April 23 Oil Market Report: Prices, News & Analysis

Table of Contents

Oil Price Movements on April 23rd

April 23rd witnessed considerable fluctuation in crude oil prices. Tracking both Brent crude and West Texas Intermediate (WTI) crude is crucial for understanding the overall market dynamics. Below are the key price movements:

-

Brent Crude:

- Opening Price: $80.50 per barrel

- High: $82.20 per barrel

- Low: $79.80 per barrel

- Closing Price: $81.90 per barrel

- Percentage Change from Previous Day: +2.1%

- Compared to the previous week: +4.5%

- Compared to the previous month: +8.0%

-

WTI Crude:

- Opening Price: $77.00 per barrel

- High: $78.70 per barrel

- Low: $76.50 per barrel

- Closing Price: $78.40 per barrel

- Percentage Change from Previous Day: +1.8%

- Compared to the previous week: +3.9%

- Compared to the previous month: +7.5%

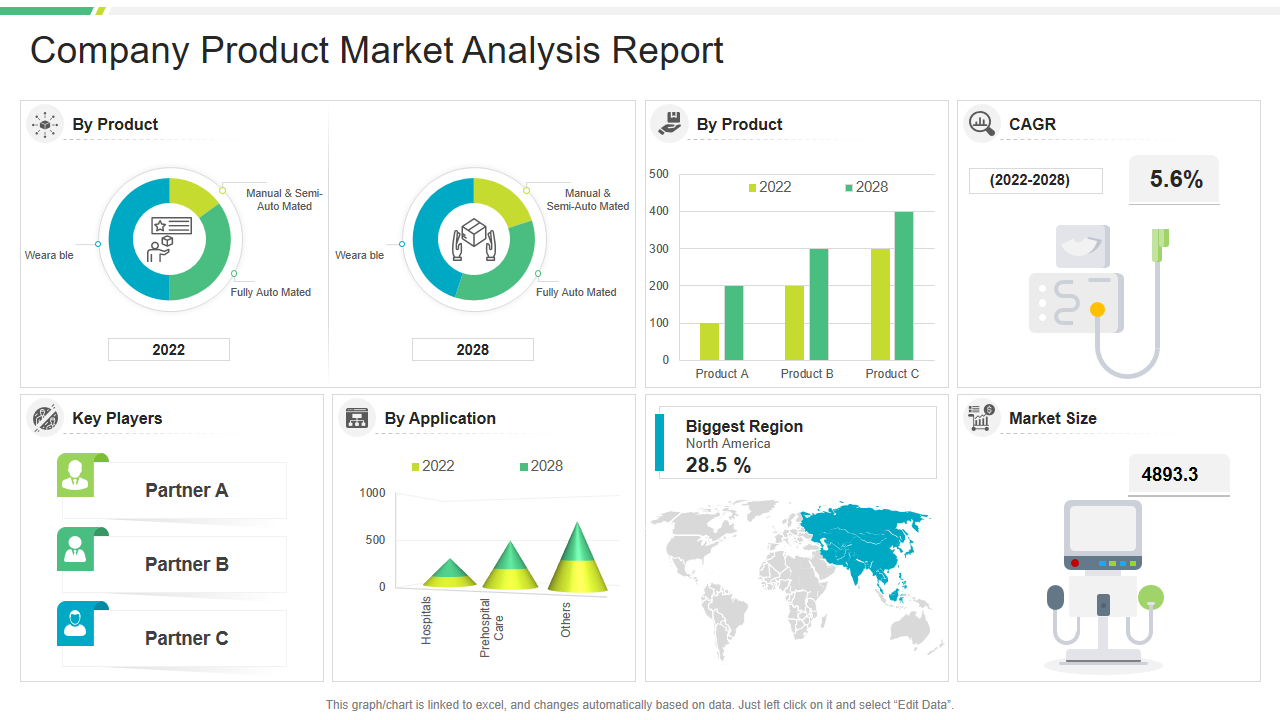

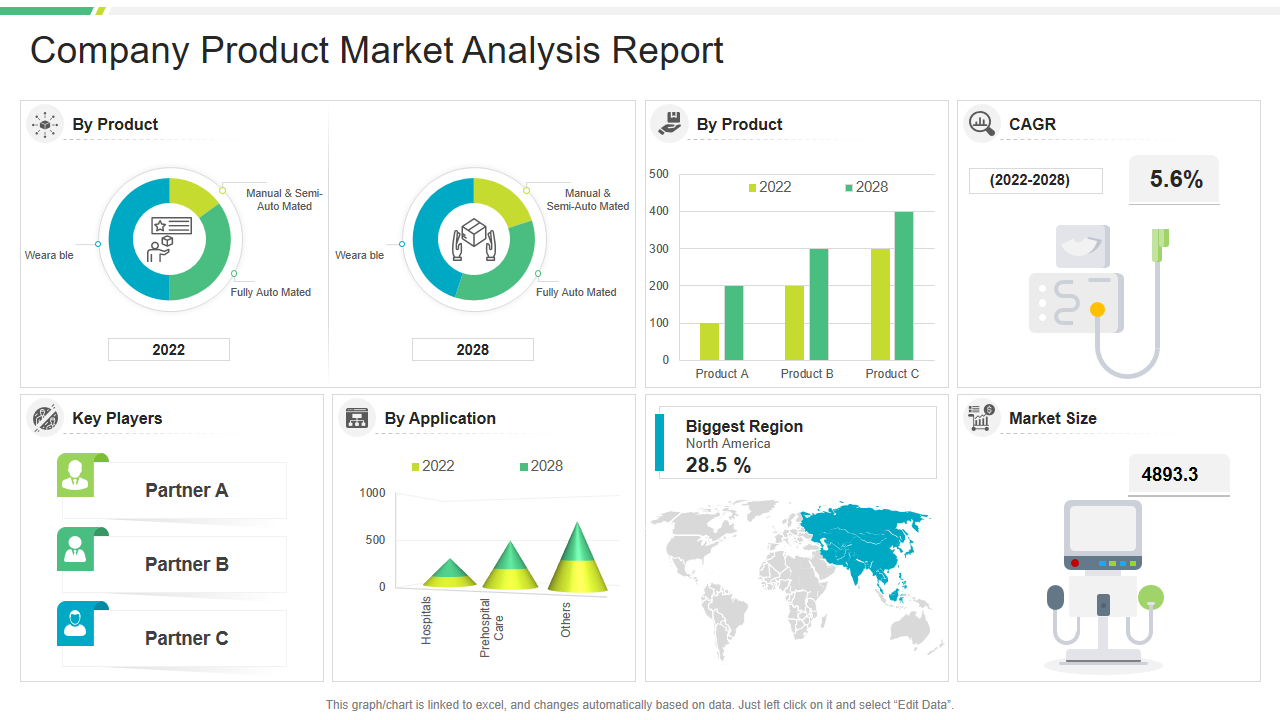

[Insert a chart or graph visually representing the price movements of both Brent and WTI crude oil throughout April 23rd here.]

Key News and Events Impacting the Oil Market

Several significant news and events contributed to the oil price surge on April 23rd. These factors highlight the complex interplay between geopolitical risks and market sentiment.

-

Escalating Geopolitical Tensions in [Specific Region]: Renewed tensions in [Specific Region] led to concerns about potential disruptions to oil supplies from the area. This uncertainty pushed prices upwards.

-

OPEC+ Meeting Outcome: The OPEC+ meeting, while not resulting in a major production change announcement, did create some market uncertainty due to differing opinions among member states. This contributed to price volatility. [Link to reputable news source].

-

Unexpected Supply Disruption: A reported pipeline disruption in [Location] caused temporary supply concerns, further increasing upward pressure on prices. [Link to reputable news source].

-

Stronger-than-Expected Economic Data: Positive economic data from major oil-consuming nations suggested increased future demand, contributing to the price increase. [Link to reputable news source].

