Bank Of Canada Interest Rate Cuts: The Impact Of Tariffs On Employment And Economic Growth

Table of Contents

The Impact of Tariffs on Canadian Businesses

Tariffs, essentially taxes on imported or exported goods, create significant hurdles for Canadian businesses operating in a globally interconnected market. These levies disrupt established trade flows, impacting both export and import activities.

Reduced Export Demand

Tariffs imposed by other countries on Canadian goods directly reduce export demand. This decline in international sales forces Canadian businesses to lower production levels, leading to potential job losses and reduced economic activity.

- Industries Affected: The agricultural sector (e.g., wheat, lumber, dairy), forestry products, and manufacturing (e.g., automotive parts, steel) have been particularly vulnerable to reduced export demand due to tariffs.

- Export Decline Statistics: Statistics Canada data shows a significant drop in exports in certain sectors since the implementation of tariffs, with specific figures varying depending on the industry and trading partner. (Note: Specific statistical data would need to be researched and inserted here from a reliable source.)

- Businesses Struggling: Numerous case studies illustrate the difficulties faced by Canadian businesses, with anecdotal evidence from smaller businesses struggling to maintain profitability and larger corporations forced to implement cost-cutting measures, including layoffs.

Increased Input Costs

Tariffs on imported goods also impact Canadian businesses by increasing their input costs. Many industries rely on imported raw materials, machinery, and components for their production processes. Increased tariffs translate to higher production costs, squeezing profit margins.

- Imported Goods: Canadian businesses rely heavily on imported goods like raw materials (e.g., steel, aluminum), machinery for manufacturing, and intermediate goods for various industries.

- Increased Input Costs Statistics: The cost of these inputs has risen significantly in some sectors due to tariffs, leading to increased prices and reduced competitiveness in the global market. (Again, specific data would need to be added here from a credible source.)

- Impact on Pricing and Profitability: To maintain profitability, businesses may be forced to increase prices, potentially impacting consumer demand. This reduction in competitiveness creates a challenging environment for expansion and investment.

The Impact of Tariffs on Employment

The combined effect of reduced export demand and increased input costs stemming from tariffs translates directly into negative consequences for Canadian employment.

Job Losses in Affected Sectors

Reduced production and business closures lead to job losses in sectors directly affected by tariffs. This unemployment can ripple throughout the economy, impacting related industries and communities.

- Statistics on Job Losses: (Insert relevant data from Statistics Canada or other reliable sources showing job losses in specific sectors affected by tariffs.) Specific job losses need to be researched and included.

- Geographic Areas: Certain regions of Canada, particularly those heavily reliant on specific export-oriented industries, have been disproportionately affected by job losses due to tariffs.

- Government Support Programs: The Canadian government has implemented various support programs aimed at assisting workers affected by job losses due to economic downturns, including retraining initiatives and unemployment benefits.

Reduced Investment and Hiring

The uncertainty created by tariffs discourages business investment and hiring. Businesses become hesitant to expand or take on new employees when facing unpredictable market conditions.

- Reduced Business Investment: (Insert data demonstrating decreased business investment in response to tariff uncertainty.) Statistics showing this trend need to be added.

- Analyst Predictions: Economic analysts often forecast future job growth based on various economic indicators. Including these predictions can provide valuable context.

- Business Confidence: The overall level of business confidence is often negatively impacted by trade tensions and tariff uncertainty, leading to a cautious approach to investment and hiring.

The Bank of Canada's Response: Interest Rate Cuts

In response to the negative economic impacts of tariffs, the Bank of Canada has implemented interest rate cuts as a component of its stimulative monetary policy.

Stimulative Monetary Policy

Interest rate cuts aim to boost economic activity by making borrowing cheaper. Lower interest rates incentivize businesses and consumers to borrow more money, leading to increased investment and spending.

- Mechanism of Interest Rate Cuts: Lower interest rates reduce the cost of borrowing for businesses, enabling them to invest in expansion, equipment, and hiring. Lower rates also make it cheaper for consumers to borrow, potentially stimulating consumer spending.

- Historical Precedent: The Bank of Canada and central banks worldwide have historically used interest rate cuts as a tool to combat economic slowdowns. Examples of past instances where this was effective (or ineffective) would be valuable here.

- Potential Risks: While interest rate cuts can stimulate the economy, they also carry potential risks, such as inflation and asset bubbles.

