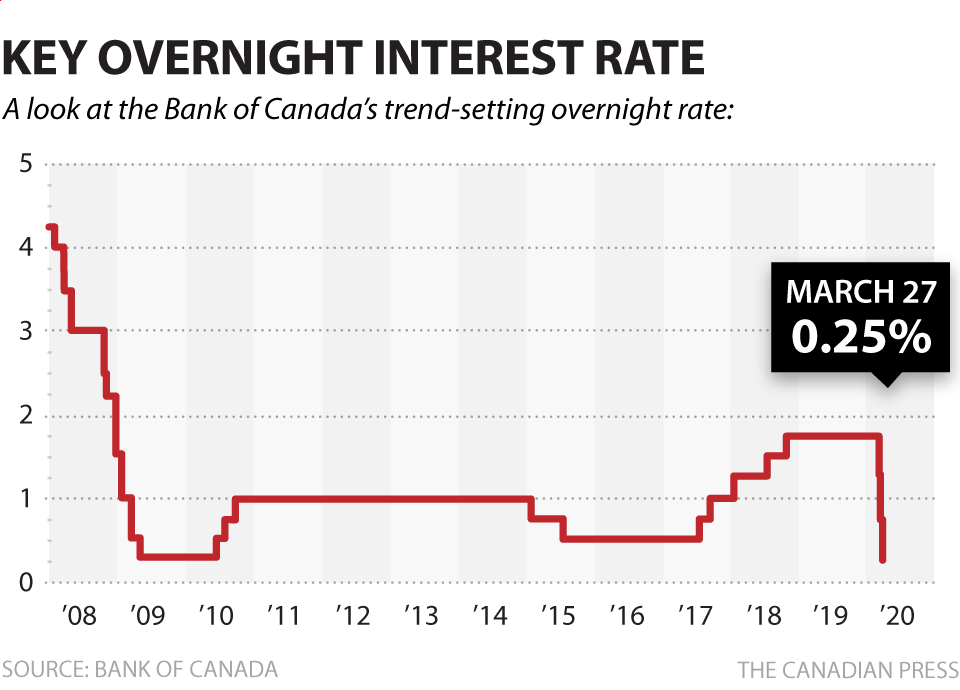

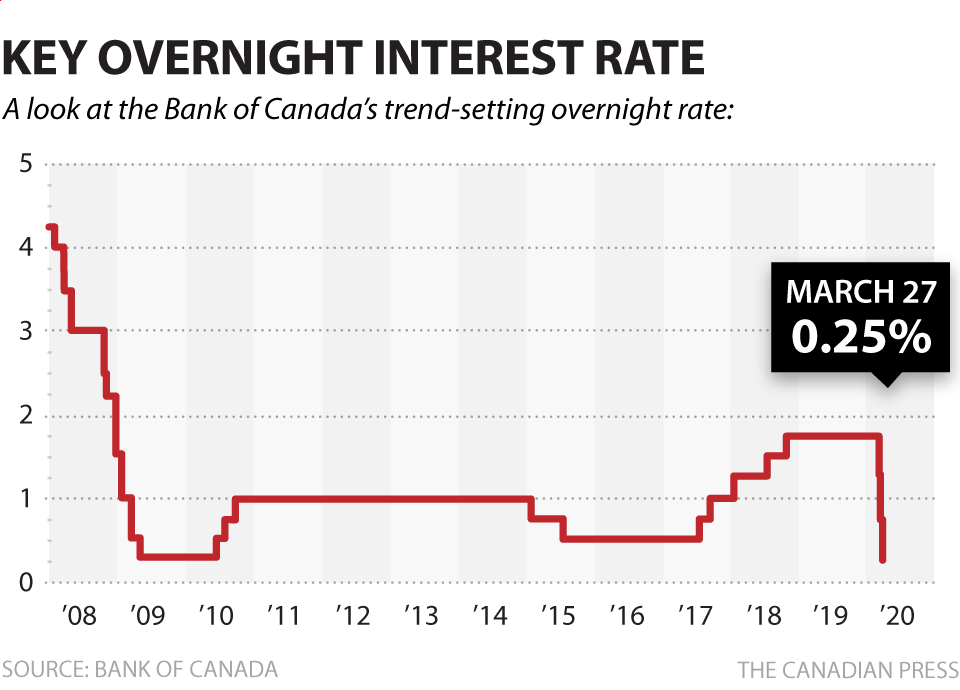

Bank Of Canada Rate Cuts: Desjardins Predicts Three More

Table of Contents

Desjardins' Rationale Behind the Rate Cut Prediction

Desjardins' forecast of three additional Bank of Canada rate cuts stems from a comprehensive analysis of several key economic indicators. Their prediction hinges on a confluence of factors suggesting a weakening economy. They are not alone in their assessment; a growing number of economists anticipate a slowdown or even a mild recession.

-

Analysis of Slowing GDP Growth: Desjardins points to a decelerating Gross Domestic Product (GDP) growth rate as a primary driver for their prediction. Recent data suggests a significant slowdown compared to previous quarters, signaling weakening economic momentum.

-

Assessment of Persistent Inflation, Despite Recent Decreases: While inflation has cooled from its peak, Desjardins notes that it remains stubbornly above the Bank of Canada's target range. This persistent inflation, coupled with slowing growth, creates a complex economic environment that warrants further interest rate reductions.

-

Evaluation of the Current Unemployment Rate and its Potential Impact: The unemployment rate, while relatively low, may not fully capture the weakening labor market dynamics. Desjardins' analysis likely considers factors such as underemployment and declining job creation as indicators of economic fragility.

-

Discussion of Potential Global Economic Factors Influencing the Canadian Economy: The global economic landscape significantly impacts Canada. Desjardins' assessment likely accounts for global uncertainties, such as geopolitical tensions and potential further slowdowns in major economies, which could further dampen Canadian economic growth.

-

Mention of Other Key Economic Data Desjardins is Considering: Besides the factors mentioned above, Desjardins' comprehensive forecast likely incorporates other data points such as consumer confidence indices, business investment trends, and housing market indicators. These combined data points paint a picture necessitating further monetary easing.

Potential Impacts of Further Bank of Canada Rate Cuts

The potential consequences of three more Bank of Canada rate cuts are multifaceted and far-reaching, influencing various sectors of the Canadian economy.

-

