Bank Of Canada Reconsiders Rate Cuts After Strong Retail Sales Report

Table of Contents

Robust Retail Sales Fuel the Reconsideration

The unexpectedly strong retail sales figures for [Insert Month and Year] have significantly influenced the Bank of Canada's reconsideration of further rate cuts. These figures, released by [Source, e.g., Statistics Canada], showed a [Percentage]% increase compared to the previous month and a [Percentage]% increase year-over-year. This surpasses analysts' predictions and signals a robust rebound in consumer spending.

Several sectors contributed to this surge:

- Automotive Sales: A significant increase in new and used vehicle purchases fueled a substantial portion of the retail sales growth.

- Furniture and Home Furnishings: Pent-up demand and home renovation projects boosted sales in this sector.

- Electronics and Appliances: Strong sales in this category indicate increased consumer confidence and spending power.

- Other Durable Goods: Growth was also seen in other durable goods categories, indicating a broader-based recovery.

This strong performance is partly attributed to ongoing government stimulus programs and a growing sense of consumer confidence. The success of these initiatives, coupled with the improving job market (see discussion below), appears to have boosted discretionary spending. The unexpectedly strong Canadian retail sales are a key factor in the Bank of Canada's reevaluation of its monetary policy.

Inflationary Pressures and the Bank of Canada's Mandate

The Bank of Canada's primary mandate is to maintain price stability, targeting an inflation rate of [Insert Target Inflation Rate]%. Strong retail sales, however, can contribute to inflationary pressures. Increased consumer demand, if not matched by a corresponding increase in supply, can lead to rising prices across various goods and services.

- Impact on Interest Rates: If inflation begins to rise significantly, the Bank of Canada might need to increase interest rates to cool down the economy and prevent runaway inflation. This could make borrowing more expensive for businesses and consumers.

- Balancing Act: The Bank of Canada faces the complex challenge of balancing economic growth with inflation control. Stimulating the economy through rate cuts can be beneficial, but it also risks triggering inflation. The recent data presents a potential conflict in these two goals.

- Inflation Rate Canada Concerns: The current inflation rate in Canada is [Insert Current Inflation Rate], and the Bank of Canada will be closely monitoring any upward trend. A persistent rise above the target rate would likely prompt a shift towards tighter monetary policy.

Alternative Economic Indicators and Their Influence

While robust retail sales provide a positive picture, the Bank of Canada considers a range of economic indicators to formulate its monetary policy. Other factors influencing the decision include:

- Canadian GDP Growth: The recent GDP growth rate of [Insert Current GDP Growth Rate] provides further context, offering a broader picture of economic health than retail sales alone.

- Unemployment Rate Canada: The unemployment rate currently stands at [Insert Current Unemployment Rate]. A declining unemployment rate indicates a strengthening labor market, which is generally positive but can contribute to inflationary pressure.

- Conflicting Signals: Interpreting economic data is complex. Sometimes, different indicators send conflicting signals, making it difficult for policymakers to form a cohesive strategy. The Bank of Canada must carefully weigh the nuances of all the data available.

The Role of Global Economic Factors

The Canadian economy is deeply intertwined with the global economy. Several external factors can influence the Bank of Canada's decisions, including:

- US Interest Rates: Changes in US interest rates can impact the Canadian dollar's exchange rate and influence investment flows into Canada. A rise in US rates, for example, could strengthen the US dollar, potentially impacting Canadian exports.

- Global Trade: Global trade conditions significantly affect Canada's export-oriented economy. Any disruption in global trade could impact economic growth and influence the Bank of Canada's monetary policy.

- Canadian Dollar Exchange Rate: Fluctuations in the Canadian dollar's exchange rate affect the price of imports and exports, impacting inflation and overall economic activity.

Conclusion

The Bank of Canada's reconsideration of planned rate cuts is a multifaceted issue, driven by a confluence of factors. Strong retail sales, the potential for increased inflationary pressures, the broader economic indicators like GDP growth and unemployment, and the influence of global economic conditions all play a significant role. Understanding the implications of Bank of Canada rate cuts requires a nuanced view of the interplay of these elements.

Call to Action: Stay informed about the evolving situation and the Bank of Canada's future decisions regarding interest rates. Regularly monitor news and analysis regarding Bank of Canada rate cuts and related keywords like Canadian retail sales, inflation rate Canada, and Canadian GDP growth to make informed financial decisions. Follow the Bank of Canada's official website for updates and announcements on monetary policy. Understanding the implications of Bank of Canada rate cuts is crucial for both individual financial planning and business strategy.

