Apple Stock Suffers Setback Amidst Tariff Announcement

Table of Contents

The Impact of Tariffs on Apple's Manufacturing and Supply Chain

A significant portion of Apple's products are manufactured in China, making the company highly susceptible to tariffs imposed on goods originating from that country. This heavy reliance on Chinese manufacturing presents a considerable vulnerability in the face of escalating trade tensions. The keywords here are supply chain disruption, manufacturing costs, China tariffs, iPhone production, and import costs.

- Increased Manufacturing Costs: Increased tariffs directly translate to higher manufacturing costs for Apple, potentially squeezing profit margins. Every additional dollar added to the cost of producing an iPhone directly impacts the company's bottom line.

- Supply Chain Disruption: Disruptions to the supply chain due to geopolitical uncertainty and trade wars could lead to production delays and shortages of crucial components. This could result in lower-than-expected sales and further pressure on Apple stock.

- iPhone Production Impact: The impact on iPhone production is particularly noteworthy, given its significant contribution to Apple's overall revenue. Any disruption to iPhone production, whether due to tariffs or supply chain issues, would have a cascading effect on the company's financial performance.

- Shifting Production: Apple may explore shifting some of its manufacturing operations to other countries to mitigate the impact of tariffs. However, this is a complex and costly undertaking, involving significant time and investment.

Investor Sentiment and Market Reaction to the News

The tariff announcement triggered immediate selling pressure on Apple stock, reflecting investor concerns about the company's future profitability. This sell-off highlights the fragility of investor confidence in the face of unexpected economic headwinds. The keywords to consider here include investor confidence, stock market volatility, sell-off, market analysis, and trading volume.

- Market Volatility: Increased market volatility is likely to continue as investors assess the long-term implications of the tariffs on Apple and the broader tech sector. Uncertainty breeds volatility, leading to fluctuating stock prices and increased risk for investors.

- Trading Volume Surge: Trading volume for Apple stock likely surged following the announcement, indicating heightened investor activity. Many investors react swiftly to news events, leading to increased buying or selling pressure.

- Analyst Predictions: Analyst predictions and ratings for Apple stock will be closely watched in the coming days and weeks. These predictions can influence investor sentiment and further impact the stock price.

Alternative Investment Strategies During Market Uncertainty

The current market uncertainty surrounding Apple stock underscores the importance of robust risk management strategies. Keywords here include: diversification, risk management, portfolio adjustment, long-term investment, and hedging strategies.

- Portfolio Diversification: Diversifying your investment portfolio can mitigate the risk associated with individual stock fluctuations. Don't put all your eggs in one basket.

- Strategic Portfolio Adjustment: Consider adjusting your investment strategy based on your risk tolerance and long-term financial goals. This might involve shifting assets to less volatile investments.

- Hedging Strategies: Explore hedging strategies, such as options trading, to protect against further market declines. These strategies can help limit potential losses.

- Financial Advisor Consultation: Consult a financial advisor for personalized advice tailored to your specific circumstances. Professional guidance is essential during periods of high market volatility.

Apple's Response and Future Outlook

Apple's official response to the tariff announcement (if any) will be closely scrutinized by investors. The company's strategic response will play a crucial role in shaping its future performance and investor confidence. Key words for this section include company statement, strategic response, long-term prospects, financial performance, and future predictions.

- Mitigating Tariff Impacts: Analyzing Apple's potential strategies for mitigating the impact of tariffs is crucial. This could involve shifting production, negotiating with suppliers, or absorbing some of the increased costs.

- Long-Term Financial Performance: The long-term outlook for Apple's financial performance will depend on several factors, including the duration and intensity of the tariffs, the success of Apple's mitigation strategies, and overall economic conditions.

- Absorbing Increased Costs: Assessing the potential for Apple to absorb increased costs without significantly impacting its profitability is crucial for understanding the sustainability of its current business model.

Conclusion

The tariff announcement has created a significant setback for Apple stock, impacting its manufacturing, supply chain, and investor sentiment. The resulting market volatility underscores the importance of informed investment decisions. The impact on Apple's future financial performance remains uncertain, depending heavily on its strategic response and the broader economic landscape.

Call to Action: Stay informed about the evolving situation surrounding Apple stock and the ongoing impact of tariffs. Monitor news and expert analysis to make well-informed decisions regarding your investments in Apple and other tech stocks. Consider diversifying your portfolio to mitigate risk and consult a financial advisor for personalized guidance on managing your investments in the face of market volatility. Don't let this Apple stock setback catch you unprepared. Make informed decisions about your Apple stock investments today.

