Bank Of Canada Rate Expectations: Interpreting Rosenberg's Labour Data Analysis

Table of Contents

Rosenberg's Key Labour Market Indicators

David Rosenberg, a highly respected economist known for his insightful economic forecasting, meticulously examines various key labour market metrics to predict the trajectory of the Canadian economy. He focuses on a set of indicators that paint a comprehensive picture of the employment landscape, providing valuable insight into the Bank of Canada’s future monetary policy decisions. These key indicators significantly influence Bank of Canada rate expectations.

-

Unemployment Rate: Rosenberg closely monitors changes in the unemployment rate, assessing whether it’s moving toward or away from full employment. A persistently low unemployment rate can signal inflationary pressures. For example, if the unemployment rate falls below 5%, Rosenberg might interpret this as a sign of a tight labour market, fueling wage growth and inflation.

-

Employment Growth: The rate of employment growth provides insights into the health of the economy. Strong employment growth, particularly in key sectors, suggests a robust economy, potentially leading to increased consumer spending and inflation. Conversely, slowing employment growth can signal an economic slowdown.

-

Participation Rate: The labour force participation rate reflects the percentage of the working-age population actively seeking employment. A decline in the participation rate can mask underlying economic weakness, while a rise suggests a healthy economy and potentially more inflationary pressures.

-

Wage Growth: Rosenberg considers wage growth a critical indicator of inflationary pressures. Rapid wage growth, exceeding productivity gains, often directly contributes to rising inflation. Conversely, stagnant wage growth may indicate a weakening economy. For example, Rosenberg may point to an increase in average hourly earnings of 5% as a signal of potential inflationary pressures, impacting Bank of Canada rate expectations.

These indicators, analyzed in conjunction with other economic data, provide Rosenberg with a comprehensive understanding of the Canadian labour market's health, directly impacting his predictions for Bank of Canada rate expectations. The Bank of Canada mandate, focusing on price stability and full employment, heavily relies on these very same data points.

Interpreting Rosenberg's Analysis: Signs of a Slowdown or Continued Strength?

Rosenberg's assessment of the Canadian labour market often provides crucial insights into future monetary policy. While specific predictions vary depending on the data at hand, his analysis generally focuses on identifying potential signs of economic slowdown or continued strength.

Currently, [insert Rosenberg's most recent assessment of the Canadian labour market here]. He might, for example, argue that while employment growth remains positive, it’s slowing, suggesting a potential economic slowdown. This might be supported by specific data points like a decline in the participation rate or a moderation in wage growth.

However, it’s important to consider alternative perspectives. Other economists may interpret the same data differently. For instance, some might argue that the slowing employment growth is a healthy adjustment following a period of rapid expansion, and not necessarily indicative of an impending recession.

- Rosenberg's Key Arguments (Example):

- Slowing employment growth in the manufacturing sector.

- Rising unemployment claims in certain provinces.

- Moderation in wage growth despite continued low unemployment.

These arguments, combined with other economic factors, inform Rosenberg's outlook on the Canadian economy and his predictions for Bank of Canada rate expectations.

