Apple Stock Forecast: One Analyst Predicts $254 – Should You Invest Now?

Table of Contents

Keywords: Apple stock, Apple stock forecast, Apple stock price prediction, AAPL stock, Apple investment, should I buy Apple stock, Apple stock analysis, $254 Apple stock price, Apple stock price target, Apple stock future

The tech world is buzzing! A prominent analyst has predicted that Apple stock (AAPL) could skyrocket to a staggering $254 per share. This bold Apple stock price prediction has investors everywhere asking: should I buy Apple stock now? This article delves into the details of this prediction, examines the factors influencing Apple's stock price, and helps you determine if this investment opportunity aligns with your financial goals. We'll explore the potential upside, the inherent risks, and provide you with the information you need to make an informed decision about your Apple investment.

The $254 Apple Stock Prediction: A Deep Dive

While specific analyst names and firms are often kept private due to confidentiality agreements, a recent prediction suggests Apple stock could hit $254. [Note: Replace bracketed information with a link to the source if available. If not, remove the bracketed section.] This prediction isn't made in a vacuum; it’s based on several key factors:

- Key factors cited by the (unnamed) analyst:

- Strong iPhone sales and expanding services revenue: Apple's continued dominance in the smartphone market, coupled with the increasing contribution of its services sector (including Apple Music, iCloud, and the App Store), is a primary driver of this optimistic Apple stock price prediction.

- Anticipated new product launches: Rumored new products, such as innovative wearables or advancements in AR/VR technology, could significantly boost Apple's stock price and market capitalization.

- Long-term growth potential: The analyst likely sees sustained growth in emerging markets and the continued expansion of Apple's ecosystem as key to long-term success, justifying the $254 Apple stock price target.

- Analyst's assessment of risks: While the prediction is bullish, it's likely the analyst also acknowledged potential risks, such as increased competition, supply chain disruptions, or negative economic impacts on consumer spending. These factors could influence the actual AAPL stock performance.

Analyzing Apple's Current Market Position and Financial Health

To properly evaluate the $254 Apple stock price prediction, let's look at Apple's current financial standing:

- Apple's recent financial performance: Apple consistently reports strong revenue and earnings, maintaining a dominant market share in multiple sectors. Examining quarterly reports offers a clear picture of its financial health and growth trajectory.

- Analysis of Apple's key product lines:

- iPhone: Remains the core revenue generator, although growth might be leveling off in mature markets.

- Mac: Steady performance with consistent updates and a loyal customer base.

- Services: A rapidly growing segment, showcasing the increasing importance of Apple's ecosystem and recurring revenue streams. This is a key factor influencing Apple stock price predictions.

- Wearables: A consistently expanding market segment offering further growth opportunities.

- Competitive landscape: Apple faces competition from Samsung, Google, and other tech giants. Maintaining its innovative edge is crucial for continued success and justifies the high Apple stock price prediction.

- External factors: Supply chain issues and regulatory changes could impact Apple’s profitability and, subsequently, its stock price. Keeping an eye on geopolitical events is also essential for any Apple stock analysis.

Factors to Consider Before Investing in Apple Stock

While the $254 Apple stock price prediction is tempting, investing in the stock market always carries risks:

- Market volatility: The stock market is inherently volatile. Even strong companies like Apple can experience price fluctuations based on broader market trends. This must be factored into any Apple stock investment strategy.

- Economic downturns: Economic recessions can significantly impact consumer spending, potentially reducing demand for Apple products and affecting the Apple stock price.

- Diversification: Never put all your eggs in one basket. Diversifying your portfolio across different asset classes reduces overall risk. An Apple stock investment should only be a part of a broader investment strategy.

- Risk tolerance and investment timeline: Consider your own risk tolerance and your long-term investment goals. A long-term investment horizon can help mitigate some of the short-term risks associated with Apple stock price fluctuations.

Alternative Investment Strategies

Diversification is key! Consider other investment options, such as bonds, mutual funds, ETFs, or real estate, to create a balanced portfolio and reduce your reliance on the performance of a single stock like Apple.

Conclusion

This article examined the intriguing $254 Apple stock forecast and the diverse factors influencing Apple's stock price. While the prediction is compelling, remember that investing in the stock market is inherently risky. Thorough due diligence, including a comprehensive Apple stock analysis, and a well-diversified portfolio are crucial for long-term investment success. Before making any investment decisions regarding Apple stock (AAPL), consult a financial advisor. Conduct your own thorough research and carefully consider your risk tolerance and investment timeline. This information is for educational purposes only and should not be considered financial advice. Remember to do your due diligence before making any decisions about investing in Apple stock, and don't solely rely on a single price prediction.

