Analyzing Warren Buffett's Investing History: Insights From His Best And Worst Decisions

Table of Contents

Warren Buffett's Greatest Investment Wins: Mastering Value Investing

Warren Buffett's unparalleled success stems from his mastery of value investing. By identifying undervalued companies with strong fundamentals and holding them for the long term, he's generated astronomical returns. Let's examine some of his most significant wins:

Berkshire Hathaway Acquisition: A Monumental Investment

Arguably Buffett's most impactful investment was his strategic acquisition and subsequent build-up of Berkshire Hathaway.

- Initial Investment: Buffett's initial investment in Berkshire Hathaway was relatively small, but his long-term vision transformed it. He recognized the company's potential beyond its textile operations.

- Growth and Transformation: Buffett gradually shifted Berkshire Hathaway's focus from textiles to insurance and other profitable ventures. This strategic shift, coupled with his astute investment decisions using Berkshire Hathaway as a vehicle, is a textbook example of how long-term vision can yield extraordinary results. This significantly increased the value of Berkshire Hathaway stock, making it one of the most successful companies globally.

- Impact on Net Worth: The growth of Berkshire Hathaway directly contributed to the massive growth of Buffett's personal net worth, solidifying his status as one of the world's wealthiest individuals. His long-term investment strategy, centered around this core holding, exemplifies patience and strategic acumen. Understanding his value investing strategy is key to unlocking the secrets of his success.

Coca-Cola Investment: A Classic Value Play

Buffett's investment in Coca-Cola is a quintessential example of his value investing philosophy in action.

- Rationale: Buffett recognized Coca-Cola's strong brand recognition, wide moats, and exceptional return on capital. He saw it as an undervalued asset with significant long-term potential.

- Significant Returns: This investment, originally made in the late 1980s, has generated massive returns through both capital appreciation and dividend stocks payouts. It showcases the power of identifying durable businesses and holding them through market fluctuations.

- Portfolio Contribution: The Coca-Cola investment represents a substantial portion of Berkshire Hathaway's portfolio, highlighting the long-term value generated from a well-researched and strategically placed investment. The consistent performance of Coca-Cola stock performance has been a significant factor in Berkshire Hathaway’s success.

American Express Investment: Capitalizing on Market Downturns

Buffett's investment in American Express during a period of crisis demonstrates his ability to capitalize on market downturns.

- Contrarian Approach: While many investors fled American Express following a scandal, Buffett saw an opportunity. He recognized the underlying strength of the company and its undervalued stock.

- Substantial Profits: His contrarian approach during this market downturn resulted in significant profits, further underscoring the importance of discerning fundamentals from short-term market noise.

- Undervalued Stocks: This investment underscores Buffett's knack for identifying undervalued stocks and exploiting market inefficiencies for considerable returns. This showcases his contrarian investing style, a key element of his Warren Buffett investing history.

Analyzing Warren Buffett's Notable Investment Mistakes: Lessons Learned

Even the greatest investors make mistakes. Analyzing Buffett's missteps provides valuable lessons about risk management, due diligence, and the limitations of even the most experienced investor.

Dexter Shoe Company: A Case Study in Misjudgment

The Dexter Shoe Company investment serves as a cautionary tale.

- Investment Details: Buffett invested in Dexter Shoe, but it ultimately failed to meet expectations.

- Reasons for Failure: Several factors contributed to the investment's failure, including misjudgments regarding the business's long-term prospects and competitive landscape. This highlights the importance of thorough business analysis and due diligence.

- Lessons Learned: The Dexter Shoe experience underscores the importance of rigorous due diligence and the potential for even experienced investors to misjudge a business’s long-term potential. This reinforces the significance of learning from investment mistakes.

Derivatives Investments (Limited): A Cautious Approach

Buffett has generally maintained a cautious approach to derivatives, acknowledging their inherent risks.

- Limited Exposure: Although Buffett has made some derivative investments, his exposure has remained relatively limited in comparison to his overall holdings.

- Risk Management Lessons: His measured approach highlights his emphasis on risk management and the importance of understanding the complexities of derivative instruments. This is an important aspect of his overall Warren Buffett investing history.

