Are Strong Corporate Earnings Sustainable? An Analyst's Perspective

Table of Contents

Analyzing the Drivers of Recent Strong Earnings

Several factors contributed to the robust corporate earnings witnessed recently. However, it's vital to analyze whether these drivers are temporary or represent a sustainable long-term trend.

Impact of Post-Pandemic Economic Rebound

The post-pandemic economic rebound significantly boosted corporate earnings. Pent-up demand and substantial government stimulus fueled a surge in consumer spending and business investment. However, these factors are inherently temporary.

- Pent-up demand: This effect is gradually diminishing as consumers return to pre-pandemic spending patterns.

- Government stimulus: The impact of stimulus packages is waning as programs expire.

Specific sectors benefited disproportionately:

- Travel and leisure: Experienced a significant rebound in demand.

- Retail: Saw increased sales driven by pent-up demand and consumer spending.

- Technology: Benefited from increased remote work and digital transformation.

Supply Chain Improvements and Their Effects

Easing supply chain bottlenecks played a significant role in improving profitability for many companies. Reduced delays and lower transportation costs directly impacted production and margins. However, this improvement is fragile and subject to future disruptions.

- Geopolitical instability: Conflicts and trade tensions can easily disrupt global supply chains.

- Natural disasters: Extreme weather events can cause significant delays and shortages.

- Labor shortages: Persistent labor shortages in certain sectors can constrain production.

Companies benefiting from improved supply chains include:

- Automotive manufacturers: Experienced reduced production delays.

- Electronics manufacturers: Saw improved component availability.

- Retailers: Experienced fewer stockouts and improved inventory management.

Strategic Corporate Decisions and Innovation

Successful corporate strategies and innovation also contributed significantly to strong earnings. Companies that adapted quickly to changing market conditions, invested in research and development, and implemented efficient operational models often outperformed their peers.

- Digital transformation: Companies leveraging digital technologies experienced increased efficiency and productivity.

- Data analytics: Effective data analysis enabled better decision-making and improved resource allocation.

- Strategic acquisitions: Well-executed acquisitions broadened market reach and strengthened competitive positioning.

Examples of successful innovation driving profitability include:

- Development of new products and services: Meeting evolving consumer demand.

- Implementation of sustainable practices: Attracting environmentally conscious consumers.

- Enhanced customer experience: Improving customer loyalty and retention.

Identifying Potential Risks and Threats to Sustainability

While recent corporate earnings have been strong, several significant risks could threaten their sustainability.

Inflationary Pressures and Rising Interest Rates

Inflationary pressures and rising interest rates represent major headwinds for corporate earnings. Increased production costs reduce profit margins, while higher interest rates increase borrowing costs and dampen investment.

- Increased raw material costs: Impacting manufacturing and production.

- Higher labor costs: Leading to reduced profitability.

- Reduced consumer spending: Due to decreased purchasing power.

Sectors particularly vulnerable include:

- Manufacturing: Highly sensitive to raw material price fluctuations.

- Retail: Affected by reduced consumer spending and increased input costs.

- Real estate: Vulnerable to higher interest rates and reduced investment.

Geopolitical Uncertainty and Global Economic Slowdown

Geopolitical instability and a potential global economic slowdown pose significant threats to the sustainability of strong corporate earnings. Supply chain disruptions, reduced consumer demand, and decreased investment can severely impact profitability.

- Trade wars and sanctions: Disrupting global trade flows.

- Political instability: Creating uncertainty and affecting investment decisions.

- Energy crisis: Increasing production costs and impacting consumer spending.

Companies facing geopolitical risks include:

- Multinational corporations: Operating in multiple countries with diverse political landscapes.

- Companies reliant on global supply chains: Vulnerable to disruptions.

- Companies with significant exposure to specific regions: Affected by regional conflicts or instability.

Increased Competition and Market Saturation

Increased competition and market saturation can erode profit margins and limit revenue growth. Companies facing intense competition often need to reduce prices or increase spending on marketing and R&D to maintain market share.

- Price wars: Eroding profit margins.

- Increased marketing expenses: To compete for market share.

- Reduced innovation: Due to constrained resources.

Examples of competitive pressures in different sectors:

- Technology: Intense competition among tech giants.

- Retail: Competition from e-commerce and discount retailers.

- Pharmaceuticals: Competition in drug development and patent protection.

Evaluating Key Financial Metrics for Sustainability

Analyzing key financial metrics is essential to assess the sustainability of strong corporate earnings. A comprehensive approach considers both revenue growth and profitability alongside debt levels and cash flow.

