Are Late Student Loan Payments Hurting Your Credit Score?

Table of Contents

How Student Loan Payments Affect Your Credit Score

Late student loan payments can severely damage your credit score. Let's examine the process and its impact.

The Credit Reporting Process

When you miss a student loan payment, your loan servicer reports this delinquency to the three major credit bureaus: Equifax, Experian, and TransUnion.

- Timeline: The reporting timeline varies, but a late payment is typically reported after 30 days of delinquency.

- Delinquency Levels: The severity of the delinquency is also reported. A 30-day late payment is less damaging than a 60-day or 90+-day delinquency. The longer the delinquency, the more negative the impact.

- Credit Utilization Ratio: Late payments can negatively affect your credit utilization ratio – the percentage of available credit you're using. High utilization ratios lower your credit score.

The Impact on Your FICO Score

Your FICO score, a widely used credit scoring model, is heavily influenced by your payment history. Late student loan payments significantly lower your score.

- FICO Weighting: Payment history is one of the most significant factors in your FICO score. Late payments carry substantial weight.

- Score Drop Examples: A single late payment can result in a score drop of 30-50 points or more, depending on your credit history and the severity of the delinquency. Multiple late payments can lead to a much more significant decrease.

- Long-Term Consequences: A damaged credit score can make it harder to qualify for loans (mortgages, auto loans, etc.), rent an apartment, or even secure certain jobs. It can also lead to higher interest rates on future loans, increasing your overall borrowing costs.

Preventing Late Student Loan Payments

Preventing late payments requires proactive financial management. Here are some key strategies:

Setting Up Automatic Payments

Automatic payments are the most effective way to ensure on-time payments and avoid late fees.

- How to Set Up: Most loan servicers allow you to set up automatic payments through their online portals. You'll typically need to provide your bank account information.

- Benefits: Automatic payments eliminate the risk of forgetting a payment deadline, saving you time and stress, and avoiding late fees.

- Payment Options: You can usually set up automatic payments using a debit card, checking account, or savings account.

Budgeting and Financial Planning

Creating a realistic budget and financial plan is essential for managing your student loans effectively.

- Budgeting Tools: Utilize budgeting apps or spreadsheets to track your income and expenses.

- Expense Tracking: Carefully monitor your spending to identify areas where you can cut back.

- Financial Plan: A comprehensive financial plan should include your student loan repayment strategy, savings goals, and other financial obligations.

Exploring Repayment Options

Several repayment plans can help make your student loans more manageable.

- Income-Driven Repayment (IDR): Your monthly payment is based on your income and family size.

- Deferment: Temporarily postpones your payments, usually due to hardship.

- Forbearance: Temporarily reduces your payments or suspends them completely.

Each option has specific eligibility requirements and pros/cons. Consult your loan servicer or the federal government's student aid website for detailed information.

Repairing Your Credit Score After Late Payments

If you've already experienced late student loan payments, you can take steps to repair your credit.

Understanding Your Credit Report

Obtain and review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify any errors.

- Free Annual Reports: You're entitled to one free credit report from each bureau annually at AnnualCreditReport.com.

- Dispute Errors: If you find inaccuracies, dispute them with the credit bureau.

- Regular Monitoring: Monitor your credit reports regularly to catch any errors or suspicious activity.

Strategies for Credit Score Improvement

Improving your credit score takes time and consistent effort.

- Responsible Credit Card Use: Use credit cards responsibly, keeping your credit utilization low and paying your bills on time.

- On-Time Payments: Make all your payments on time, including student loans, credit cards, and other debts.

- Credit Counseling: If you're struggling to manage your debt, consider seeking professional credit counseling.

Conclusion

Late student loan payments severely impact your credit score, potentially hindering your ability to access credit and other financial opportunities in the future. Preventing late payments through automatic payments, budgeting, and exploring repayment options is crucial. If you've already experienced late payments, repairing your credit requires understanding your credit report, addressing errors, and consistently making on-time payments. Don't let late student loan payments damage your credit score. Take control of your finances today by implementing the strategies outlined in this article. Learn more about managing your student loans and protecting your credit.

