Apple Stock: Analysis Of Q2 Results And Future Outlook

Table of Contents

Q2 2024 Apple Stock Performance: A Deep Dive

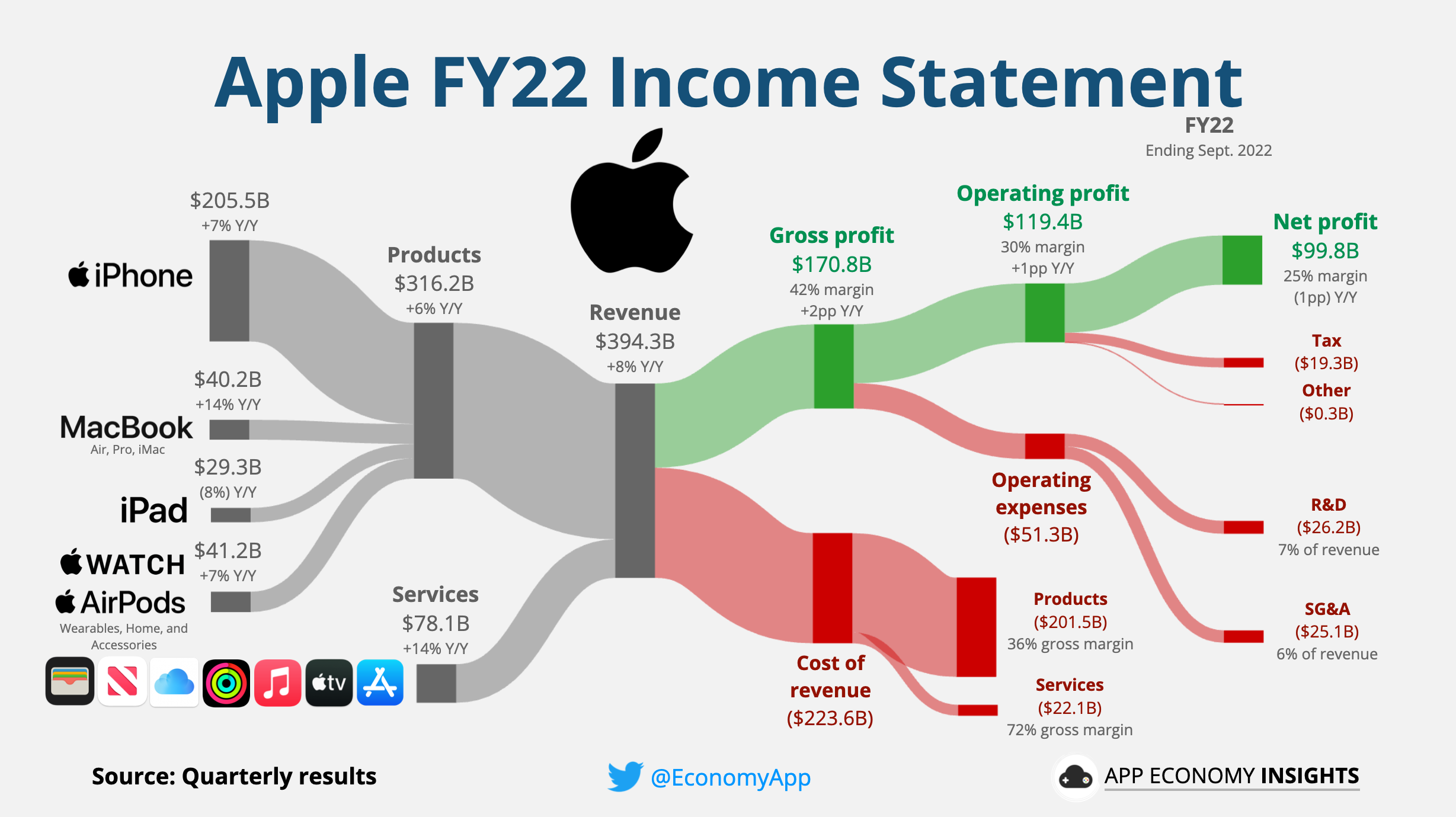

Revenue Analysis

Apple reported strong Q2 2024 revenue, exceeding analyst expectations by [Insert Percentage or Specific Number] and showcasing continued growth despite challenging macroeconomic conditions. Compared to Q2 2023, revenue increased by [Insert Percentage or Specific Number].

- Breakdown of revenue by product category: While iPhone sales remain the dominant revenue driver, the Services segment continues to show robust growth, demonstrating the increasing importance of Apple's recurring revenue streams. Specific figures for each category (iPhone, Mac, iPad, Services, Wearables) should be inserted here based on the actual Q2 2024 results.

- Analysis of revenue growth or decline in each category: Detailed analysis of growth percentages for each category should be included here, highlighting the performance of each product line. Explanation for growth or decline in specific categories is crucial, tying it to factors like new product releases or market trends.

- Comparison to competitor performance: A comparison of Apple's revenue growth to its main competitors (e.g., Samsung, Google) helps contextualize its performance within the broader tech landscape.

- Impact of macroeconomic factors on revenue: Discuss how factors like inflation, currency fluctuations, and global economic uncertainty impacted Apple's revenue during Q2 2024.