Featured Posts

-

Planning Your Memorial Day Trip In 2025 Air Travel Tips

May 24, 2025

Planning Your Memorial Day Trip In 2025 Air Travel Tips

May 24, 2025 -

Ferrari Challenge Racing Days Conquer South Florida

May 24, 2025

Ferrari Challenge Racing Days Conquer South Florida

May 24, 2025 -

Consequences Of Dissent Why Seeking Change Can Be Punished

May 24, 2025

Consequences Of Dissent Why Seeking Change Can Be Punished

May 24, 2025 -

Sejarah Dan Evolusi Porsche 356 Di Pabrik Zuffenhausen Jerman

May 24, 2025

Sejarah Dan Evolusi Porsche 356 Di Pabrik Zuffenhausen Jerman

May 24, 2025 -

Porsche 356 Dari Zuffenhausen Sebuah Studi Sejarah Manufaktur Jerman

May 24, 2025

Porsche 356 Dari Zuffenhausen Sebuah Studi Sejarah Manufaktur Jerman

May 24, 2025

Latest Posts

-

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025 -

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025 -

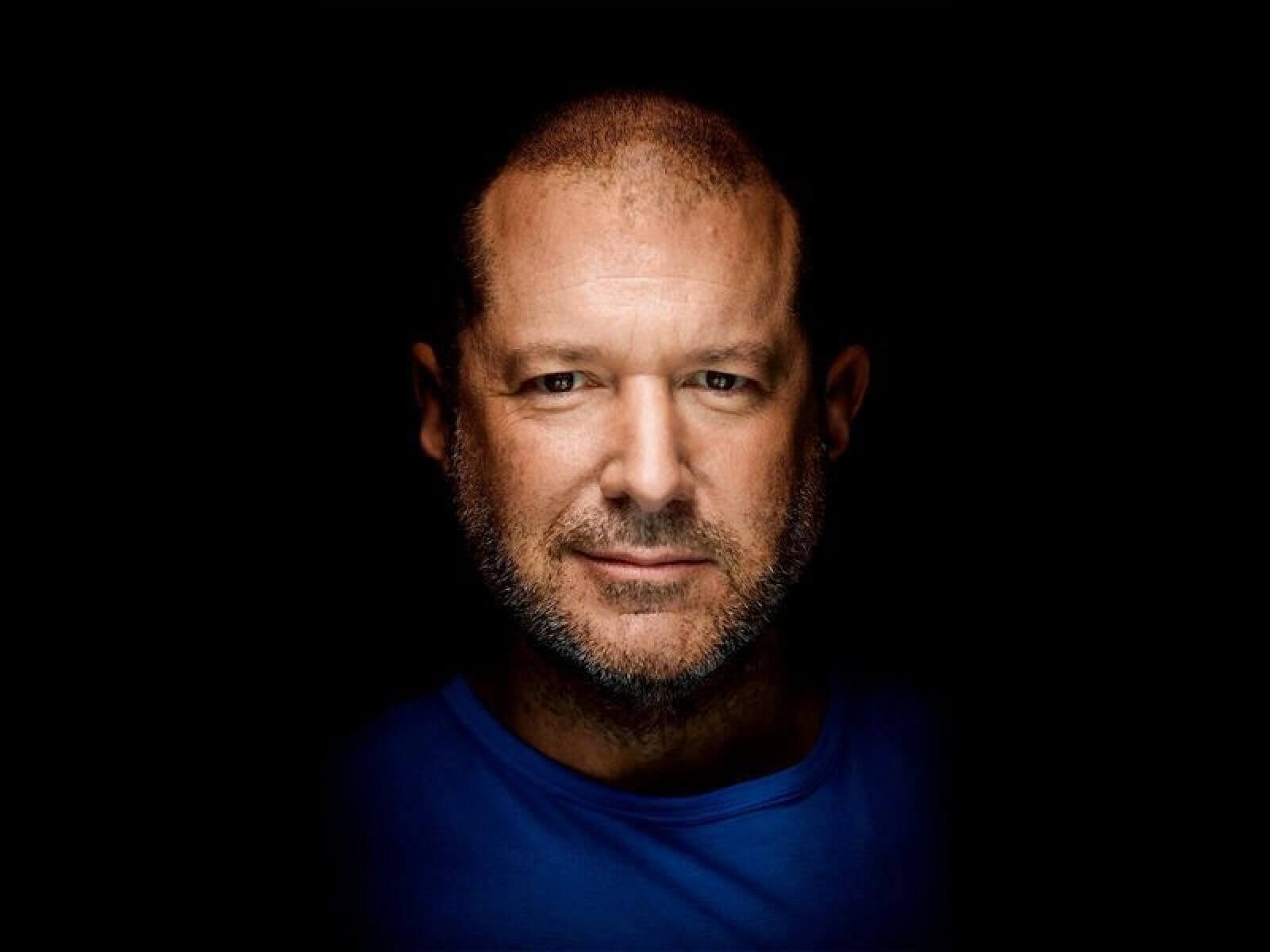

The Future Of Ai Hardware Open Ais Potential Deal With Jony Ive

May 24, 2025

The Future Of Ai Hardware Open Ais Potential Deal With Jony Ive

May 24, 2025 -

Understanding Microsofts Palestine Email Block A Recent Controversy

May 24, 2025

Understanding Microsofts Palestine Email Block A Recent Controversy

May 24, 2025 -

Orbital Space Crystals A Novel Approach To Enhanced Drug Development

May 24, 2025

Orbital Space Crystals A Novel Approach To Enhanced Drug Development

May 24, 2025