Australian Dollar Outperforms New Zealand Dollar Amidst Easing Trade Tensions

Table of Contents

Easing Trade Tensions Boosting the Australian Dollar

Reduced global uncertainty has disproportionately benefited the Australian dollar compared to the New Zealand dollar, primarily due to Australia's stronger commodity export base. The improved global economic outlook has significantly impacted the AUD/NZD exchange rate.

-

Increased Demand for Australian Commodities: Decreased trade war anxieties have led to a surge in demand for Australian commodities like iron ore and coal. China, a major importer of these resources, has seen renewed economic activity, boosting demand and subsequently strengthening the AUD. This positive impact on the Australian economy directly affects the AUD/NZD exchange rate.

-

Stronger Global Growth Prospects: Improved global growth prospects translate into higher demand for Australian exports, further bolstering the Australian dollar. This contrasts with New Zealand's economy, which is less reliant on bulk commodity exports. Analyzing global growth forecasts provides valuable insight into the future trajectory of the AUD/NZD pair.

-

Improved Investor Sentiment: The easing of trade tensions has improved investor sentiment towards Australia, leading to increased demand for the Australian dollar as a safe haven and growth currency. This increased investment further strengthens the AUD against the NZD. Tracking investor confidence indices can help predict future AUD/NZD movements.

-

Trade Data Analysis: Examining recent trade data reveals a clear correlation between easing trade tensions and increased Australian exports, directly impacting the AUD's strength against the NZD. Analyzing specific trade figures provides concrete evidence supporting this trend.

Diverging Monetary Policies Influence Exchange Rate

The differing monetary policy stances of the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) play a crucial role in influencing the AUD/NZD exchange rate.

-

Interest Rate Differentials: A comparison of RBA and RBNZ interest rate decisions and their projected paths reveals a potential divergence in monetary policy. Higher interest rates in Australia, for example, would attract foreign investment, strengthening the AUD relative to the NZD. Keeping abreast of interest rate announcements is essential for forecasting AUD/NZD fluctuations.

-

Future Rate Hikes/Cuts: Potential future rate hikes or cuts by either central bank significantly impact their respective currencies and the overall AUD/NZD exchange rate. Analysts' predictions on future rate changes are key indicators to watch.

-

Inflation Rates: Analyzing inflation rates in both countries is crucial, as higher inflation often prompts central banks to raise interest rates, affecting the exchange rate. Comparing inflation data helps determine the relative strength of each currency.

-

Quantitative Easing (QE): The impact of quantitative easing (if applicable) on both currencies must be considered. QE policies can influence exchange rates through their effects on money supply and interest rates.

New Zealand's Economic Challenges Weigh on the NZD

Internal economic factors within New Zealand are contributing to downward pressure on the NZD, further amplifying the AUD's relative strength.

-

Current Account Deficit: New Zealand's current account deficit, indicating a larger outflow of funds than inflow, exerts downward pressure on the NZD. A persistent deficit can weaken a nation's currency.

-

Economic Vulnerabilities: Potential vulnerabilities in the New Zealand economy, such as the housing market or tourism sector, can negatively affect investor confidence and weaken the NZD. Analyzing the health of key sectors provides insights into the NZD's prospects.

-

Political/Social Instability: Domestic political or social instability in New Zealand can create uncertainty and negatively impact the NZD, increasing the relative appeal of the more stable AUD. Monitoring political and social developments in New Zealand is crucial.

-

Economic Growth Forecasts: Comparing economic growth forecasts for both countries offers a valuable perspective on the long-term outlook for the AUD/NZD exchange rate.

