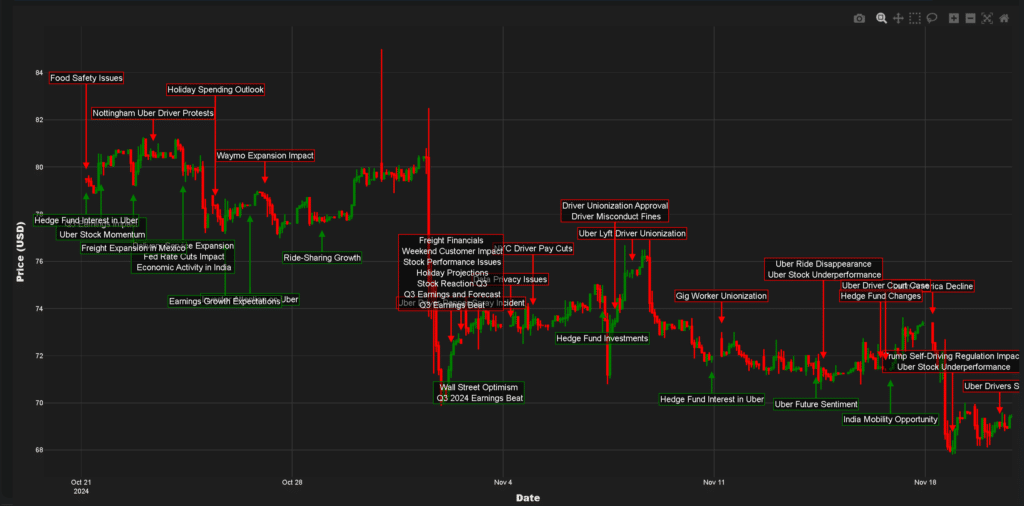

Analyzing Uber's Stock Performance Amid Recession Concerns

Table of Contents

Uber's Recent Financial Performance and Key Metrics

Understanding Uber's recent financial performance is crucial to assessing its resilience during a potential recession. Key performance indicators (KPIs) like revenue growth, profitability, and user acquisition rates provide valuable insights. Let's examine some crucial metrics:

-

Revenue Growth: Analyzing recent quarterly earnings reports reveals Uber's revenue trends. While Uber has shown periods of significant growth, closely examining the revenue figures, particularly the breakdown between its ride-hailing and Uber Eats segments, is vital. A slowdown in revenue growth would signal a potential negative impact from a recession.

-

Profitability and EBITDA: Uber's path to profitability remains a key focus for investors. Examining its EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) helps gauge its operational efficiency and ability to generate cash flow. A decline in profitability during a recession would be a significant concern.

-

User and Driver Growth: Tracking the number of active riders and drivers is critical. A decrease in user growth, especially in a recessionary environment, indicates weakening demand and potential pressure on the business model. Similarly, driver acquisition and retention rates are vital for maintaining service levels.

-

Operating Expenses and Inflation: Rising fuel costs and inflation directly impact Uber's operating expenses. Analyzing how effectively Uber manages these costs and mitigates their impact on profitability is essential. Strategies for cost optimization and efficiency improvements will be under scrutiny.

-

New Initiatives and Services: Uber has continuously launched new services and initiatives, including expanding into freight and other delivery services. Assessing the success and contribution of these diversification efforts to overall revenue and profitability is crucial for evaluating its long-term prospects.

The Impact of Recessionary Conditions on Ride-Sharing Demand

Recessions significantly impact consumer spending, particularly on discretionary services like ride-sharing. Understanding the historical relationship between economic downturns and Uber's performance is crucial.

-

Consumer Spending and Discretionary Services: During economic uncertainty, consumers tend to reduce spending on non-essential services. Ride-sharing, often viewed as a discretionary expense, is particularly vulnerable to this trend.

-

Historical Data Analysis: Analyzing Uber's performance during previous economic slowdowns provides valuable insights into its resilience. Identifying past patterns in ride volume and pricing strategies will help predict potential future behavior.

