Are High Stock Market Valuations A Cause For Concern? BofA Says No.

Table of Contents

BofA's Rationale for Dismissing High Valuations

BofA's recent reports present a bullish perspective on the stock market, even with the seemingly high valuations. Their reasoning hinges on several key factors:

-

Low Interest Rates Fuel Growth: BofA argues that persistently low interest rates significantly impact company profitability and investor behavior. Low borrowing costs allow companies to invest more readily, leading to increased earnings growth. Simultaneously, these low rates reduce the attractiveness of bonds, pushing investors towards riskier assets like stocks, thereby supporting higher valuations. The cost of capital remains depressed, allowing for increased valuations even if earnings growth is only moderate.

-

Projected Earnings Growth: The BofA report projects continued earnings growth, particularly within specific sectors. While they don't provide specific numbers here (for confidentiality), they highlight the technology, healthcare, and consumer discretionary sectors as key drivers of future earnings, suggesting robust profit generation to support the current valuation levels. This projected growth, they maintain, offsets the concerns about high price-to-earnings ratios.

-

Inflation's Manageable Impact: BofA acknowledges inflationary pressures but argues that the current inflation rate remains manageable, largely due to robust supply chains and technological advancements increasing efficiency. They suggest that the impact on earnings will be moderate, not significantly enough to derail the positive growth projections. They contrast this with the potential for strong economic growth, which may prove sufficient to offset any negative impact of inflation.

-

Positive Economic Growth Outlook: BofA's optimism extends to the broader economic outlook. They foresee continued, albeit moderate, economic expansion, further fueling their belief in sustained corporate earnings growth. This positive growth trajectory, they argue, justifies the current market valuations and makes a significant market correction unlikely.

Counterarguments and Considerations

While BofA presents a compelling case, it's crucial to acknowledge counterarguments and potential risks:

-

High Valuation Multiples: Critics point to high price-to-earnings ratios (P/E ratios) and other valuation multiples as signs of overvaluation. These multiples often compare current stock prices to historical averages, suggesting that many stocks are currently trading at significantly elevated levels compared to their intrinsic value. This high P/E ratio can signal that investors are willing to pay a significant premium for future growth, but that premium could prove unrealistic.

-

Market Correction Risk: The possibility of a market correction remains a significant concern. High valuations often precede market downturns. Even with BofA's positive outlook, unexpected economic events or shifts in investor sentiment could trigger a sharp decline in stock prices. This isn't merely a theoretical concern, but a possibility that demands attention. Scenarios ranging from a minor correction to a more substantial downturn need consideration.

-

Impact of Unexpected Events: Unforeseen economic shocks, geopolitical instability, or abrupt policy changes could significantly impact stock market valuations. "Black swan" events – unpredictable occurrences with severe consequences – pose a constant threat to even the most optimistic market forecasts. These could range from further pandemic disruptions to major shifts in international relations.

-

Balanced Perspective: It's essential to maintain a balanced perspective. BofA's analysis offers a credible view, but it's not without its limitations. Considering both the optimistic and pessimistic viewpoints allows for a more thorough risk assessment.

Alternative Investment Strategies in a High-Valuation Market

Given the high stock market valuations, diversifying your portfolio is critical:

-

Diversification Across Asset Classes: Reducing your exposure to equities through diversification is vital. Consider allocating a portion of your investments to other asset classes like bonds, real estate, or alternative investments. This reduces risk associated with over-reliance on the stock market.

-

Strategic Risk Management: Implementing robust risk management strategies is paramount. This could involve setting stop-loss orders to limit potential losses, defining your risk tolerance, and regularly rebalancing your portfolio. These strategies can help manage your exposure to high valuation risk.

-

Adjusting Asset Allocation: Re-evaluating your asset allocation based on your risk tolerance and investment goals is crucial. If you're concerned about high valuations, you might consider shifting a portion of your equity holdings into less volatile assets. This cautious approach is better than reacting with panic when the market turns against expectations.

-

Exploring Alternative Investments: Explore alternative investment options, such as private equity, hedge funds, or commodities, to diversify your portfolio beyond traditional stocks and bonds. However, remember that these alternatives often carry their own set of risks and require careful due diligence.

Conclusion

BofA's optimistic outlook on high stock market valuations rests on low interest rates, projected earnings growth, and a positive economic outlook. However, counterarguments highlight the risks associated with high valuation multiples and the possibility of a market correction. The potential impact of unexpected events further underscores the importance of careful risk management.

Ultimately, the decision of how to navigate this market depends on your individual risk tolerance and investment goals. Carefully consider your investment strategy in light of high stock market valuations and don't ignore the potential risks associated with current high stock market valuations. Conduct thorough research and consult with a qualified financial advisor before making any significant investment decisions. Remember, a well-diversified portfolio tailored to your specific circumstances is key to mitigating risk and achieving your financial goals in this environment.

