Bank Of Canada's April Interest Rate Decision: Impact Of Trump Tariffs

Table of Contents

Inflationary Pressures and the Interest Rate Decision

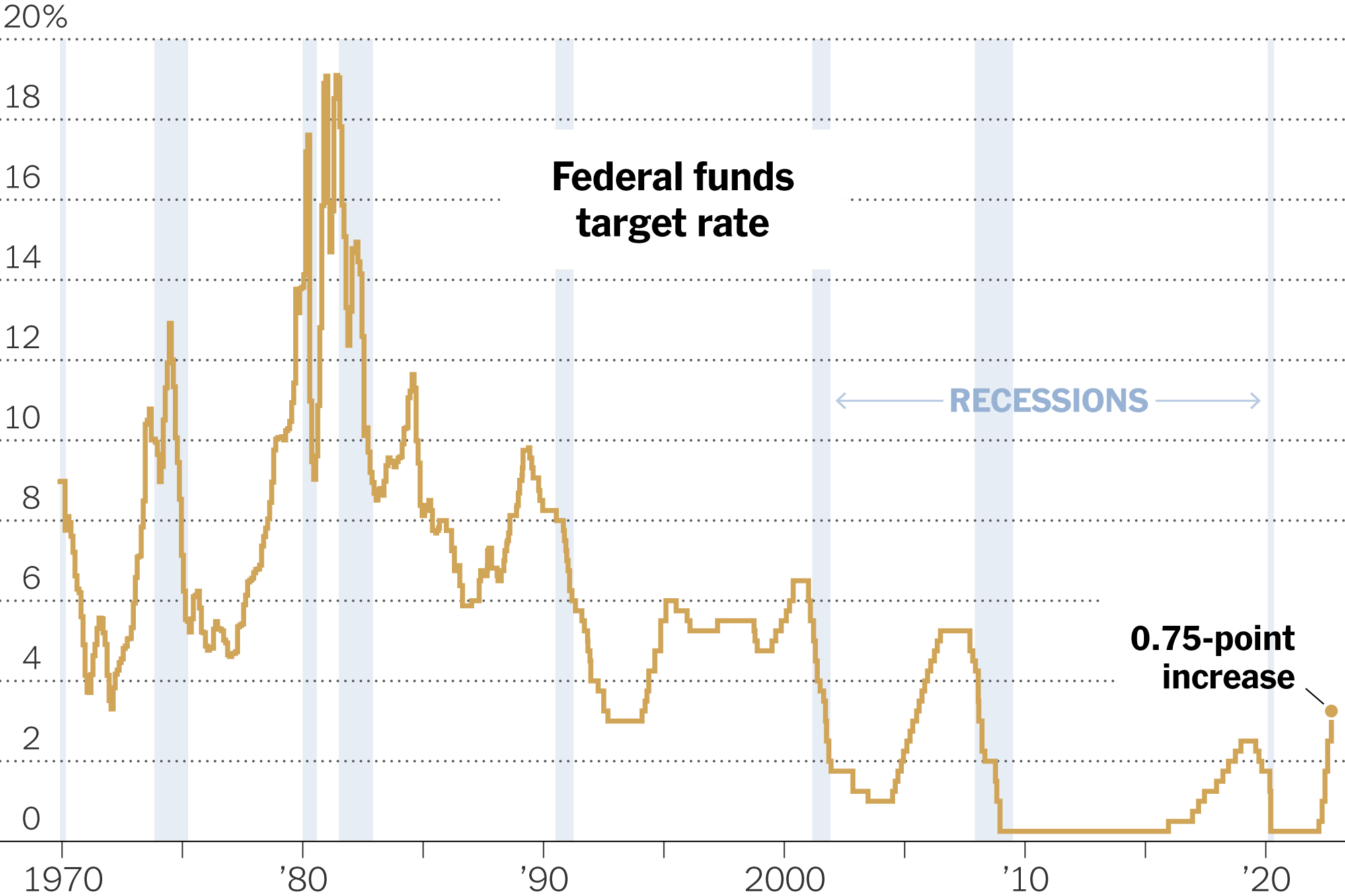

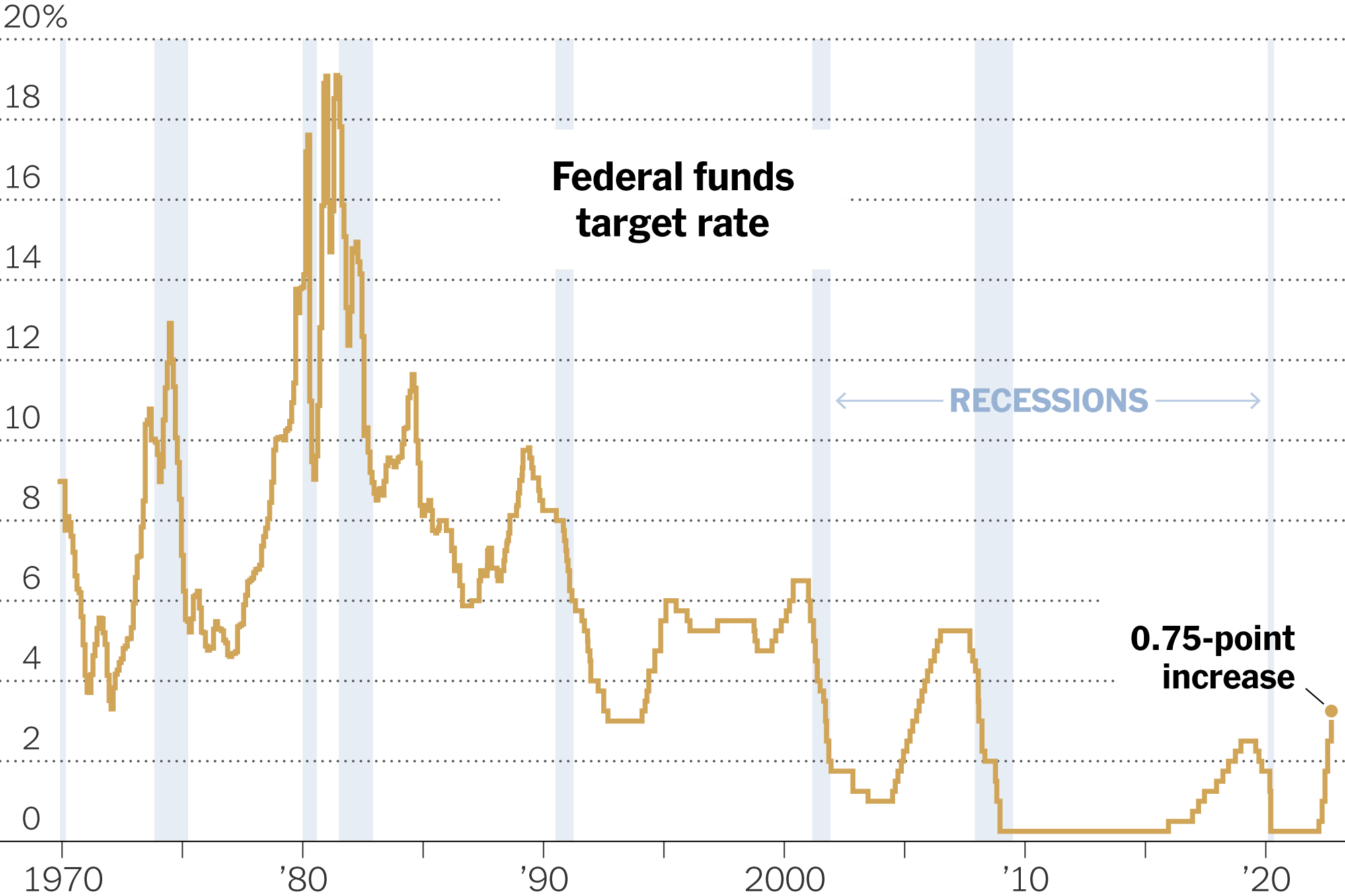

Canada's inflation rate in the lead-up to the April decision was a critical factor for the Bank of Canada. While the Bank aims for a 2% inflation target, measured by the Consumer Price Index (CPI), the actual rate fluctuated, influenced by several factors. The lingering effects of the Trump tariffs played a significant role, contributing to increased import prices.

- Impact of rising energy prices: Fluctuations in global energy markets directly impacted inflation, pushing prices higher.

- Effect of supply chain disruptions due to tariffs: Tariffs introduced bottlenecks and increased costs throughout supply chains, contributing to inflationary pressures.

- Consumer price index (CPI) analysis: Careful analysis of the CPI was crucial in determining the overall inflationary pressure within the Canadian economy and guiding the Bank's decision. Deviation from the target rate influenced the potential for a rate hike or hold.

Economic Growth and Trade Relations in the Wake of Tariffs

The Canadian economy's health, reflected in GDP growth and employment figures, was another key consideration. The Trump tariffs directly impacted specific sectors, such as agriculture and manufacturing, leading to reduced exports to the US and affecting overall economic growth.

- Impact on Canadian exports to the US: Reduced demand for Canadian goods due to tariffs led to decreased export revenues and job losses in affected industries.

- Trade diversification strategies employed by Canada: In response to the challenges posed by tariffs, Canada actively pursued strategies to diversify its trade relationships, reducing reliance on the US market.

- Government response to tariff-related economic challenges: The Canadian government implemented various support programs to help industries affected by the tariffs, mitigating some of the negative impacts.

