Are High Stock Market Valuations A Concern? BofA Weighs In

Table of Contents

BofA's Stance on Current Market Valuations

BofA's assessment of current stock market valuations presents a nuanced perspective. While acknowledging the historically high valuations, their outlook isn't purely bearish. Their analysis suggests a cautiously optimistic stance, emphasizing the need for careful consideration and strategic portfolio management. Rather than predicting an imminent crash, BofA highlights the importance of understanding the underlying factors driving these valuations and adjusting investment strategies accordingly.

- Key Findings on Valuation Metrics: BofA's reports cite elevated Price-to-Earnings (P/E) ratios and Price-to-Sales (P/S) ratios across various sectors, indicating that many stocks are trading at premiums compared to historical averages. However, they also note that these valuations are not uniformly high across all sectors.

- Overvalued and Undervalued Sectors: BofA's analysis pinpoints specific sectors, such as certain technology stocks, as potentially overvalued, while others, potentially in the cyclical or value segments, may be considered relatively undervalued based on their projections. Precise sector identification requires referencing BofA's specific reports.

- Economic Indicators Considered: BofA's valuation analysis incorporates key economic indicators, including inflation rates, interest rate projections, and corporate earnings growth forecasts. These inputs inform their assessment of the sustainability of current market levels.

Factors Contributing to High Stock Market Valuations

Several intertwined factors have contributed to the current elevated stock market valuations. Understanding these drivers is crucial for informed investment decisions.

- Low Interest Rates: Historically low interest rates have fueled investment flows into the stock market, increasing demand and driving up prices. The search for yield pushes investors toward assets offering higher potential returns.

- Strong Corporate Earnings (and Projections): Robust corporate earnings, particularly in specific sectors, have supported higher valuations. Future earnings growth projections also contribute significantly to investor optimism.

- Government Stimulus: Government stimulus packages designed to mitigate the economic fallout from the pandemic injected substantial liquidity into the market, further boosting demand and asset prices.

- Inflationary Pressures: While inflation can be detrimental long-term, initially, it can push investors to stocks for better returns than bonds. The anticipation of future inflation often drives investors towards assets that are expected to retain or increase their value.

- Geopolitical Risks: Geopolitical uncertainties and global events can also affect investor sentiment and market valuations, though their effects are typically unpredictable and can be both positive or negative for stocks.

Potential Risks Associated with High Valuations

Investing in a market characterized by high stock market valuations presents inherent risks that investors should carefully consider.

- Market Corrections and Crashes: Markets with high valuations are generally more susceptible to sharp corrections or even crashes. A significant drop in investor confidence can trigger a rapid decline in asset prices.

- Lower Potential Returns: Historically, periods of high valuations are often followed by lower returns compared to periods of lower valuations. Investors should temper their return expectations.

- Impact on Investment Strategies: High valuations pose challenges for different investment strategies. Value investors might find fewer attractive opportunities, while growth investors may need to be more discerning in their stock selection.

- Investor Sentiment and Bubbles: High valuations can reflect speculative bubbles driven by excessive investor optimism and herd behavior, increasing the risk of a sudden market reversal.

BofA's Recommended Investment Strategies

Based on their analysis, BofA's recommended investment strategies emphasize a cautious approach, prioritizing risk management and diversification.

- Asset Allocation: BofA likely suggests a diversified portfolio approach, potentially reducing the weight on equities and increasing allocations to less volatile asset classes, such as high-quality bonds or alternative investments, depending on risk tolerance. Specific allocation recommendations depend on the investor's risk profile and investment goals and would be detailed in BofA's reports.

- Sector Diversification: Diversification across various sectors is crucial to mitigate the impact of potential downturns in specific industries. Reducing concentration in potentially overvalued sectors is key.

- Risk Management Techniques: Employing robust risk management techniques, such as stop-loss orders and hedging strategies, is recommended to protect against potential losses.

- Investment Opportunities: BofA might highlight specific investment opportunities within undervalued sectors or asset classes, but this would require consulting their latest research.

Conclusion

BofA's analysis of high stock market valuations offers a balanced perspective. While acknowledging the elevated valuations, they advocate for a cautious yet opportunistic approach. Understanding the contributing factors, potential risks, and BofA's recommended strategies is crucial for navigating this market environment. The key takeaway is the importance of informed decision-making, considering your personal risk tolerance and investment goals. Understanding the implications of high stock market valuations is crucial for effective investment planning. Take the time to assess your risk tolerance and consider seeking professional advice to navigate the current market. Remember, actively managing risk is paramount when dealing with high stock market valuations.