Featured Posts

-

Week In Review Analyzing Past Mistakes For Future Success

May 17, 2025

Week In Review Analyzing Past Mistakes For Future Success

May 17, 2025 -

Nba News Thibodeau And Bridges Address Publicly Sparked Controversy

May 17, 2025

Nba News Thibodeau And Bridges Address Publicly Sparked Controversy

May 17, 2025 -

Bryce Miller Mariners Pitcher Heads To 15 Day Injured List

May 17, 2025

Bryce Miller Mariners Pitcher Heads To 15 Day Injured List

May 17, 2025 -

Thibodeau And Bridges Settle Differences After Public Disagreement

May 17, 2025

Thibodeau And Bridges Settle Differences After Public Disagreement

May 17, 2025 -

Fargo Educator Recognized For Outstanding Science Teaching Eagleson Honored

May 17, 2025

Fargo Educator Recognized For Outstanding Science Teaching Eagleson Honored

May 17, 2025

Latest Posts

-

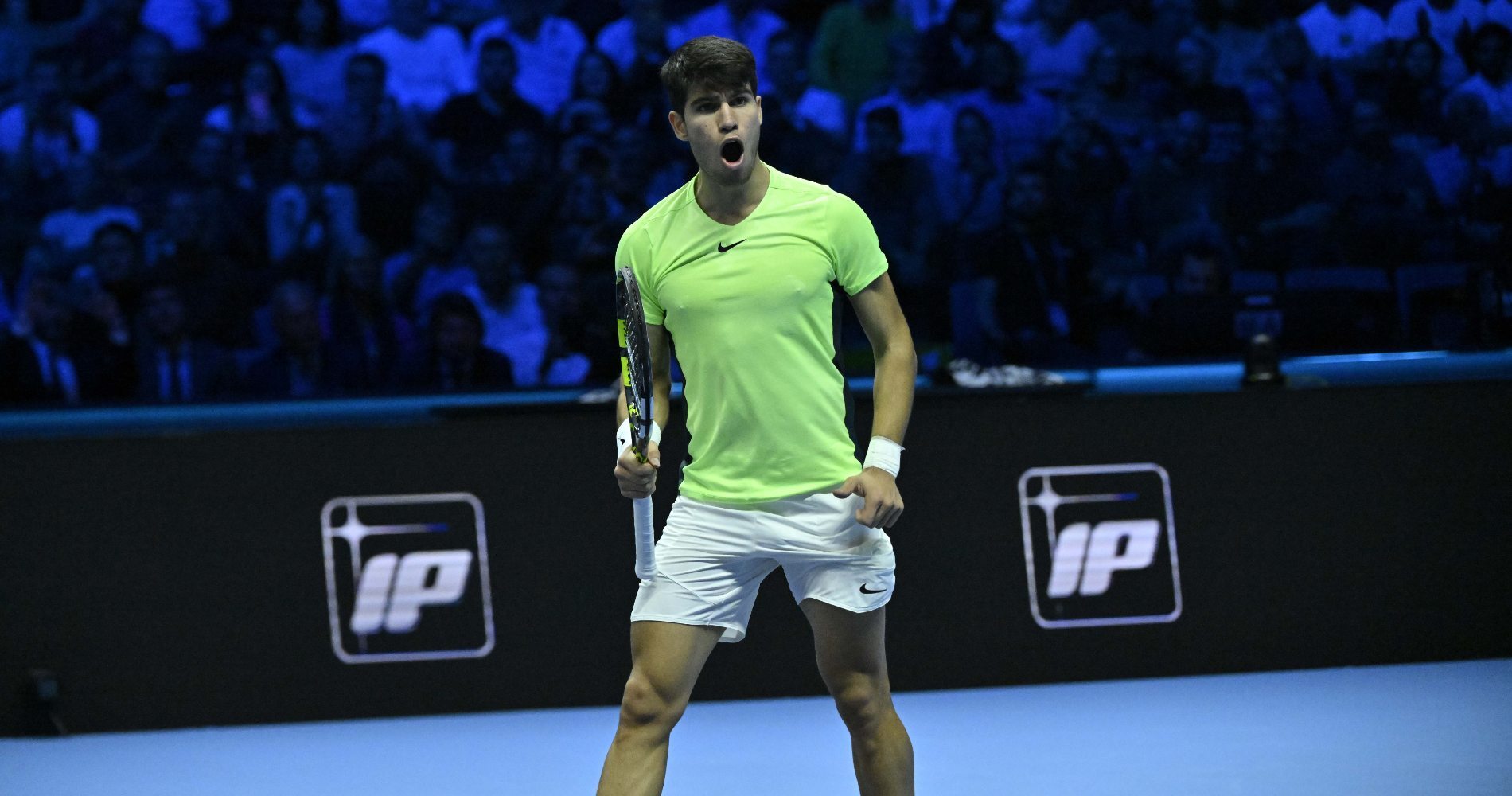

Iznenadenje U Barceloni Rune Pobeduje Alcarasa

May 17, 2025

Iznenadenje U Barceloni Rune Pobeduje Alcarasa

May 17, 2025 -

Alcaraz Predaje Mec Runeu U Finalu Barcelone

May 17, 2025

Alcaraz Predaje Mec Runeu U Finalu Barcelone

May 17, 2025 -

Lawrence O Donnell Highlights Trumps Public Humiliation

May 17, 2025

Lawrence O Donnell Highlights Trumps Public Humiliation

May 17, 2025 -

Barselona Rune Trijumfuje Nad Alcarasom

May 17, 2025

Barselona Rune Trijumfuje Nad Alcarasom

May 17, 2025 -

Rune Osvaja Barcelonu Posle Pobede Nad Povredenim Alcarasom

May 17, 2025

Rune Osvaja Barcelonu Posle Pobede Nad Povredenim Alcarasom

May 17, 2025