Apple Stock Price Prediction: $254? Is Apple A Buy At $200?

Table of Contents

Apple's Current Market Position and Recent Performance

Financial Health and Growth Prospects

Apple's recent financial reports paint a picture of continued strength, though not without challenges. The company’s revenue streams are diversified, with significant contributions from iPhone sales, its robust services segment (including App Store, iCloud, Apple Music), and the growing wearables, home, and accessories category.

- Key Financial Metrics: Apple consistently demonstrates high revenue and earnings per share (EPS), maintaining impressive profit margins. However, recent quarters have shown some slowdown in iPhone sales growth, prompting scrutiny from investors.

- New Product Launches: The launch of new iPhones, Apple Watches, iPads, and Macs, along with ongoing software updates, are crucial drivers of future revenue. The success of these launches will significantly influence Apple's stock price prediction.

- Competitive Threats: Intense competition in the smartphone market from companies like Samsung and Google, as well as emerging players in wearables and services, poses a challenge to Apple's continued dominance.

Analyst Ratings and Price Targets

Analyst sentiment towards Apple is generally positive, though price targets vary considerably. Many analysts remain bullish on Apple's long-term prospects, citing the strength of its ecosystem and brand loyalty.

- Analyst Reports: Major investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan regularly publish reports on Apple, offering various price targets ranging from $180 to $250 or higher.

- Average Price Target: The average price target among analysts provides a reasonable estimate, but individual predictions vary based on different valuation methodologies and assumptions about future growth.

- Bearish Predictions: While mostly positive, some analysts express concerns about macroeconomic headwinds and increased competition, leading to more conservative price targets or even bearish outlooks.

Factors Influencing Apple Stock Price Prediction

Macroeconomic Conditions

Broader economic conditions significantly impact Apple's stock price prediction. Factors like inflation, interest rates, and recession fears influence consumer spending and investor sentiment.

- Impact on Investor Sentiment: Periods of economic uncertainty often lead to decreased investor risk appetite, potentially impacting Apple's stock price negatively.

- Consumer Spending: High inflation and interest rates can reduce consumer discretionary spending, potentially affecting demand for Apple's products, particularly higher-priced items like iPhones.

Technological Innovations and Competition

Apple's ability to innovate and stay ahead of the competition is crucial to its future success. New product launches and technological advancements influence the Apple stock price prediction significantly.

- Impact of New Technologies: The potential of emerging technologies like AR/VR and autonomous vehicles could present significant opportunities for growth, though their impact on Apple's financials remains uncertain.

- Competitive Threats: Samsung, Google, and other tech giants continue to innovate, posing considerable competitive pressure on Apple across various product categories.

Supply Chain and Geopolitical Risks

Supply chain disruptions and geopolitical risks can significantly impact Apple's production, distribution, and overall financial performance.

- Supply Chain Disruptions: Global supply chain issues can lead to production delays, impacting product availability and potentially slowing revenue growth.

- Geopolitical Tensions: US-China relations and other geopolitical factors could disrupt Apple's manufacturing and distribution networks, impacting its profitability and share price.

Is Apple a Buy at $200? Investment Analysis

Valuation Metrics

Analyzing Apple's valuation using metrics like the Price-to-Earnings ratio (P/E) and Price-to-Sales ratio (P/S) is crucial for determining its attractiveness as an investment.

- P/E Ratio: Apple's P/E ratio should be compared to its historical levels and those of its competitors to assess whether it's overvalued or undervalued.

- P/S Ratio: The P/S ratio provides another perspective on valuation, considering revenue rather than earnings.

Risk Assessment

Investing in Apple stock carries inherent risks.

- Market Risks: Broader market downturns can negatively impact even strong companies like Apple.

- Company-Specific Risks: Unexpected product failures, increased competition, or management changes can all impact Apple's performance.

Investment Recommendation

Based on Apple's strong fundamentals, diversified revenue streams, and significant brand loyalty, a “hold” or “buy” rating might be considered for investors with a long-term perspective and moderate risk tolerance. However, potential macroeconomic headwinds and competitive pressures necessitate careful consideration. Further research and consultation with a financial advisor are highly recommended.

Conclusion

The Apple stock price prediction of $254 is plausible considering its strong financial health and growth prospects. However, several factors, including macroeconomic conditions, technological innovation, competition, and geopolitical risks, influence its future performance. Whether Apple is a buy at $200 depends on individual investor risk tolerance and investment horizon. While a $254 Apple stock price prediction is plausible, remember that investing in the stock market involves inherent risks. Conduct thorough due diligence before making any investment decisions regarding Apple stock. Consider consulting a financial advisor to determine if Apple is the right investment for your portfolio. Careful analysis of the Apple stock price prediction, considering all relevant factors, is crucial for informed investment decisions.

