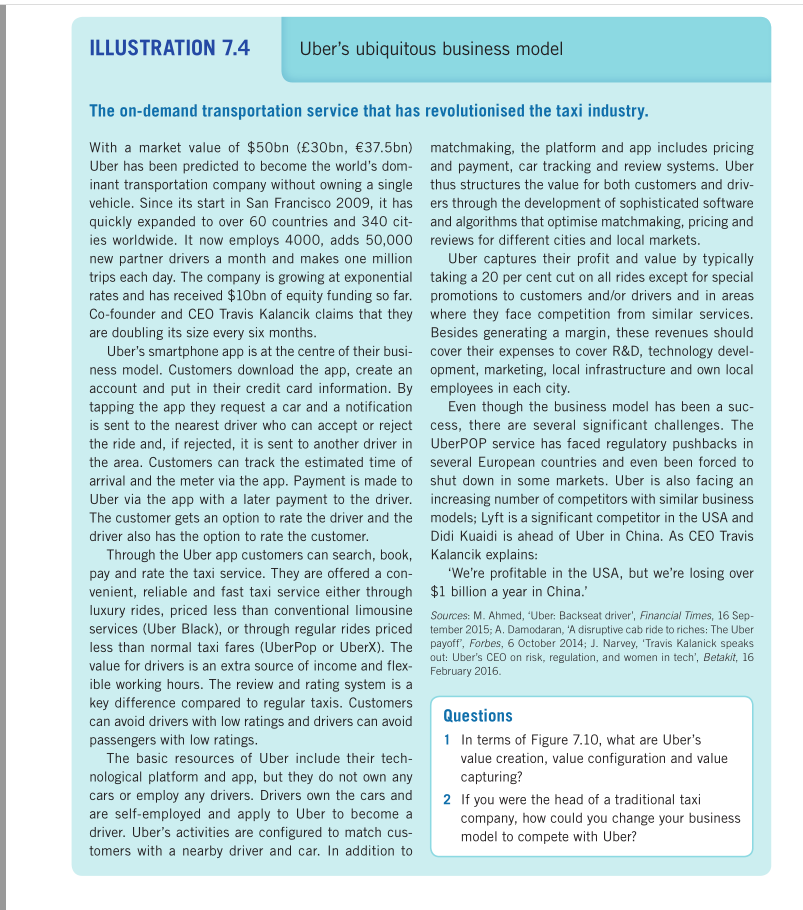

Analyzing Uber's Resilience In A Potential Recession

Table of Contents

Uber's Diverse Revenue Streams as a Recession Buffer

Uber's success isn't solely reliant on its ride-sharing services. Its diversification into multiple revenue streams acts as a significant buffer against economic downturns. The company operates Uber Eats, a food delivery service; Uber Freight, a logistics platform; and even explores other innovative areas. This diversification significantly reduces the company's reliance on any single sector, mitigating the risk of a catastrophic impact from a recession.

Let's consider the relative contributions: While ride-sharing historically formed a larger part of Uber's revenue, Uber Eats has shown remarkable growth, especially during periods of increased home-based consumption.

- Growth potential of Uber Eats during economic uncertainty: As disposable income decreases, people may opt to eat at home more frequently, boosting demand for food delivery services.

- Resilience of Uber Freight due to essential goods transportation needs: The transportation of essential goods remains a vital service regardless of economic conditions. This segment provides a stable revenue base.

- Impact of potential reduced discretionary spending on ride-sharing: Ride-sharing, being a discretionary expense, is likely to be affected by reduced consumer spending during a recession. However, the impact might be softened by price adjustments and targeted promotions.

The interdependencies between these streams are also notable. For example, the driver network used for ride-sharing can also be utilized for food and freight delivery, maximizing efficiency and resource utilization.

Pricing Strategies and Demand Elasticity in a Recession

Uber's dynamic pricing model, while sometimes criticized, could prove crucial during a recession. This model adjusts prices based on real-time demand and supply. While this might lead to higher prices during peak demand, it allows Uber to maintain profitability even when demand drops.

The price sensitivity of Uber's services varies across segments. Ride-sharing is likely to be more price-sensitive than Uber Eats, where the demand for convenience might outweigh price considerations even during a downturn.