Revenue Growth vs. Profit Margin Analysis

Examining both revenue growth and profit margins provides a holistic picture of a company's financial health. Relying solely on revenue growth can be misleading, as it doesn't account for profitability.

- Revenue growth: Indicates market demand and market share.

- Profit margin: Measures profitability and efficiency.

Key financial ratios to consider:

- Gross profit margin

- Operating profit margin

- Net profit margin

Debt Levels and Leverage Ratios

Assessing a company's debt burden and its ability to service debt is crucial for evaluating the sustainability of its earnings. High leverage increases financial risk and can hinder future growth.

- Debt-to-equity ratio: Measures the proportion of debt to equity financing.

- Interest coverage ratio: Indicates a company's ability to pay its interest expenses.

- Debt service coverage ratio: Measures the company's ability to meet its debt obligations.

Free Cash Flow and Dividend Sustainability

Free cash flow (FCF) is a crucial indicator of a company's financial health and dividend sustainability. Declining FCF can signal potential problems with future earnings.

- Free cash flow: Cash generated by operations after deducting capital expenditures.

- Dividend payout ratio: The proportion of earnings paid out as dividends.

Analyzing free cash flow statements involves:

- Reviewing cash flow from operating activities.

- Subtracting capital expenditures.

- Analyzing trends over time.

Conclusion: The Long-Term Outlook for Strong Corporate Earnings

The sustainability of strong corporate earnings depends on a complex interplay of factors. While post-pandemic recovery, supply chain improvements, and strategic corporate decisions have contributed to recent growth, inflationary pressures, geopolitical risks, and increased competition pose significant threats. A comprehensive analysis using key financial metrics, including revenue growth, profit margins, debt levels, and free cash flow, is essential for assessing the long-term outlook. The likelihood of sustained strong corporate earnings is balanced, with potential for further growth tempered by inherent risks.

By carefully analyzing these factors, investors can better assess whether strong corporate earnings are sustainable and make informed investment decisions. Understanding the key drivers and risks impacting the sustainability of strong corporate earnings is crucial for strategic planning. Begin your in-depth analysis today.