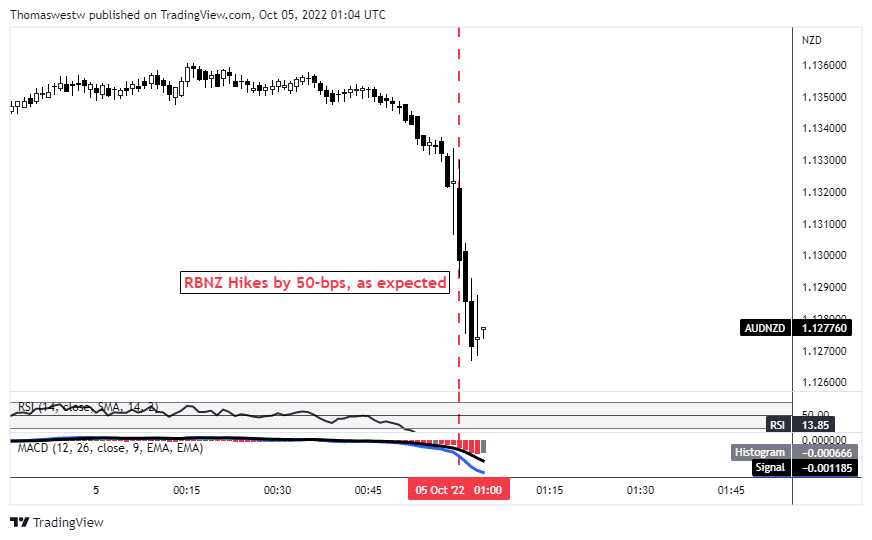

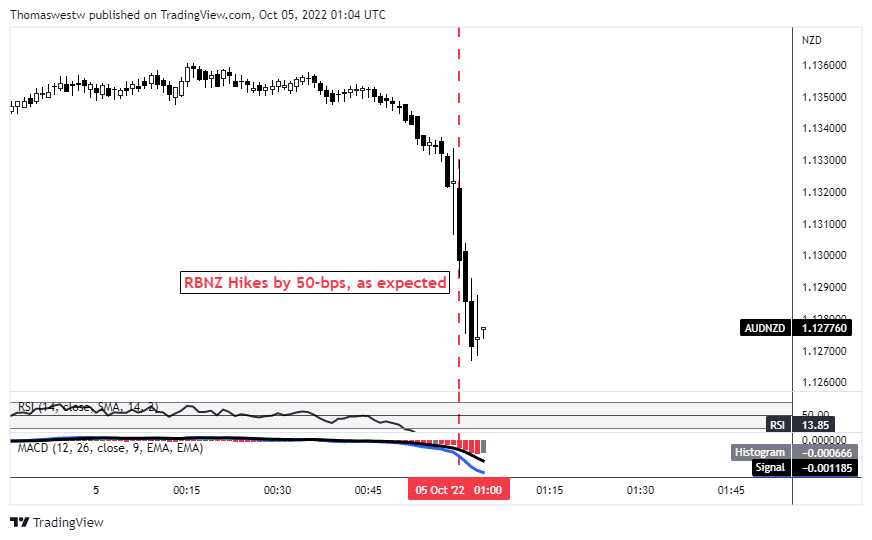

Technical Analysis of AUD/NZD Exchange Rate

Analyzing the AUD/NZD chart using technical indicators can help identify potential future trends.

-

Price Action Analysis: Examining recent price action, including identifying support and resistance levels, helps determine potential turning points in the exchange rate. Support and resistance levels indicate areas where the price is likely to find buying or selling pressure.

-

Technical Indicators: The use of relevant technical indicators, such as moving averages and the Relative Strength Index (RSI), can provide signals about potential future price movements. These indicators offer insights into momentum and potential overbought or oversold conditions.

-

Chart Visualization: Presenting charts and graphs visualizing the exchange rate movement is essential for understanding the historical trend and identifying patterns. Visual representations aid in understanding the data.

-

Price Movement Predictions: Based on technical analysis, it's possible to make predictions about potential future price movements. These predictions should always be considered alongside fundamental analysis.

Conclusion

The Australian dollar's recent outperformance against the New Zealand dollar is a multifaceted phenomenon stemming from easing global trade tensions, diverging monetary policies, and New Zealand's internal economic challenges. While the AUD/NZD exchange rate fluctuates constantly, understanding these underlying trends allows investors and businesses to make more informed decisions. To make the best choices regarding the Australian Dollar vs New Zealand Dollar exchange rate, stay updated on global and national economic developments. Continue monitoring the Australian Dollar vs New Zealand Dollar for further insights into this dynamic currency pair.