- Impact of lower demand on pricing strategies: Uber can strategically lower prices during periods of low demand to attract customers and maintain market share.

- Potential for targeted promotions and discounts to stimulate demand: Offering targeted discounts and promotions can incentivize customers to continue using Uber's services, counteracting the impact of reduced spending.

- Analysis of historical data on Uber's performance during previous economic slowdowns: Examining how Uber performed during past recessions provides valuable insights into its resilience and adaptability.

Understanding demand elasticity is critical. While ride-sharing might experience a decrease in demand during a recession (relatively elastic demand), the demand for essential services like food delivery might remain more stable (relatively inelastic demand).

Cost-Cutting Measures and Operational Efficiency

To maintain profitability during a potential recession, Uber can implement several cost-cutting measures without significantly compromising service quality. This involves optimizing its operations and leveraging its technological advantages.

- Reduction in marketing and advertising expenditure: Optimizing marketing spend and focusing on more cost-effective channels can reduce expenses.

- Optimization of driver compensation and incentives: While maintaining driver satisfaction is crucial, Uber can review its incentive programs to ensure they remain cost-effective while still attracting and retaining drivers.

- Investment in automation and AI to increase efficiency: Automation and AI can streamline operations, reducing manual labor costs and improving efficiency.

These cost-cutting measures will need to be carefully managed to avoid negatively impacting driver satisfaction and retention, which is crucial for maintaining service quality.

Uber's Technological Advantage and Future Innovation

Uber's technological prowess is a significant asset. Its robust platform, data analytics capabilities, and ongoing investment in innovation position it well to navigate economic hardship.

- Autonomous vehicle development and its long-term impact on costs: The successful implementation of autonomous vehicles could drastically reduce operational costs in the long run.

- Data analytics and AI for optimizing operations and predicting demand: Data-driven insights can help Uber anticipate demand fluctuations, optimize pricing strategies, and efficiently allocate resources.

- Investment in new technologies and services to maintain competitive advantage: Continuing to innovate and develop new services allows Uber to stay ahead of the competition and adapt to changing market conditions.

However, the development and implementation of these technologies present challenges and risks, requiring careful planning and substantial investment.

Assessing Uber's Recession-Proofing Strategies

In conclusion, Uber's diversified revenue streams, adaptable pricing strategies, potential for cost-cutting, and significant technological advantages contribute to its resilience in a potential recession. While the impact of a downturn is undeniable, Uber's proactive measures and strategic positioning suggest it has a relatively strong chance of navigating these economic headwinds successfully. However, uncertainties remain, and continuous monitoring of economic indicators and consumer behavior is essential. To further explore Uber's resilience in a potential recession, continue researching the company's financial performance and strategic initiatives. Share your thoughts and insights on this crucial topic in the comments section below!

