April's U.S. Jobs Report: 177,000 Jobs Added, Unemployment Rate At 4.2%

Table of Contents

H2: Job Growth Breakdown: Sector-Specific Analysis of April's Numbers

The 177,000 jobs added in April represent a slowdown compared to previous months. A deeper dive into sectoral job growth reveals a more nuanced picture.

-

H3: Strongest Performing Sectors: Several sectors demonstrated notable resilience.

- Leisure and Hospitality: This sector continued its recovery, adding a substantial number of jobs, reflecting the ongoing rebound in tourism and entertainment.

- Professional and Business Services: This sector also saw solid job growth, driven by increased demand for consulting, financial services, and other professional expertise.

- Healthcare: Continued growth in healthcare employment reflects the aging population and increasing demand for healthcare services.

-

H3: Underperforming Sectors: Conversely, some sectors lagged behind expectations.

- Manufacturing: Manufacturing jobs showed only marginal growth, possibly indicating persistent supply chain challenges and global economic uncertainty.

- Retail: The retail sector experienced a slight decline in job creation, potentially reflecting shifts in consumer spending habits and e-commerce dominance.

The unexpected weakness in manufacturing contrasts with the sustained strength in the service sector, hinting at ongoing structural shifts in the U.S. economy. This sectoral divergence will be a key factor to watch in future U.S. jobs report analyses.

H2: Unemployment Rate Deep Dive: 4.2% – What Does it Mean?

The 4.2% unemployment rate remains relatively low, historically speaking, suggesting a tight labor market. However, this figure alone doesn't tell the whole story.

- H3: Analyzing the 4.2% Unemployment Rate: Compared to pre-pandemic levels, the current unemployment figures are quite low. This suggests a healthy job market but could also indicate inflationary pressures due to high demand for labor.

- H3: Labor Force Participation Rate: The labor force participation rate provides additional context. An increase in this rate would suggest more people actively seeking employment, potentially exerting upward pressure on wages and inflation. A decrease could signal underlying workforce challenges.

- H3: Types of Unemployment: The 4.2% figure encompasses different types of unemployment. Frictional unemployment (temporary unemployment between jobs) is naturally present; however, a rise in structural unemployment (mismatch between worker skills and available jobs) or cyclical unemployment (due to economic downturns) would be cause for concern.

Understanding these nuances is crucial for interpreting the overall health of the U.S. labor market.

H2: Wage Growth and Inflation: A Balancing Act

The April U.S. jobs report also shed light on the interplay between wage growth and inflation.

- H3: Average Hourly Earnings: Average hourly earnings data revealed a modest increase, indicating some wage growth. However, this increase needs to be considered in relation to the current inflation rate.

- H3: Inflationary Pressures: The relationship between wage growth and inflation is complex. If wage increases outpace productivity growth, it can fuel inflation. Conversely, if inflation erodes purchasing power, despite wage increases, real wages may stagnate. The current data needs careful consideration in the context of overall economic activity and productivity levels.

The balance between wage growth and inflation is a critical factor influencing consumer spending and economic stability.

H2: Implications for Monetary Policy: The Fed's Next Move

The April U.S. jobs report will undoubtedly influence the Federal Reserve's monetary policy decisions.

- H3: Federal Reserve Response: The report's data will likely inform the Fed's decisions regarding future interest rate hikes. A robust jobs report, coupled with persistent inflation, might prompt further interest rate increases to cool down the economy.

- H3: Economic Forecast Impact: The report's findings will have significant implications for the overall economic forecast. Sustained job growth and a low unemployment rate, combined with manageable inflation, would point to a positive outlook.

The Fed's response and its impact on interest rates will be crucial in shaping the future direction of the U.S. economy.

3. Conclusion: Understanding the April U.S. Jobs Report and its Future Implications

April's U.S. jobs report presented a mixed picture of economic health, with modest job growth and a low unemployment rate. The report highlighted sectoral variations, the need to consider labor force participation rate alongside unemployment figures, and the intricate interplay between wage growth and inflation. These findings will significantly influence the Federal Reserve's monetary policy and shape the overall economic outlook. Understanding these dynamics is crucial for investors, businesses, and policymakers alike. Stay tuned for our next analysis of the U.S. jobs report to stay updated on the evolving economic landscape and how the April jobs report data influences future trends.

Featured Posts

-

Blake Lively And Anna Kendrick Team Up For Another Simple Favor Promotion

May 04, 2025

Blake Lively And Anna Kendrick Team Up For Another Simple Favor Promotion

May 04, 2025 -

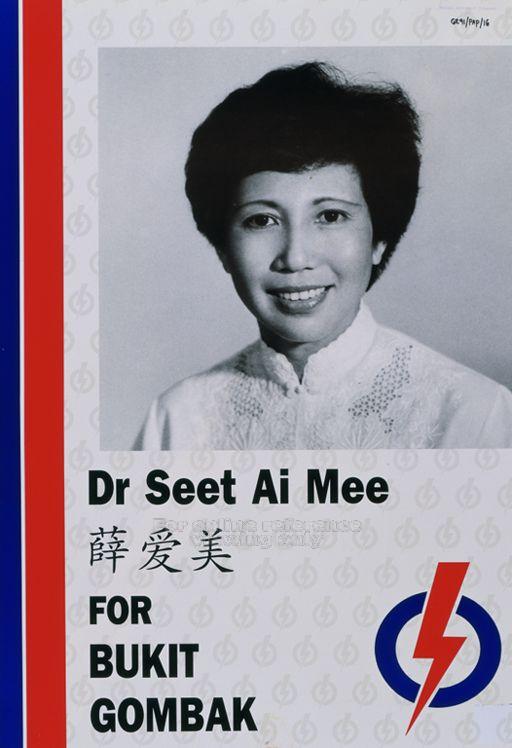

How Singapores Elections Could Reshape Its Political System

May 04, 2025

How Singapores Elections Could Reshape Its Political System

May 04, 2025 -

Nhl Playoff Race Crucial Friday Matchups And Standings Analysis

May 04, 2025

Nhl Playoff Race Crucial Friday Matchups And Standings Analysis

May 04, 2025 -

Singapore Elections A Test Of The Paps Grip On Power

May 04, 2025

Singapore Elections A Test Of The Paps Grip On Power

May 04, 2025 -

Nhl Playoffs 2024 Golden Knights Path To The Stanley Cup Final

May 04, 2025

Nhl Playoffs 2024 Golden Knights Path To The Stanley Cup Final

May 04, 2025

Latest Posts

-

Ufc 314 Early Betting Odds And Potential Upsets

May 04, 2025

Ufc 314 Early Betting Odds And Potential Upsets

May 04, 2025 -

Tri State Area Snow Forecast Timing And Accumulation

May 04, 2025

Tri State Area Snow Forecast Timing And Accumulation

May 04, 2025 -

Ufc 314 Fight Card Opening Betting Odds And Predictions

May 04, 2025

Ufc 314 Fight Card Opening Betting Odds And Predictions

May 04, 2025 -

Ufc 314 Complete Fight Card Order Main Event To Prelims

May 04, 2025

Ufc 314 Complete Fight Card Order Main Event To Prelims

May 04, 2025 -

New York New Jersey Connecticut Snow Predictions

May 04, 2025

New York New Jersey Connecticut Snow Predictions

May 04, 2025