Featured Posts

-

Guccis New Creative Director Demna Gvasalia

May 25, 2025

Guccis New Creative Director Demna Gvasalia

May 25, 2025 -

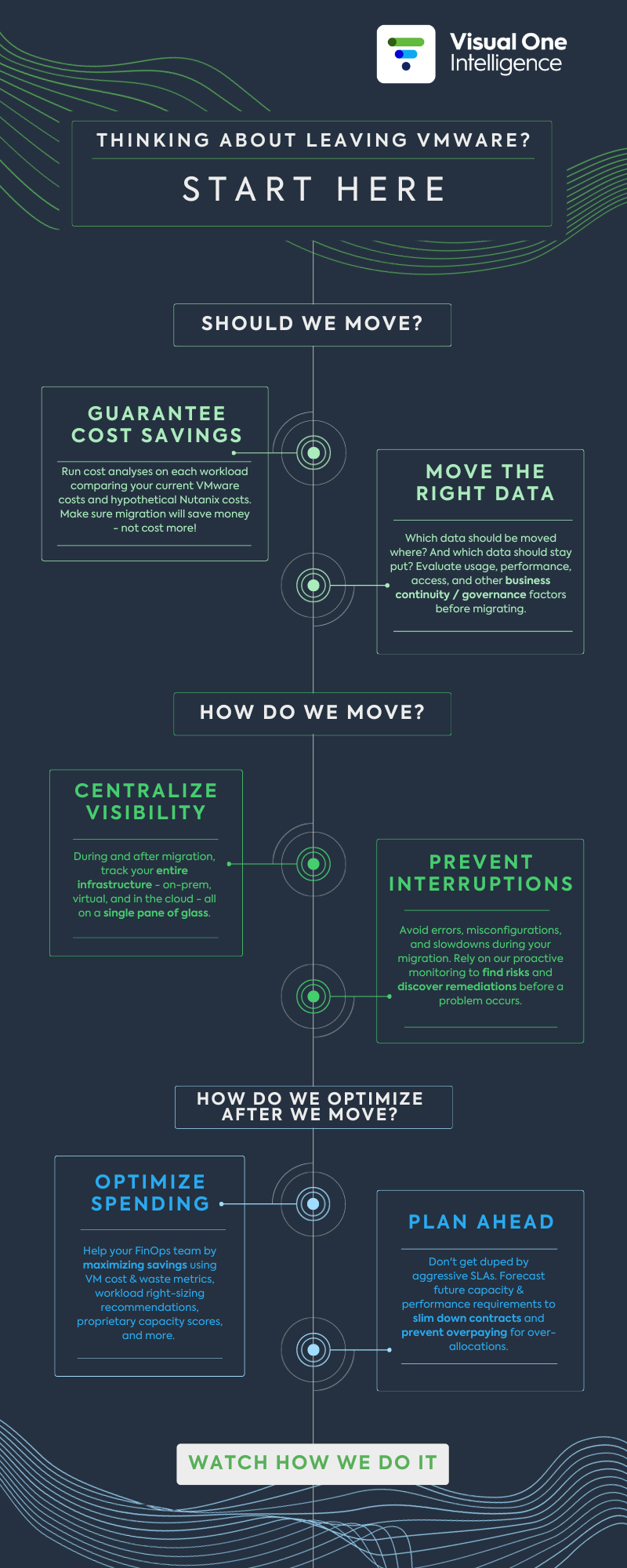

Extreme Price Hike Broadcoms V Mware Acquisition Could Increase At And Ts Costs By 1 050

May 25, 2025

Extreme Price Hike Broadcoms V Mware Acquisition Could Increase At And Ts Costs By 1 050

May 25, 2025 -

Paris In The Red Luxury Goods Slump Hits City Budget March 7 2025

May 25, 2025

Paris In The Red Luxury Goods Slump Hits City Budget March 7 2025

May 25, 2025 -

Onrust Op Wall Street Positieve Aex Prestaties Verklaard

May 25, 2025

Onrust Op Wall Street Positieve Aex Prestaties Verklaard

May 25, 2025 -

The Sean Penn Woody Allen Relationship A Me Too Perspective

May 25, 2025

The Sean Penn Woody Allen Relationship A Me Too Perspective

May 25, 2025

Latest Posts

-

How Canada Posts Challenges Are Fueling Growth In The Delivery Sector

May 25, 2025

How Canada Posts Challenges Are Fueling Growth In The Delivery Sector

May 25, 2025 -

1 050 V Mware Cost Increase At And T Sounds The Alarm On Broadcoms Extreme Pricing

May 25, 2025

1 050 V Mware Cost Increase At And T Sounds The Alarm On Broadcoms Extreme Pricing

May 25, 2025 -

Extreme Price Hike Broadcoms V Mware Acquisition Could Increase At And Ts Costs By 1 050

May 25, 2025

Extreme Price Hike Broadcoms V Mware Acquisition Could Increase At And Ts Costs By 1 050

May 25, 2025 -

Broadcoms Proposed V Mware Price Increase A 1 050 Cost Hike For At And T

May 25, 2025

Broadcoms Proposed V Mware Price Increase A 1 050 Cost Hike For At And T

May 25, 2025 -

Resistance Grows Car Dealerships Push Back On Electric Vehicle Regulations

May 25, 2025

Resistance Grows Car Dealerships Push Back On Electric Vehicle Regulations

May 25, 2025