Apple Stock Slumps: $900 Million Tariff Impact

Table of Contents

The $900 Million Tariff Hit: A Detailed Breakdown

The $900 million figure represents the estimated increased cost to Apple due to newly imposed tariffs on various products imported from China and other affected regions. These tariffs specifically target components and finished goods crucial to Apple's manufacturing process.

-

Affected Products: The tariffs impact a range of Apple products, including iPhones, iPads, AirPods, Apple Watches, and MacBooks. Many components for these devices, such as processors, displays, and circuit boards, are sourced from factories in China.

-

Geographical Origins and Import Costs: A significant portion of Apple's manufacturing relies on Chinese factories. The tariffs imposed increased import costs on goods originating from China, Vietnam, and other key manufacturing hubs. Specific import costs vary widely depending on the product and component, but the cumulative effect is substantial.

-

Increased Production Costs: The tariffs have resulted in a percentage increase in Apple's production costs. While the exact percentage varies depending on the product, estimates suggest a noticeable rise, adding to the overall cost of manufacturing and significantly impacting profit margins.

-

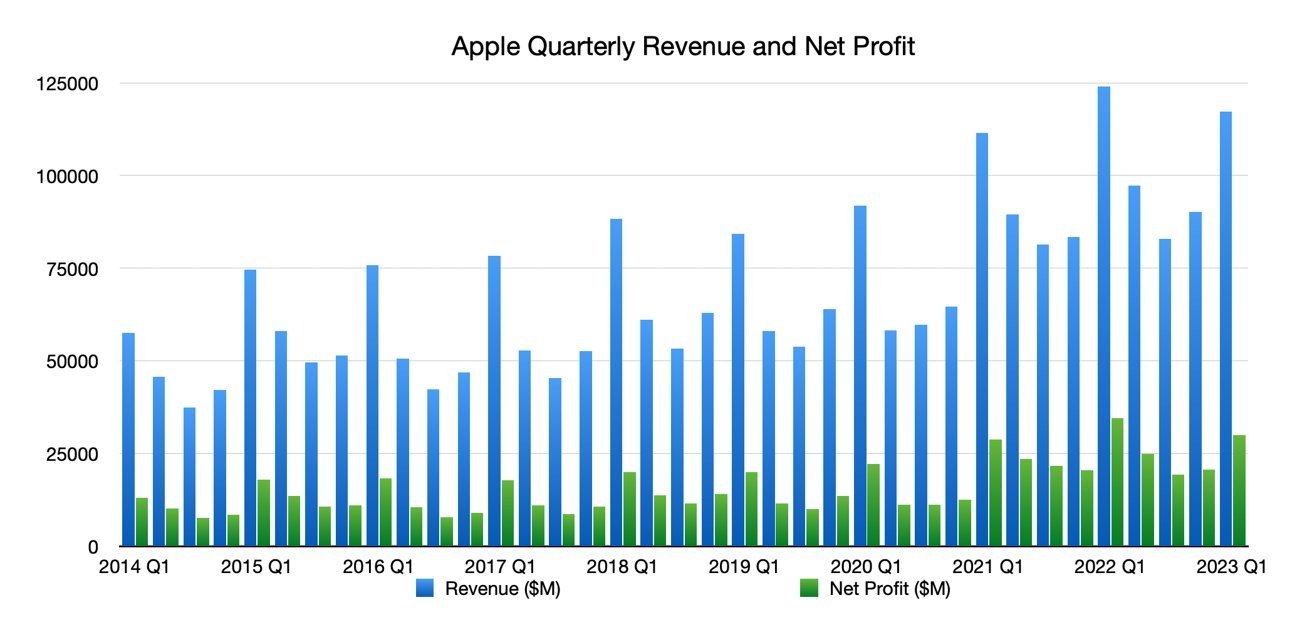

Financial Impact Visualization:

[Insert a chart or graph here visualizing the impact on Apple's quarterly earnings. This could be a bar chart comparing earnings before and after the tariff implementation, or a line graph showing the stock price fluctuation in relation to the tariff announcement.]

Impact on Apple Stock Performance

The announcement of the tariffs had an immediate and noticeable impact on Apple's stock price. The correlation between the tariff news and the subsequent decline is clear, representing a significant Apple stock slump.

-

Stock Price Decline: [Insert relevant stock charts showcasing the decline in Apple's stock price following the tariff announcement. Clearly label the axes and highlight key dates.]

-

Investor Sentiment: Investor sentiment turned negative following the news, with many expressing concern about the long-term impact on Apple's profitability and growth potential. This negative sentiment contributed to the sell-off.

-

Analyst Downgrades: Several financial analysts downgraded their ratings on Apple stock, citing the tariff impact as a major factor in their revised outlook. This further fueled the downward pressure on the stock price.

-

Key Stock Metrics:

- Trading Volume: Trading volume increased significantly following the tariff announcement, indicating heightened investor activity and uncertainty.

