AT&T Reveals Extreme Price Increase In Broadcom's VMware Acquisition Proposal

Table of Contents

AT&T's Stake and Potential Losses

AT&T, a significant user of VMware's virtualization technologies, has a substantial stake in the outcome of this acquisition. The increased price tag directly translates to potential financial losses for AT&T. The exact nature and extent of AT&T's VMware investment remain undisclosed publicly, but we can extrapolate based on their scale of operations and reliance on VMware's infrastructure solutions.

- Quantifying AT&T's Investment: While precise figures are unavailable, AT&T's reliance on VMware's solutions across its vast network suggests a considerable investment in licenses, support, and integration. The scale of their operation implies millions, if not billions, of dollars' worth of investment in VMware infrastructure.

- Potential Financial Losses: The price hike significantly increases the overall cost of the Broadcom-VMware merger. If this acquisition proceeds at the increased price, AT&T, and other VMware clients, may indirectly face increased operational costs through future licensing fees or price adjustments reflecting the change in ownership and potentially increased profit margins.

- Impact on AT&T's Financial Strategy: This unexpected increase in acquisition price could force AT&T to reassess its budget allocation, potentially impacting investments in other crucial areas like 5G network expansion or research and development. It could also negatively influence their overall financial projections and investor confidence.

Analysis of Broadcom's Revised Acquisition Proposal

Broadcom's initial offer for VMware was already substantial. However, the revised proposal represents a significant percentage increase, reportedly exceeding expectations by a substantial margin (insert percentage if available from reliable sources). Broadcom's justification for this price increase remains unclear, but potential reasons may include:

- Original Offer Price vs. New Price: [Insert original offer price here] was the initial offer, while the revised proposal stands at [Insert revised offer price here], representing a [Percentage Increase]% increase.

- Changes in Acquisition Terms: [Details on any changes to the terms of the acquisition, such as altered payment structures or conditions].

- Reasons for the Price Increase: Several factors could be contributing to this jump, including increased competition for acquiring VMware, shifts in market valuations, and potentially the emergence of alternative bidders.

Market Reactions and Expert Opinions

The market reacted negatively to the news of the increased price, with both Broadcom's and VMware's stock prices experiencing fluctuations. Financial analysts have expressed varied opinions.

- Analyst Quotes: "[Insert quote from a reputable financial analyst expressing concerns about the price increase and its impact]." "[Insert quote from a different analyst offering a more optimistic perspective, if applicable]."

- Stock Price Impact: The price increase resulted in [Describe the impact on Broadcom's and VMware's stock prices – percentage changes, etc.].

- Market Consensus: The overall market sentiment leans towards [Describe the general market feeling – cautious optimism, concern, etc.] regarding the acquisition and its ultimate impact.

Potential Implications for the Telecom Industry

The AT&T Broadcom VMware acquisition and its inflated price tag have significant implications for the wider telecom industry.

- Impact on Competition: The acquisition could potentially reshape the competitive landscape, with Broadcom's influence potentially impacting pricing and innovation in software solutions for telecom companies. This could lead to reduced competition or potential anti-trust concerns.

- Effects on Pricing and Innovation: Increased costs associated with VMware's products and services could lead to higher prices for telecom companies and, ultimately, consumers. The resulting market consolidation could potentially stifle innovation if Broadcom focuses on optimizing profits instead of developing new technologies.

- Regulatory Concerns: This significant acquisition is likely to draw scrutiny from regulatory bodies worldwide, given its potential impact on competition and market dynamics. Antitrust investigations are a possibility given the size and scope of the deal.

Conclusion: The Future of AT&T in the Light of the Broadcom VMware Acquisition Price Increase

The increased price in the AT&T Broadcom VMware acquisition presents significant challenges for AT&T, the telecom industry, and the overall market. The unexpected price hike creates uncertainty around future operational costs, potentially impacting AT&T's financial strategies and the competitive landscape. Market reactions have been mixed, highlighting the significant uncertainty surrounding the deal. Regulatory scrutiny is highly likely. To stay abreast of developments in this rapidly evolving situation, follow leading financial news outlets and industry analysts for ongoing updates on the AT&T Broadcom VMware acquisition and its unfolding implications. Further research into the financial ramifications of this price hike is crucial for stakeholders in the telecom industry.

