Bank Of Canada Considered Rate Cut In April Amidst Trump Tariff Uncertainty

Table of Contents

The Impact of Trump's Tariffs on the Canadian Economy

Trump's tariffs, implemented as part of his "America First" trade agenda, created significant ripples throughout the global economy, severely impacting Canada's trade relationships with the United States.

Weakened Canadian Dollar

The uncertainty surrounding the escalating trade conflict significantly weakened the Canadian dollar (CAD) against the US dollar (USD). This devaluation made Canadian exports more expensive for US buyers and imports from the US more costly for Canadian businesses and consumers.

- The automotive sector, a major player in the Canadian economy, faced substantial challenges due to the increased cost of importing parts and exporting vehicles.

- The lumber industry, another key contributor, experienced reduced demand from the US due to tariffs and the overall economic slowdown.

- Data from April showed the CAD fluctuating significantly against the USD, reaching its lowest point in [insert specific data point, e.g., several years] amidst increasing tariff uncertainty.

Decreased Business Investment

The uncertainty surrounding future trade relations led to a chilling effect on business investment. Companies became hesitant to commit to large-scale projects or expansion plans, fearing the unpredictable consequences of prolonged trade disputes.

- Business confidence indices in Canada dropped considerably during this period, reflecting the prevailing pessimism. [Insert statistic, e.g., The Conference Board of Canada's Business Outlook Index fell by X%].

- Several major infrastructure projects were delayed or postponed indefinitely, contributing to a slowdown in overall economic activity. [Insert example of a delayed project].

Slowdown in Economic Growth

Reduced trade volumes and decreased business investment inevitably translated into a slowdown in Canada's overall economic growth. The potential for a prolonged trade war posed a considerable threat to the nation's GDP.

- Economic forecasts for the period predicted a significant reduction in GDP growth compared to previous projections. [Insert specific forecast data and source].

- The ripple effect of reduced consumer spending and business activity further dampened the economic outlook.

The Bank of Canada's Response and Considerations

The Bank of Canada, responsible for managing monetary policy, carefully weighed the economic implications of Trump's tariffs and their potential impact on Canadian inflation and employment.

Monetary Policy Tools

The Bank of Canada's primary tool for influencing the economy is adjusting its key interest rate—the overnight rate. Lowering this rate makes borrowing cheaper, encouraging businesses and consumers to spend and invest more, thereby stimulating economic activity.

- Interest rate cuts are designed to inject liquidity into the economy, combating deflationary pressures and promoting growth.

- Conversely, increasing interest rates aims to curb inflation by making borrowing more expensive and slowing down economic activity.

April Meeting Deliberations

During their April meeting, Bank of Canada officials meticulously examined the situation, considering a range of economic indicators. The pervasive uncertainty caused by Trump's tariffs was a dominant factor in their discussions.

- Inflation rates remained relatively stable, but the risk of deflation was a concern, given the weakening economy. [Insert relevant inflation data].

- Employment data showed signs of slowing growth, reflecting the impact of reduced investment and trade activity. [Insert employment data].

- Official statements from the Bank of Canada acknowledged the tariff uncertainty as a major factor influencing their policy decision. [Reference the official statement if available].

Decision to Hold Rates Steady

Ultimately, the Bank of Canada opted to hold interest rates steady in April. This decision was a calculated risk, balancing the potential benefits of stimulating the economy with the potential drawbacks.

- The Bank likely chose to wait for more concrete data to assess the full impact of the tariffs before making any drastic changes to interest rates.

- Mitigating the risk of fueling inflation or exacerbating existing economic vulnerabilities might have also played a role in their decision to maintain the status quo.

Long-Term Implications and Future Outlook

The lingering effects of US-China trade tensions and their ripple effects continue to pose challenges for the Canadian economy.

Continued Trade Tensions

The ongoing uncertainties surrounding global trade relationships remain a major concern. The potential for further escalation or prolonged trade disputes could significantly hinder Canada's economic recovery.

- Continued trade wars could lead to further weakening of the CAD, impacting exports and increasing the cost of living.

- Businesses may continue to delay investment decisions until greater clarity emerges regarding future trade policies.

Predicting Future Rate Adjustments

Experts hold diverse opinions on the future direction of Bank of Canada interest rates. Forecasts range from further rate cuts to potential increases, depending on how the economy evolves.

- Some economists anticipate a need for further rate cuts to counter a prolonged economic slowdown. [Cite an expert opinion and their reasoning].

- Others predict that the Bank of Canada might maintain current rates or even increase them if inflation starts to rise unexpectedly. [Cite another expert opinion].

Analyzing the Bank of Canada's Response to Tariff Uncertainty

In April, the Bank of Canada carefully considered the ramifications of Trump's tariffs on the Canadian economy, ultimately deciding against an immediate interest rate cut. The decision reflected a cautious approach, weighing the need to stimulate economic growth against potential risks. The impact of tariffs on the Canadian dollar, business investment, and overall economic growth were significant factors influencing the Bank's decision. The Bank's role in navigating this economic uncertainty highlighted the complexities of monetary policy in a rapidly changing global landscape.

To stay informed about the Bank of Canada's monetary policy decisions and their impact on the Canadian economy, regularly check official sources like the Bank of Canada website and reputable financial news outlets for updates on interest rate changes and their implications for Canadian businesses and consumers. Staying abreast of these developments is crucial for understanding the future of the Canadian economy and making sound financial decisions. Understanding the intricacies of Bank of Canada interest rates is key to navigating the economic climate.