Effectiveness of Interest Rate Cuts

The effectiveness of interest rate cuts in mitigating the negative impacts of tariffs is a complex issue. While lower borrowing costs can encourage investment, they may not be sufficient to offset the structural challenges posed by tariffs.

- Evidence of Effectiveness: (Include evidence supporting or refuting the effectiveness of the interest rate cuts.) This requires research and citing of economic data.

- Alternative Economic Policies: Other economic policies, such as targeted government subsidies for affected industries or direct financial aid to businesses, could complement interest rate cuts and potentially achieve better results.

- Economic Indicators: Monitoring key economic indicators, such as GDP growth, employment rates, and inflation, can provide insights into the effectiveness of the interest rate cuts in achieving their intended objectives.

Long-Term Economic Outlook and Potential Solutions

The long-term implications of tariffs on the Canadian economy are still unfolding. While interest rate cuts can provide temporary relief, addressing the underlying structural issues is crucial for sustainable economic growth.

Beyond interest rate cuts, other potential solutions include:

- Government Subsidies: Targeted government subsidies can help businesses facing increased input costs or reduced export demand to stay afloat and maintain employment.

- Trade Negotiations: Negotiating favorable trade deals and resolving trade disputes can reduce the impact of tariffs and create a more stable trade environment.

- Diversification Strategies: Encouraging diversification of export markets and reducing reliance on specific trading partners can make the Canadian economy less vulnerable to trade shocks.

Conclusion

The impact of tariffs on Canadian employment and economic growth is significant, leading to reduced export demand, increased input costs, and job losses. The Bank of Canada's interest rate cuts are intended to mitigate these challenges by stimulating economic activity through lower borrowing costs. However, the long-term success of this strategy depends on addressing the underlying structural issues caused by tariffs and exploring alternative policy solutions. Understanding the interplay between Bank of Canada interest rate cuts and the challenges posed by tariffs is crucial for navigating the current economic landscape. Stay informed about future developments and the continuing impact on Canadian businesses and employment, and consider how these factors will influence future Bank of Canada interest rate decisions.

Featured Posts

-

Transgender Day Of Visibility Measuring Gender Euphoria To Enhance Mental Health Support

May 14, 2025

Transgender Day Of Visibility Measuring Gender Euphoria To Enhance Mental Health Support

May 14, 2025 -

Alkaras Idol Mladih Tenisera

May 14, 2025

Alkaras Idol Mladih Tenisera

May 14, 2025 -

Lindt Opens Central London Chocolate Paradise A New Destination For Chocoholics

May 14, 2025

Lindt Opens Central London Chocolate Paradise A New Destination For Chocoholics

May 14, 2025 -

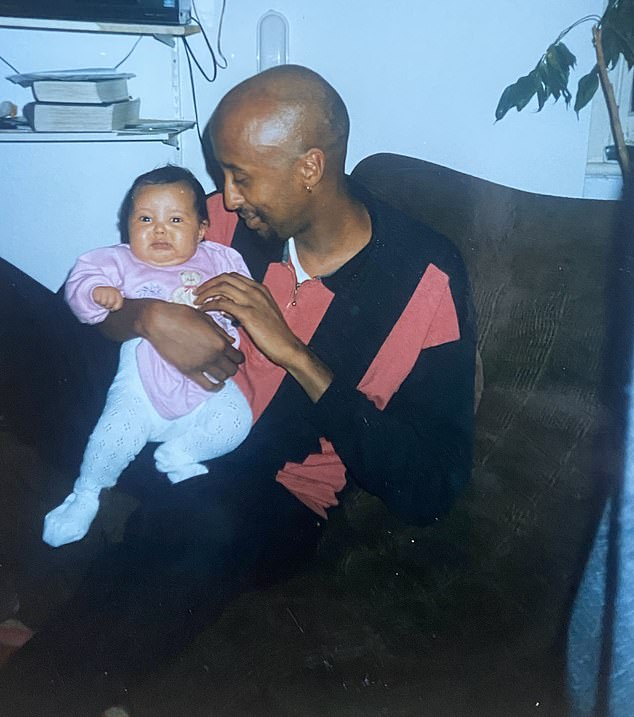

Celebrity Skincare Maya Jamas On The Go Face Mask

May 14, 2025

Celebrity Skincare Maya Jamas On The Go Face Mask

May 14, 2025 -

Selin Dion Khvoroba Osobiste Zhittya Ta Novini Pro Zirku

May 14, 2025

Selin Dion Khvoroba Osobiste Zhittya Ta Novini Pro Zirku

May 14, 2025