Featured Posts

-

Loyle Carner To Play 3 Arena In Dublin

May 02, 2025

Loyle Carner To Play 3 Arena In Dublin

May 02, 2025 -

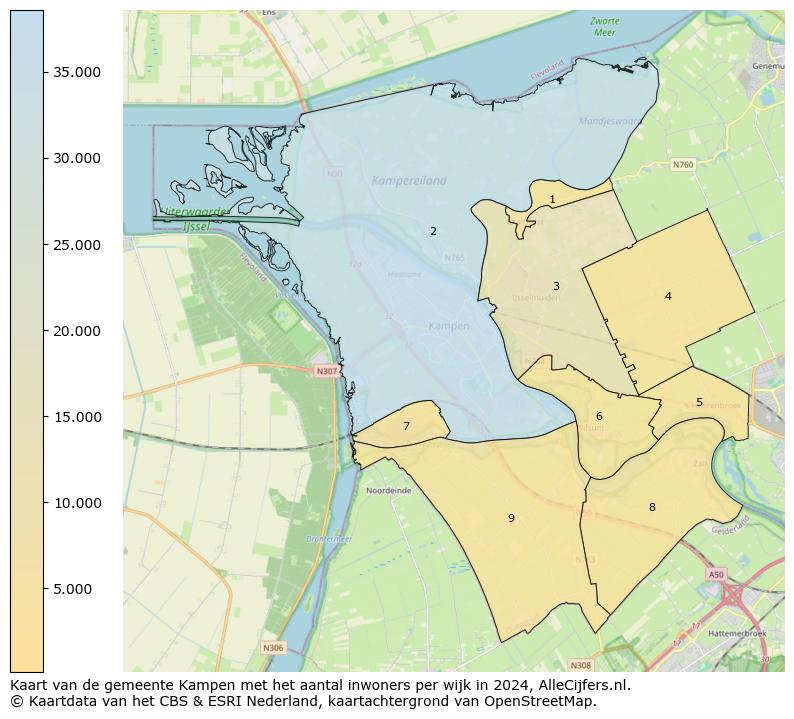

Kort Geding Gemeente Kampen Vecht Voor Snelle Stroomaansluiting

May 02, 2025

Kort Geding Gemeente Kampen Vecht Voor Snelle Stroomaansluiting

May 02, 2025 -

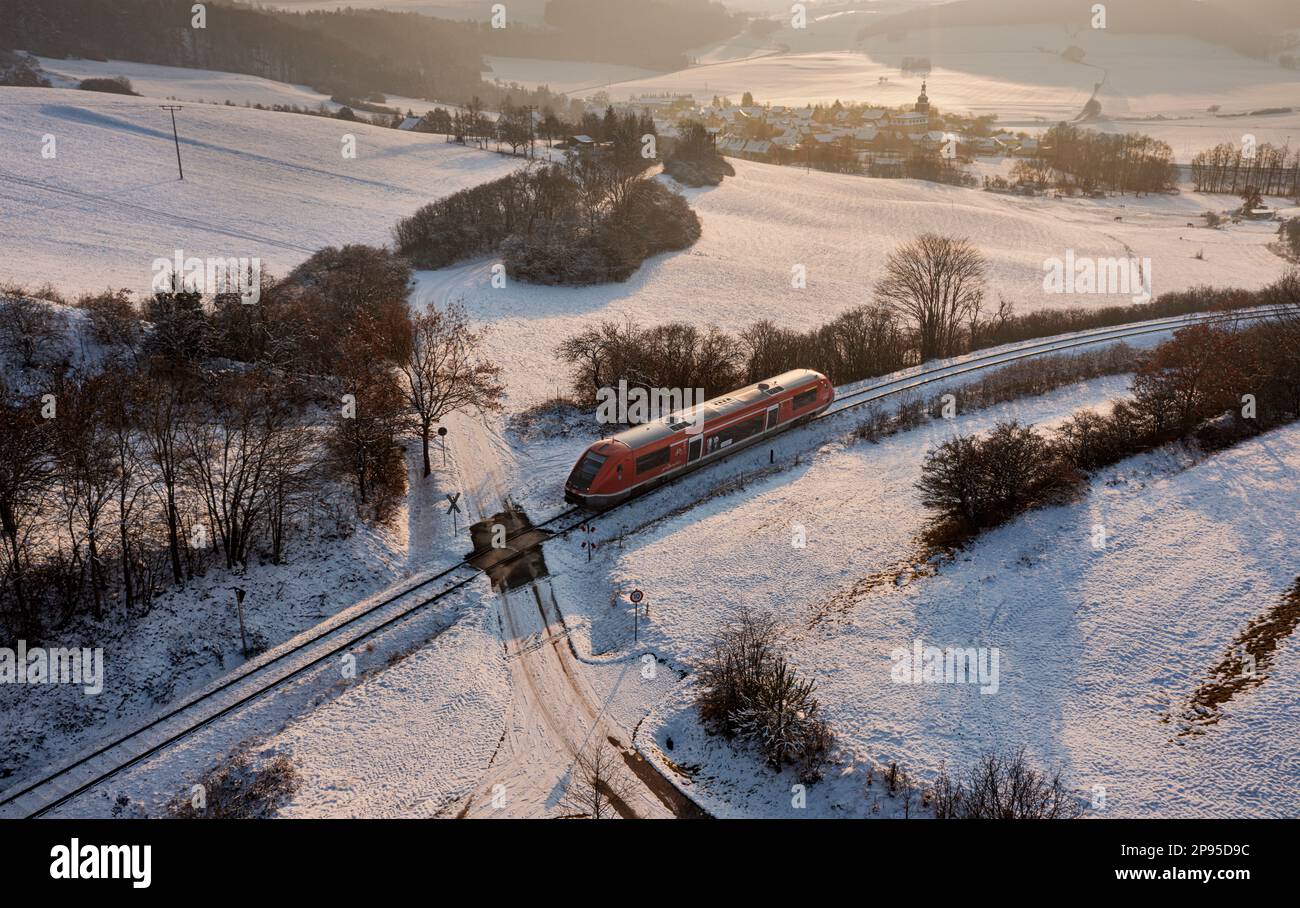

This Country A Regional Overview

May 02, 2025

