Are High Stock Market Valuations A Concern? BofA Says No.

Table of Contents

High stock market valuations have become a major talking point among investors. The fear of a market correction or even a crash hangs heavy in the air. However, Bank of America (BofA) recently released a report suggesting a more nuanced perspective. This article delves into BofA's analysis, exploring why they believe current high valuations might not be as alarming as they seem and examining the supporting arguments. We'll dissect key valuation metrics, address potential risks, and explore BofA's strategic recommendations for investors navigating this complex market landscape.

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's argument against immediate concern regarding high stock market valuations rests on several key pillars. They contend that a simplistic interpretation of high Price-to-Earnings (P/E) ratios ignores crucial macroeconomic and corporate factors.

-

Low Interest Rates Justify Higher P/E Ratios: Historically low interest rates significantly impact valuation. Lower borrowing costs allow companies to invest more aggressively, fueling growth and justifying higher P/E multiples. Investors are willing to pay more for future earnings when the cost of capital is low. This dynamic is a key element in BofA's analysis.

-

Strong Corporate Earnings Growth Exceeding Expectations: BofA points to robust corporate earnings growth as a primary justification for current valuations. Many companies have consistently outperformed analyst expectations, demonstrating underlying strength and resilience. This strong earnings performance supports higher price-to-earnings ratios.

-

Continued Technological Innovation Driving Future Growth Potential: Technological advancements across various sectors are fueling significant growth opportunities. Companies at the forefront of innovation are commanding premium valuations reflecting investor confidence in their future potential. This growth potential, in BofA's view, mitigates concerns around current high valuations.

-

Positive Economic Indicators Supporting Market Strength: Positive economic indicators, such as continued GDP growth (despite recent volatility) and relatively high consumer confidence levels, bolster BofA's optimistic outlook. These indicators suggest a strong economic foundation supporting higher stock prices.

-

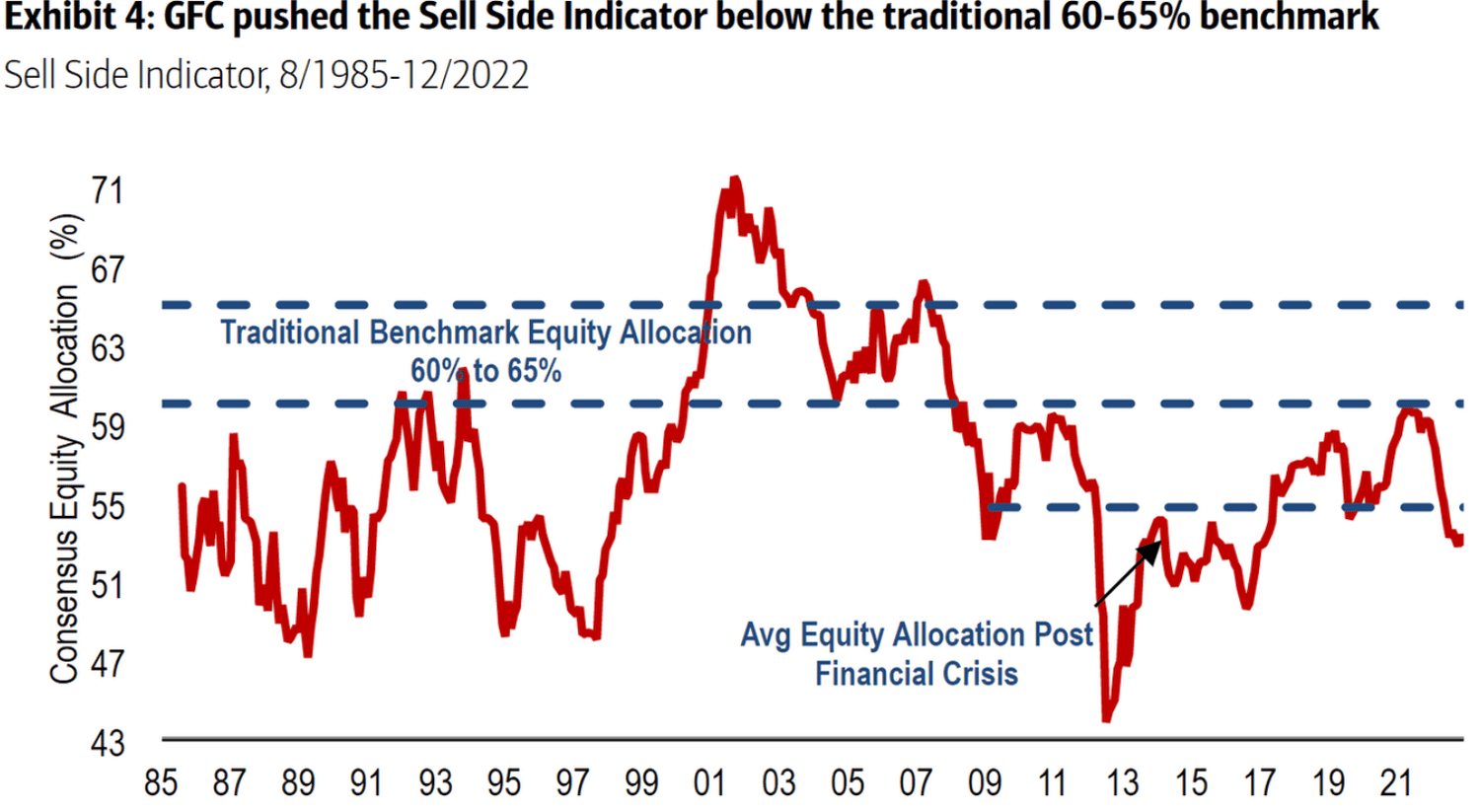

Comparison to Historical Valuation Peaks and Their Subsequent Performance: BofA's analysis also includes a historical perspective. Comparing current valuations to previous periods of high valuations reveals that market corrections, while possible, haven't always resulted in catastrophic crashes. The bank's research highlights instances where high valuations were followed by sustained periods of growth.