Featured Posts

-

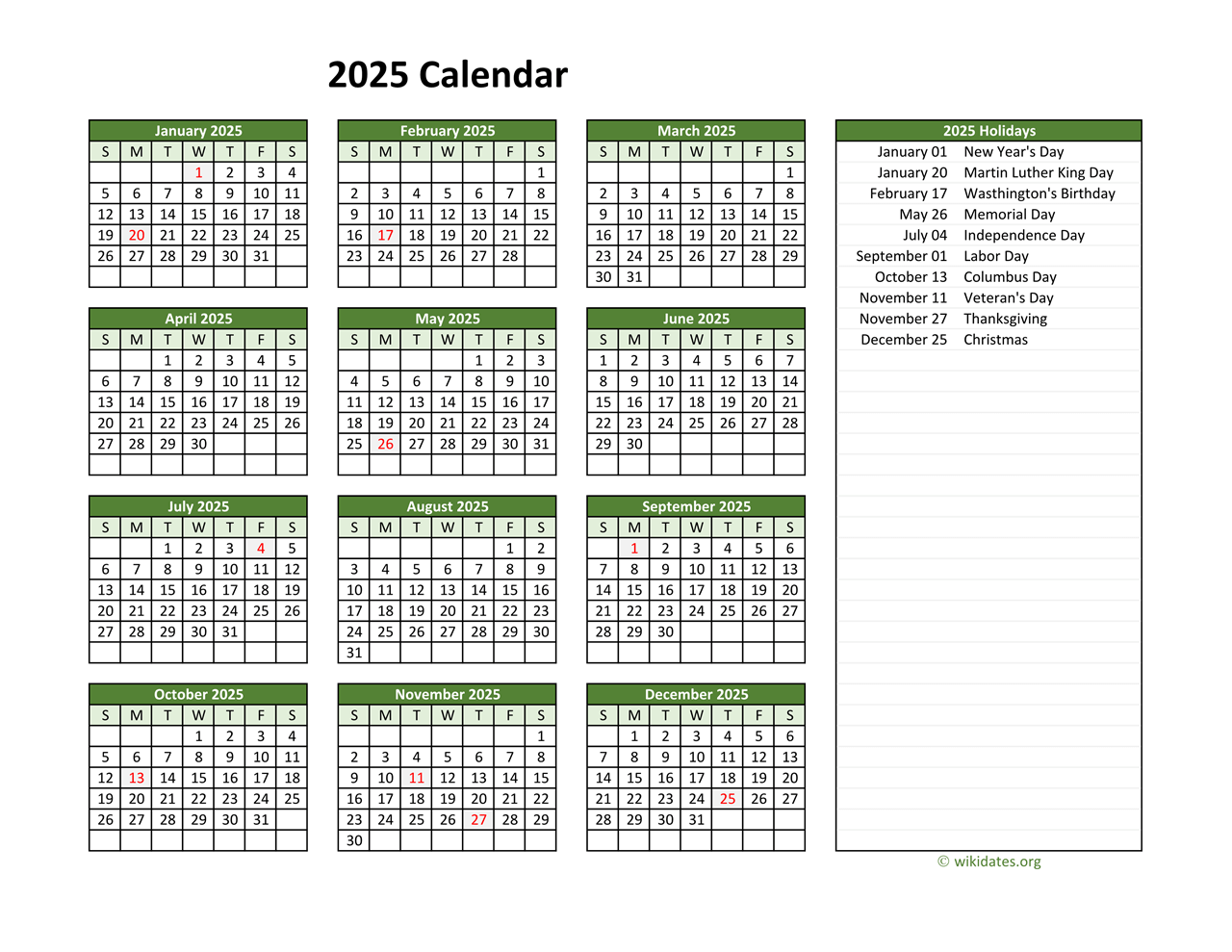

Us Holiday Calendar 2025 Federal State And Bank Holidays

Apr 23, 2025

Us Holiday Calendar 2025 Federal State And Bank Holidays

Apr 23, 2025 -

State Treasurers Confront Tesla Board Regarding Musks Leadership

Apr 23, 2025

State Treasurers Confront Tesla Board Regarding Musks Leadership

Apr 23, 2025 -

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

Apr 23, 2025

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

Apr 23, 2025 -

Caat Pension Plan Expands Canadian Private Investment Portfolio

Apr 23, 2025

Caat Pension Plan Expands Canadian Private Investment Portfolio

Apr 23, 2025 -

Le Role De Pascal Boulanger A La Tete De La Federation Des Promoteurs Immobiliers Fpi

Apr 23, 2025

Le Role De Pascal Boulanger A La Tete De La Federation Des Promoteurs Immobiliers Fpi

Apr 23, 2025