Analyzing XRP (Ripple) Below $3: Is It A Smart Investment?

Table of Contents

Ripple's Ongoing Legal Battle with the SEC

Understanding the SEC Lawsuit and its Impact on XRP Price

The core of the SEC lawsuit against Ripple Labs centers around the classification of XRP as an unregistered security. The SEC argues that Ripple's sales of XRP constituted an illegal offering of securities, impacting investor confidence and causing significant price volatility for XRP. Key legal developments, such as witness testimonies and filings, continually influence market sentiment. Uncertainty surrounding the outcome casts a shadow over XRP's future.

- Uncertainty surrounding the outcome: The SEC lawsuit's unpredictable nature creates considerable market uncertainty.

- Impact on exchange listings: Several major exchanges delisted XRP during the height of the lawsuit, impacting trading volume and accessibility.

- Potential for future regulatory clarity: A definitive ruling, regardless of the outcome, could bring much-needed clarity to the regulatory landscape for XRP and potentially stabilize its price.

Analyzing Potential Outcomes and Their Implications for XRP Investors

Several scenarios are possible:

- SEC win: A complete SEC victory could severely damage XRP's price, potentially leading to delisting from more exchanges and a significant loss of investor confidence.

- Ripple win: A Ripple victory would likely trigger a substantial price surge as investor confidence is restored and regulatory uncertainty is reduced.

- Settlement: A settlement between Ripple and the SEC would likely result in a less dramatic price reaction than a complete win for either side. The terms of the settlement would be crucial in determining the subsequent price movement.

Considering these possibilities, it's crucial for potential XRP investors to assess their risk tolerance carefully. While a positive outcome offers substantial upside potential, the risks associated with a negative outcome are equally significant.

XRP's Technological Advantages and Use Cases

Exploring XRP's Role in Cross-Border Payments

XRP's primary use case is facilitating faster and cheaper international transactions. RippleNet, Ripple's payment network, utilizes XRP to enable near real-time settlements between financial institutions. This offers a significant advantage over traditional methods, which can be slow and expensive. XRP's scalability and energy efficiency also distinguish it from other cryptocurrencies used for similar purposes.

- Speed of transactions: XRP transactions are significantly faster than traditional banking systems.

- Transaction costs: The cost of using XRP for cross-border payments is considerably lower than traditional methods.

- Partnerships and integrations: Ripple has established partnerships with numerous financial institutions globally, expanding the network's reach and adoption.

Other Potential Applications of XRP Technology

Beyond cross-border payments, XRP's technology holds potential in other areas:

- Potential for DeFi applications: XRP could be integrated into decentralized finance (DeFi) protocols, offering new functionalities and opportunities.

- Use in NFTs and the metaverse: XRP could be used for transactions within the NFT and metaverse spaces, leveraging its speed and low cost.

- Future technological upgrades: Ongoing developments and improvements to XRP's technology could further enhance its capabilities and adoption.