-

Potential Scenarios: Several scenarios are possible during a recession: decreased ride volume, increased price sensitivity among consumers, and shifts in consumer behavior towards cheaper alternatives like public transportation.

-

Impact on Uber Eats: While ride-hailing might be affected, Uber Eats, its food delivery service, might demonstrate different resilience. Consumer spending on food delivery may prove more resilient than discretionary spending on rides during an economic downturn.

-

Shift in Consumer Preferences: Consumers might shift their preferences to cheaper transportation options. This necessitates a close examination of how Uber will adapt to changes in consumer behavior and maintain market share.

Uber's Strategic Responses to Economic Headwinds

Uber's strategic responses to economic headwinds will be a crucial determinant of its stock performance during a recession.

-

Cost-Cutting Measures: Implementing cost-cutting measures, such as streamlining operations and reducing marketing expenses, can improve profitability and enhance resilience.

-

Diversification Strategies: Uber's diversification into areas like Uber Eats and freight transportation reduces reliance on a single revenue stream and improves its ability to withstand economic downturns.

-

Technological Innovation: Investing in technological advancements, such as optimizing its algorithms for efficient routing and driver matching, can improve operational efficiency and reduce costs.

-

Acquisitions and Partnerships: Strategic acquisitions or partnerships can enhance Uber's capabilities and expand its market reach, improving its long-term resilience.

-

Marketing and Advertising Strategies: Adjusting marketing and advertising strategies to target price-sensitive consumers during a recession is important to maintain demand and market share.

Assessing the Long-Term Outlook for Uber Stock

Assessing the long-term outlook for Uber stock requires a balanced perspective, considering both potential growth opportunities and potential risks.

-

Potential for Long-Term Growth: Factors such as technological advancements, expansion into new markets, and increased adoption of ride-sharing services suggest potential for long-term growth.

-

Risks and Challenges: Economic downturns, increased competition, regulatory changes, and driver relations remain significant challenges that could negatively impact future performance.

-

Valuation and Competitor Analysis: Comparing Uber's valuation to its competitors and the broader market helps assess its potential for future growth.

-

Investment Outlook: Considering the interplay of various factors, investors should formulate a well-informed investment strategy for Uber stock within the context of a potentially recessionary environment.

Conclusion

This analysis of Uber's stock performance during potential recessionary concerns reveals a complex interplay of financial performance, consumer behavior, and corporate strategies. While economic uncertainty poses challenges, Uber's diversification efforts and technological advancements provide potential avenues for resilience. Understanding the factors impacting Uber's stock performance is crucial for investors navigating the current economic climate. Continue your research on analyzing Uber's stock performance and stay informed about the latest developments in the ride-sharing and broader technology sectors to make informed investment decisions.

