Apple Stock Slumps On $900 Million Tariff Projection

Table of Contents

The $900 Million Tariff Projection: A Detailed Breakdown

The $900 million tariff projection stems from recent analyst reports forecasting the impact of increased import duties on various Apple products. These reports suggest that a substantial portion of Apple's manufacturing costs will increase, significantly affecting their profit margins.

Specifically, the tariffs are expected to disproportionately affect several key product lines:

- Specific product lines impacted: iPhones, iPads, Apple Watches, and MacBooks are predicted to see the most significant price increases due to increased manufacturing costs.

- Percentage increase in projected manufacturing costs: Estimates vary, but some analysts predict a 5-10% increase in manufacturing costs for certain products. This increase directly impacts Apple's overall profitability.

- Potential impact on Apple's profit margins: The increased costs could significantly erode Apple's already competitive profit margins, potentially leading to reduced earnings and impacting shareholder returns. This is a key factor contributing to the Apple stock slumps.

Market Reaction and Investor Sentiment

The news of the projected $900 million tariff impact sent shockwaves through the market. Apple's stock price experienced a sharp decline, with significant trading volume indicating heightened investor activity and concern.

- Percentage drop in Apple stock price: The stock price dropped by [Insert Percentage] following the release of the tariff projection, reflecting immediate investor concern.

- Changes in Apple's market capitalization: The decline in stock price resulted in a considerable decrease in Apple's overall market capitalization, highlighting the severity of the situation.

- Expert opinions on the future of Apple stock: Analysts have expressed mixed opinions. Some believe the impact will be temporary, while others suggest long-term consequences for Apple's profitability and stock performance, potentially leading to further Apple stock slumps. Many are closely watching Apple's response and the potential for further tariff increases.

Apple's Response and Mitigation Strategies

While Apple has not yet issued a formal statement directly addressing the specific $900 million figure, the company is likely exploring various strategies to mitigate the impact of the tariffs.

- Apple's official statement (if any): [Insert any official statement from Apple here. If none exists, state that].

- Potential production shifts (location, etc.): One possible response is shifting some manufacturing to countries with more favorable trade agreements. This could involve significant logistical changes and investment.

- Potential price adjustments for consumers: To offset increased costs, Apple may consider raising prices for its products. However, this could negatively impact consumer demand and market share.

Long-Term Implications for Apple and the Tech Industry

The implications of these tariffs extend far beyond Apple. Increased costs for tech products could negatively affect consumer spending, potentially slowing overall economic growth.

- Potential impact on consumer spending: Higher prices for Apple products could lead consumers to delay purchases or opt for cheaper alternatives, impacting Apple's revenue.

- Effects on Apple's competitors: Competitors could gain market share if Apple's prices increase significantly.

- Potential long-term shifts in global supply chains: The tariffs could spur companies to diversify their supply chains, reducing reliance on specific countries and potentially increasing manufacturing costs across the board.

Conclusion

The $900 million tariff projection presents a significant challenge for Apple. The resulting Apple stock slumps reflect investor concerns about the potential impact on profitability and future growth. Apple's response, market reactions, and the broader implications for the tech industry remain to be seen. The long-term effects on consumer spending, global supply chains, and competition within the tech sector warrant close monitoring.

Stay updated on the latest developments regarding Apple stock and the ongoing tariff situation by following [link to reputable financial news source, e.g., Bloomberg, Reuters]. Understanding the evolving situation surrounding Apple stock slumps is critical for informed investment decisions.