Market Analysis and Price Prediction

Current Market Sentiment and Trading Volume

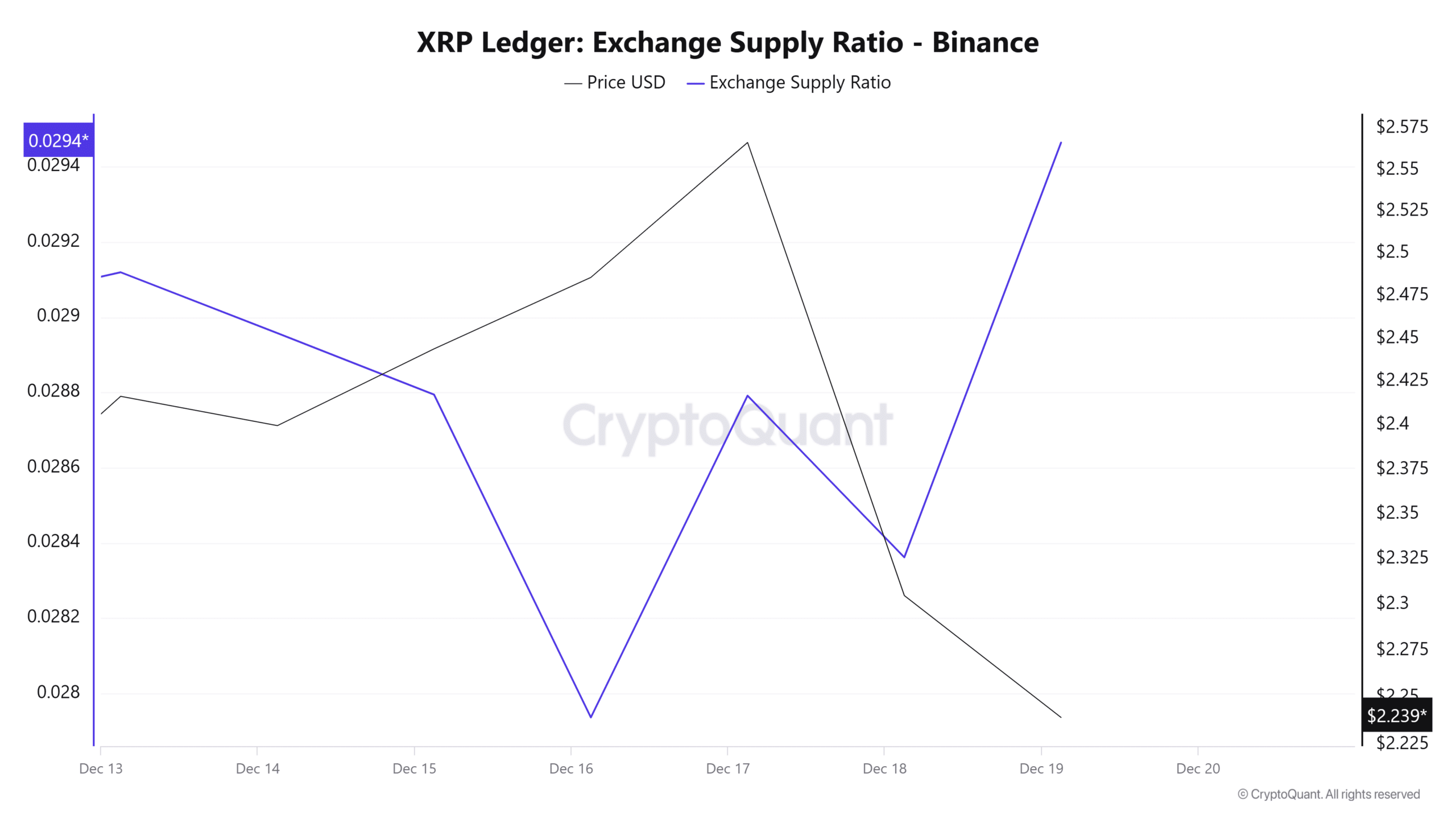

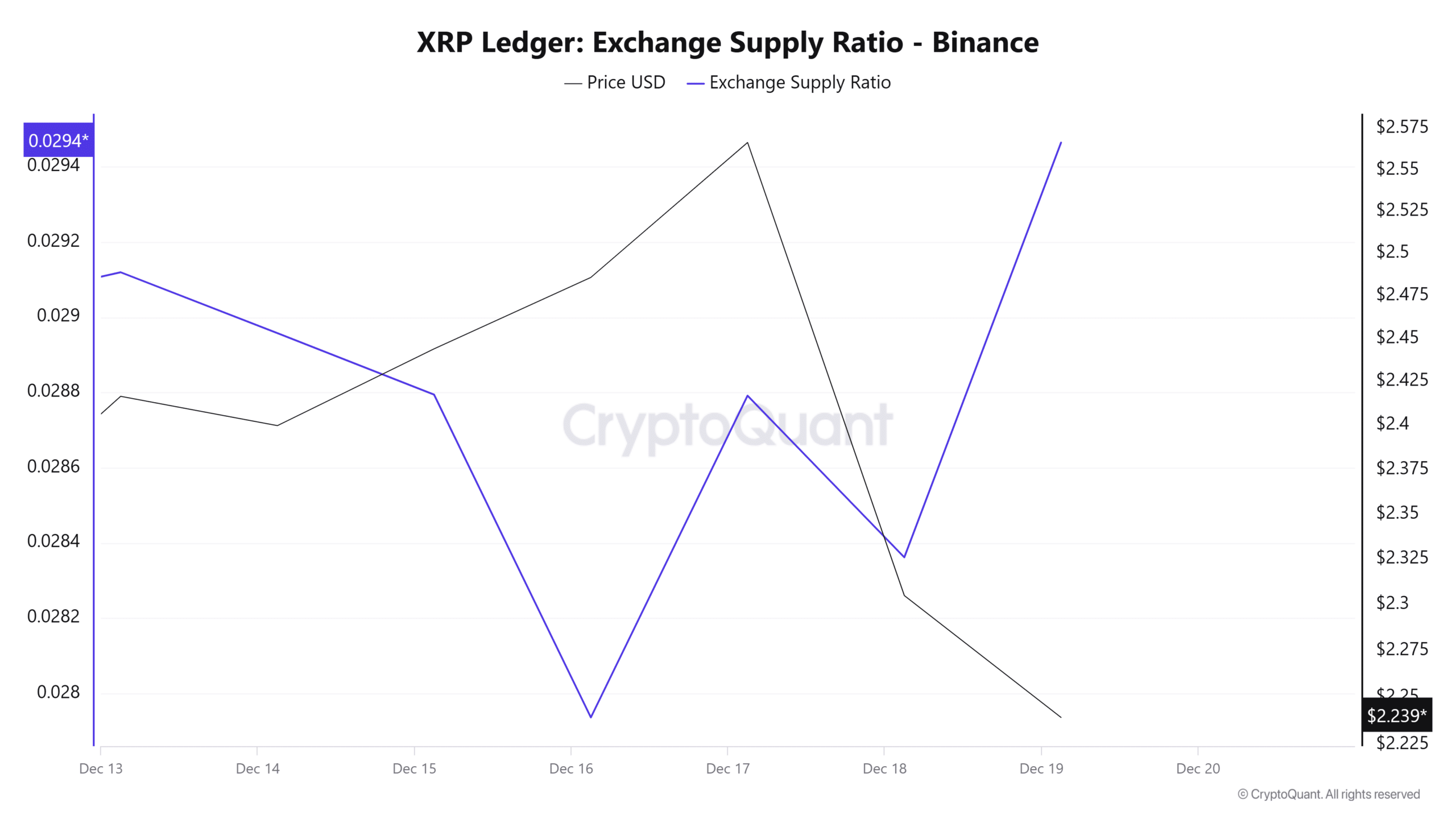

Current market sentiment towards XRP is highly influenced by the ongoing SEC lawsuit. Trading volume often fluctuates dramatically based on news and developments related to the case. Analyzing XRP's market capitalization and price trends in relation to overall cryptocurrency market performance provides a broader perspective.

- Current price trends: Monitoring current price charts and analyzing recent price movements is crucial.

- Trading volume analysis: High trading volume often indicates significant market interest, while low volume might suggest limited activity.

- Market capitalization: Assessing XRP's market cap in relation to other cryptocurrencies gives a sense of its relative size and potential.

Factors Influencing Future XRP Price

Several factors could impact XRP's future price:

- Regulatory landscape: The outcome of the SEC lawsuit will significantly influence XRP's price. Further regulatory developments, both positive and negative, could also impact its trajectory.

- Adoption by financial institutions: Increased adoption of RippleNet and XRP by financial institutions would drive demand and price appreciation.

- Overall crypto market performance: The overall performance of the cryptocurrency market significantly impacts the price of individual cryptocurrencies, including XRP.

Predicting future XRP prices with any certainty is impossible. However, analyzing these factors offers a framework for understanding potential price movements. Remember that any price prediction should be treated with caution.

Risks Associated with Investing in XRP

Regulatory Uncertainty and Legal Risks

The ongoing legal battle with the SEC presents significant regulatory uncertainty and risks. Investing in cryptocurrencies inherently involves a degree of risk due to their volatile nature and susceptibility to regulatory changes.