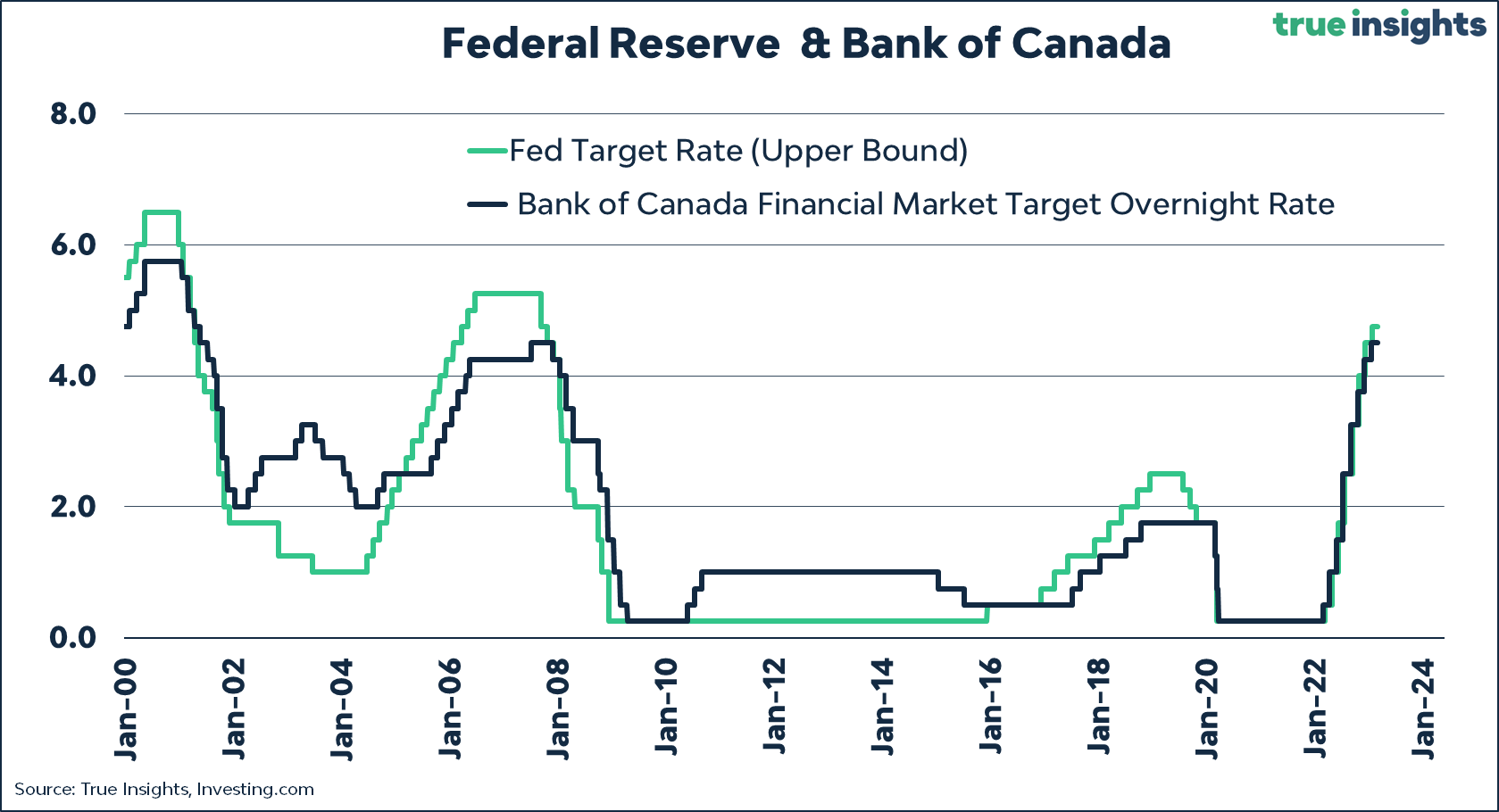

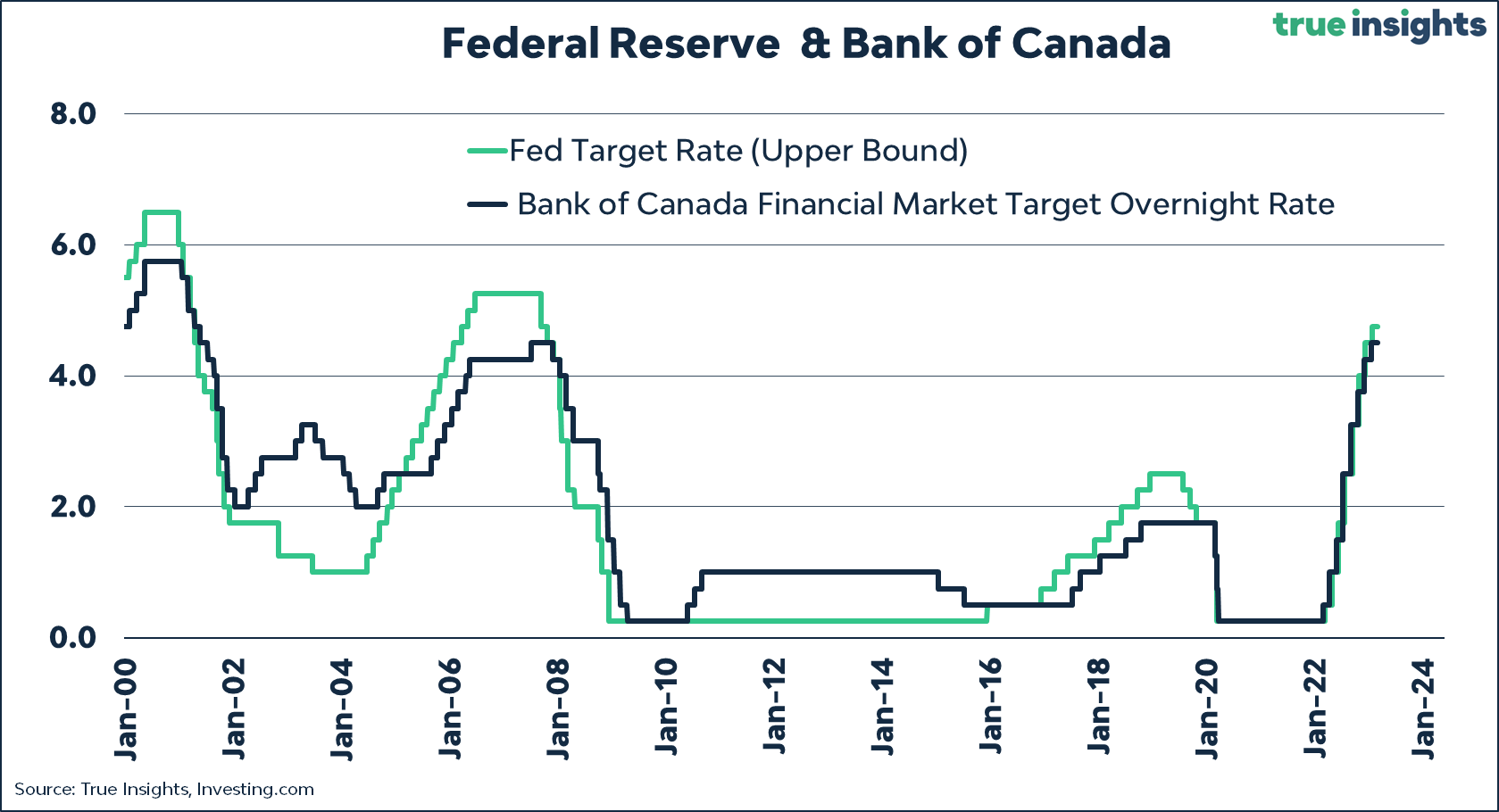

Implications for Bank of Canada Rate Expectations

Rosenberg’s analysis directly influences expectations regarding future Bank of Canada interest rate decisions. If he perceives the labour market as overheating (high wage growth, low unemployment), he may anticipate further interest rate hikes to curb inflation, in line with the Bank of Canada's mandate. Conversely, if he sees signs of a significant economic slowdown (slowing employment growth, rising unemployment), he might predict interest rate cuts or a pause in the rate hiking cycle.

- Potential Scenarios:

- Scenario 1 (Rosenberg's prediction of continued economic strength): Further interest rate hikes in the coming months to combat inflation.

- Scenario 2 (Rosenberg's prediction of a slowdown): The Bank of Canada pausing rate hikes or potentially cutting rates to stimulate economic growth.

- Scenario 3 (Neutral Stance): The Bank of Canada maintaining interest rates at the current level to assess the evolving economic situation.

The timing of these potential rate changes depends heavily on the data and Rosenberg's ongoing analysis. His insights are closely followed by market participants as they formulate their own Bank of Canada rate projections.

Conclusion: Understanding Bank of Canada Rate Expectations and Rosenberg's Insights

