Are High Stock Market Valuations A Cause For Concern? BofA Weighs In

Table of Contents

BofA's Stance on Current Market Valuations

Bank of America's market outlook frequently incorporates detailed valuation analysis. Their assessments consider a range of economic indicators to gauge market risk. While specific reports and statements change, BofA generally employs a multi-faceted approach to evaluate stock market valuation, considering several key factors.

-

BofA's Assessment: BofA's view on stock market valuations fluctuates based on prevailing economic conditions and market data. They often utilize a combination of quantitative and qualitative analysis to determine whether the market is overvalued, fairly valued, or undervalued. Referencing their most recent research reports is essential for accessing their up-to-the-minute perspective. Checking their official website and reputable financial news sources for the latest updates on their stock market prediction is crucial.

-

Factors Considered: BofA's valuation analysis incorporates several crucial factors:

- Interest Rates: Lower interest rates generally support higher stock valuations, as they reduce the cost of borrowing for companies and make bonds less attractive relative to stocks.

- Economic Growth: Strong economic growth tends to boost corporate profits, leading to higher stock prices. Conversely, economic slowdowns can put downward pressure on valuations.

- Corporate Earnings: BofA carefully scrutinizes corporate earnings reports to assess the profitability and growth potential of companies. Strong earnings growth is a significant driver of higher stock valuations.

- Inflation: High inflation can erode corporate profits and investor confidence, potentially leading to lower stock valuations. BofA considers inflation a critical factor in its market risk assessment.

-

Methodology: BofA uses various valuation metrics, including:

- Price-to-Earnings Ratio (P/E): This ratio compares a company's stock price to its earnings per share. A high P/E ratio can suggest that a stock is overvalued.

- Price-to-Sales Ratio (P/S): This ratio compares a company's stock price to its revenue per share. It's often used to evaluate companies with negative earnings.

- Other Metrics: BofA likely employs other valuation models and metrics tailored to specific sectors and market conditions, providing a comprehensive picture of market valuation.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the elevated stock market valuations. Understanding these drivers is crucial to assessing the market's sustainability.

-

Low Interest Rates: Historically low interest rates have made borrowing cheaper for companies, fueling investment and boosting corporate profits. This low-cost capital environment, in turn, supports higher stock prices.

-

Robust Corporate Earnings: Strong corporate earnings growth, driven by factors like technological innovation and global expansion, has contributed to increased investor confidence and higher stock valuations.

-

Government Stimulus: Government stimulus packages, designed to bolster the economy during periods of uncertainty, can inject liquidity into the market, driving up asset prices including stocks.

-

Inflationary Pressures: While inflation can negatively impact valuations, moderate inflation coupled with strong corporate earnings growth can sometimes coexist and still lead to high stock prices. However, persistently high inflation can eventually trigger a market correction.

Potential Risks Associated with High Valuations

High stock market valuations, while potentially rewarding, also carry significant risks. Understanding these risks is crucial for effective risk management.

-

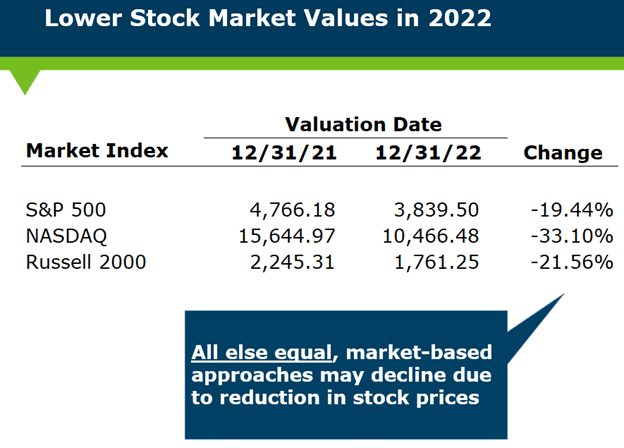

Market Correction: Overvalued markets are susceptible to sharp corrections or crashes, which can lead to substantial portfolio losses.

-

Increased Volatility: Highly valued markets tend to be more volatile, meaning prices can fluctuate significantly in short periods, increasing the potential for both gains and losses.

-

Lower Future Returns: High starting valuations typically imply lower potential returns in the future compared to investing at lower valuations.

-

Portfolio Diversification: Diversifying your investment portfolio across different asset classes, sectors, and geographies is crucial to mitigating risk in a high-valuation environment. This reduces the impact of any single market segment performing poorly.

