Bank Of Canada Rate Cuts: Economists Predict Renewed Interest Rate Reductions Amidst Tariff Job Losses

Table of Contents

1. The Impact of Tariffs on the Canadian Economy

Tariffs have dealt a significant blow to the Canadian economy, triggering a cascade of negative consequences. The impact is particularly acute in key sectors, leading to widespread job losses and dampening overall economic activity.

1.1 Job Losses in Key Sectors:

The manufacturing and agriculture sectors have been disproportionately affected by the imposition of tariffs. The "tariff impact" has resulted in substantial job displacement, particularly in regions heavily reliant on these industries.

- Manufacturing: Estimates suggest over 15,000 manufacturing jobs have been lost in Ontario alone since the implementation of new tariffs, with companies like XYZ Manufacturing announcing significant layoffs.

- Agriculture: The agricultural sector has faced decreased export demand due to retaliatory tariffs, leading to an estimated loss of 5,000 jobs across the prairies. Regional disparities are evident, with rural communities suffering the most significant job losses.

- Automotive: The automotive sector, a cornerstone of the Canadian economy, has also experienced significant job losses as a result of supply chain disruptions caused by tariffs.

1.2 Reduced Consumer Spending and Business Investment:

The job losses stemming from tariffs have had a knock-on effect on consumer confidence and spending. Fear of job insecurity and reduced income are prompting many Canadians to curb their spending, further weakening economic activity. Simultaneously, businesses are delaying or canceling investment projects due to economic uncertainty, creating a vicious cycle of declining growth.

- Statistics Canada reports a noticeable drop in consumer spending in the last quarter, reflecting a decline in consumer confidence.

- Several large Canadian corporations have announced delays in planned expansion projects, citing concerns about the current economic climate and the uncertainty surrounding future tariff policies.

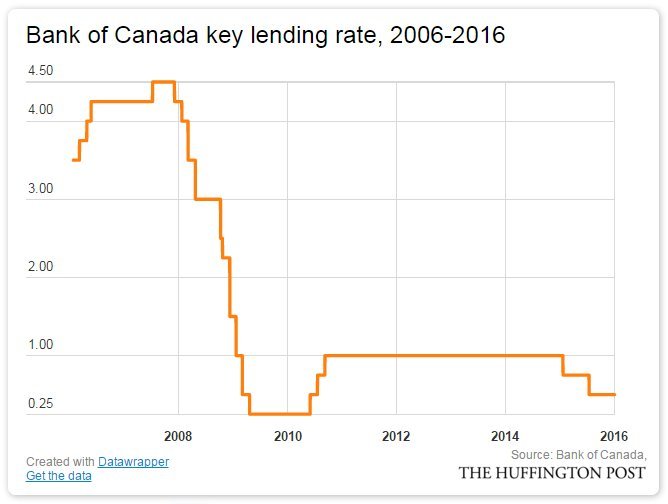

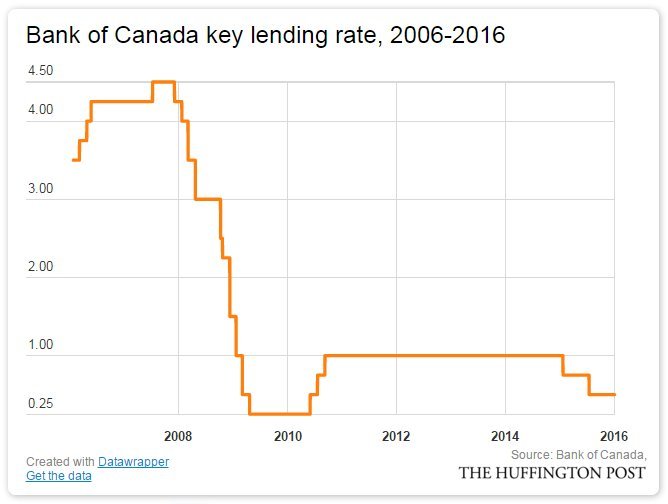

2. Economists' Forecasts and Predictions for Bank of Canada Rate Cuts

The bleak economic outlook has prompted a chorus of calls for the Bank of Canada to intervene. Economists are closely monitoring key economic indicators to gauge the likelihood and timing of further Bank of Canada rate cuts.