Understanding Bank of Canada rate expectations requires close attention to key economic indicators, particularly those related to the Canadian labour market. David Rosenberg’s analysis offers valuable insights into these indicators and their implications for future interest rate decisions. While his interpretations provide a valuable perspective, it's crucial to remember that economic forecasting is not an exact science. Unexpected events can significantly alter the economic landscape.

To refine your understanding of Bank of Canada interest rate predictions, stay informed about the latest economic data releases, Bank of Canada announcements, and follow respected economists like David Rosenberg. Consider subscribing to reputable financial news outlets and newsletters to remain updated on the latest developments and forecasts, helping you better understand Bank of Canada rate expectations and make informed decisions.

Featured Posts

-

Unexpected Visitor Elephant Seal Creates Traffic Chaos In Cape Town

May 31, 2025

Unexpected Visitor Elephant Seal Creates Traffic Chaos In Cape Town

May 31, 2025 -

Bernard Keriks Wife And Children An Overview Of His Family

May 31, 2025

Bernard Keriks Wife And Children An Overview Of His Family

May 31, 2025 -

The Good Life A Balanced Approach To Wellbeing And Success

May 31, 2025

The Good Life A Balanced Approach To Wellbeing And Success

May 31, 2025 -

Guelsen Bubikoglu Nun Son Goeruentuesue Yesilcam In Unutulmaz Guezeli Buguen Nasil Goeruenueyor Mine Tugay In Destegi

May 31, 2025

Guelsen Bubikoglu Nun Son Goeruentuesue Yesilcam In Unutulmaz Guezeli Buguen Nasil Goeruenueyor Mine Tugay In Destegi

May 31, 2025 -

Creating Voice Assistants Made Easy Open Ais 2024 Announcement

May 31, 2025

Creating Voice Assistants Made Easy Open Ais 2024 Announcement

May 31, 2025