Bank Of Canada Rate Cuts Possible Following Disappointing Retail Sales Figures

Table of Contents

Disappointing Retail Sales Figures: A Deeper Dive

The latest retail sales data paints a concerning picture for the Canadian economy. Sales declined by [Insert Percentage]% in [Month, Year], marking a significant downturn in consumer spending. This decline wasn't uniform across all sectors; durable goods, such as appliances and furniture, experienced a steeper drop than non-durable goods. Regional variations also emerged, with [mention specific regions and their performance].

Several factors likely contributed to this decline:

- High Inflation: Persistent inflation has eroded consumer purchasing power, forcing households to cut back on discretionary spending.

- High Interest Rates: The Bank of Canada's previous interest rate hikes have increased borrowing costs, making it more expensive for consumers to finance purchases.

- Weakening Consumer Confidence: Uncertainty about the economic outlook has dampened consumer confidence, leading to reduced spending.

- Global Economic Slowdown: The global economic slowdown is impacting Canadian exports and overall economic growth, further impacting retail sales.

[Insert a chart or graph visually representing the decline in retail sales, clearly labeled and showing relevant data points.]

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada's current inflation target is [Insert Target Percentage]%. Recent policy decisions have focused on combating inflation through a series of interest rate hikes. The current interest rate stands at [Insert Current Interest Rate]%, significantly impacting borrowing costs for both consumers and businesses. Historically, the Bank of Canada has responded to economic downturns with interest rate cuts to stimulate economic activity, but the current situation presents a complex challenge.

- Previous Responses: [Provide brief examples of past Bank of Canada responses to economic slowdowns and their effectiveness].

Factors Favoring Bank of Canada Rate Cuts

Several arguments support the possibility of Bank of Canada rate cuts:

- Weakening Consumer Spending: The significant decline in retail sales clearly indicates weakening consumer spending and reduced economic activity.

- Recession Risks: The persistent economic slowdown raises concerns about the potential for a recession or a significant economic contraction.

- Cooling Inflation: [If applicable, mention evidence suggesting inflation is cooling down, supporting the case for rate cuts.]

- Market Expectations: Market analysts and economists are increasingly discussing the likelihood of interest rate cuts, reflecting growing concerns about the economic outlook.

Factors Against Bank of Canada Rate Cuts

Conversely, several factors argue against immediate Bank of Canada rate cuts:

- Persistent Inflationary Pressures: While overall inflation might be cooling, inflationary pressures persist in certain sectors, potentially hindering the effectiveness of rate cuts.

- Wage Growth Concerns: Rapid wage growth could exacerbate inflationary pressures, making rate cuts a risky proposition.

- Price Stability: The Bank of Canada's primary mandate is to maintain price stability, and premature rate cuts could jeopardize this goal.

- Global Economic Uncertainty: Global economic uncertainties pose significant risks to the Canadian economy, making it challenging to predict the impact of rate cuts.

Potential Impacts of Bank of Canada Rate Cuts

Bank of Canada rate cuts would have several potential impacts:

- Stimulated Consumer Spending: Lower interest rates could boost consumer spending and borrowing, potentially reviving economic activity.

- Increased Business Investment: Reduced borrowing costs could encourage businesses to increase investment and hiring.

- Impact on the Canadian Dollar: Rate cuts could weaken the Canadian dollar exchange rate, potentially affecting both imports and exports.

Conclusion: The Outlook for Bank of Canada Rate Cuts

The decision facing the Bank of Canada is a complex one, weighing the potential benefits of stimulating economic growth through Bank of Canada rate cuts against the risks of fueling inflation. While the disappointing retail sales figures strongly suggest a weakening economy, the persistence of inflationary pressures and global economic uncertainty complicate the picture. The likelihood of rate cuts will depend on upcoming economic data, particularly inflation figures and consumer confidence indicators. It's crucial to remain informed about future Bank of Canada announcements and monitor key economic indicators to understand the evolving situation. Stay updated on the Bank of Canada's website and follow reputable financial news sources for the latest information regarding Bank of Canada rate cuts and their impact on the Canadian economy.