Geopolitical Risks and their Influence

Geopolitical risks remain a significant driver of oil price volatility. The ongoing situation in [Specific Region] continues to pose a considerable threat to global energy security. Potential supply disruptions due to conflict or sanctions remain a major concern for market participants. The impact is not just on the direct supply from the region but also on investor confidence and overall market sentiment.

-

Potential for further escalation: The possibility of further escalation in [Specific Region] could lead to significant supply disruptions and a subsequent spike in oil prices.

-

Sanctions and their consequences: Existing and potential future sanctions on oil-producing nations add another layer of complexity, potentially restricting supply and influencing price dynamics.

-

Strategic Petroleum Reserve releases: The potential for or the actual release of oil from strategic petroleum reserves by major consuming nations can influence short-term price stability, but its effect on long-term prices is debated.

Oil Market Analysis and Outlook

The April 23rd oil market showcased a complex interplay between supply and demand, fueled by geopolitical uncertainty and economic indicators. The current market sentiment leans towards cautious optimism, with many analysts expecting prices to remain elevated in the short term.

-

Supply Concerns: Ongoing geopolitical tensions and potential supply disruptions remain a key concern.

-

Demand Outlook: Stronger-than-expected economic data from key oil consumers suggests a robust demand outlook for the coming months.

-

Short-Term Outlook: Considering the current geopolitical climate and robust demand, prices are expected to remain relatively high in the near term. However, unforeseen events could significantly impact this forecast. It's crucial to remember that this is a short-term prediction and significant changes can occur rapidly.

Conclusion

The April 23rd oil market report reveals a day of significant price increases driven largely by escalating geopolitical tensions and unforeseen supply disruptions. The interplay between these factors and the overall market sentiment influenced both Brent and WTI crude oil prices. Continued monitoring of geopolitical developments and economic indicators is crucial for understanding future oil price movements. Stay informed about daily fluctuations in the oil market with our daily oil market reports. Subscribe to our newsletter for daily updates on oil prices and analysis. Follow us for the latest [link to social media or website] for regular oil market reports and insightful oil price analysis.

Featured Posts

-

Chainalysis Acquisition Of Alterya Boosting Ai In Blockchain Security

Apr 24, 2025

Chainalysis Acquisition Of Alterya Boosting Ai In Blockchain Security

Apr 24, 2025 -

Over The Counter Birth Control A Post Roe Game Changer

Apr 24, 2025

Over The Counter Birth Control A Post Roe Game Changer

Apr 24, 2025 -

Sophie Nyweide Mammoth And Noah Child Actor Dead At 24

Apr 24, 2025

Sophie Nyweide Mammoth And Noah Child Actor Dead At 24

Apr 24, 2025 -

Bethesda Confirms Oblivion Remastered Release

Apr 24, 2025

Bethesda Confirms Oblivion Remastered Release

Apr 24, 2025 -

T Mobile To Pay 16 Million For Data Breaches Spanning Three Years

Apr 24, 2025

T Mobile To Pay 16 Million For Data Breaches Spanning Three Years

Apr 24, 2025

Latest Posts

-

Shane Lowry And Rory Mc Ilroy To Play Zurich Classic

May 12, 2025

Shane Lowry And Rory Mc Ilroy To Play Zurich Classic

May 12, 2025 -

The Masters Aftermath Shane Lowrys Message Of Support For Rory Mc Ilroy

May 12, 2025

The Masters Aftermath Shane Lowrys Message Of Support For Rory Mc Ilroy

May 12, 2025 -

Lowrys Encouraging Words For Mc Ilroy Post Masters Highlight Their Strong Bond

May 12, 2025

Lowrys Encouraging Words For Mc Ilroy Post Masters Highlight Their Strong Bond

May 12, 2025 -

Zurich Classic Mc Ilroy Lowry Trail Leaders By Six Strokes

May 12, 2025

Zurich Classic Mc Ilroy Lowry Trail Leaders By Six Strokes

May 12, 2025 -

Isaiah Salinda And Kevin Velo Zurich Classic Leaders With Stunning 58

May 12, 2025

Isaiah Salinda And Kevin Velo Zurich Classic Leaders With Stunning 58

May 12, 2025