Featured Posts

-

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 24, 2025

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 24, 2025 -

A Successful Escape To The Country Tips For A Smooth Transition

May 24, 2025

A Successful Escape To The Country Tips For A Smooth Transition

May 24, 2025 -

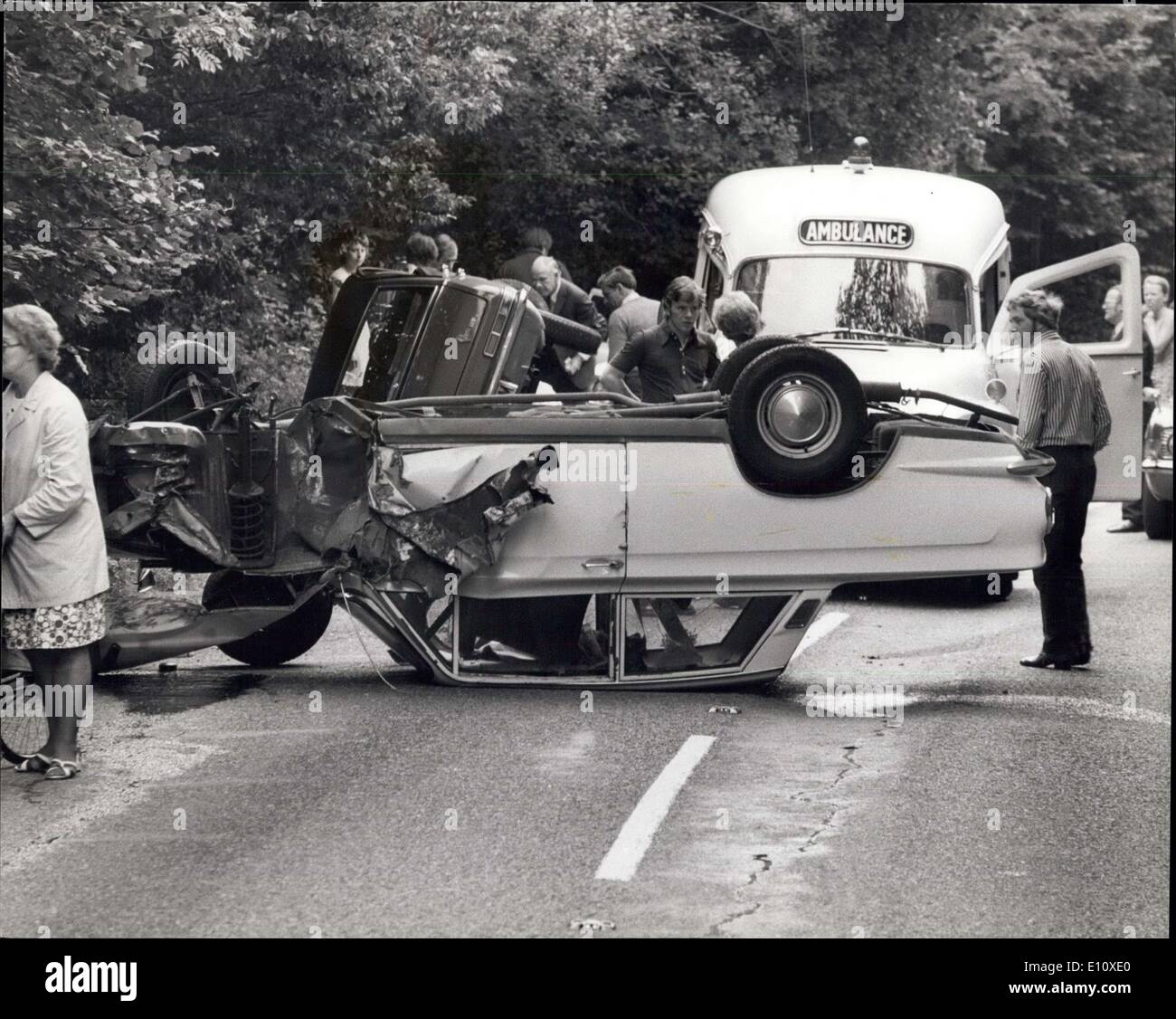

Emergency Services Respond To M56 Crash Car Overturned