Featured Posts

-

Kommentariy Zakharovoy Situatsiya Vokrug Emmanuelya I Brizhit Makron

May 03, 2025

Kommentariy Zakharovoy Situatsiya Vokrug Emmanuelya I Brizhit Makron

May 03, 2025 -

The Tory Partys Gamble A Boris Johnson Comeback

May 03, 2025

The Tory Partys Gamble A Boris Johnson Comeback

May 03, 2025 -

Improving Mental Health Literacy Through Education

May 03, 2025

Improving Mental Health Literacy Through Education

May 03, 2025 -

Is This Facelift Too Much Public Outcry Over Stars New Look

May 03, 2025

Is This Facelift Too Much Public Outcry Over Stars New Look

May 03, 2025 -

Where To Invest A Geographic Overview Of The Countrys Best New Business Opportunities

May 03, 2025

Where To Invest A Geographic Overview Of The Countrys Best New Business Opportunities

May 03, 2025

Latest Posts

-

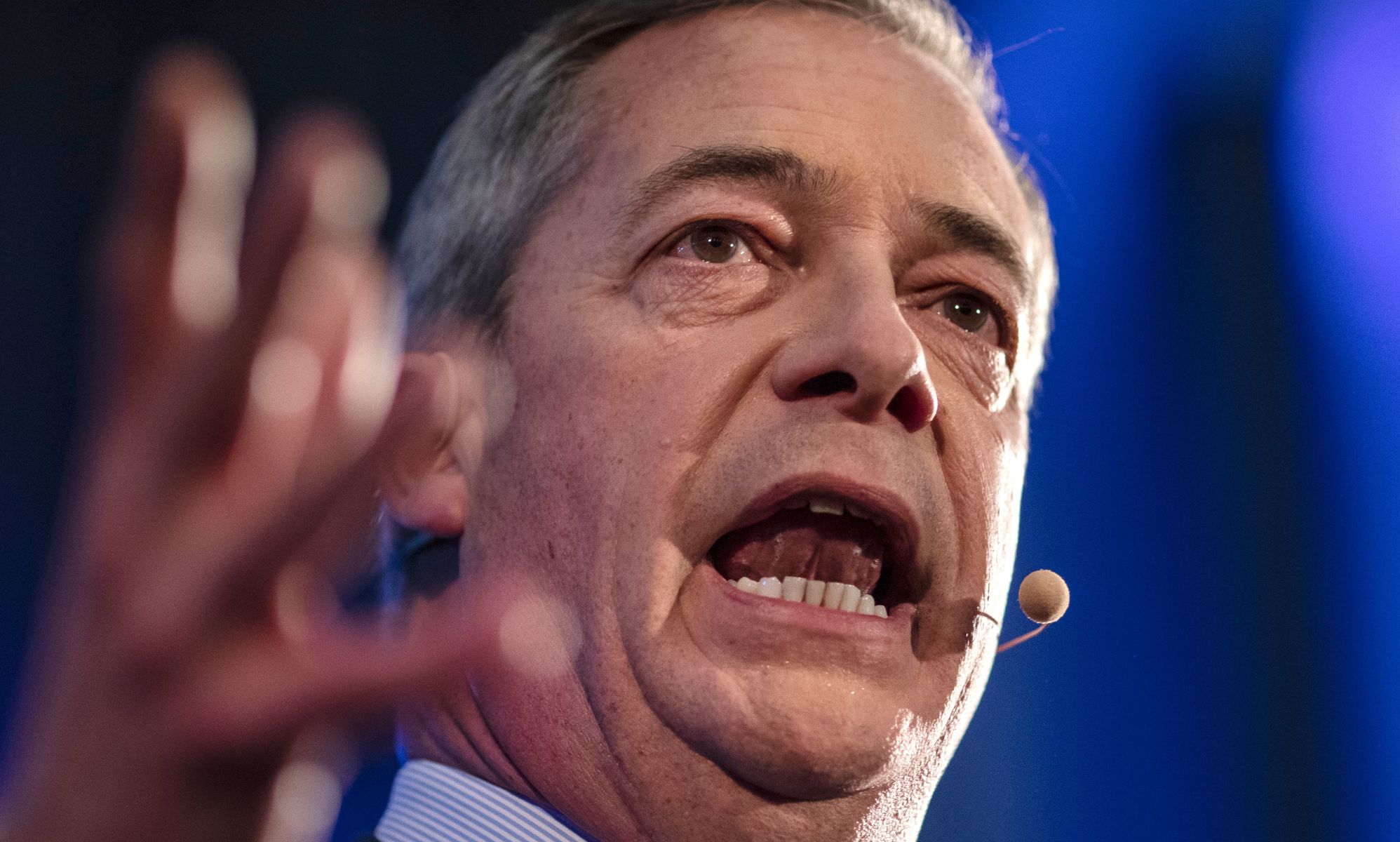

Analyzing Reform Uks Influence Nigel Farages Strategy And Success

May 03, 2025

Analyzing Reform Uks Influence Nigel Farages Strategy And Success

May 03, 2025 -

The Farage Teaching Union Clash A Dispute Over Far Right Allegations

May 03, 2025

The Farage Teaching Union Clash A Dispute Over Far Right Allegations

May 03, 2025 -

Conservative Chairman Faces Reform Uk Tensions A Battle For Influence

May 03, 2025

Conservative Chairman Faces Reform Uk Tensions A Battle For Influence

May 03, 2025 -

Tory Chairmans Tensions With Reform Uk Populism And Party Divisions

May 03, 2025

Tory Chairmans Tensions With Reform Uk Populism And Party Divisions

May 03, 2025 -

The Influence Of Reform Uk Nigel Farages Impact On Uk Politics

May 03, 2025

The Influence Of Reform Uk Nigel Farages Impact On Uk Politics

May 03, 2025