Featured Posts

-

Fountain City Classic Scholarship Preparing For Your Midday Interview

May 17, 2025

Fountain City Classic Scholarship Preparing For Your Midday Interview

May 17, 2025 -

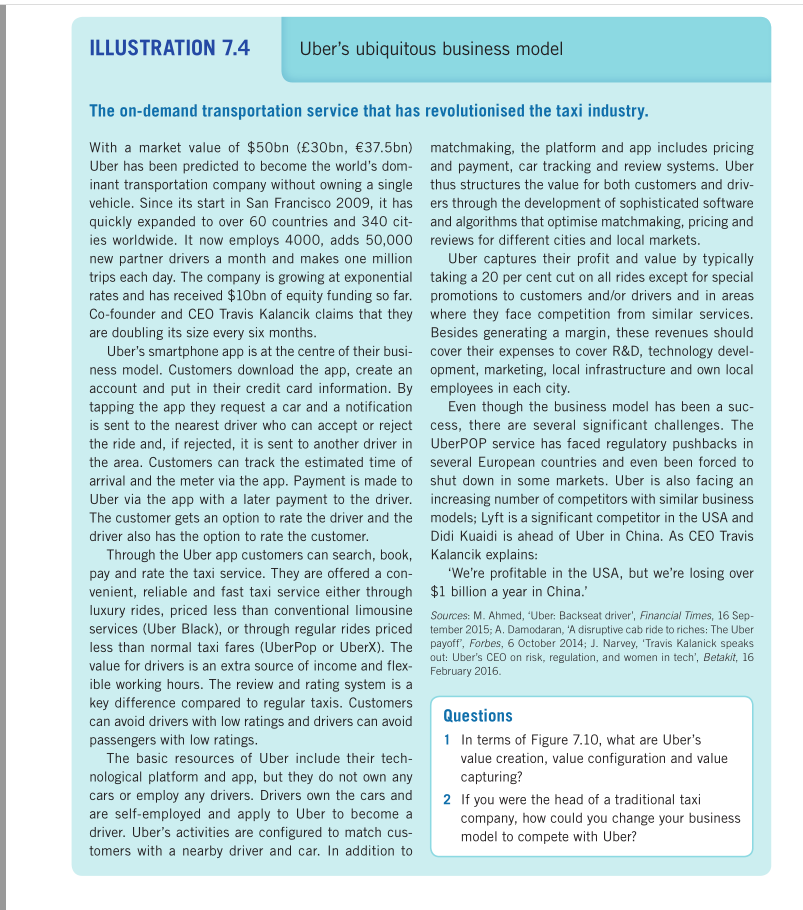

Memahami Pentingnya Laporan Keuangan Bagi Kesehatan Bisnis Anda

May 17, 2025

Memahami Pentingnya Laporan Keuangan Bagi Kesehatan Bisnis Anda

May 17, 2025 -

Trumps F 55 And F 22 Upgrade Proposals Feasibility And Impact

May 17, 2025

Trumps F 55 And F 22 Upgrade Proposals Feasibility And Impact

May 17, 2025 -

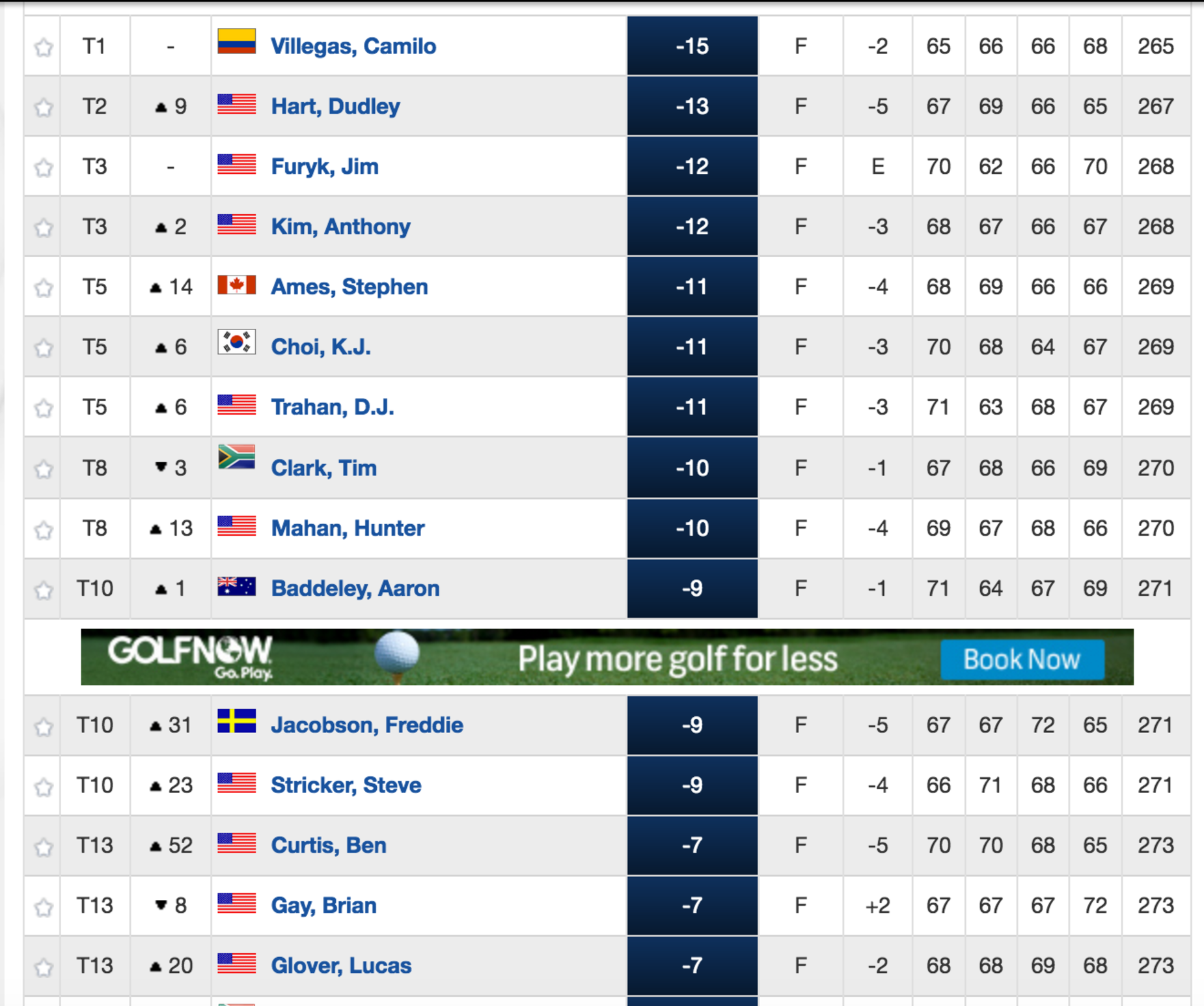

Pga Championship Day 1 A Surprise Leader And A Challenging Course

May 17, 2025

Pga Championship Day 1 A Surprise Leader And A Challenging Course

May 17, 2025 -

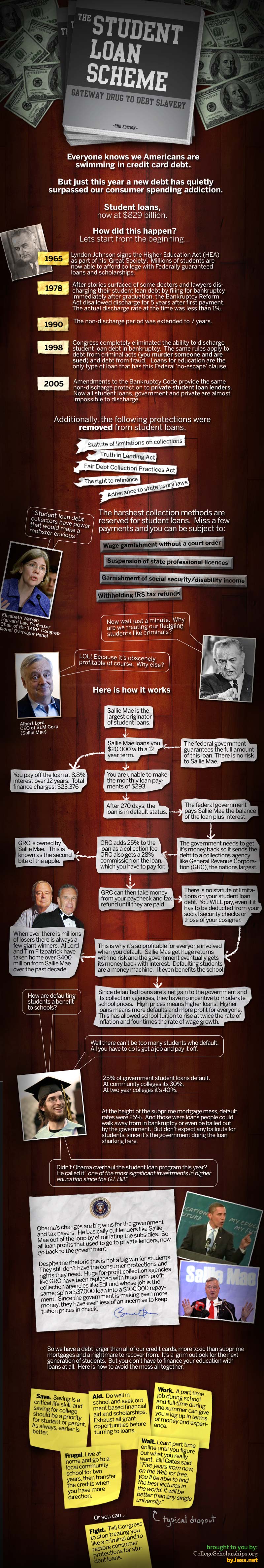

Impacto De La Nueva Politica Del Departamento De Educacion Sobre Prestamos Estudiantiles

May 17, 2025

Impacto De La Nueva Politica Del Departamento De Educacion Sobre Prestamos Estudiantiles

May 17, 2025

Latest Posts

-

Jalen Brunsons Ankle Injury Knicks Lakers Game Update

May 17, 2025

Jalen Brunsons Ankle Injury Knicks Lakers Game Update

May 17, 2025 -

Analyzing The Knicks Performance Without Jalen Brunson

May 17, 2025

Analyzing The Knicks Performance Without Jalen Brunson

May 17, 2025 -

The Knicks Post Brunson Problems A Long Road To Recovery

May 17, 2025

The Knicks Post Brunson Problems A Long Road To Recovery

May 17, 2025 -

Analyzing The Impact Jalen Brunson Vs Luka Doncic Trade Which Setback Hurt The Mavericks More

May 17, 2025

Analyzing The Impact Jalen Brunson Vs Luka Doncic Trade Which Setback Hurt The Mavericks More

May 17, 2025 -

The New York Knicks And Their Unexpected Depth A Brunson Less Success Story

May 17, 2025

The New York Knicks And Their Unexpected Depth A Brunson Less Success Story

May 17, 2025