May 24, 2025

Emergency Services Respond To M56 Crash Car Overturned

May 24, 2025 -

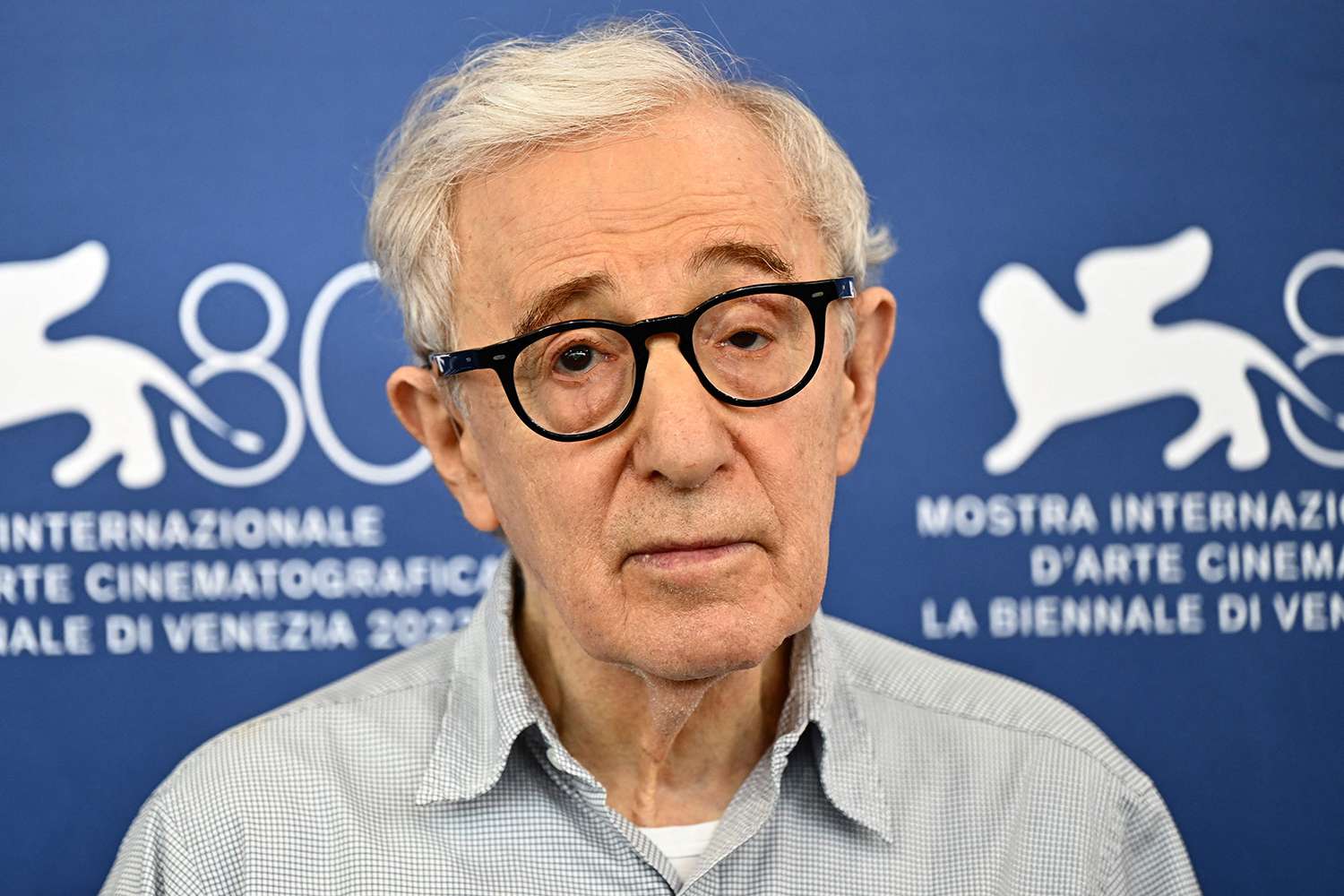

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025 -

New R And B Music Leon Thomas And Flos Latest Releases And Other Top Picks

May 24, 2025

New R And B Music Leon Thomas And Flos Latest Releases And Other Top Picks

May 24, 2025

Latest Posts

-