Featured Posts

-

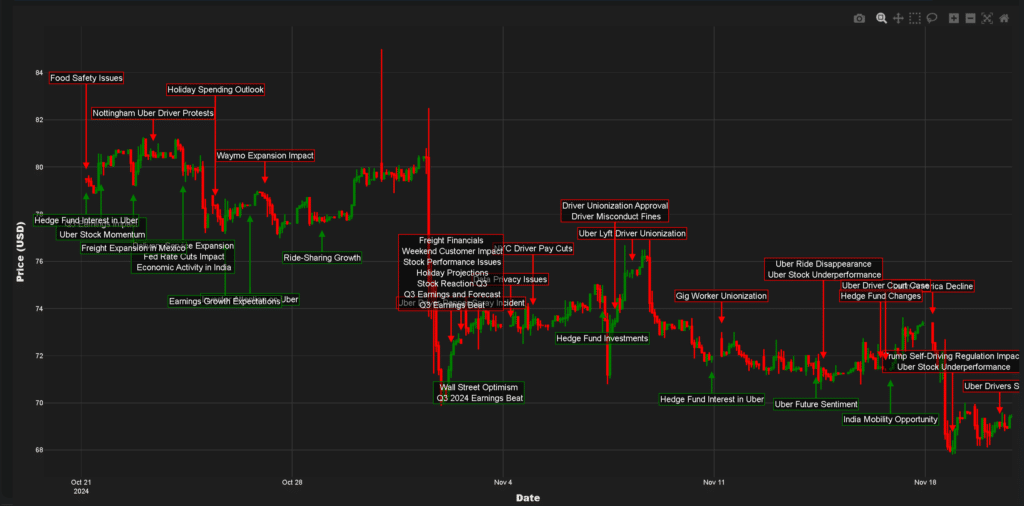

Abba Voyage Setlist Changes And Band Statement

May 19, 2025

Abba Voyage Setlist Changes And Band Statement

May 19, 2025 -

Understanding Global Tariff Fluctuations An Fp Video Analysis

May 19, 2025

Understanding Global Tariff Fluctuations An Fp Video Analysis

May 19, 2025 -

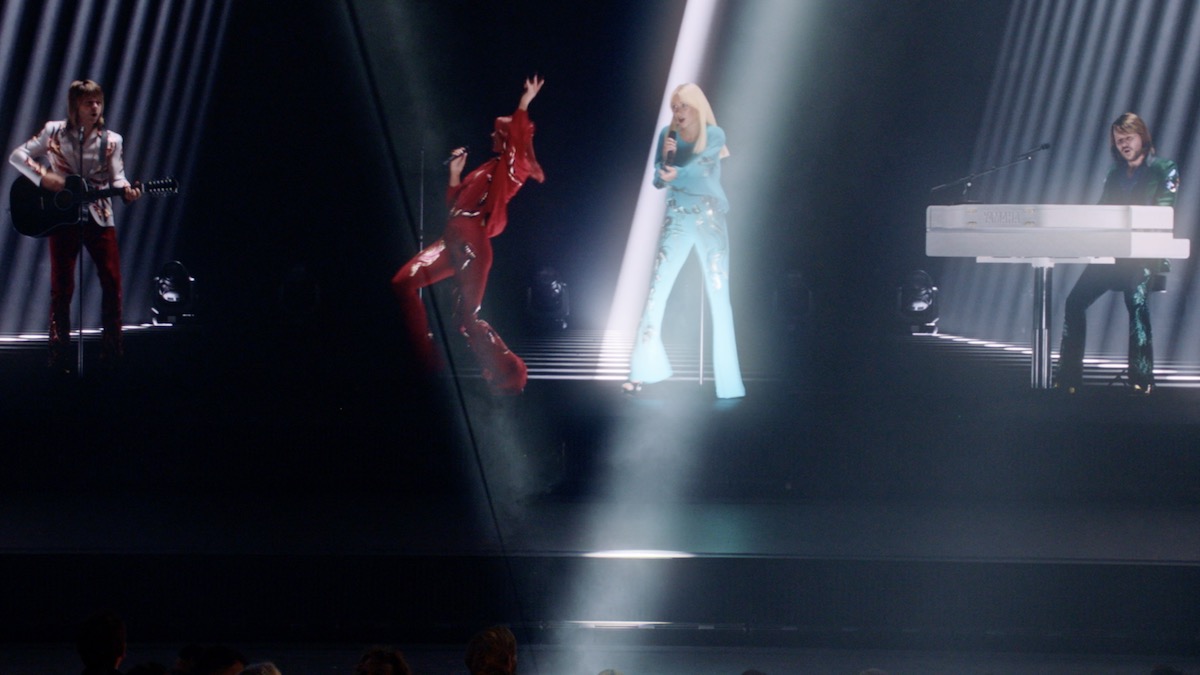

Eurovision 2024 Infe Poll Vote Now In Esc Todays 9th Annual Prediction

May 19, 2025

Eurovision 2024 Infe Poll Vote Now In Esc Todays 9th Annual Prediction

May 19, 2025 -

Marko Bosnjak Hrvatska Na Eurosongu 2024

May 19, 2025

Marko Bosnjak Hrvatska Na Eurosongu 2024

May 19, 2025 -

Hillsborough Principal Of The Year Award Goes To De Soto Elementary

May 19, 2025

Hillsborough Principal Of The Year Award Goes To De Soto Elementary

May 19, 2025