Bank Of Canada Rate Cut Less Likely After Strong Retail Sales Figures

Table of Contents

Strong Retail Sales Indicate Robust Consumer Spending

The latest retail sales figures paint a picture of surprisingly strong consumer spending, significantly impacting the probability of a Bank of Canada rate cut. This robust performance suggests a healthy economy, but also raises concerns about inflationary pressures. Key increases were observed across various sectors, signaling broad-based consumer confidence.

- Retail sales surged by 1.5% in July compared to June, and a significant 4% year-over-year increase. (Source: Statistics Canada)

- Strong growth was observed in several key sectors: automotive sales rose by 2%, furniture sales increased by 3%, and electronics sales showed a surprising 5% jump.

- Consumer confidence indicators, such as the Conference Board of Canada's Consumer Confidence Index, also support these findings, suggesting optimism among Canadian consumers.

[Insert Chart/Graph visualizing the retail sales data here]

Inflationary Pressures Remain a Concern

The robust consumer spending indicated by strong retail sales directly contributes to inflationary pressures. Increased demand for goods and services puts upward pressure on prices, potentially pushing inflation further away from the Bank of Canada's target range.

- The current inflation rate sits at 3.3%, slightly above the Bank of Canada's target range of 1-3%. (Source: Bank of Canada)

- Continued strong consumer spending risks exacerbating inflationary pressures, potentially necessitating further monetary policy tightening.

- Recent statements from Bank of Canada officials express ongoing concerns about inflation and the need to maintain price stability.

(Link to relevant data sources for inflation figures from Statistics Canada or the Bank of Canada)

Labour Market Remains Tight

A tight labor market, characterized by low unemployment and high labor demand, further complicates the argument for a Bank of Canada rate cut. This situation fuels wage growth, which can contribute to inflationary pressures.

- The unemployment rate currently stands at 5.5%, indicating a robust labor market. (Source: Statistics Canada)

- Significant labor shortages persist in key sectors such as healthcare and technology, driving up wages.

- Wage growth is accelerating, adding to inflationary concerns and making a rate cut less appealing to the central bank.

(Cite reputable sources for labor market data, such as Statistics Canada)

Impact on Future Monetary Policy Decisions

Given the strong retail sales, persistent inflation, and a tight labor market, the likelihood of a Bank of Canada rate cut in the near future has diminished significantly.

- The probability of a rate hike is currently higher than a rate cut, although maintaining the current rate remains a possibility.

- Future economic indicators such as GDP growth, inflation reports, and further retail sales data will be crucial in shaping the Bank of Canada's future monetary policy decisions.

- Many economic experts predict that the Bank of Canada will maintain its current interest rate stance, closely monitoring economic data for signs of easing inflation before considering any further adjustments.

Conclusion

In summary, strong retail sales figures, persistent inflationary pressures, and a tight labor market significantly reduce the probability of an imminent Bank of Canada rate cut. The robust consumer spending, while positive for economic growth, also adds to inflationary concerns, influencing the Bank of Canada's decision-making process. The central bank is likely to prioritize maintaining price stability and monitor economic indicators closely before making any further adjustments to interest rates.

Stay tuned for updates on Bank of Canada interest rate decisions and continue monitoring key economic indicators to understand the implications of future monetary policy changes. Visit the Bank of Canada website ([link to Bank of Canada website]) for the latest announcements and data releases related to interest rates.