This Country A Regional Overview

May 02, 2025 -

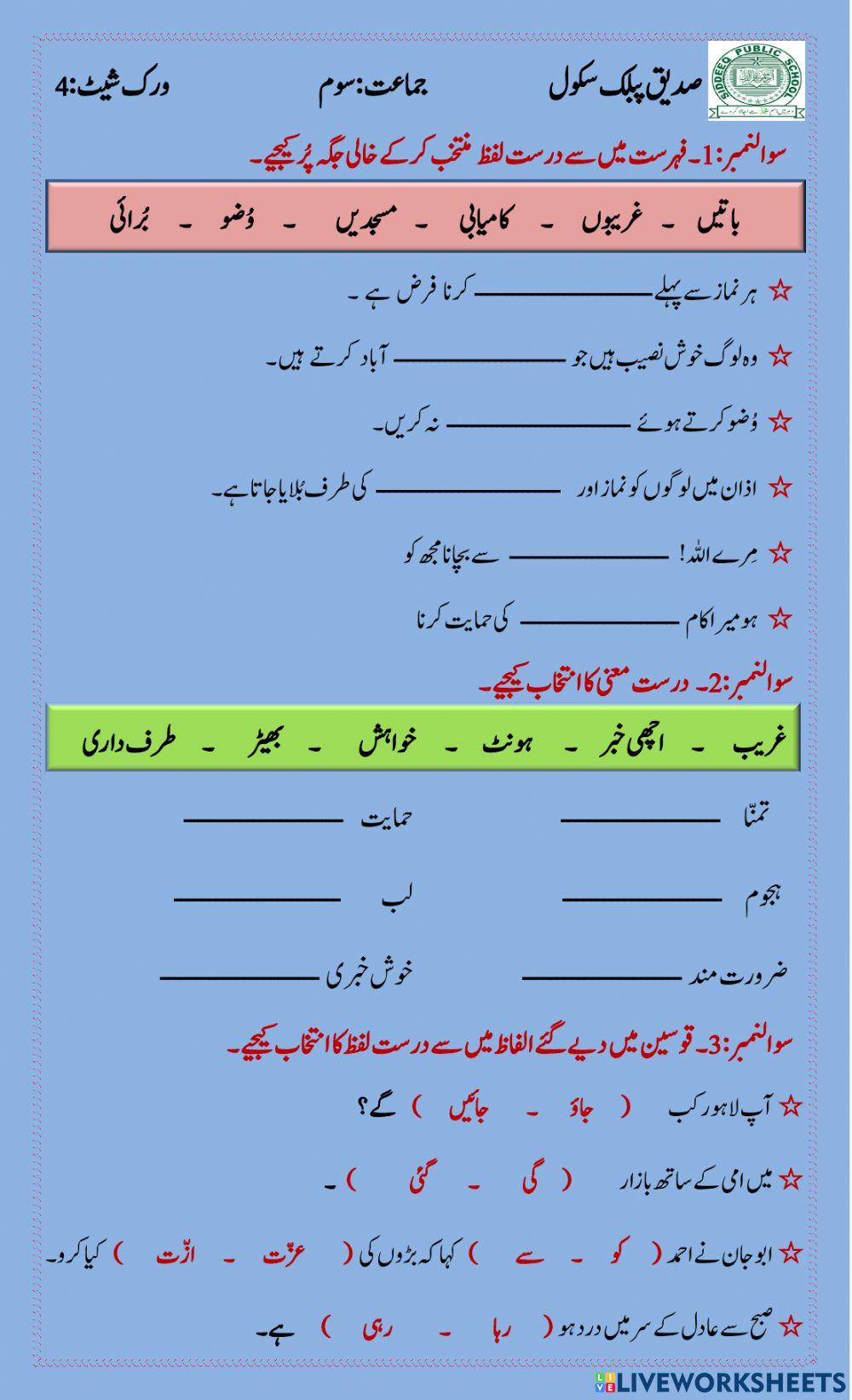

Pakstan Ka Kshmyr Pr Mwqf Tyn Jngwn Awr Mstqbl Ky Tyaryan

May 02, 2025

Pakstan Ka Kshmyr Pr Mwqf Tyn Jngwn Awr Mstqbl Ky Tyaryan

May 02, 2025 -

Unlawful Harassment Allegations Against Rupert Lowe In Reform Shares Report

May 02, 2025

Unlawful Harassment Allegations Against Rupert Lowe In Reform Shares Report

May 02, 2025