Lower Mortgage Rates and Their Impact on the Housing Market: Lower interest rates will likely translate to more affordable mortgages, potentially stimulating the housing market and providing a boost to consumer confidence. This could lead to increased home sales and construction activity.

-

Reduced Borrowing Costs for Businesses and Their Effect on Investment and Expansion: Lower borrowing costs for businesses will incentivize investment and expansion plans. This can lead to increased job creation and economic growth in the long run. However, businesses might be hesitant to invest if they are uncertain about future demand.

-

Potential Increase in Consumer Spending Driven by Lower Borrowing Rates: Lower interest rates can make borrowing more attractive for consumers, leading to increased spending on goods and services. This can be a powerful stimulus for economic activity, but it could also exacerbate inflationary pressures if not managed carefully.

-

Possible Impact on the Canadian Dollar's Exchange Rate: Further rate cuts may weaken the Canadian dollar against other currencies, potentially making Canadian exports more competitive but also increasing the cost of imports.

-

Risks Associated with Further Rate Cuts (e.g., Inflation Resurgence): A key risk associated with aggressive rate cuts is the potential for a resurgence of inflation. If consumer spending increases significantly, it could put upward pressure on prices, negating the intended effects of the monetary policy.

Alternative Perspectives and Market Reactions

While Desjardins' prediction is significant, it's not universally shared. Other financial institutions and economic experts hold diverse viewpoints on the future trajectory of Bank of Canada interest rates.

-

Summary of Other Major Financial Institutions' Predictions: Some institutions may foresee fewer rate cuts, while others might predict a more aggressive easing cycle than Desjardins. Analyzing these different forecasts reveals the level of economic uncertainty.

-

Analysis of Market Reactions – Stock Market, Bond Yields, etc.: Market reactions to Desjardins’ prediction can provide insights into investor sentiment. A positive market reaction might indicate confidence in the forecast's accuracy and its potential positive impact on the economy. Conversely, a negative reaction could signal concerns about the risks of further rate cuts.

