Balancing The Budget: A Realistic Vision For Canada's Finances

Table of Contents

Understanding Canada's Current Fiscal Situation

The Current Deficit and Debt

Canada currently faces a significant budget deficit, meaning government spending exceeds revenue. This deficit contributes to the accumulation of national debt, which represents the total amount of money the government owes. While precise figures fluctuate, it's crucial to understand the context. For detailed, up-to-date information, refer to the official Government of Canada website [insert link to relevant government website here].

-

Factors contributing to the deficit:

- An aging population leading to increased demand for healthcare and social security programs.

- Rising healthcare costs driven by technological advancements and an aging population.

- The increasing cost of social programs designed to support vulnerable populations.

- Economic downturns which reduce tax revenue and increase demand for social support.

-

Implications of the national debt:

- Increased interest payments on the debt, reducing funds available for other crucial programs and services.

- Potential for reduced credit rating, increasing borrowing costs for the government.

- A burden on future generations who will inherit the debt.

Revenue Streams: Taxation and Other Sources

The Canadian government relies on various revenue streams to fund its operations. These include:

-

Personal income tax: Taxes levied on the earnings of Canadian residents.

-

Corporate income tax: Taxes levied on the profits of corporations operating in Canada.

-

Goods and Services Tax (GST)/Harmonized Sales Tax (HST): A consumption tax applied to most goods and services.

-

Other levies: Excise taxes on specific goods (e.g., alcohol, tobacco), customs duties, and other fees.

-

Effectiveness and efficiency of current tax systems:

- Debate exists regarding the progressivity of the tax system and its impact on income inequality.

- Concerns about tax avoidance and evasion require ongoing efforts for enforcement and reform.

-

Potential areas for tax reform:

- A revised carbon tax could incentivize environmentally sustainable practices and generate additional revenue.

- Closing tax loopholes utilized by high-income earners and corporations could increase tax revenue significantly.

- Exploring alternative revenue sources, such as a wealth tax, requires careful consideration and public debate.

Strategies for Reducing Government Spending

Prioritizing Government Programs

Effective budget balancing in Canada requires a critical examination of government programs and services. Prioritization based on effectiveness and societal impact is paramount.

-

Streamlining bureaucratic processes:

- Reducing administrative overhead through the adoption of efficient technologies and processes.

- Eliminating redundant programs or departments.

-

Analyzing the cost-effectiveness of social programs:

- Implementing evidence-based evaluations to assess the impact and value for money of existing programs.

- Targeting support to those most in need.

-

Program consolidation or elimination:

- Merging similar programs to improve efficiency and reduce duplication.

- Phasing out ineffective or outdated programs that no longer serve their intended purpose.

Improving Efficiency and Reducing Waste

Government operations must be optimized for efficiency and transparency.

-

Leveraging technology:

- Utilizing digital tools to streamline administrative processes, reduce paperwork, and improve service delivery.

- Implementing robust cybersecurity measures to protect sensitive data and prevent fraud.

-

Learning from other jurisdictions:

- Studying successful cost-cutting measures implemented in other countries or provinces.

- Adopting best practices in public sector management.

-

Transparency and accountability:

- Ensuring open access to government spending data, allowing for public scrutiny and accountability.

- Strengthening mechanisms for detecting and preventing fraud and waste.

Stimulating Economic Growth to Increase Revenue

Investing in Infrastructure

Strategic infrastructure investment is crucial for driving economic growth.

-

Long-term economic benefits:

- Creating jobs in construction and related industries.

- Improving productivity and efficiency in various sectors.

- Attracting investment and boosting economic competitiveness.

-

Successful infrastructure projects:

- Highlight examples of projects that have yielded significant economic benefits.

-

Public-private partnerships:

- Exploring innovative funding models that leverage private sector expertise and capital.

Promoting Innovation and Technological Advancement

Investing in innovation and technology is essential for long-term economic prosperity.

-

Government policies:

- Implementing policies that incentivize research and development, entrepreneurship, and the adoption of new technologies.

-

Education and training:

- Investing in education and training programs to equip Canadians with the skills needed for a rapidly changing economy.

-

Attracting foreign investment:

- Creating a favorable business environment that attracts foreign investment and fosters economic growth.

Conclusion

Achieving budget balancing in Canada necessitates a multi-pronged approach. It requires responsible spending, efficient revenue generation, and sustained economic growth. Prioritizing government programs, improving efficiency, stimulating economic growth through infrastructure investment and innovation, and reforming the tax system are crucial steps. This involves careful consideration of various fiscal levers and a commitment to transparency and accountability.