2.1 Analysis of Current Economic Indicators:

Several key economic indicators point to a weakening economy, strengthening the case for interest rate reductions.

- Inflation Rate: Inflation remains stubbornly below the Bank of Canada's target, suggesting there is room to lower interest rates without fueling inflationary pressures.

- GDP Growth: GDP growth has slowed considerably, falling below the projected rate for the current fiscal year.

- Unemployment Rate: The unemployment rate has ticked upwards, exceeding expectations and reflecting the impact of tariff-related job losses. This increase in the unemployment rate is a significant driver behind predictions for interest rate reductions.

2.2 Expert Opinions and Diverging Views:

While many economists agree that further interest rate cuts are likely, there is some divergence in opinion regarding the timing and magnitude of these reductions.

- "The Bank of Canada needs to act decisively to prevent a deeper economic downturn," states Dr. Evelyn Reed, Chief Economist at the Canadian Economic Institute.

- Others, however, caution against overly aggressive rate cuts, citing potential risks to financial stability and the possibility of creating asset bubbles.

3. Potential Consequences of Further Bank of Canada Rate Cuts

Further Bank of Canada rate cuts could have significant consequences, both positive and negative.

3.1 Stimulating Economic Growth:

Lower interest rates can provide a much-needed stimulus to the economy. Reduced borrowing costs can encourage businesses to invest and consumers to spend, potentially boosting economic activity.

- Lower interest rates could incentivize businesses to undertake expansion projects, creating new jobs and driving GDP growth.

- Lower mortgage rates could encourage housing investment and construction, providing a boost to the real estate sector.

3.2 Risks and Potential Drawbacks:

However, there are potential downsides to aggressive interest rate reductions.

- Increased inflation: Lower interest rates could potentially lead to increased inflation if demand outpaces supply.

- Asset bubbles: Low interest rates can also inflate asset bubbles, creating risks for financial stability.

Conclusion:

The impact of tariffs on the Canadian economy is undeniable, leading to significant job losses and reduced economic activity. This situation has fueled predictions of renewed Bank of Canada rate cuts, as economists urge intervention to stimulate growth. While lower interest rates could provide a boost, policymakers must carefully weigh the potential benefits against the risks of increased inflation or asset bubbles. To stay informed on this critical issue, follow reputable sources like the Bank of Canada website and major financial news outlets for updates on interest rate reductions and other monetary policy changes. Understanding the implications of these shifts is essential for navigating the current economic climate.

Featured Posts

-

Virginia Giuffre Skandalen En Analyse Av Hendelsene Og Deres Innvirkning

May 11, 2025

Virginia Giuffre Skandalen En Analyse Av Hendelsene Og Deres Innvirkning

May 11, 2025 -

Los Angeles Wildfires And The Disturbing Trend Of Disaster Betting

May 11, 2025

Los Angeles Wildfires And The Disturbing Trend Of Disaster Betting

May 11, 2025 -

Hotel Transylvania A Complete Guide To The Franchise

May 11, 2025

Hotel Transylvania A Complete Guide To The Franchise

May 11, 2025 -

Sydney Mc Laughlin Levrone Sets New 400m Hurdle World Lead At Grand Slam

May 11, 2025

Sydney Mc Laughlin Levrone Sets New 400m Hurdle World Lead At Grand Slam

May 11, 2025 -

Uruguay Regala Inusual Obsequio A China Para Impulsar Exportaciones Ganaderas

May 11, 2025

Uruguay Regala Inusual Obsequio A China Para Impulsar Exportaciones Ganaderas

May 11, 2025