Featured Posts

-

New Claims Surface Regarding Kanye Wests Influence On Bianca Censori

May 05, 2025

New Claims Surface Regarding Kanye Wests Influence On Bianca Censori

May 05, 2025 -

Des Moines Ufc Fight Night Predictions And Betting Odds

May 05, 2025

Des Moines Ufc Fight Night Predictions And Betting Odds

May 05, 2025 -

La Francia Si Sposta A Destra Il Governo Bayrou Insegue Le Pen

May 05, 2025

La Francia Si Sposta A Destra Il Governo Bayrou Insegue Le Pen

May 05, 2025 -

Okc Thunder Game Nuggets Star Player Suffers Injury

May 05, 2025

Okc Thunder Game Nuggets Star Player Suffers Injury

May 05, 2025 -

Thursday Court Roundup Bra Smugglers Case Breaks New Ground

May 05, 2025

Thursday Court Roundup Bra Smugglers Case Breaks New Ground

May 05, 2025

Latest Posts

-

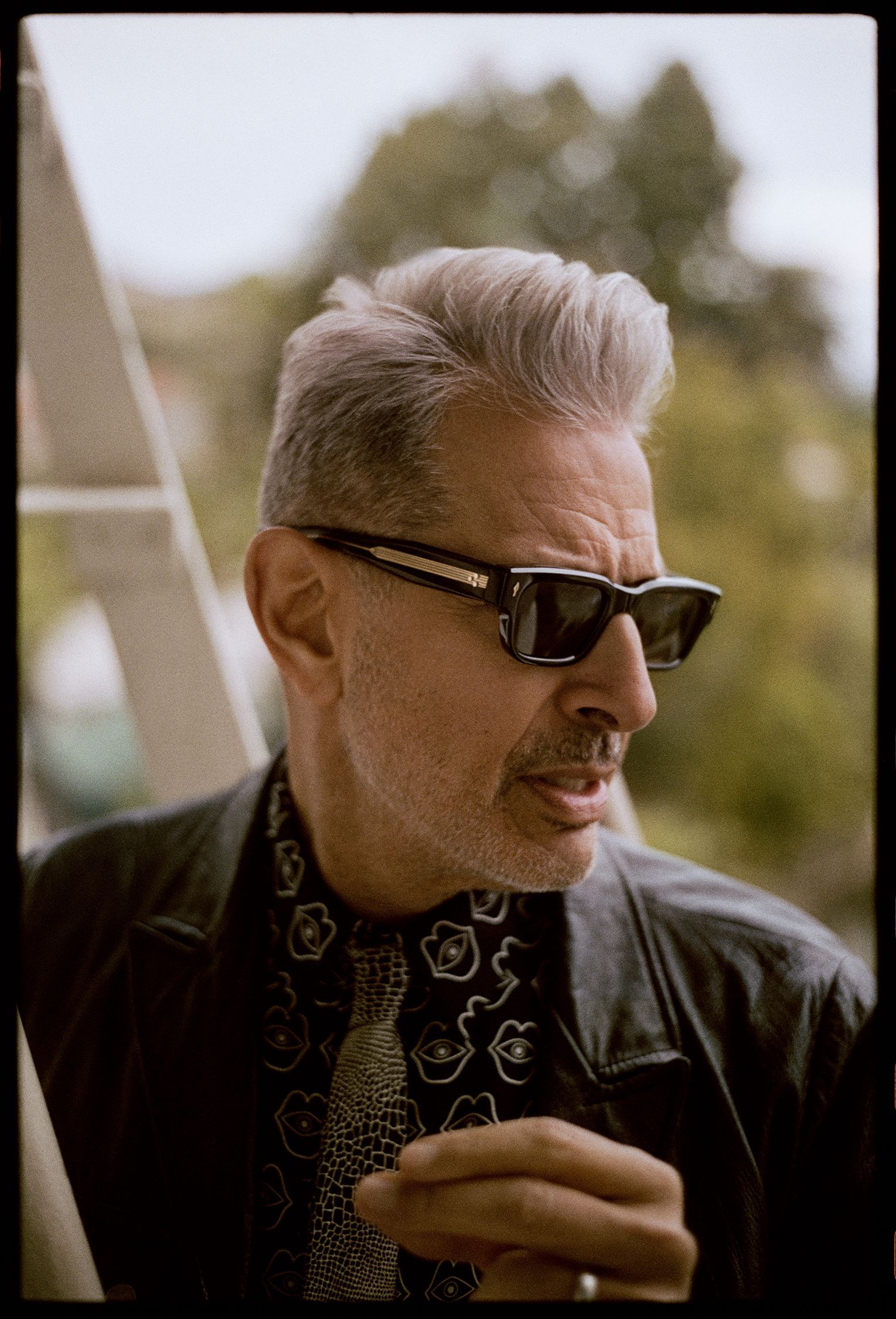

Internet Buzz Jeff Goldblum Checks His Own Oscars Photos Proving Hes Just Like Us

May 06, 2025

Internet Buzz Jeff Goldblum Checks His Own Oscars Photos Proving Hes Just Like Us

May 06, 2025 -

Jeff Goldblum Releases Unexpected New Music Album

May 06, 2025

Jeff Goldblum Releases Unexpected New Music Album

May 06, 2025 -

Jeff Goldblums Oscar Photo Check Goes Viral The Internet Reacts

May 06, 2025

Jeff Goldblums Oscar Photo Check Goes Viral The Internet Reacts

May 06, 2025 -

Jurassic Parks Jeff Goldblum A London Fan Event

May 06, 2025

Jurassic Parks Jeff Goldblum A London Fan Event

May 06, 2025 -

London Welcomes Jeff Goldblum A Jurassic Park Reunion

May 06, 2025

London Welcomes Jeff Goldblum A Jurassic Park Reunion

May 06, 2025