Apple Stock Prediction: $254? Is AAPL A Buy Near $200?

Table of Contents

Apple's Recent Financial Performance and Future Outlook

Analyzing Apple's recent financial performance is crucial for any AAPL stock prediction. We need to look beyond the headline numbers and dig into the details of their quarterly earnings reports. Examining key metrics like revenue, earnings per share (EPS), and growth rates provides a clearer picture of Apple's financial health.

-

AAPL Earnings: Apple consistently delivers strong earnings, though growth rates can fluctuate. Examining the trend in AAPL earnings over the past few quarters reveals if the company is maintaining its momentum or facing headwinds. For example, analyzing Apple Q4 2023 earnings against Q4 2022 gives a year-over-year comparison to understand growth.

-

Apple Revenue Growth: The overall revenue growth is a key indicator. Are iPhone sales driving revenue growth, or is there diversification across other product lines? Apple's Services revenue, which includes subscriptions like Apple Music and iCloud, has been a significant growth driver in recent years.

-

Key Product Sales: A breakdown of individual product sales is essential.

- iPhone Sales: While the iPhone remains Apple's flagship product, understanding the sales trajectory—including the impact of new iPhone releases—is crucial.

- Mac Sales: The Mac segment's performance, including sales of MacBook Pro and iMac models, reveals trends in the computer market.

- Apple Services Revenue: This segment's growth is often a key indicator of Apple's future potential, representing recurring revenue streams.

- Apple Watch Sales: The growth of wearables like the Apple Watch reflects broader trends in the consumer electronics market and can signify Apple's adaptability.

-

Specific Data Points: (Replace with actual data from recent reports)

- Q4 2023 Revenue: [Insert Data] (Year-over-year growth: [Insert Data]%)

- Q4 2023 EPS: [Insert Data] (Year-over-year growth: [Insert Data]%)

- iPhone Sales Q4 2023: [Insert Data] (Year-over-year growth: [Insert Data]%)

Factors Influencing Apple Stock Price

Predicting Apple's stock price requires considering various factors beyond the company's financials. Macroeconomic conditions and competitive landscapes significantly impact AAPL's valuation.

-

Macroeconomic Factors: Global economic trends significantly influence investor sentiment.

- Interest Rate Impact on AAPL: Rising interest rates typically increase borrowing costs, potentially impacting consumer spending and thus Apple's sales.

- Inflation and Apple Stock: High inflation can erode consumer purchasing power and affect demand for Apple products.

- Global Economy and Apple: A global recession could dampen demand for discretionary items like iPhones and Macs.

-

Technological Advancements and Competition: Apple faces competition from Android manufacturers and other technology giants.

- Apple Competition: The rivalry with Android continues, with Android gaining market share in emerging markets.

- Technological Innovation Apple: Apple’s continuous innovation, such as advancements in chip technology and augmented reality, helps maintain its competitive edge.

-

Apple's Innovation Pipeline: Apple’s ability to consistently introduce new and innovative products and services influences investor confidence and long-term growth prospects. The anticipation of new product releases – like new iPhones or potential Apple cars – can significantly impact the stock price. Analyzing Apple's patent filings and industry rumors can offer clues about future product launches.

-

Specific Examples:

- The impact of supply chain disruptions on Apple's manufacturing and sales.

- The competitive pressure from companies like Samsung and Google.

- The potential impact of future product launches, such as the Apple Vision Pro.

Analyst Predictions and Price Targets for AAPL

Understanding the consensus among financial analysts regarding Apple's stock price is vital. While analyst predictions aren’t foolproof, they offer valuable insights into market sentiment.

-

AAPL Price Target: Many analysts offer price targets for AAPL, ranging from conservative to bullish estimates. These targets often include a time horizon (e.g., 12-month price target).

-

Analyst Predictions Apple: A review of various analyst reports reveals a range of opinions, highlighting the inherent uncertainty in stock market predictions.

-

Apple Stock Forecast: While some analysts are optimistic about AAPL reaching $254 or higher, others hold more conservative views. It’s crucial to understand the rationale behind these differing price predictions.

-

Specific Price Targets: (Replace with data from reputable analysts)

- Analyst A: $275 (12-month target) – Rationale: [Insert rationale]

- Analyst B: $220 (12-month target) – Rationale: [Insert rationale]

Is AAPL a Buy Near $200? Risk Assessment and Investment Strategy

Deciding whether to buy AAPL near $200 requires a comprehensive risk assessment and a well-defined investment strategy.

-

AAPL Risk Assessment: Investing in any stock carries risk. With AAPL, potential risks include macroeconomic headwinds, increased competition, and the possibility of slower-than-expected growth.