Featured Posts

-

Victor Osimhen To Manchester United Transfer Update

May 27, 2025

Victor Osimhen To Manchester United Transfer Update

May 27, 2025 -

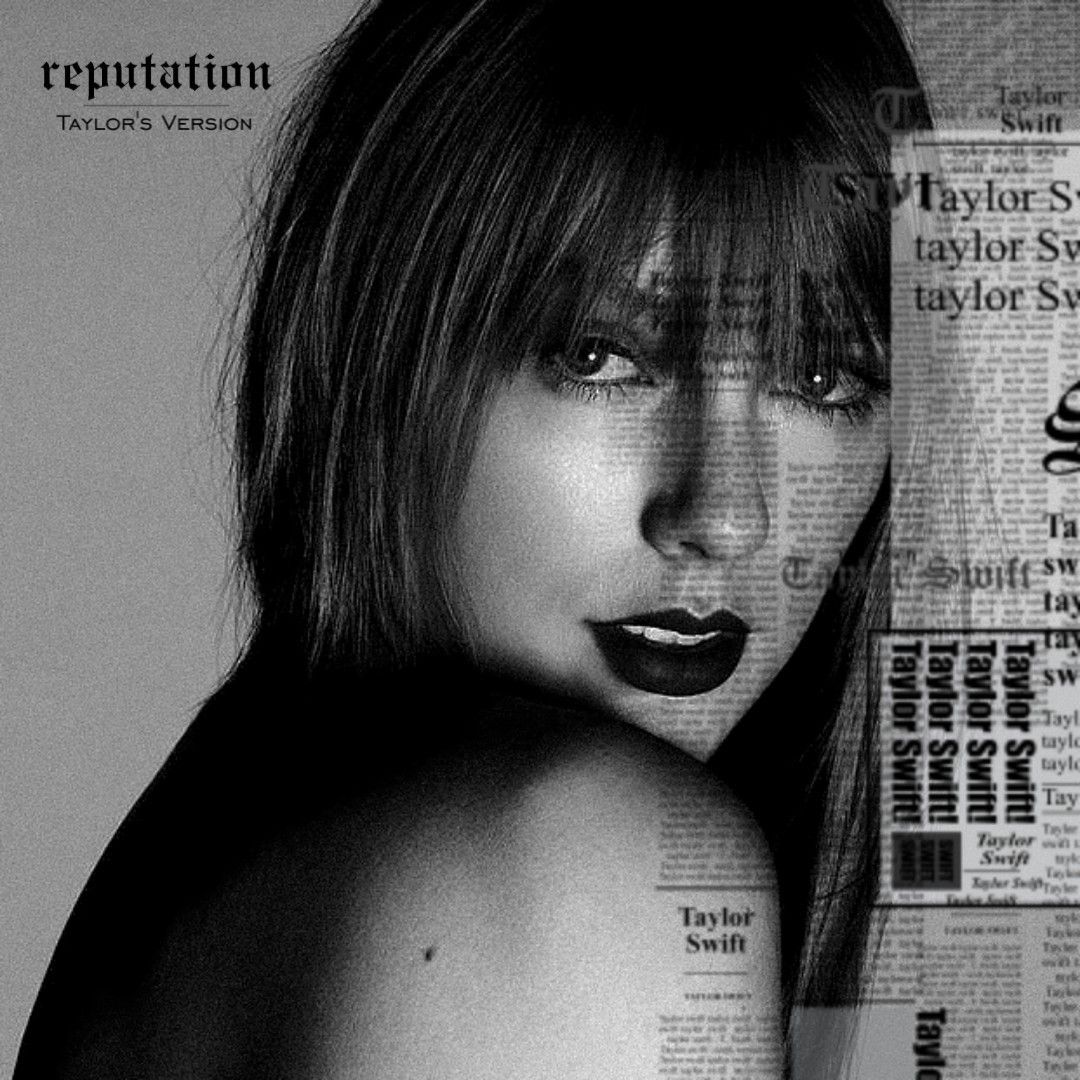

Taylor Swifts Reputation Taylors Version Tease Analyzing The Clues And What They Mean

May 27, 2025

Taylor Swifts Reputation Taylors Version Tease Analyzing The Clues And What They Mean

May 27, 2025 -

4 11 2025

May 27, 2025

4 11 2025

May 27, 2025 -

Ncaa March Madness Music Festival Artists Performing In 2024

May 27, 2025

Ncaa March Madness Music Festival Artists Performing In 2024

May 27, 2025 -

Atentatot Na Robert Kenedi Ob Aveni Dokumenti Od Amerikanskata Vlada

May 27, 2025

Atentatot Na Robert Kenedi Ob Aveni Dokumenti Od Amerikanskata Vlada

May 27, 2025

Latest Posts

-

Impact Of Manitoba Cfs Intervention On First Nations Parents A 21 Year Analysis

May 30, 2025

Impact Of Manitoba Cfs Intervention On First Nations Parents A 21 Year Analysis

May 30, 2025 -

Kivalliq Hydro Fibre Link Strengthening Manitoba And Nunavuts Energy And Economic Future

May 30, 2025

Kivalliq Hydro Fibre Link Strengthening Manitoba And Nunavuts Energy And Economic Future

May 30, 2025 -

Manitoba Child And Family Services First Nations Families And Intervention Rates 1998 2019

May 30, 2025

Manitoba Child And Family Services First Nations Families And Intervention Rates 1998 2019

May 30, 2025 -

Study Reveals High Rate Of Manitoba Cfs Intervention Among First Nations Parents

May 30, 2025

Study Reveals High Rate Of Manitoba Cfs Intervention Among First Nations Parents

May 30, 2025 -

Manitoba And Nunavut Partner On Kivalliq Hydro Fibre Link A New Economic And Energy Corridor

May 30, 2025

Manitoba And Nunavut Partner On Kivalliq Hydro Fibre Link A New Economic And Energy Corridor

May 30, 2025