Call to Action: Achieving a balanced budget demands a collaborative effort. Understanding the complexities of Canada's fiscal situation is the first step towards building a sustainable future. Let's engage in constructive dialogue and work together to find realistic solutions for effective budget balancing in Canada. Learn more about the latest budget updates and how you can contribute to fiscal responsibility. Let's work towards a financially secure Canada.

Featured Posts

-

John Travoltas Candid Bedroom Photo A Look Inside His 3 M Home

Apr 24, 2025

John Travoltas Candid Bedroom Photo A Look Inside His 3 M Home

Apr 24, 2025 -

Nba 3 Point Contest Herros Triumph In Miami

Apr 24, 2025

Nba 3 Point Contest Herros Triumph In Miami

Apr 24, 2025 -

Bitcoin Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025

Bitcoin Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025 -

Section 230 And Banned Chemicals New Legal Precedent Set By E Bay Case

Apr 24, 2025

Section 230 And Banned Chemicals New Legal Precedent Set By E Bay Case

Apr 24, 2025 -

John Travolta Reassures Fans Following Controversial Family Home Photo

Apr 24, 2025

John Travolta Reassures Fans Following Controversial Family Home Photo

Apr 24, 2025

Latest Posts

-

Ai Powered Poop Podcast Transforming Repetitive Documents Into Engaging Content

May 12, 2025

Ai Powered Poop Podcast Transforming Repetitive Documents Into Engaging Content

May 12, 2025 -

From Scatological Data To Engaging Audio Ai Driven Poop Podcast Creation

May 12, 2025

From Scatological Data To Engaging Audio Ai Driven Poop Podcast Creation

May 12, 2025 -

Turning Trash To Treasure An Ai Powered Poop Podcast Generator

May 12, 2025

Turning Trash To Treasure An Ai Powered Poop Podcast Generator

May 12, 2025 -

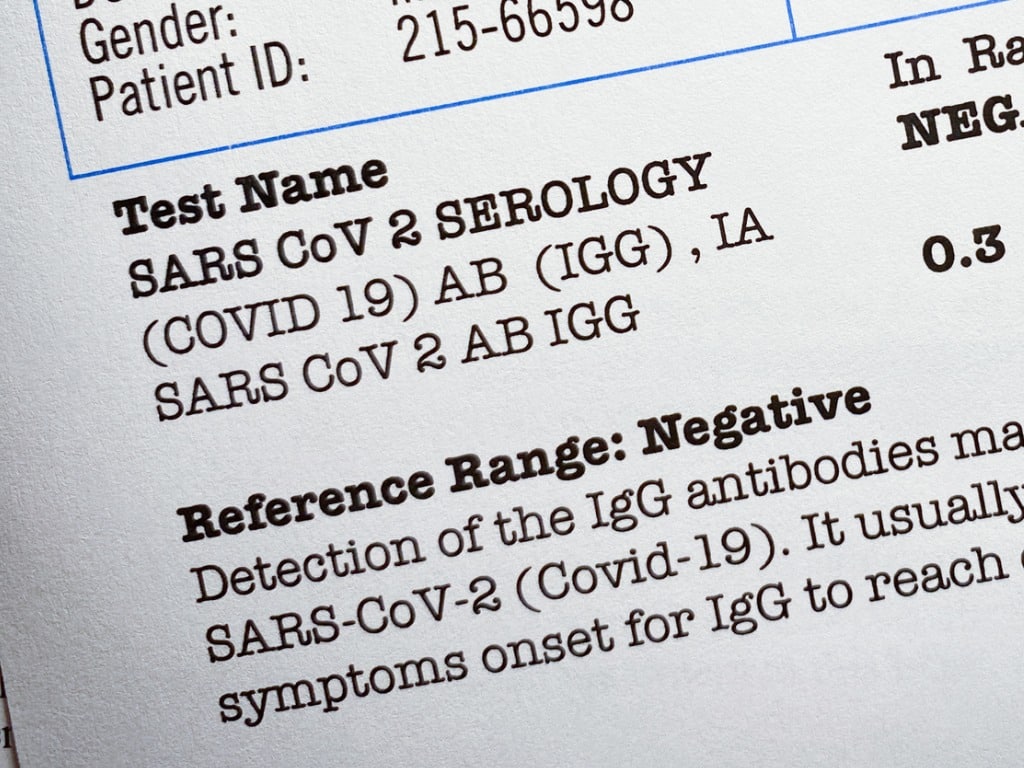

Lab Owner Convicted Guilty Plea For Fabricating Covid 19 Test Results

May 12, 2025

Lab Owner Convicted Guilty Plea For Fabricating Covid 19 Test Results

May 12, 2025 -

Pandemic Fraud Lab Owner Pleads Guilty To False Covid Test Reports

May 12, 2025

Pandemic Fraud Lab Owner Pleads Guilty To False Covid Test Reports

May 12, 2025