Featured Posts

-

Planning Your Memorial Day Trip Expect Crowds On These Flight Days 2025

May 25, 2025

Planning Your Memorial Day Trip Expect Crowds On These Flight Days 2025

May 25, 2025 -

Kyle Walker Peters To West Ham Details Of The Hammers Transfer Approach

May 25, 2025

Kyle Walker Peters To West Ham Details Of The Hammers Transfer Approach

May 25, 2025 -

Police Helicopter Pursuit High Speed Refueling During Chase

May 25, 2025

Police Helicopter Pursuit High Speed Refueling During Chase

May 25, 2025 -

Resistance Grows Car Dealerships Push Back On Electric Vehicle Regulations

May 25, 2025

Resistance Grows Car Dealerships Push Back On Electric Vehicle Regulations

May 25, 2025 -

Najvaecsie Nemecke Spolocnosti Vlna Prepustania Tisicov Zamestnancov

May 25, 2025

Najvaecsie Nemecke Spolocnosti Vlna Prepustania Tisicov Zamestnancov

May 25, 2025

Latest Posts

-

Severe Storms Trigger Flood Advisories Across Miami Valley

May 25, 2025

Severe Storms Trigger Flood Advisories Across Miami Valley

May 25, 2025 -

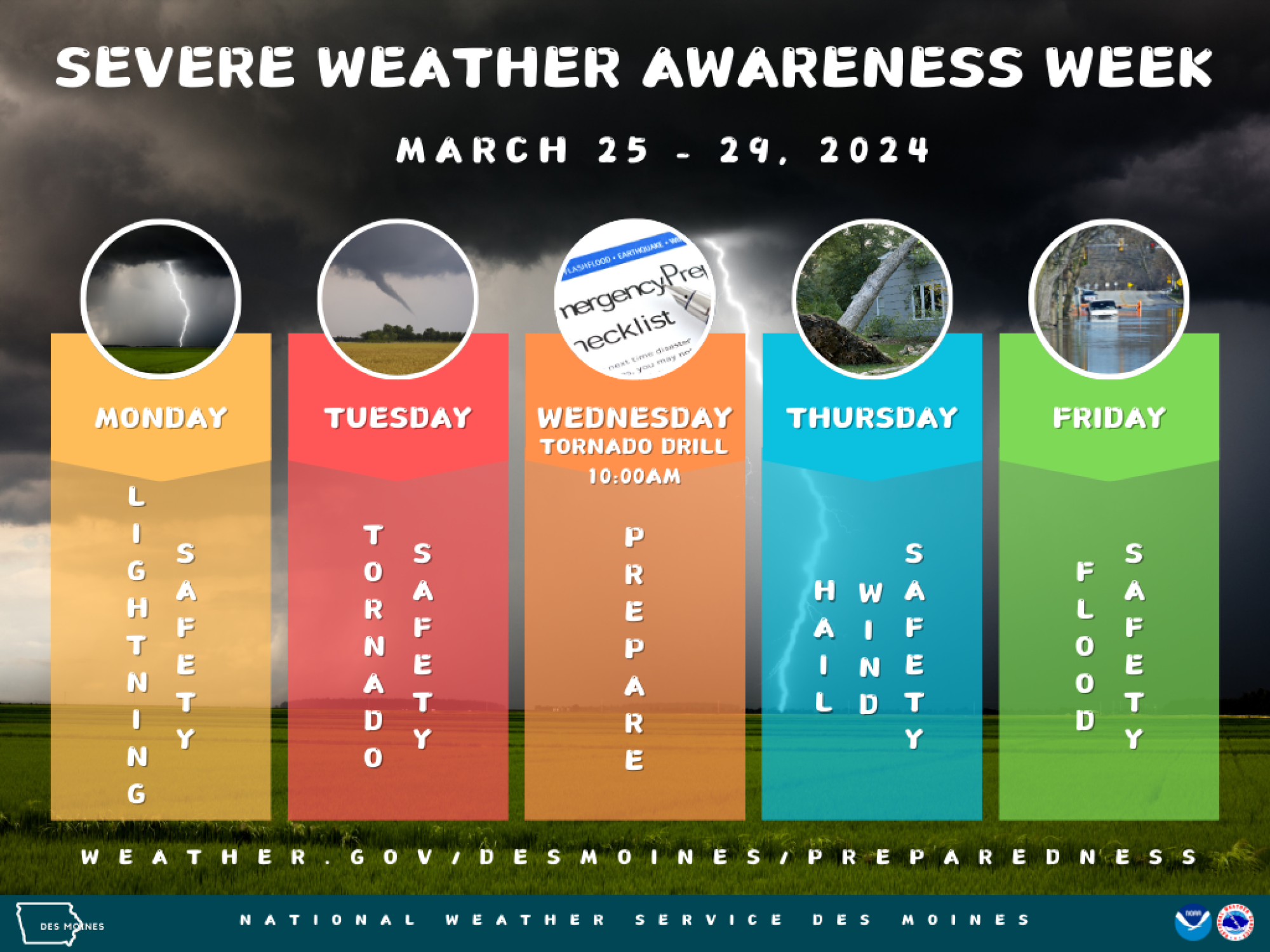

Flood Preparedness Essential Steps For Severe Weather Awareness Week

May 25, 2025

Flood Preparedness Essential Steps For Severe Weather Awareness Week

May 25, 2025 -

Is Gregor Robertson Right About Affordable Housing A Realistic Assessment

May 25, 2025

Is Gregor Robertson Right About Affordable Housing A Realistic Assessment

May 25, 2025 -

2025 Tornado And Flash Flood Summary April 4th Report

May 25, 2025

2025 Tornado And Flash Flood Summary April 4th Report

May 25, 2025 -

Miami Valley Flood Advisory Severe Weather And Potential Flooding

May 25, 2025

Miami Valley Flood Advisory Severe Weather And Potential Flooding

May 25, 2025