Featured Posts

-

La Wildfires A Reflection Of Our Times Through The Lens Of Gambling

Apr 29, 2025

La Wildfires A Reflection Of Our Times Through The Lens Of Gambling

Apr 29, 2025 -

Eleven Years After The Louisville Tornado A Communitys Resilience

Apr 29, 2025

Eleven Years After The Louisville Tornado A Communitys Resilience

Apr 29, 2025 -

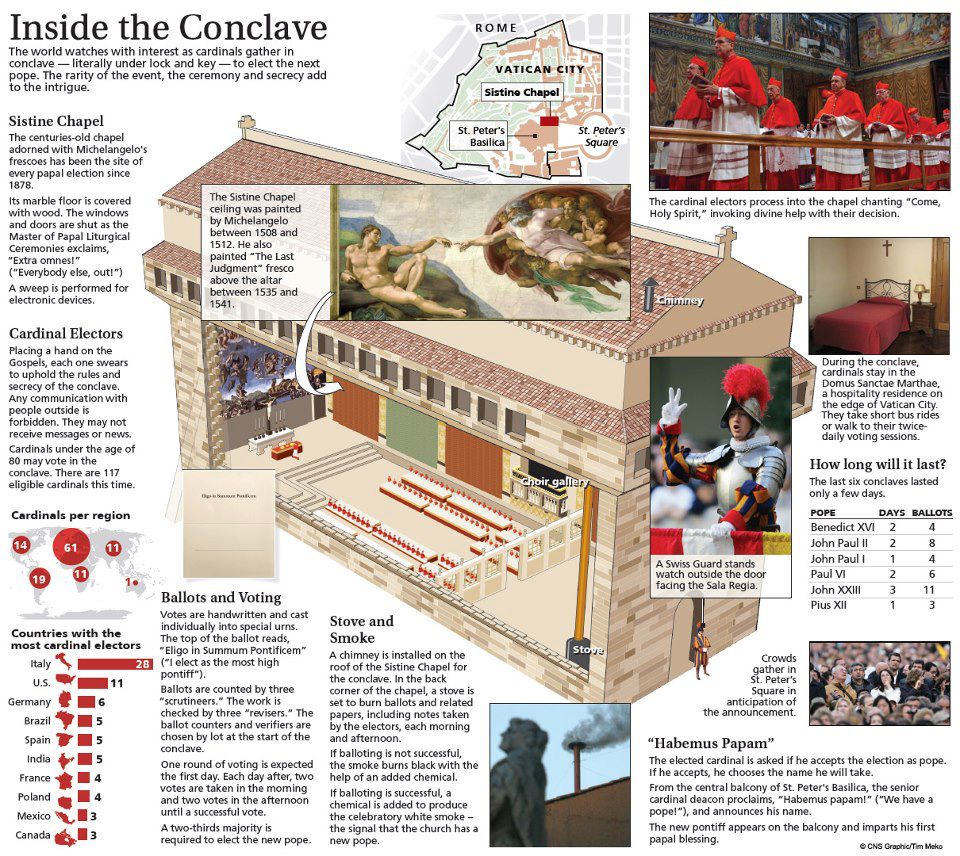

Debate Erupts Over Convicted Cardinals Voting Rights In Papal Conclave

Apr 29, 2025

Debate Erupts Over Convicted Cardinals Voting Rights In Papal Conclave

Apr 29, 2025 -

160 Mlb

Apr 29, 2025

160 Mlb

Apr 29, 2025 -

Cardinals Conviction And Papal Conclave Voting Eligibility

Apr 29, 2025

Cardinals Conviction And Papal Conclave Voting Eligibility

Apr 29, 2025

Latest Posts

-

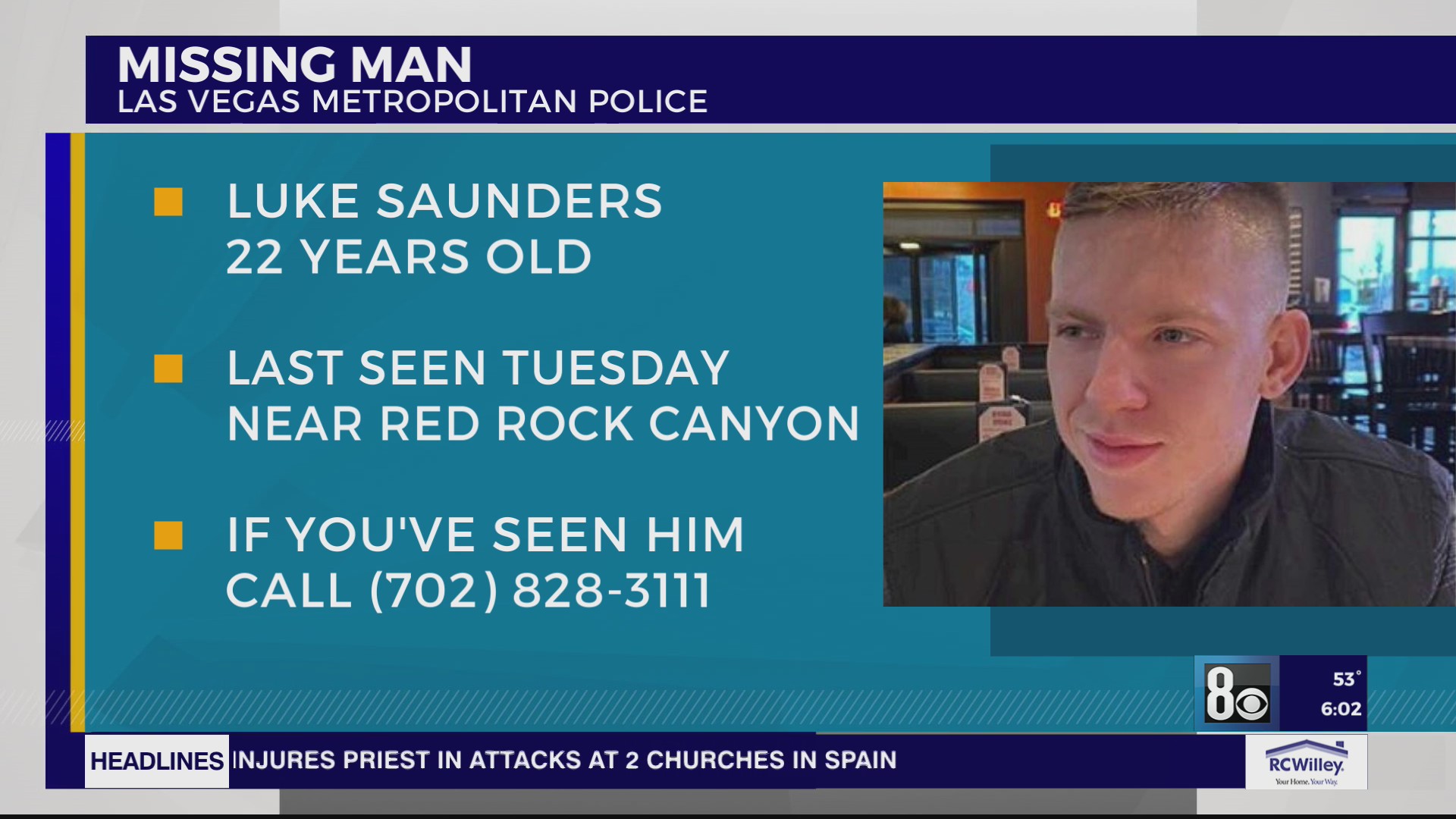

British Paralympian Sam Ruddock Missing In Las Vegas Urgent Search Underway

Apr 29, 2025

British Paralympian Sam Ruddock Missing In Las Vegas Urgent Search Underway

Apr 29, 2025 -

Missing British Paralympian Urgent Appeal For Information In Las Vegas

Apr 29, 2025

Missing British Paralympian Urgent Appeal For Information In Las Vegas

Apr 29, 2025 -

Concerns Grow Over Missing British Paralympian In Las Vegas

Apr 29, 2025

Concerns Grow Over Missing British Paralympian In Las Vegas

Apr 29, 2025 -

Midland Athlete Vanishes In Las Vegas Family And Friends Appeal For Information

Apr 29, 2025

Midland Athlete Vanishes In Las Vegas Family And Friends Appeal For Information

Apr 29, 2025 -

Search For Missing Midland Athlete Intensifies In Las Vegas

Apr 29, 2025

Search For Missing Midland Athlete Intensifies In Las Vegas

Apr 29, 2025