Australia's Opposition's Plan: A $9 Billion Budget Improvement Strategy

Table of Contents

Key Pillars of the $9 Billion Budget Improvement Plan

The Opposition's $9 billion budget improvement plan rests on three key pillars: targeted spending cuts, revenue enhancement measures, and strategic investments in growth sectors. Let's examine each in detail.

Targeted Spending Cuts

The Opposition's plan prioritizes eliminating wasteful government spending and improving budget efficiency. This involves:

- Reviewing inefficient government programs: A comprehensive audit of existing programs is planned to identify those delivering poor value for money. The Opposition projects savings of $2 billion through the consolidation or elimination of overlapping or ineffective initiatives.

- Streamlining bureaucratic processes: Reducing red tape and simplifying administrative procedures across government departments is projected to yield $1 billion in savings. This includes digitalization of services and the reduction of unnecessary layers of bureaucracy.

- Reducing wasteful spending in specific departments: The Opposition has highlighted areas such as departmental travel expenses and consulting contracts as prime targets for cuts, aiming for a further $500 million in savings.

These spending cuts, while ambitious, are intended to demonstrate the Opposition's commitment to fiscal responsibility and public sector reform. The projected savings are based on internal analysis and independent economic modeling, details of which are available on the Opposition's website.

Revenue Enhancement Measures

The Opposition's plan also focuses on increasing tax revenue through responsible means. This includes:

- Closing tax loopholes: The Opposition intends to close several identified tax loopholes exploited by high-income earners and corporations, projecting an additional $1.5 billion in revenue. Specific loopholes will be detailed in a forthcoming policy document.

- Improving tax collection efficiency: Investing in updated technology and improved compliance measures aims to reduce tax evasion and improve the overall efficiency of the Australian Taxation Office, resulting in an estimated $1 billion increase in revenue.

- Targeted tax increases on specific sectors: While avoiding broad-based tax increases, the Opposition is considering targeted levies on sectors deemed to be undercontributing to the national economy. This area is subject to further consultation and refinement.

These tax reform measures aim to ensure a fairer and more efficient tax system that supports sustainable economic growth, promoting a healthier Australian economy.

Investing in Growth Sectors

A significant portion of the $9 billion will be allocated to stimulating economic growth through strategic investments:

- Investments in infrastructure projects: Funding will be directed towards vital infrastructure projects such as upgrading transport networks, expanding renewable energy capacity, and enhancing digital infrastructure. These projects are expected to create thousands of jobs and boost economic activity.

- Supporting small and medium-sized businesses (SMEs): The Opposition proposes initiatives to reduce regulatory burdens and provide financial assistance to SMEs, boosting job creation and innovation.

- Funding research and development (R&D) in key industries: Increased funding for R&D in sectors like renewable energy, biotechnology, and advanced manufacturing is expected to foster innovation and long-term economic competitiveness. This is aimed at driving job creation and economic growth.

Potential Economic Impact of the Plan

The Opposition’s $9 billion budget improvement strategy has significant potential implications for the Australian economy.

Impact on the Budget Deficit

The plan projects a substantial reduction in the budget deficit. Specific figures will be released in a comprehensive economic impact assessment. However, the combination of spending cuts and revenue increases is expected to contribute significantly to fiscal sustainability.

Impact on Economic Growth

The plan's emphasis on infrastructure investment, SME support, and R&D is projected to stimulate GDP growth and create new jobs. Independent economic modeling suggests a positive impact on the overall economic outlook.

Impact on Different Sectors of the Economy

The effects will vary across sectors. The infrastructure investment program will benefit the construction and related industries. Support for SMEs will benefit a broad range of businesses, while R&D investment will stimulate innovation in specific sectors. A detailed sectoral analysis is planned.

Political Implications and Public Reception

The Opposition's plan has faced both support and criticism.

Public Opinion and Political Response

Initial public reaction has been mixed, with some welcoming the focus on fiscal responsibility, while others express concern about the potential impact of specific spending cuts or tax measures. Poll data and media analysis will continue to track public sentiment. The government's response has been critical, questioning the plan's feasibility and impact.

Feasibility and Challenges

Implementing the plan faces numerous challenges. Securing parliamentary support will be crucial, along with navigating potential economic headwinds and ensuring public acceptance of proposed measures. The political feasibility of implementing all aspects of the plan remains to be seen.

Conclusion

Australia's Opposition's $9 billion budget improvement strategy offers a comprehensive approach to addressing the nation's fiscal challenges. By focusing on targeted spending cuts, revenue enhancement, and strategic investments in growth sectors, the plan aims to improve budget outcomes while simultaneously stimulating economic growth. While the political and economic landscape presents challenges, the plan’s potential impact on the Australian economy warrants careful consideration. Understanding the details of this $9 billion budget improvement strategy is crucial for informed participation in the ongoing national economic debate. Learn more about the specifics of this plan and how it may affect you by researching further into the Opposition's detailed proposal.