-

Apple Investment Strategy: Consider your personal risk tolerance and investment horizon.

- Long-Term Investment Strategy: If you're a long-term investor with a 5-10 year horizon, the potential for long-term growth might outweigh the short-term risks.

- Short-Term Trading AAPL: Short-term trading is riskier and requires a higher level of market expertise.

-

Portfolio Diversification: Diversification is crucial to mitigate risk. Don’t put all your eggs in one basket; spread your investments across various asset classes.

-

Recommendations:

- For risk-averse investors: A small allocation to AAPL within a diversified portfolio may be suitable.

- For growth-oriented investors: A larger allocation might be considered, but carefully monitor market conditions and adjust your position as needed.

Conclusion

Predicting the exact price of AAPL is impossible. Apple's strong financial performance and innovative capabilities support a positive long-term outlook. While reaching $254 is a possibility, it's not guaranteed. Many factors, from macroeconomic conditions to competitive pressures, influence the stock's price. The analysis suggests a cautious optimism for long-term investors. While the potential for growth is present, a thorough understanding of the inherent risks is essential. Conduct your own thorough research before making any investment decisions regarding Apple stock (AAPL). Learn more about effective investment strategies by [Link to relevant resource]. Remember, this article provides an analysis and should not be considered financial advice.

Featured Posts

-

Tracking The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Tracking The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Ces Unveiled Europe 2024 Date Lieu Et Nouveautes Attendues

May 24, 2025

Ces Unveiled Europe 2024 Date Lieu Et Nouveautes Attendues

May 24, 2025 -

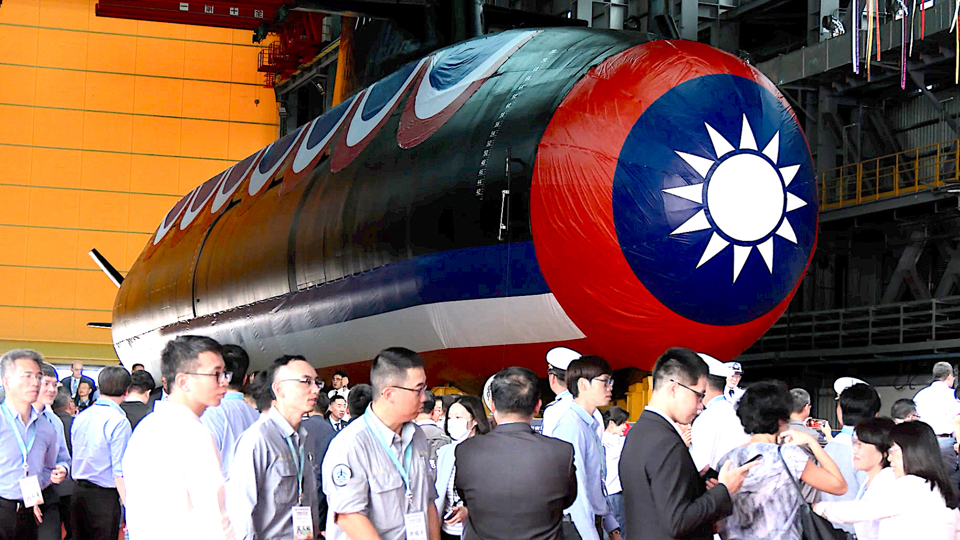

Najib Razak And The 2002 French Submarine Scandal New Allegations From Prosecutors

May 24, 2025

Najib Razak And The 2002 French Submarine Scandal New Allegations From Prosecutors

May 24, 2025 -

Philips Annual General Meeting Of Shareholders Key Highlights

May 24, 2025

Philips Annual General Meeting Of Shareholders Key Highlights

May 24, 2025 -

Major Crash Closes Road Person Taken To Hospital

May 24, 2025

Major Crash Closes Road Person Taken To Hospital

May 24, 2025

Latest Posts

-

Negotiating Your Salary Even After A Best And Final Offer

May 24, 2025

Negotiating Your Salary Even After A Best And Final Offer

May 24, 2025 -

Airplane Safety Frequency Of Accidents And Near Misses A Data Driven Analysis

May 24, 2025

Airplane Safety Frequency Of Accidents And Near Misses A Data Driven Analysis

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025 -

The Top 10 Us Beaches Of 2025 A Dr Beach Recommendation

May 24, 2025

The Top 10 Us Beaches Of 2025 A Dr Beach Recommendation

May 24, 2025 -

Close Calls And Crashes A Visual Exploration Of Airplane Safety Data

May 24, 2025

Close Calls And Crashes A Visual Exploration Of Airplane Safety Data

May 24, 2025