Featured Posts

-

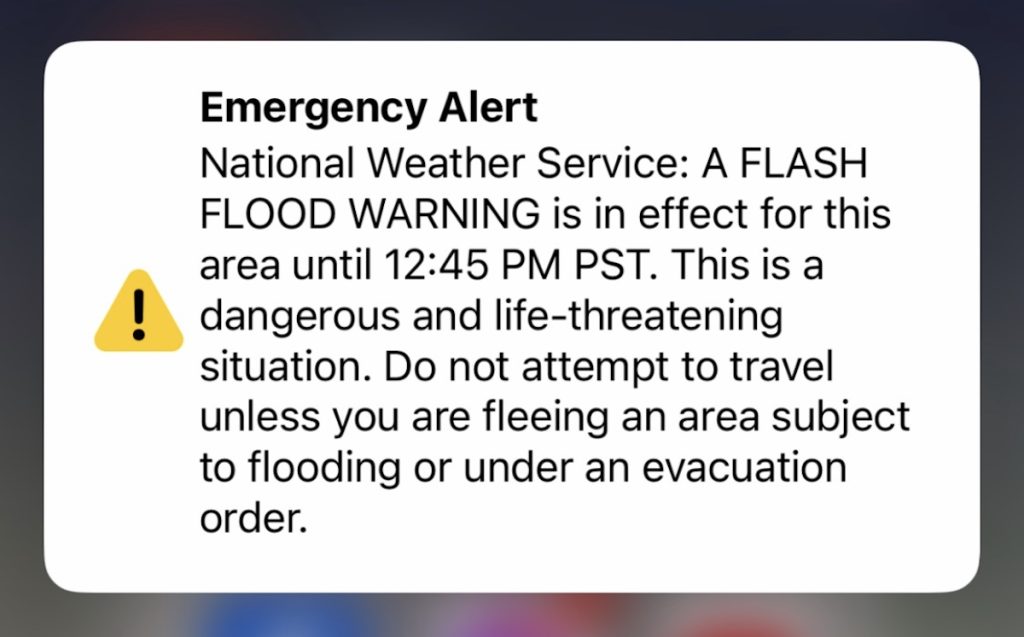

Late Winter Storm Pummels San Diego Area With Heavy Rainfall

May 30, 2025

Late Winter Storm Pummels San Diego Area With Heavy Rainfall

May 30, 2025 -

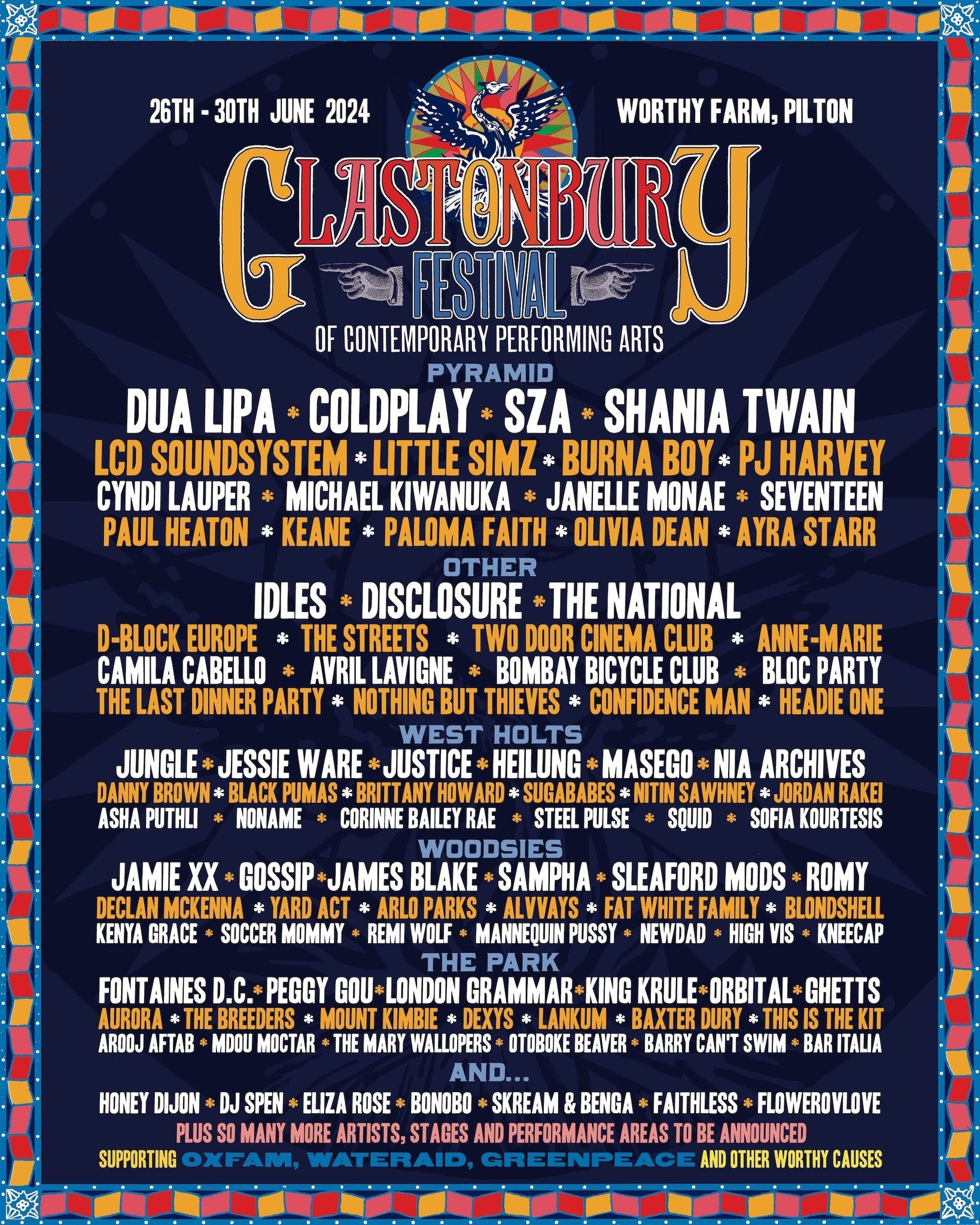

Securing Glastonbury 2025 Tickets The Resale Process Explained

May 30, 2025

Securing Glastonbury 2025 Tickets The Resale Process Explained

May 30, 2025 -

Hl Ansf Alqwm Mrajet Tarykhyt Bmnasbt Dhkra Alastqlal

May 30, 2025

Hl Ansf Alqwm Mrajet Tarykhyt Bmnasbt Dhkra Alastqlal

May 30, 2025 -

Alcarazs Monte Carlo Victory Sixth Masters 1000 Title

May 30, 2025

Alcarazs Monte Carlo Victory Sixth Masters 1000 Title

May 30, 2025 -

Die Ehe Von Steffi Graf Und Andre Agassi Eine Besondere Partnerschaft

May 30, 2025

Die Ehe Von Steffi Graf Und Andre Agassi Eine Besondere Partnerschaft

May 30, 2025