Featured Posts

-

Qdyt Mqtl Mwzfy Alsfart Alisrayylyt Melwmat En Almshtbh Bh Ilyas Rwdryjyz

May 23, 2025

Qdyt Mqtl Mwzfy Alsfart Alisrayylyt Melwmat En Almshtbh Bh Ilyas Rwdryjyz

May 23, 2025 -

First Test Bangladesh Mounts Strong Response Against Zimbabwe

May 23, 2025

First Test Bangladesh Mounts Strong Response Against Zimbabwe

May 23, 2025 -

Ihanete Karsi Acimasiz Intikami Geciktirmeyen Burclar

May 23, 2025

Ihanete Karsi Acimasiz Intikami Geciktirmeyen Burclar

May 23, 2025 -

Memorial Day Weekend Gas Prices To Hit Decade Lows

May 23, 2025

Memorial Day Weekend Gas Prices To Hit Decade Lows

May 23, 2025 -

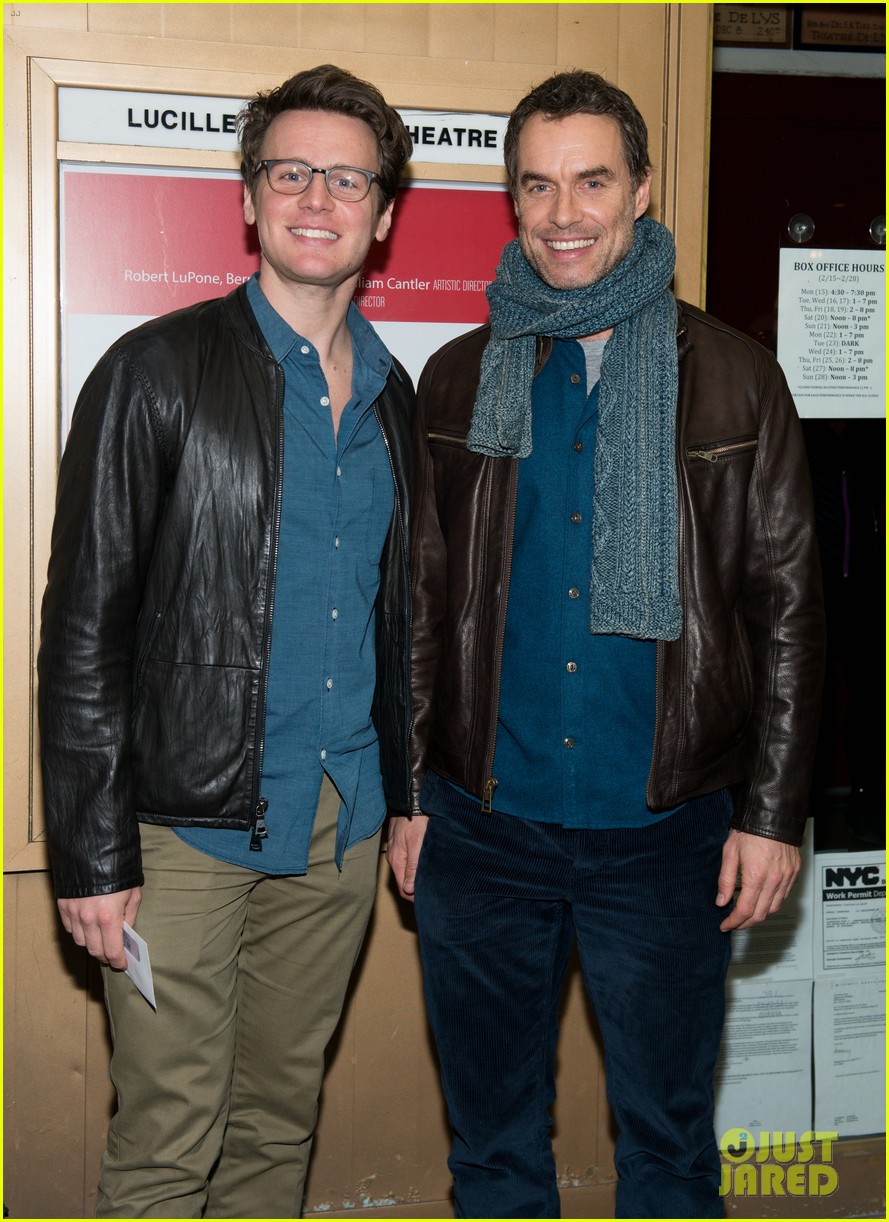

Jonathan Groffs Just In Time Broadway Opening A Star Studded Affair

May 23, 2025

Jonathan Groffs Just In Time Broadway Opening A Star Studded Affair

May 23, 2025

Latest Posts

-

Jonathan Groffs Just In Time A Night Of Celebration With Lea Michele And Friends

May 23, 2025

Jonathan Groffs Just In Time A Night Of Celebration With Lea Michele And Friends

May 23, 2025 -

Broadways Just In Time Jonathan Groff Celebrates Opening Night With Star Studded Cast

May 23, 2025

Broadways Just In Time Jonathan Groff Celebrates Opening Night With Star Studded Cast

May 23, 2025 -

Jonathan Groffs Just In Time Opening Lea Michele Daniel Radcliffe And More Celebrate

May 23, 2025

Jonathan Groffs Just In Time Opening Lea Michele Daniel Radcliffe And More Celebrate

May 23, 2025 -

Jonathan Groffs Just In Time Photos From The Star Studded Broadway Premiere

May 23, 2025

Jonathan Groffs Just In Time Photos From The Star Studded Broadway Premiere

May 23, 2025 -

Jonathan Groff And The Tony Awards Little Shop Of Horrors And Its Impact

May 23, 2025

Jonathan Groff And The Tony Awards Little Shop Of Horrors And Its Impact

May 23, 2025