Featured Posts

-

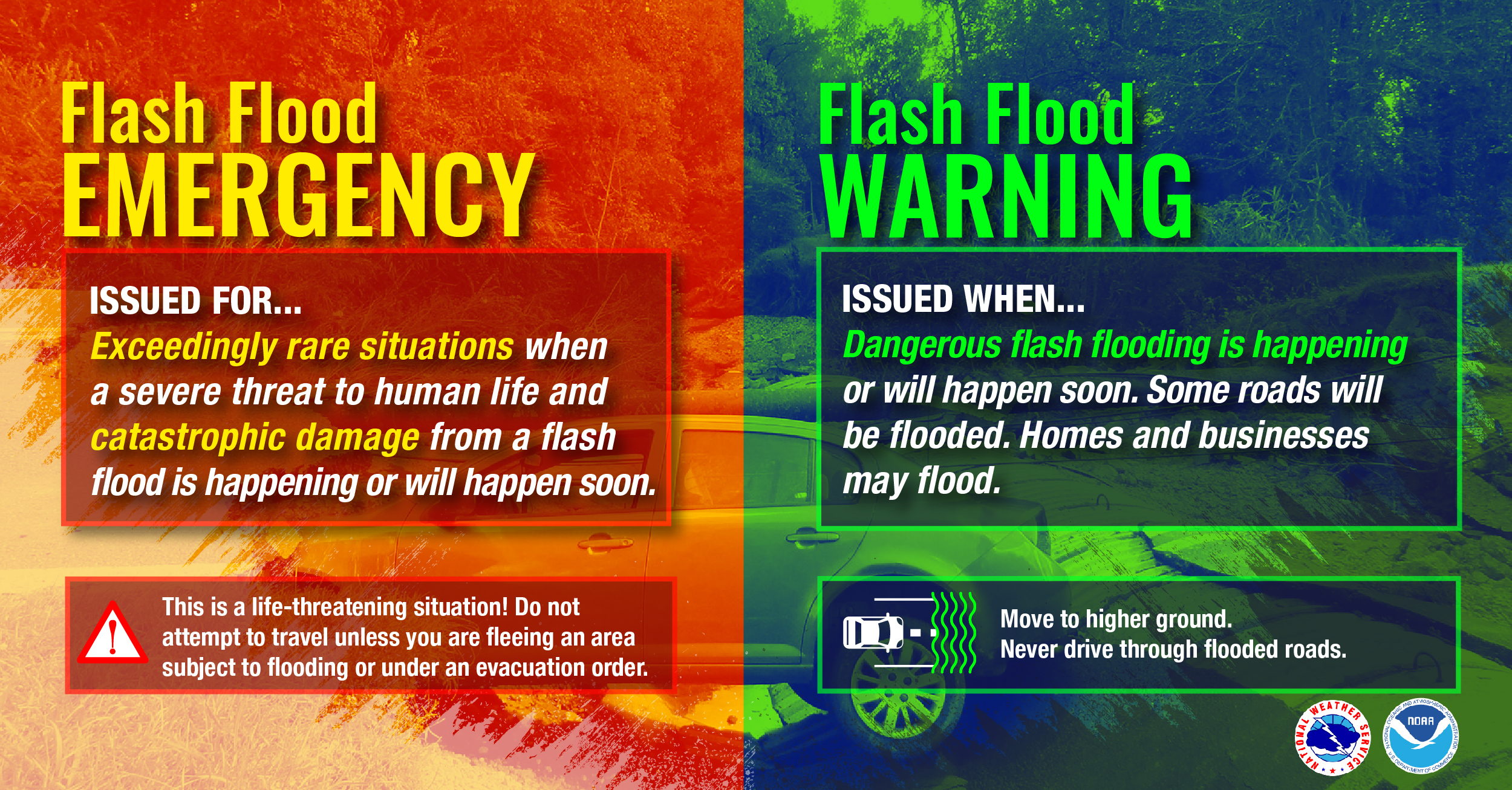

Flood Preparedness Your Guide To Severe Weather Awareness Week Day 5

May 26, 2025

Flood Preparedness Your Guide To Severe Weather Awareness Week Day 5

May 26, 2025 -

The Railway Station Man His Untold Story

May 26, 2025

The Railway Station Man His Untold Story

May 26, 2025 -

Top 5 Hudson Valley Restaurants For Shrimp

May 26, 2025

Top 5 Hudson Valley Restaurants For Shrimp

May 26, 2025 -

The Plight Of Idf Soldiers Held Captive In Gaza

May 26, 2025

The Plight Of Idf Soldiers Held Captive In Gaza

May 26, 2025 -

Finding The Best Office Chair In 2025 Reviews And Comparisons

May 26, 2025

Finding The Best Office Chair In 2025 Reviews And Comparisons

May 26, 2025

Latest Posts

-

Depistage Drogues Chauffeurs Bus Scolaires Gouvernement Renforce Les Controles

May 30, 2025

Depistage Drogues Chauffeurs Bus Scolaires Gouvernement Renforce Les Controles

May 30, 2025 -

Autoroute A69 Ministres Et Parlementaires Contournent La Justice

May 30, 2025

Autoroute A69 Ministres Et Parlementaires Contournent La Justice

May 30, 2025 -

Greve Sncf Semaine Du 8 Mai Quelles Consequences

May 30, 2025

Greve Sncf Semaine Du 8 Mai Quelles Consequences

May 30, 2025 -

Controles Antidrogue Chauffeurs Cars Scolaires Multiplication Des Tests Annoncee

May 30, 2025

Controles Antidrogue Chauffeurs Cars Scolaires Multiplication Des Tests Annoncee

May 30, 2025 -

Sncf Greve Du 8 Mai Les Dernieres Informations

May 30, 2025

Sncf Greve Du 8 Mai Les Dernieres Informations

May 30, 2025