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025 -

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025 -

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025 -

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025 -

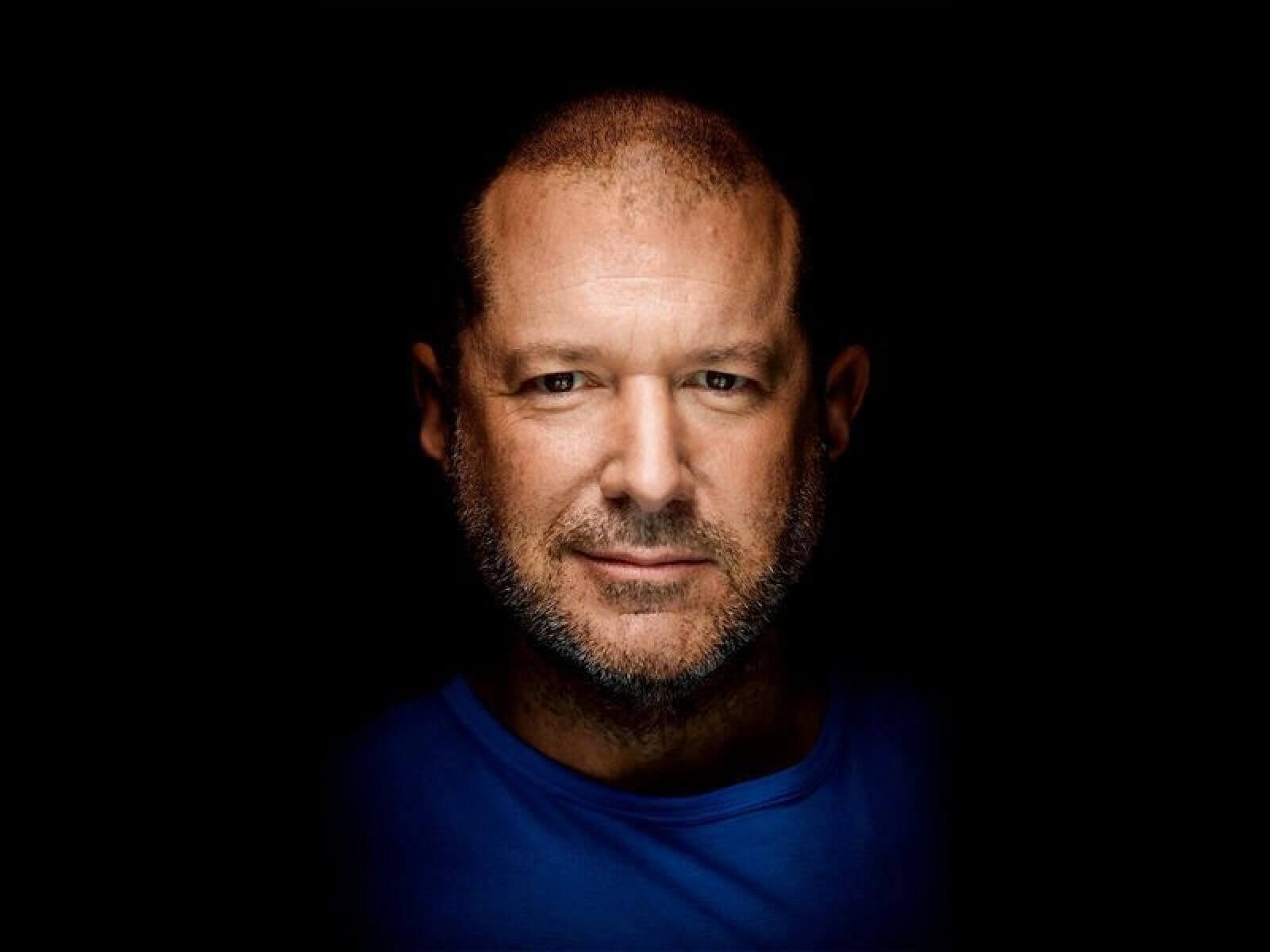

The Future Of Ai Hardware Open Ais Potential Deal With Jony Ive

May 24, 2025

The Future Of Ai Hardware Open Ais Potential Deal With Jony Ive

May 24, 2025