Avoid Unforced Errors: Warren Buffett's Leadership Strategies

Table of Contents

Long-Term Vision and Patient Decision-Making

Buffett's leadership is synonymous with a long-term perspective. He consistently emphasizes building enduring value rather than chasing fleeting short-term gains. This long-term investment strategy is a cornerstone of his success and a valuable lesson for any leader.

The Power of Patience

Buffett's patience is legendary. He doesn't jump at every opportunity; instead, he meticulously researches and understands a company's fundamentals before investing. This thorough due diligence minimizes risk and maximizes long-term returns.

- Examples of his long-term investment strategies: His decades-long holdings in Coca-Cola and American Express exemplify his commitment to long-term investing. He doesn't panic sell during market downturns, trusting in the intrinsic value of his investments.

- Emphasis on understanding a company's fundamentals: Buffett famously focuses on a company's balance sheet, earnings potential, and competitive advantage before making any investment decision. This approach requires patience and a deep understanding of the business world.

- Avoiding impulsive decisions: Impulsive decisions are often unforced errors. Buffett's deliberate and thoughtful approach allows him to avoid these pitfalls, leading to more successful outcomes. He famously advocates for thinking long-term and avoiding emotional reactions.

Resisting Market Volatility

The stock market is inherently volatile. However, Buffett's Warren Buffett investment philosophy emphasizes remaining calm during market fluctuations. He understands that short-term market movements are often irrational and don't reflect true long-term value.

- Examples of how he weathered market crashes: Buffett has successfully navigated numerous market crashes, including the 1987 Black Monday and the 2008 financial crisis, by sticking to his long-term investment strategy. He views these dips as buying opportunities.

- His philosophy on fear and greed: Buffett often warns against succumbing to fear and greed – two powerful emotions that can lead to poor investment decisions. He emphasizes rational decision-making based on fundamental analysis.

- The importance of having a long-term plan: A well-defined, long-term plan is crucial for navigating market volatility. This plan provides a framework for making sound decisions, even during times of uncertainty.

Surrounding Yourself with Talented Individuals

Buffett's success is not solely his own. He understands the importance of surrounding himself with competent and trustworthy individuals. This Warren Buffett management style focuses on building a strong team and empowering them to succeed.

Delegation and Empowerment

Buffett is a master of delegation. He trusts his managers to make independent decisions within their areas of expertise. This empowers his team and fosters a culture of responsibility.

- Examples of his trust in his managers: Buffett gives his managers significant autonomy, allowing them to run their businesses with minimal interference. This trust fosters loyalty and high performance.

- His emphasis on hiring competent individuals: Buffett is meticulous in his hiring process, seeking individuals with integrity, intelligence, and a strong work ethic. He believes in hiring people smarter than himself.

- His "circle of competence" concept: Buffett emphasizes focusing on areas where one possesses expertise. He delegates tasks outside of his own circle of competence to others with the necessary skills.

Building a Strong Corporate Culture

Berkshire Hathaway is known for its strong corporate culture. This culture is built on a foundation of integrity, ethical behavior, and long-term employee retention.

- Buffett's emphasis on integrity: Ethical behavior is paramount within Berkshire Hathaway. Buffett emphasizes honesty and transparency in all business dealings.

- Ethical leadership: His commitment to ethical leadership sets a high standard for his employees and helps to cultivate a positive work environment.

- Long-term employee retention: Berkshire Hathaway boasts exceptionally low employee turnover, testament to its strong corporate culture and commitment to its employees.

Continuous Learning and Adaptability

Buffett's remarkable success is partly due to his unwavering commitment to continuous learning and adaptation. This Warren Buffett learning style ensures he remains relevant and responsive to change.

The Importance of Lifelong Learning

Buffett is a voracious reader and a lifelong learner. He constantly seeks new knowledge and insights, refining his understanding of business and finance.

- His reading habits: Buffett is known for spending several hours each day reading and studying. This dedicated approach to learning fuels his decision-making process.

- His willingness to admit mistakes: Buffett recognizes that mistakes are inevitable. His willingness to admit mistakes and learn from them is key to his ongoing success.

- His adaptability to changing market conditions: Buffett has successfully adapted his investment strategies to changing market conditions throughout his career. He is not rigid; he is flexible and responsive.

Embracing Change and Innovation

While maintaining a long-term focus, Buffett embraces change and innovation. Berkshire Hathaway has successfully diversified its investments over the years, adapting to evolving market landscapes.

- Examples of how Berkshire Hathaway has diversified its investments: Berkshire Hathaway's portfolio includes a wide range of businesses, from insurance to railroads to consumer goods, demonstrating its adaptability.

- His willingness to explore new opportunities: Buffett is always on the lookout for new opportunities and is willing to explore different investment strategies.

- His adoption of new technologies: While not a technology company itself, Berkshire Hathaway actively incorporates new technologies to improve efficiency and effectiveness within its various businesses.