Investment Strategies in a High-Valuation Environment

Navigating a market with high stock market valuations requires a cautious and adaptable investment strategy.

-

Strategic Adjustments: Investors concerned about high valuations might consider:

- Increasing Cash Holdings: Holding more cash provides liquidity and reduces exposure to market fluctuations.

- Value Investing: Focusing on undervalued companies with strong fundamentals can offer potentially higher returns.

- Asset Allocation: Diversifying into asset classes less correlated with stocks, such as bonds or real estate, can help cushion against market downturns.

- Defensive Investing: Shifting towards less volatile investments, like dividend-paying stocks, may help protect capital during periods of market uncertainty.

-

Strategy Selection: The best investment strategy depends on individual risk tolerance, time horizon, and financial goals. Growth investing, while potentially lucrative, carries more risk than value investing in a high-valuation market.

-

Professional Guidance: Seeking advice from a qualified financial advisor is recommended to create a personalized investment strategy aligned with your risk profile and financial objectives.

Conclusion

BofA's perspective on high stock market valuations, like that of many other financial institutions, is nuanced and data-driven. While the current market presents opportunities, it's crucial to recognize the risks associated with elevated valuations. Factors such as interest rates, corporate earnings, and inflation significantly influence market dynamics. Implementing a diversified investment strategy, considering increased cash holdings, and seeking professional financial advice are all important steps to navigate this environment effectively. Understanding these factors and adjusting your investment approach based on BofA's market analysis and other reputable sources is key to managing your portfolio in the context of high stock market valuations. Thoroughly research and understand your risk tolerance before making any investment decisions related to high stock market valuations.

Featured Posts

-

Than Trong Khi Gop Von Phan Biet Cong Ty Uy Tin Va Cong Ty Lua Dao

Apr 30, 2025

Than Trong Khi Gop Von Phan Biet Cong Ty Uy Tin Va Cong Ty Lua Dao

Apr 30, 2025 -

Ukraine Les Etats Unis Facilitent L Acces A Des Systemes De Defense Anti Aeriens Europeens

Apr 30, 2025

Ukraine Les Etats Unis Facilitent L Acces A Des Systemes De Defense Anti Aeriens Europeens

Apr 30, 2025 -

Ru Pauls Drag Race Live 1 000 Shows Celebrated With Special Live Broadcast

Apr 30, 2025

Ru Pauls Drag Race Live 1 000 Shows Celebrated With Special Live Broadcast

Apr 30, 2025 -

Natural Gas Leak Prompts Downtown Louisville Evacuations

Apr 30, 2025

Natural Gas Leak Prompts Downtown Louisville Evacuations

Apr 30, 2025 -

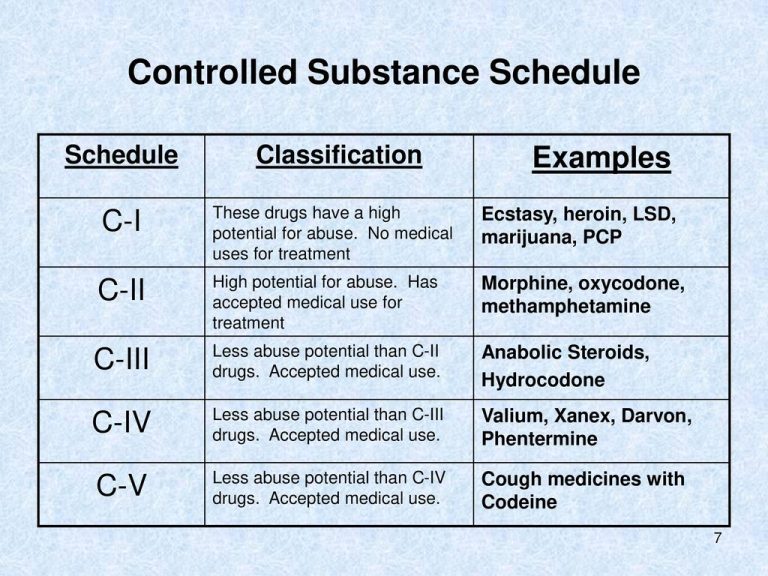

Finding Substitutes For Us Drugs Chinas New Initiative

Apr 30, 2025

Finding Substitutes For Us Drugs Chinas New Initiative

Apr 30, 2025