Avoiding Costly Financial Mistakes: A Guide For Women

Table of Contents

Underestimating the Importance of Retirement Planning

One of the most significant financial mistakes for women is underestimating the importance of retirement planning. The gender pay gap, a persistent disparity in earnings between men and women, significantly impacts retirement savings. Women often earn less than their male counterparts throughout their careers, leading to a smaller nest egg by retirement age. This gap is further exacerbated by career interruptions, such as maternity leave or caring for family members, which can disrupt consistent contributions to retirement accounts.

Starting early and making consistent contributions is crucial to mitigating the effects of the gender pay gap. Even small, regular contributions accumulate significantly over time due to the power of compounding interest.

- Maximize employer matching contributions: Take full advantage of employer-matched contributions to your 401(k) plan. This is essentially free money, boosting your retirement savings instantly.

- Explore different retirement investment options: Familiarize yourself with various retirement accounts such as 401(k)s, traditional IRAs, and Roth IRAs. Understand the tax implications of each to choose the best option for your financial situation.

- Consider the impact of career breaks on retirement planning: If you anticipate career breaks, plan ahead and adjust your savings strategy accordingly. Consider increasing contributions during periods of continuous employment to offset potential gaps in savings.

[Link to Retirement Calculator] [Link to Financial Planning Tool]

Neglecting Emergency Funds

Another common financial mistake for women is neglecting to build and maintain an emergency fund. Unexpected expenses, such as medical bills, car repairs, or home maintenance, can quickly derail your financial stability. Aim to save 3-6 months' worth of living expenses in a readily accessible account.

Building an emergency fund can be achieved through various methods: high-yield savings accounts offer competitive interest rates, while money market accounts provide liquidity and slightly higher returns than standard savings accounts.

- Automate savings: Set up automatic transfers from your checking account to your savings account each month to make saving effortless.

- Track expenses: Carefully track your spending to identify areas where you can cut back and allocate more funds to your emergency fund.

- Prioritize building an emergency fund: Before investing in other areas, ensure you have a robust emergency fund in place to protect yourself from unforeseen circumstances.

Real-life examples include unexpected medical bills after an illness, needing car repairs after an accident, or facing unexpected home maintenance costs like a leaky roof. An emergency fund provides a financial safety net during these challenging times.

Ignoring Debt Management

High-interest debt, such as credit card debt and payday loans, can significantly impact your financial health. The high interest rates can quickly spiral out of control, making it difficult to pay off the debt and hindering your ability to save and invest.

Effective debt management strategies include the debt snowball method (paying off the smallest debt first for motivation) and the debt avalanche method (paying off the highest-interest debt first for cost savings).

- Create a budget: A detailed budget helps you track your income and expenses, identifying areas to reduce spending and allocate more towards debt repayment.

- Negotiate lower interest rates: Contact your creditors to negotiate lower interest rates on your existing debt. Many creditors are willing to work with borrowers to avoid defaults.

- Consider debt consolidation options: Explore debt consolidation options, such as balance transfer credit cards or personal loans, to simplify your debt repayment process and potentially lower your interest rate.

Avoid predatory lending practices by carefully reviewing loan terms and interest rates before borrowing money. Be wary of offers that seem too good to be true.

Failing to Understand Investing

Many women avoid investing, fearing the complexity or potential risks involved. However, understanding basic investment concepts and developing a diversified investment portfolio is crucial for long-term financial growth.

Basic investment concepts include stocks (ownership in a company), bonds (loans to a company or government), and mutual funds (diversified portfolios of stocks and bonds).

- Start small: Begin with small, manageable investments to gain experience and build confidence. Gradually increase your investment amounts as your understanding and comfort level grow.

- Seek professional advice: Consider consulting a financial advisor to receive personalized guidance tailored to your financial goals and risk tolerance.

- Understand your risk tolerance: Before investing, assess your risk tolerance. Are you comfortable with potential fluctuations in the market, or do you prefer a more conservative approach?

Debunking common investment myths for women is essential. Many women believe investing is too risky or too complicated, but with proper education and planning, investing can be a powerful tool for building wealth.

Lack of Financial Literacy and Education

A significant barrier to financial success for many women is a lack of financial literacy and education. Continuous learning about personal finance empowers you to make informed decisions and avoid costly mistakes.

Improve your financial literacy through various resources:

- Attend financial workshops and seminars: Many organizations offer workshops and seminars specifically designed for women, covering topics such as budgeting, investing, and retirement planning.

- Read personal finance books and articles: Numerous books and articles are available on personal finance topics, providing valuable information and practical strategies.

