Analyzing XRP (Ripple) At Under $3: Buy Or Sell?

Table of Contents

XRP's Current Market Position and Recent Price Action

XRP's price action below $3 is a complex issue requiring a multifaceted analysis. Let's examine the technical, fundamental, and market sentiment aspects.

Technical Analysis

Technical analysis of XRP charts reveals fluctuating support and resistance levels.

- Key Price Levels: Observe recent lows and highs to identify potential support and resistance areas. A break above a key resistance level could signal a bullish trend. Conversely, a break below a support level might suggest further downside.

- Technical Indicators: Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can offer insights into momentum and potential trend reversals. Analyzing these indicators helps determine whether XRP is oversold or overbought.

- Chart Patterns: Identifying chart patterns like head and shoulders or double bottoms can provide clues about future price movements. However, remember that chart patterns are not foolproof predictors.

Fundamental Analysis

Ripple's fundamentals are crucial to understanding XRP's value proposition.

- SEC Lawsuit: The ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) significantly impacts XRP's price. Positive developments in the case could trigger a price surge. Negative news could lead to further declines.

- Partnerships and Adoption: Ripple's partnerships with financial institutions are essential for XRP's adoption. New partnerships and successful implementations of XRP in payment systems can boost investor confidence and price.

- Technology and Innovation: Ripple's ongoing development and innovation in blockchain technology could influence long-term investor sentiment.

Market Sentiment and Social Media Analysis

Gauging market sentiment is vital.

- Social Media: Analyze discussions on platforms like Twitter and Reddit to understand prevailing opinions. Positive sentiment generally correlates with higher prices, while negative sentiment suggests potential downward pressure.

- Google Trends: Examining Google Trends data for "XRP" reveals the level of public interest. Increased searches might reflect growing interest, potentially influencing price.

- News and Media Coverage: The overall tone of news articles and media coverage influences public perception. Positive coverage can boost investor confidence and price.

Factors Influencing XRP Price Below $3

Several factors beyond XRP's internal dynamics impact its price.

Macroeconomic Factors

Broader market trends play a significant role.

- Bitcoin's Price: Bitcoin's price movements often affect the entire cryptocurrency market, including XRP. A Bitcoin price increase often leads to a ripple effect across other cryptocurrencies.

- Overall Crypto Market Cap: The total market capitalization of all cryptocurrencies influences investor sentiment. A market downturn can negatively affect XRP regardless of its own performance.

- Global Economic Conditions: Global economic factors like inflation, interest rates, and recessionary fears can affect risk appetite in the cryptocurrency market, impacting XRP's price.

Regulatory Landscape

Regulatory clarity is crucial for cryptocurrency markets.

- SEC Lawsuit Outcome: The SEC lawsuit against Ripple is a major uncertainty. A favorable outcome could significantly boost XRP's price, while an unfavorable outcome could lead to substantial losses.

- Global Regulations: Varying regulations across different countries influence XRP's adoption and trading volume. Stricter regulations can limit growth potential.

- Future Regulatory Changes: Uncertainty about future regulations creates volatility. Changes in regulatory frameworks can significantly impact the cryptocurrency market, including XRP.

Adoption and Use Cases

Real-world adoption fuels price appreciation.

- Payment System Integrations: Successful integrations of XRP into payment systems drive adoption and increase demand. Wider adoption leads to price increases.

- On-Chain Activity: Monitoring on-chain activity, such as transaction volume and network usage, provides insights into real-world adoption. Increased activity suggests growing interest and potential price appreciation.

- Limitations and Competition: Competition from other cryptocurrencies and technological limitations can hinder XRP's adoption and limit its price potential.

Risk Assessment and Investment Strategy

Investing in XRP involves risks and rewards.

Potential Rewards and Risks

XRP offers high growth potential but also significant risks.

- High Growth Potential: If the SEC lawsuit is resolved favorably and XRP gains wider adoption, the potential for significant price appreciation is substantial.

- Price Volatility: XRP's price is highly volatile, and significant price swings are common. Investors should be prepared for both potential gains and losses.

- Regulatory Uncertainty: The uncertain regulatory landscape poses a significant risk. Negative regulatory developments could lead to significant price declines.

Diversification and Portfolio Management

Diversification is key to mitigating risk.

- Portfolio Allocation: Allocate only a small percentage of your investment portfolio to XRP to minimize potential losses.

- Risk Tolerance: Only invest in XRP if you have a high-risk tolerance and understand the potential for significant losses.

- Investment Goals: Align your XRP investment with your overall financial goals and risk tolerance.

Trading Strategies

Consider various strategies to manage risk.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, mitigating the risk of investing a lump sum at a high price.

- Stop-Loss Orders: A stop-loss order automatically sells your XRP if the price falls below a predetermined level, limiting potential losses.

- Professional Advice: Always seek professional financial advice before making investment decisions.

Conclusion: Analyzing XRP (Ripple) at Under $3 – The Verdict

Analyzing XRP at under $3 reveals both compelling opportunities and significant risks. The outcome of the SEC lawsuit remains the most influential factor. While XRP's technology and potential for adoption are attractive, the inherent volatility and regulatory uncertainty cannot be ignored. This analysis does not constitute financial advice.

Therefore, a "hold" recommendation is suggested for investors already holding XRP, pending clarity on the SEC lawsuit. New investors should carefully weigh the potential rewards against the substantial risks. Conduct thorough research and consult with a financial advisor before investing in XRP or any other cryptocurrency. Remember that informed investment choices are crucial when dealing with the volatile world of XRP (Ripple) under $3.

Featured Posts

-

Gambling On Calamity The Case Of The Los Angeles Wildfires

May 02, 2025

Gambling On Calamity The Case Of The Los Angeles Wildfires

May 02, 2025 -

Melissa Gorga Reveals Exclusive Beach House Guest

May 02, 2025

Melissa Gorga Reveals Exclusive Beach House Guest

May 02, 2025 -

Graeme Souness On Manchester Uniteds Atrocious Transfer

May 02, 2025

Graeme Souness On Manchester Uniteds Atrocious Transfer

May 02, 2025 -

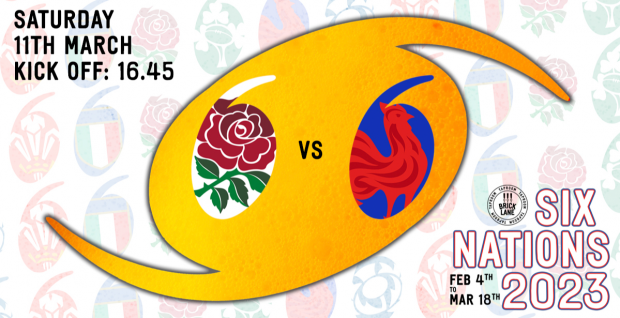

England Vs France Six Nations Dalys Impact Decides Tight Match

May 02, 2025

England Vs France Six Nations Dalys Impact Decides Tight Match

May 02, 2025 -

Strong Mental Health Policies Key To A More Productive Workforce

May 02, 2025

Strong Mental Health Policies Key To A More Productive Workforce

May 02, 2025