-

Discussion of the Uncertainties and Risks Surrounding the Forecast: Predicting economic activity is inherently complex, and numerous unforeseen events can disrupt forecasts. Geopolitical risks, unexpected changes in consumer behavior, and unforeseen global economic shifts are among the uncertainties that could invalidate predictions.

-

Mention of Any Dissenting Opinions or Alternative Scenarios: It's crucial to acknowledge dissenting opinions. Some experts may argue that the current economic conditions don't warrant further rate cuts, citing potential risks to inflation control or the long-term health of the Canadian economy.

Conclusion

Desjardins' forecast of three more Bank of Canada rate cuts reflects a careful consideration of current economic indicators. While lower interest rates offer the potential for economic stimulus – boosting consumer spending, business investment, and the housing market – risks remain, notably the possibility of reigniting inflation. The market reaction and alternative viewpoints highlight the significant uncertainties surrounding the Canadian economic outlook. Staying informed about Bank of Canada announcements and monitoring economic data is vital. Understanding Bank of Canada rate cuts and their implications is essential for effective financial planning. Monitor our website for further updates on Bank of Canada rate cuts and their implications for your financial future.

Featured Posts

-

Cows Airlifted From Swiss Village A Unique Rescue Operation

May 23, 2025

Cows Airlifted From Swiss Village A Unique Rescue Operation

May 23, 2025 -

Jonathan Groffs Just In Time Opening A Star Studded Affair

May 23, 2025

Jonathan Groffs Just In Time Opening A Star Studded Affair

May 23, 2025 -

Alix Earle How The Dancing With The Stars Cast Member Conquered Gen Z Marketing

May 23, 2025

Alix Earle How The Dancing With The Stars Cast Member Conquered Gen Z Marketing

May 23, 2025 -

En Zeki Burclar Dahilik Genleri Ve Oezellikleri

May 23, 2025

En Zeki Burclar Dahilik Genleri Ve Oezellikleri

May 23, 2025 -

Microsoft Blocks Emails Containing Palestine Employee Protest Fallout

May 23, 2025

Microsoft Blocks Emails Containing Palestine Employee Protest Fallout

May 23, 2025

Latest Posts

-

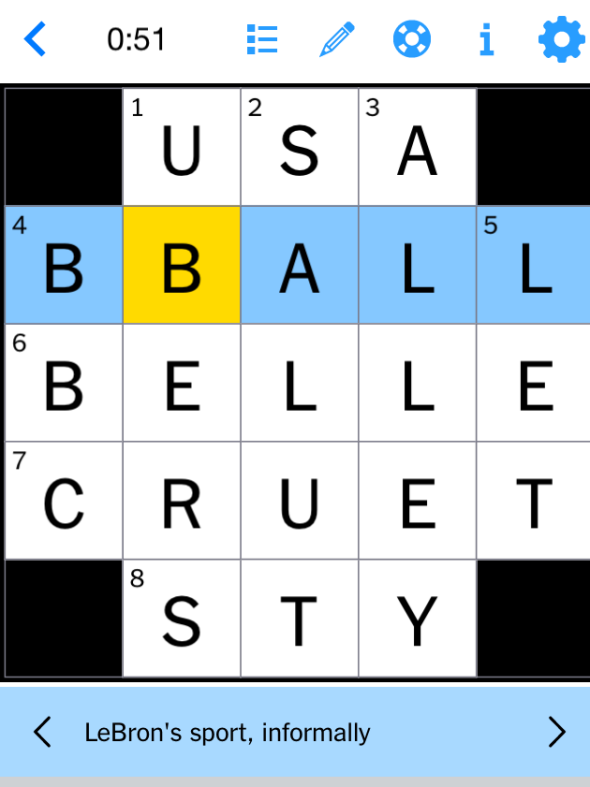

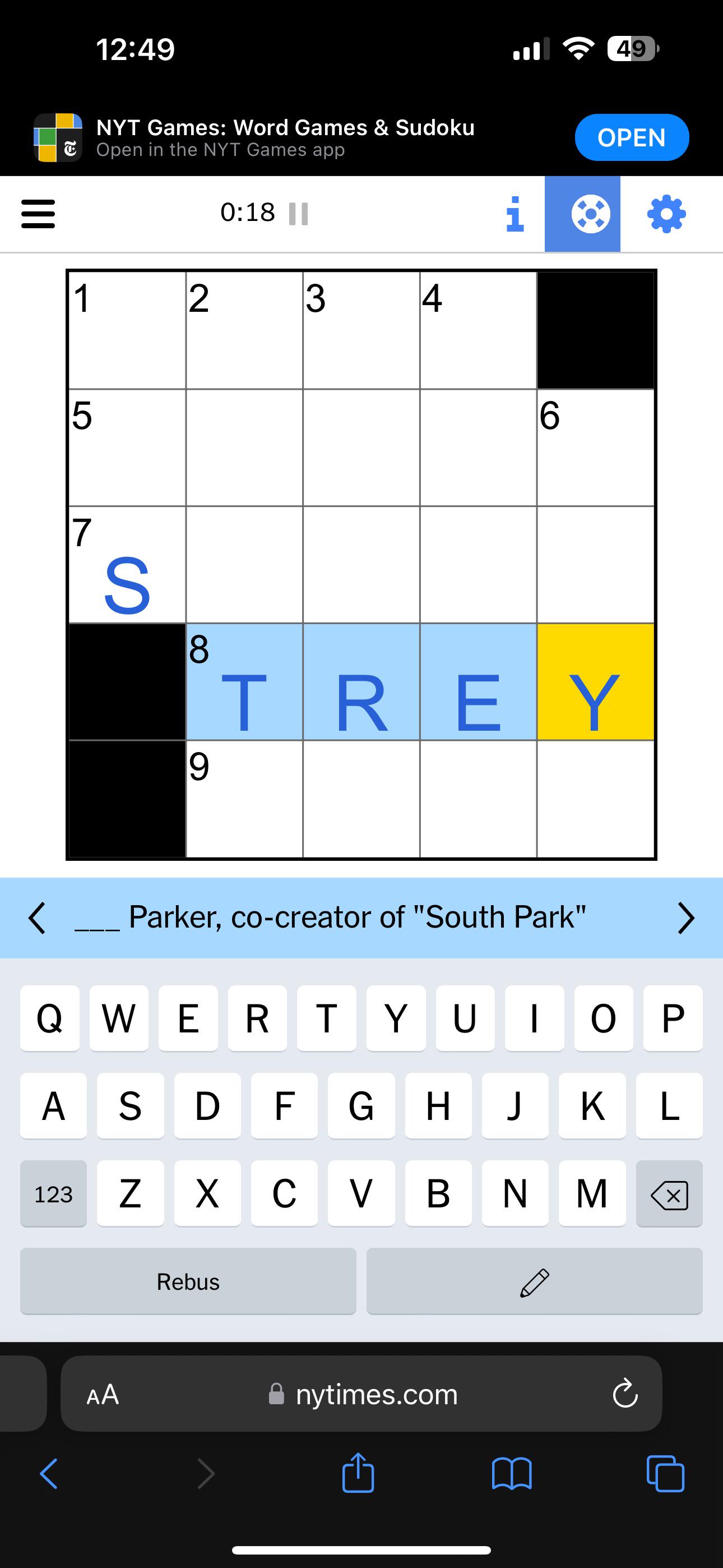

Nyt Mini Crossword Clues And Solutions April 8 2025

May 23, 2025

Nyt Mini Crossword Clues And Solutions April 8 2025

May 23, 2025 -

Marvel The Avengers Crossword Clue Full Breakdown And Solving Tips For May 1st Nyt Mini

May 23, 2025

Marvel The Avengers Crossword Clue Full Breakdown And Solving Tips For May 1st Nyt Mini

May 23, 2025 -

Todays Nyt Mini Crossword Answers March 5 2025

May 23, 2025

Todays Nyt Mini Crossword Answers March 5 2025

May 23, 2025 -

Nyt Mini Crossword Answers March 12 2025 Full Solution Guide

May 23, 2025

Nyt Mini Crossword Answers March 12 2025 Full Solution Guide

May 23, 2025 -

March 26 2025 Nyt Mini Crossword Solutions And Clues

May 23, 2025

March 26 2025 Nyt Mini Crossword Solutions And Clues

May 23, 2025