- Join online communities: Connect with other women online who share an interest in personal finance. Sharing experiences and learning from others can be incredibly valuable.

Seeking advice from mentors or financial advisors can provide invaluable support and guidance as you navigate your financial journey.

Conclusion

Successfully navigating the financial landscape requires careful planning and awareness. By understanding and avoiding common financial mistakes for women, you can build a strong financial foundation for a secure and prosperous future. Remember, taking proactive steps to manage your finances empowers you to achieve your goals and secure your financial independence. Start today by addressing the financial mistakes for women that may be impacting you and work towards a brighter financial future. Take control of your finances and build a plan that works for you!

Featured Posts

-

Did Taylor Swift And Blake Livelys Friendship End Over Legal Troubles

May 22, 2025

Did Taylor Swift And Blake Livelys Friendship End Over Legal Troubles

May 22, 2025 -

Frimpong Transfer To Liverpool Deal Agreed Club Contact Awaits

May 22, 2025

Frimpong Transfer To Liverpool Deal Agreed Club Contact Awaits

May 22, 2025 -

Blake Lively And The Hadid Swift Fallout Family Loyalty Takes Center Stage

May 22, 2025

Blake Lively And The Hadid Swift Fallout Family Loyalty Takes Center Stage

May 22, 2025 -

Kwartaalcijfers Abn Amro Forse Stijging In Aex

May 22, 2025

Kwartaalcijfers Abn Amro Forse Stijging In Aex

May 22, 2025 -

Espns Insight Crucial Factors In The Boston Bruins Offseason Restructuring

May 22, 2025

Espns Insight Crucial Factors In The Boston Bruins Offseason Restructuring

May 22, 2025

Latest Posts

-

Ascii Jp Ntt Multi Interconnect At Be X

May 22, 2025

Ascii Jp Ntt Multi Interconnect At Be X

May 22, 2025 -

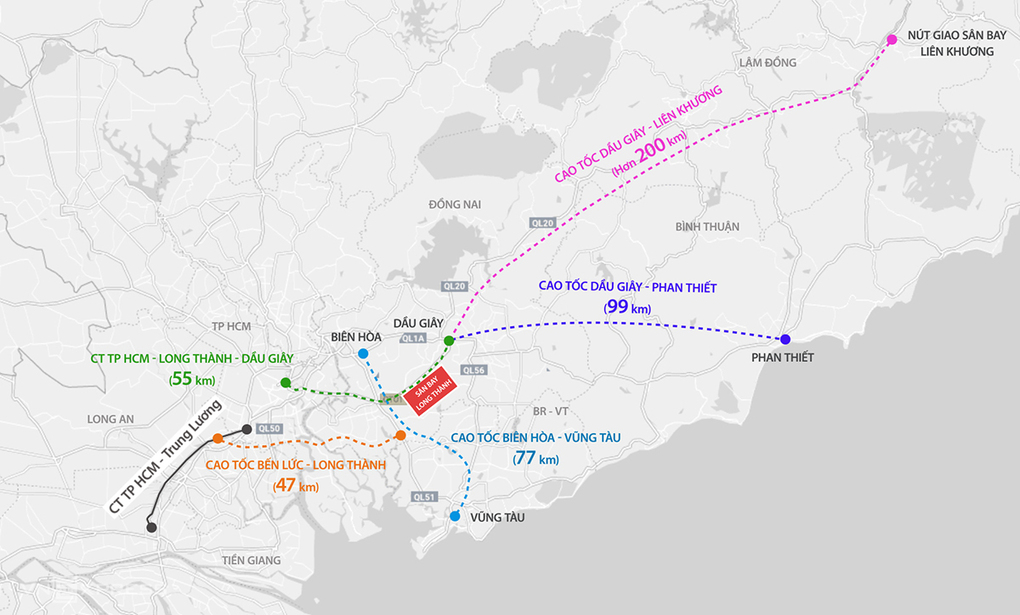

Cao Toc Dong Nai Vung Tau Du Kien Thong Xe Thang 9

May 22, 2025

Cao Toc Dong Nai Vung Tau Du Kien Thong Xe Thang 9

May 22, 2025 -

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025 -

Cac Tuyen Duong Ket Noi Tp Hcm Va Ba Ria Vung Tau Huong Dan Chi Tiet

May 22, 2025

Cac Tuyen Duong Ket Noi Tp Hcm Va Ba Ria Vung Tau Huong Dan Chi Tiet

May 22, 2025 -

Kham Pha Mang Luoi Giao Thong Tp Hcm Ba Ria Vung Tau

May 22, 2025

Kham Pha Mang Luoi Giao Thong Tp Hcm Ba Ria Vung Tau

May 22, 2025