- Investment Diversification: Buffett's conservative stance on derivatives emphasizes the significance of investment diversification to mitigate overall portfolio risk.

Investment Timing Blunders (Limited): Patience as a Virtue

While Buffett is known for his long-term approach, there have been instances where his market timing might have slightly impacted returns.

- Long-Term Focus trumps Timing: The overall narrative of his success points to the overwhelming power of a long-term investment approach that significantly outweighs the impact of minor timing flaws.

- Buy and Hold Strategy: His success underscores his core belief in a buy-and-hold strategy, where patience and understanding of intrinsic value supersede short-term market fluctuations. This is a cornerstone of his overall Warren Buffett investing history.

Key Takeaways and Principles from Buffett's Investing History

Buffett's Warren Buffett investing history offers several key takeaways that can inform investment strategies for all levels of experience.

Importance of Long-Term Investing

The cornerstone of Buffett's success is his commitment to long-term investing.

- Patient Investing: He's demonstrated time and again the importance of patient capital allocation and avoiding short-term market pressures.

- Compounding Returns: This strategy allows for compounding returns, where profits generate further profits over time.

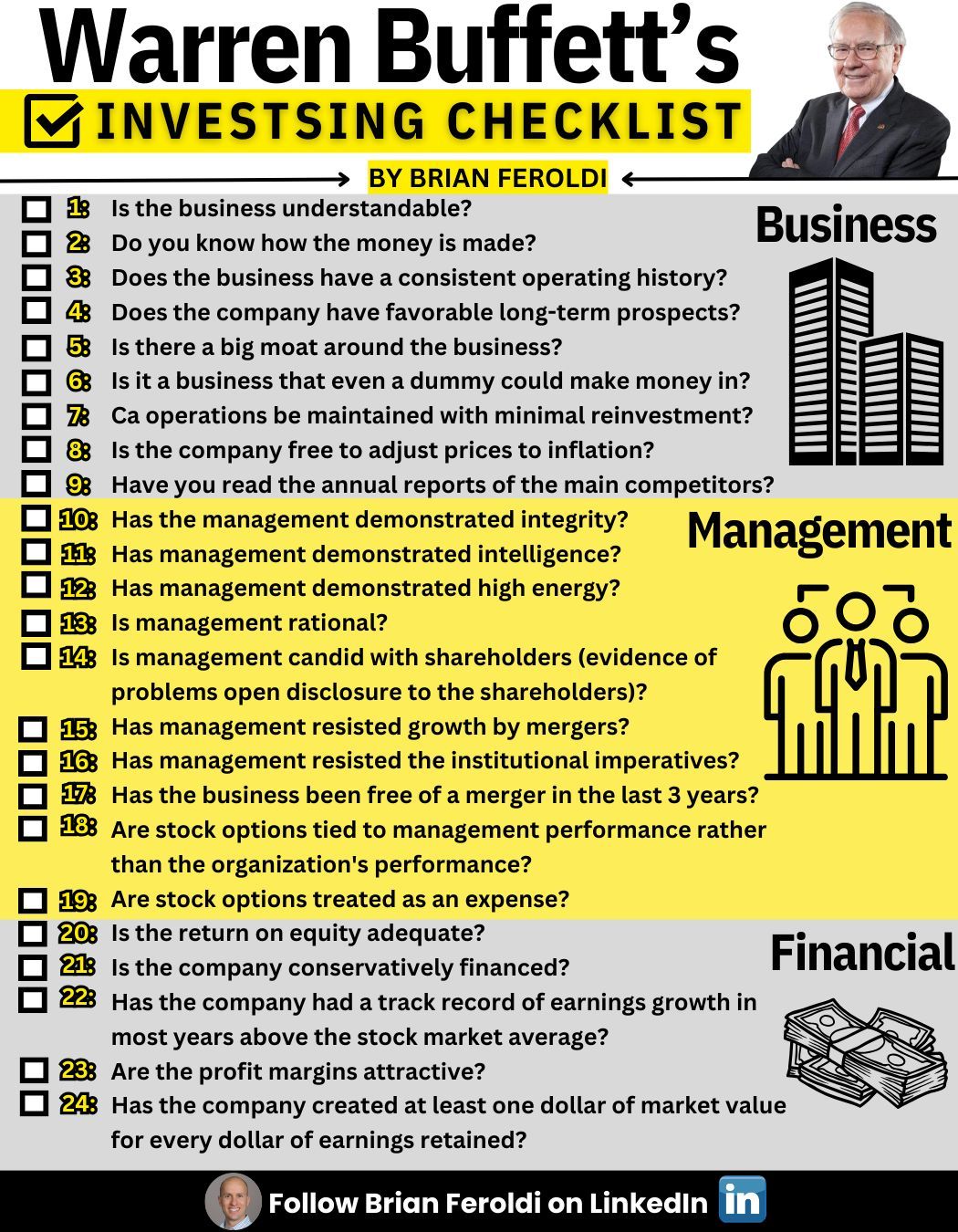

Value Investing Principles

Buffett's adherence to value investing principles is the foundation of his success.

- Fundamental Analysis: He rigorously analyzes the fundamentals of a company, focusing on its intrinsic value.

- Undervalued Assets: He seeks to identify undervalued assets that are trading below their intrinsic worth.

- Discounted Cash Flow Analysis: His techniques often involve utilizing discounted cash flow analysis to determine fair market value.

Risk Management and Diversification

Despite his concentrated positions, Buffett effectively manages risk through diversification and a thorough understanding of the underlying business.

- Strategic Diversification: While often holding significant positions in select companies, Buffett strategically diversifies across various sectors and asset classes.

- Risk Mitigation: This approach minimizes the impact of individual investment setbacks. This, coupled with excellent risk mitigation strategies, is a core strength evident in his Warren Buffett investing history.