Analyzing Key Valuation Metrics: A Deeper Dive

While P/E ratios are widely used, a comprehensive valuation assessment requires analyzing multiple metrics. BofA likely utilizes a more holistic approach, considering the following:

-

Price-to-Sales (P/S) Ratios: P/S ratios provide a different perspective, comparing a company's market capitalization to its revenue. This metric is less sensitive to profit margins and can be particularly useful for evaluating companies in high-growth sectors with potentially low current profitability.

-

Shiller PE (CAPE) Ratio: The Cyclically Adjusted Price-to-Earnings Ratio (CAPE) offers a long-term perspective on valuations. It smooths out short-term earnings fluctuations, providing a more stable measure of valuation over time. This helps to contextualize current valuations within a longer-term historical trend.

-

Comparison of Current Valuations Across Different Sectors: A sectoral analysis reveals significant variations in valuations. Some sectors might appear overvalued, while others may be more reasonably priced. This nuanced approach allows for a more targeted investment strategy.

-

A More Comprehensive View: Using a combination of these metrics gives a more robust and balanced view of market valuations, reducing the risk of misinterpreting any single metric in isolation.

Potential Risks and Counterarguments: Acknowledging the Bearish Case

While BofA presents a bullish case, it's crucial to acknowledge potential counterarguments and risks:

-

Inflationary Pressures and Their Impact on Valuations: Rising inflation could erode corporate profit margins and potentially trigger interest rate hikes, negatively impacting stock valuations. This is a significant risk that needs careful consideration.

-

Geopolitical Risks and Market Volatility: Geopolitical instability and unexpected events can create market volatility and negatively impact investor sentiment, leading to market corrections. The ongoing global uncertainty is a factor BofA likely acknowledges in its analysis.

-

Potential for Interest Rate Hikes and Their Effect on Stock Prices: As mentioned earlier, interest rate increases can significantly impact valuations. Higher borrowing costs can reduce corporate investment and potentially lead to lower earnings, impacting stock prices.

-

The Possibility of a Market Correction: While BofA's analysis suggests that current valuations don't necessarily predict an imminent crash, the possibility of a market correction remains. Acknowledging this risk is vital for responsible investing.

BofA's Strategic Recommendations for Investors

BofA's strategic recommendations, derived from their analysis, are likely to emphasize a balanced approach:

-

Sector-Specific Recommendations: BofA's research may highlight specific sectors they believe are more resilient to potential market downturns or offer better growth prospects.

-

Suggestions for Portfolio Diversification: Diversification remains a cornerstone of sound investment strategy. BofA likely recommends diversifying across different asset classes and sectors to mitigate risk.

-

Strategies for Managing Risk in a Potentially Volatile Market: In a potentially volatile market, BofA might recommend strategies such as dollar-cost averaging or employing stop-loss orders to manage risk effectively.

Conclusion

While high stock market valuations are understandably a source of concern for many investors, BofA's analysis offers a compelling counterargument. By considering factors such as low interest rates, strong corporate earnings, and technological advancements, BofA suggests that current valuations might not signal an imminent market crash. However, it's crucial to acknowledge potential risks such as inflation, geopolitical uncertainty, and the possibility of interest rate hikes. Adopting a diversified investment strategy and employing effective risk management techniques are essential.

Understanding stock market valuations is critical for making informed investment decisions. To learn more about BofA's detailed analysis and strategies for navigating the current market, explore their latest research and reports. Don't let concerns about high stock market valuations paralyze you – make informed choices based on thorough research and expert insights.

Featured Posts

-

Investing In Better Mental Health Care A Call To Action

May 03, 2025

Investing In Better Mental Health Care A Call To Action

May 03, 2025 -

Harry Potters Crabbe A Shocking Transformation

May 03, 2025

Harry Potters Crabbe A Shocking Transformation

May 03, 2025 -

Friday April 18th 2025 Daily Lotto Winning Numbers

May 03, 2025

Friday April 18th 2025 Daily Lotto Winning Numbers

May 03, 2025 -

Why Arent Nick Robinson And Emma Barnett Hosting Together On Radio 4

May 03, 2025

Why Arent Nick Robinson And Emma Barnett Hosting Together On Radio 4

May 03, 2025 -

Joseph Sur Tf 1 Une Serie Policiere A La Hauteur De Columbo

May 03, 2025

Joseph Sur Tf 1 Une Serie Policiere A La Hauteur De Columbo

May 03, 2025

Latest Posts

-

Ow Subsidy Revival Netherlands Explores Options To Stimulate Competition

May 04, 2025

Ow Subsidy Revival Netherlands Explores Options To Stimulate Competition

May 04, 2025 -

Belgium Securing Funding For A 270 M Wh Battery Energy Storage System Bess

May 04, 2025

Belgium Securing Funding For A 270 M Wh Battery Energy Storage System Bess

May 04, 2025 -

Dutch Government Considers Reviving Ow Subsidies To Attract Bidders

May 04, 2025

Dutch Government Considers Reviving Ow Subsidies To Attract Bidders

May 04, 2025 -

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 04, 2025

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 04, 2025 -

Netherlands Weighs Reintroducing Ow Subsidies To Boost Bidding

May 04, 2025

Netherlands Weighs Reintroducing Ow Subsidies To Boost Bidding

May 04, 2025