Featured Posts

-

Miss Pacific Islands 2025 Samoas Victory

May 02, 2025

Miss Pacific Islands 2025 Samoas Victory

May 02, 2025 -

Charity Swim Graeme Souness Takes On The Channel For Isla

May 02, 2025

Charity Swim Graeme Souness Takes On The Channel For Isla

May 02, 2025 -

Fifty Years On Us Military Personnel Recall Risking All To Rescue Civilians In Saigon

May 02, 2025

Fifty Years On Us Military Personnel Recall Risking All To Rescue Civilians In Saigon

May 02, 2025 -

The Urgent Mental Health Crisis Among Canadian Youth Insights From A Global Commission

May 02, 2025

The Urgent Mental Health Crisis Among Canadian Youth Insights From A Global Commission

May 02, 2025 -

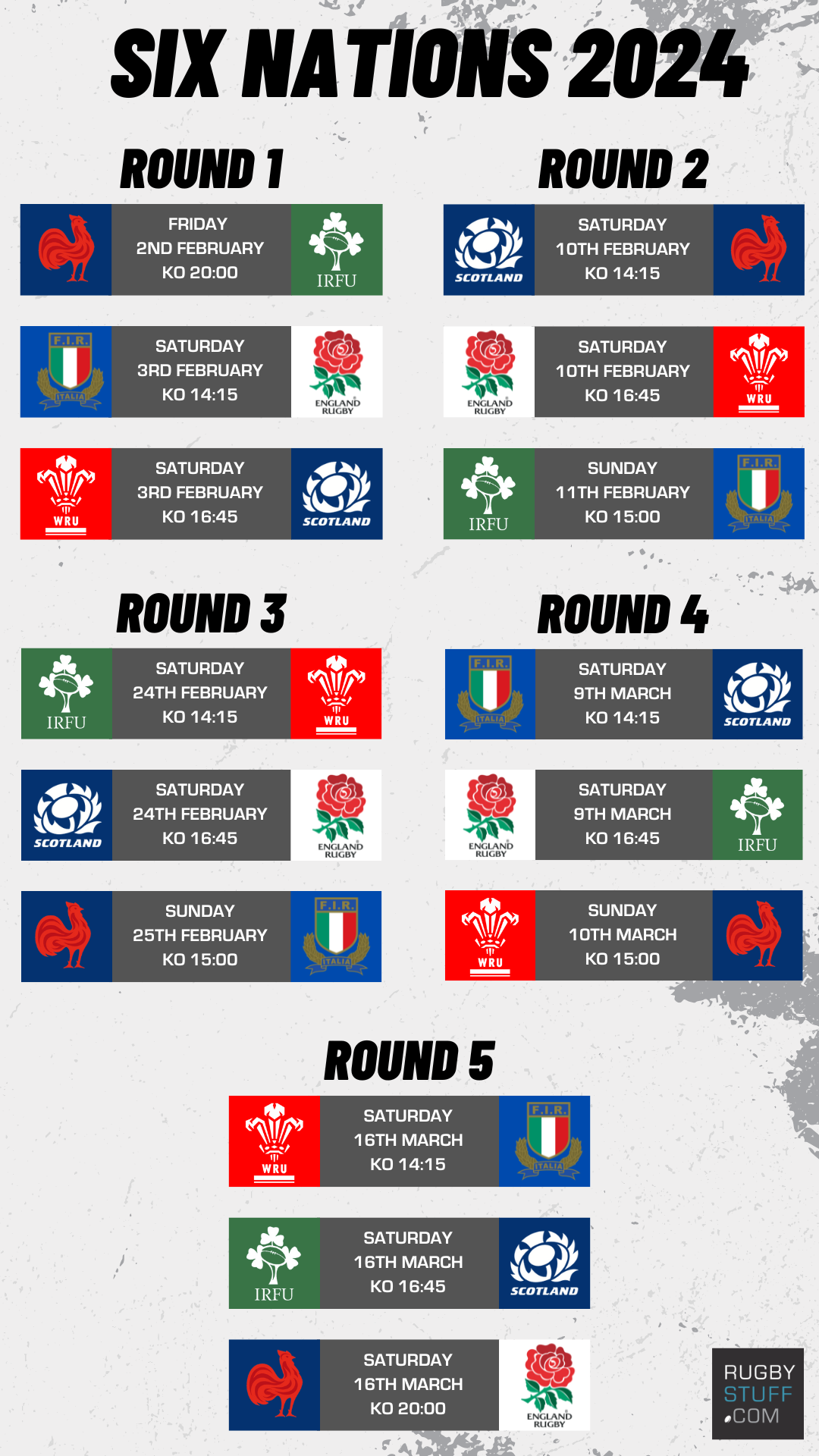

Six Nations Frances Victory Over Italy A Preview Of The Ireland Match

May 02, 2025

Six Nations Frances Victory Over Italy A Preview Of The Ireland Match

May 02, 2025