Conclusion

Analyzing Warren Buffett's investing history offers invaluable lessons for all investors. By studying both his triumphs and his occasional setbacks, we can glean profound insights into effective investment strategies, the importance of long-term vision, and the value of thorough due diligence. Remember that while mimicking his every move is impossible, understanding the underlying principles of value investing and patient long-term growth, as demonstrated throughout his Warren Buffett investing history, can significantly improve your own investment outcomes. Start exploring Warren Buffett's investing history today and build a robust investment strategy based on his wisdom.

Featured Posts

-

Romania Election Far Right Leader Heads To Runoff Against Centrist

May 06, 2025

Romania Election Far Right Leader Heads To Runoff Against Centrist

May 06, 2025 -

Shotgun Cop Man A Bizarre Platforming Journey

May 06, 2025

Shotgun Cop Man A Bizarre Platforming Journey

May 06, 2025 -

Pratts Reaction To Schwarzeneggers Full Frontal Scene In Movie Title

May 06, 2025

Pratts Reaction To Schwarzeneggers Full Frontal Scene In Movie Title

May 06, 2025 -

Broadcoms V Mware Deal An Extreme Price Hike Of 1 050 According To At And T

May 06, 2025

Broadcoms V Mware Deal An Extreme Price Hike Of 1 050 According To At And T

May 06, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Hike Concerns

May 06, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Hike Concerns

May 06, 2025

Latest Posts

-

Pratts Reaction To Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Pratts Reaction To Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

Chris Pratt Discusses Patrick Schwarzeneggers White Lotus Nudity

May 06, 2025

Chris Pratt Discusses Patrick Schwarzeneggers White Lotus Nudity

May 06, 2025 -

Patrick Schwarzeneggers Nude Scenes Father Arnolds View

May 06, 2025

Patrick Schwarzeneggers Nude Scenes Father Arnolds View

May 06, 2025 -

Arnold Schwarzeneggers Opinion Patricks Public Nudity

May 06, 2025

Arnold Schwarzeneggers Opinion Patricks Public Nudity

May 06, 2025 -

Joseph Baena A Fitneszvilag Feltoerekvo Csillaga Arnold Schwarzenegger Fia

May 06, 2025

Joseph Baena A Fitneszvilag Feltoerekvo Csillaga Arnold Schwarzenegger Fia

May 06, 2025