Earnings Per Share (EPS) and Profitability

Apple's Q2 2024 EPS showed [Insert increase/decrease and percentage] compared to the same period last year, exceeding projections.

- EPS figures and year-over-year comparison: Clearly state the EPS figures for Q2 2024 and the year-over-year change, providing a clear picture of profitability.

- Discussion of profitability margins and their trends: Analyze profit margins and discuss any trends, explaining the factors contributing to changes in profitability.

- Impact of cost-cutting measures or increased expenses: Discuss any cost-cutting initiatives or increased expenses impacting profitability and their overall effect on the EPS.

Key Performance Indicators (KPIs)

Beyond revenue and EPS, other key performance indicators provide a more holistic view of Apple's performance.

- User growth: Discuss the growth in active users across Apple's ecosystem, including iPhone users, Mac users, and subscribers to its services.

- Average revenue per user (ARPU): Analyze ARPU trends, indicating the average revenue generated per user. Growth in ARPU signals increased customer engagement and higher spending.

- Market share: Analyze Apple's market share in key product categories, comparing it to previous quarters and competitors to gauge its competitive position.

Product Performance and Market Share

Analyzing individual product performance provides a more granular understanding of Apple's Q2 2024 results.

iPhone Sales

iPhone sales remain a key driver of Apple's revenue. [Insert sales figures and percentage changes].

- Sales figures and year-over-year comparison: Present iPhone sales figures for Q2 2024 and compare them to the same period last year.

- Impact of new iPhone models or product upgrades: Discuss the impact of any new iPhone models or significant product upgrades released during the quarter on sales.

- Market share trends: Analyze Apple's market share in the smartphone market and how it changed during the quarter.

Services Revenue Growth

Apple's Services segment continues its impressive growth trajectory. [Insert growth percentage].

- Growth rate compared to previous quarters: Compare the growth rate of the Services segment to previous quarters and highlight any acceleration or deceleration.

- Impact of subscription model changes or new services: Discuss the impact of any new services launched or changes to existing subscription models on revenue growth.

- Contribution to overall revenue and profitability: Highlight the increasing contribution of the Services segment to Apple's overall revenue and profitability.

Mac and iPad Performance

The Mac and iPad segments also contributed to Apple's Q2 performance. [Insert sales data and analysis]. Discuss market trends and competitive pressures within these segments.

Future Outlook for Apple Stock: Predictions and Considerations

The future outlook for Apple stock is positive, but several factors need to be considered.

Analyst Predictions and Ratings

Many analysts maintain a positive outlook on Apple stock, with [Insert average price target and range]. [Cite sources for analyst predictions].

Potential Risks and Challenges

Several factors could pose challenges to Apple's future growth.

- Economic slowdown: A global economic slowdown could impact consumer spending on electronics, affecting Apple's sales.

- Supply chain disruptions: Geopolitical instability and supply chain issues could disrupt Apple's production and distribution.

- Competition: Intense competition from other tech companies could erode Apple's market share.

Growth Opportunities

Despite the challenges, Apple has several avenues for future growth.

- Emerging markets: Expansion into emerging markets offers significant growth potential.

- New product categories: Exploring new product categories such as augmented reality/virtual reality (AR/VR) devices and electric vehicles could unlock new revenue streams.

- Technological advancements: Investing in and leveraging advancements in areas like AI and machine learning could drive innovation and growth. Mention potential acquisitions or partnerships as relevant.

Investing in Apple Stock: The Bottom Line

Apple's Q2 2024 results showcased strong performance across key metrics, with particularly strong growth in its Services segment. While economic headwinds and competition remain potential risks, the company's robust financial position, innovative product lineup, and expanding services ecosystem suggest a positive outlook for Apple stock. Understanding the Q2 results is crucial for making informed decisions about Apple stock. Further research and due diligence are recommended before making any investment choices. Learn more about Apple’s financial performance and stay updated on future developments in Apple stock.

Featured Posts

-

Darwin Homicide Investigation Teen In Custody Following Nightcliff Theft

May 25, 2025

Darwin Homicide Investigation Teen In Custody Following Nightcliff Theft

May 25, 2025 -

Is Elon Musk Selling His Dogecoin

May 25, 2025

Is Elon Musk Selling His Dogecoin

May 25, 2025 -

Luxus Porsche 911 80 Millio Forintos Extrak Reszletesen

May 25, 2025

Luxus Porsche 911 80 Millio Forintos Extrak Reszletesen

May 25, 2025 -

Analysis Former French Pms Disagreement With Macron

May 25, 2025

Analysis Former French Pms Disagreement With Macron

May 25, 2025 -

Peredbachennya Konchiti Vurst Khto Peremozhe Na Yevrobachenni 2025 Unian

May 25, 2025

Peredbachennya Konchiti Vurst Khto Peremozhe Na Yevrobachenni 2025 Unian

May 25, 2025

Latest Posts

-

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025 -

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025 -

Turning Poop Into Podcast Gold Ai Digest For Repetitive Documents

May 25, 2025

Turning Poop Into Podcast Gold Ai Digest For Repetitive Documents

May 25, 2025 -

Dogecoin Price Prediction Considering Elon Musks Role

May 25, 2025

Dogecoin Price Prediction Considering Elon Musks Role

May 25, 2025 -

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025