Conclusion

In summary, Warren Buffett leadership strategies are built on a foundation of long-term vision, patient decision-making, building a strong team, and a commitment to continuous learning. By avoiding unforced errors through meticulous planning and a long-term perspective, Buffett has built one of the most successful companies in the world. By incorporating these strategies into your approach, particularly focusing on avoiding unforced errors through meticulous planning and a long-term perspective, you can pave the way for sustainable success. Learn more about implementing these powerful Warren Buffett leadership strategies today!

Featured Posts

-

Golden State Wins Close Game 4 Up 3 1 On Houston

May 07, 2025

Golden State Wins Close Game 4 Up 3 1 On Houston

May 07, 2025 -

Seattle Mariners Why Their Starting Pitchers Are Untouchable

May 07, 2025

Seattle Mariners Why Their Starting Pitchers Are Untouchable

May 07, 2025 -

Knicks Vs Cavaliers Game Prediction Breaking Down The Odds

May 07, 2025

Knicks Vs Cavaliers Game Prediction Breaking Down The Odds

May 07, 2025 -

Jenna Ortega And Glen Powell Movie Top Secret Tease Revealed

May 07, 2025

Jenna Ortega And Glen Powell Movie Top Secret Tease Revealed

May 07, 2025 -

Jacek Harlukowicz I Jego Najwieksze Sukcesy Wydawnicze Na Onecie 2024

May 07, 2025

Jacek Harlukowicz I Jego Najwieksze Sukcesy Wydawnicze Na Onecie 2024

May 07, 2025

Latest Posts

-

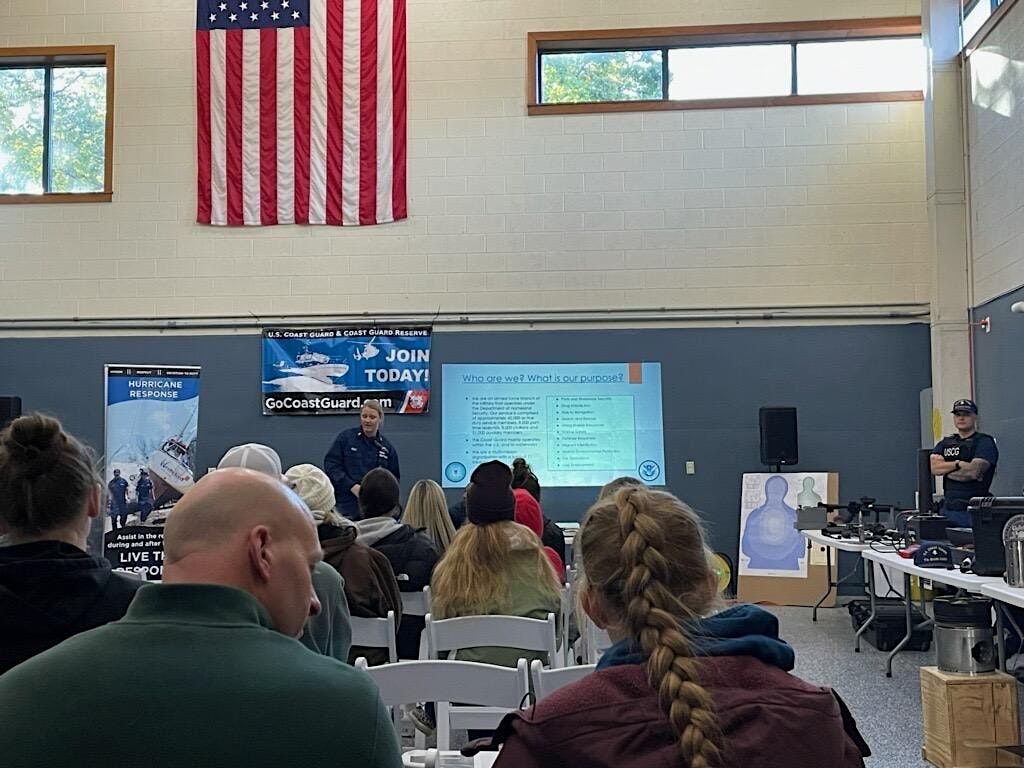

29 Years Of Service Us Coast Guard Honors Ryan Gentry In Outer Banks

May 08, 2025

29 Years Of Service Us Coast Guard Honors Ryan Gentry In Outer Banks

May 08, 2025 -

Outer Banks Voice Ryan Gentrys Long Coast Guard Career Celebrated

May 08, 2025

Outer Banks Voice Ryan Gentrys Long Coast Guard Career Celebrated

May 08, 2025 -

Unforgettable Oscars Snubs Moments That Defined Academy Awards Controversy

May 08, 2025

Unforgettable Oscars Snubs Moments That Defined Academy Awards Controversy

May 08, 2025 -

Biggest Oscars Snubs Ever Iconic Performances That Were Overlooked

May 08, 2025

Biggest Oscars Snubs Ever Iconic Performances That Were Overlooked

May 08, 2025 -

The Biggest Oscars Snubs That Still Sting A Look Back At Historys Biggest Oversights

May 08, 2025

The Biggest Oscars Snubs That Still Sting A Look Back At Historys Biggest Oversights

May 08, 2025