- Market Capitalization: Apple's market capitalization experienced a substantial drop, reflecting the decline in its stock price.

Apple's Response and Mitigation Strategies

Apple is actively exploring various strategies to mitigate the negative effects of these tariffs. The company faces a complex challenge balancing cost increases with maintaining its competitive pricing and profitability.

-

Production Diversification: Apple is likely exploring options to diversify its manufacturing base, potentially shifting some production to countries outside of the regions affected by the tariffs, such as India or Vietnam. This is a long-term strategy with significant logistical and financial implications.

-

Price Adjustments: Apple may consider passing some of the increased costs onto consumers through price increases. However, this carries significant risks, potentially impacting sales volume and market share.

-

Lobbying Efforts: Apple is likely engaged in lobbying efforts to advocate for the reduction or removal of these tariffs. This involves engaging with policymakers and participating in discussions aimed at influencing trade policy.

-

Potential Risks and Opportunities:

- Risk: Increased production costs could severely impact profit margins.

- Risk: Consumer resistance to price increases could lead to reduced sales.

- Opportunity: Diversification of manufacturing could lead to greater supply chain resilience.

- Opportunity: Innovation and new product launches could offset the impact of tariffs.

Wider Implications for the Tech Industry

The tariffs imposed on Apple have broader implications for the entire tech industry. It highlights the vulnerability of tech companies heavily reliant on global supply chains.

-

Impact on Other Tech Companies: Many other technology companies face similar challenges, with tariffs impacting their production costs and profitability.

-

Global Trade War: The situation underscores the potential for an escalating global trade war, with severe consequences for the tech sector and the global economy.

-

Regulatory Responses: Governments may implement various regulatory responses to mitigate the impact of tariffs on their domestic industries.

-

Vulnerability of the Tech Industry:

- Supply Chain Dependence: The tech industry's reliance on complex global supply chains makes it particularly susceptible to trade disputes.

- Price Sensitivity: Consumers are often price-sensitive, making it challenging for companies to absorb increased costs without impacting sales.

- Geopolitical Risks: Trade disputes highlight the geopolitical risks inherent in globalized manufacturing.

Conclusion

The $900 million tariff impact on Apple has resulted in significant Apple stock slumps, highlighting the vulnerability of the tech industry to global trade uncertainties. The decline in Apple's stock price reflects investor concerns about the company's ability to mitigate these increased costs. Apple's response, including exploring production diversification and potential price adjustments, is crucial to its long-term financial health. The wider implications for the tech industry are significant, underscoring the need for greater supply chain resilience and a careful consideration of geopolitical risks.

Call to Action: Stay informed about the evolving situation regarding Apple stock slumps and the ongoing impact of tariffs. Continue following our coverage for further analysis and insights into Apple's financial performance and future strategy in the face of global trade uncertainties. Keep an eye on how Apple stock slumps might continue to impact the market and explore the many resources available to learn more about investing and global trade issues.

Featured Posts

-

Sew A Lei Hawaii Keiki Artistic Talent On Display For Memorial Day

May 25, 2025

Sew A Lei Hawaii Keiki Artistic Talent On Display For Memorial Day

May 25, 2025 -

Long Delays On M6 After Van Crash

May 25, 2025

Long Delays On M6 After Van Crash

May 25, 2025 -

Apple Stock Q2 Earnings I Phone Sales Fuel Growth

May 25, 2025

Apple Stock Q2 Earnings I Phone Sales Fuel Growth

May 25, 2025 -

Finding Peace Amidst The Pandemic One Womans Seattle Green Space

May 25, 2025

Finding Peace Amidst The Pandemic One Womans Seattle Green Space

May 25, 2025 -

Escape To The Country Balancing Rural Life And Modern Needs

May 25, 2025

Escape To The Country Balancing Rural Life And Modern Needs

May 25, 2025

Latest Posts

-

George L Russell Jr S Legacy A Reflection On His Impact On Maryland Law

May 25, 2025

George L Russell Jr S Legacy A Reflection On His Impact On Maryland Law

May 25, 2025 -

Passing Of George L Russell Jr Remembering A Maryland Legal Pioneer

May 25, 2025

Passing Of George L Russell Jr Remembering A Maryland Legal Pioneer

May 25, 2025 -

Prominent Maryland Attorney George L Russell Jr Dies

May 25, 2025

Prominent Maryland Attorney George L Russell Jr Dies

May 25, 2025 -

Maryland Mourns The Loss Of Legal Leader George L Russell Jr

May 25, 2025

Maryland Mourns The Loss Of Legal Leader George L Russell Jr

May 25, 2025 -

George L Russell Jr Maryland Legal Giant And Progressive Icon Passes Away

May 25, 2025

George L Russell Jr Maryland Legal Giant And Progressive Icon Passes Away

May 25, 2025