- Ongoing SEC lawsuit risks: The lawsuit's uncertain outcome poses a substantial risk to XRP investors.

- Potential for further regulatory scrutiny: Future regulatory actions from various jurisdictions could impact XRP's future.

Market Volatility and Price Fluctuations

The cryptocurrency market is highly volatile, meaning XRP's price can experience dramatic swings in short periods.

- High volatility: Significant price fluctuations are common in the crypto market.

- Potential for substantial losses: Investors should be prepared for the possibility of significant losses.

Conclusion

Analyzing XRP below $3 requires careful consideration of its potential and risks. While XRP's technology and use cases offer advantages, the ongoing legal battle creates significant uncertainty. The decision to invest should be based on thorough research, understanding your risk tolerance, and your individual financial circumstances. Before making any investment decisions regarding XRP, conduct thorough due diligence. Consider the information presented in this analysis of XRP below $3 to help make an informed choice regarding this potentially lucrative but risky asset. Remember, this analysis is for informational purposes only and not financial advice.

Featured Posts

-

Canadas Economic Future Challenges For The Incoming Prime Minister

May 01, 2025

Canadas Economic Future Challenges For The Incoming Prime Minister

May 01, 2025 -

Social Media Frenzy Kashmir Cat Owners Respond To Viral Content

May 01, 2025

Social Media Frenzy Kashmir Cat Owners Respond To Viral Content

May 01, 2025 -

Michael Sheens 1 Million Debt Relief For 900 Individuals

May 01, 2025

Michael Sheens 1 Million Debt Relief For 900 Individuals

May 01, 2025 -

Kort Geding Nieuwe School In Kampen Kan Niet Op Het Stroomnet Worden Aangesloten

May 01, 2025

Kort Geding Nieuwe School In Kampen Kan Niet Op Het Stroomnet Worden Aangesloten

May 01, 2025 -

Rekord Ovechkina Kinopoisk Darit Unikalnye Soski Novorozhdennym

May 01, 2025

Rekord Ovechkina Kinopoisk Darit Unikalnye Soski Novorozhdennym

May 01, 2025