The Bank of Canada's Response: Rate Hike or Hold?

Considering the interplay of inflation, economic growth, and trade tensions, the Bank of Canada had a crucial decision to make: raise interest rates or maintain the status quo. A rate hike could curb inflation but potentially stifle economic growth, while a hold could allow for continued growth but risk higher inflation.

- Factors considered by the Bank of Canada: The Bank carefully weighed the risks and benefits of each scenario, analyzing the available data on inflation, economic growth, and the ongoing impact of tariffs.

- Potential future interest rate adjustments: The decision in April was likely viewed as one step in a broader strategy, with future adjustments contingent on evolving economic indicators.

- Market reaction to the decision: The market's response to the Bank's announcement provided valuable insights into its impact on investor confidence and overall economic sentiment.

Long-Term Implications for the Canadian Economy

The Bank of Canada's April interest rate decision carries long-term consequences for the Canadian economy. The lingering effects of Trump-era tariffs continue to create uncertainty, impacting investment and consumer spending.

- Future economic forecasts: Economic forecasts following the decision provided insights into the projected trajectory of growth, inflation, and employment.

- Potential for future policy adjustments: The Bank's future actions will depend on economic developments, potentially requiring further policy adjustments to navigate economic challenges.

- Impact on Canadian dollar exchange rate: The interest rate decision and the overall economic outlook influenced the value of the Canadian dollar relative to other currencies.

Conclusion: Understanding the Bank of Canada's April Interest Rate Decision and the Lasting Impact of Tariffs

The Bank of Canada's April interest rate decision was a complex balancing act, heavily influenced by the persistent effects of Trump-era tariffs on inflation, economic growth, and trade relations. The short-term and long-term implications for the Canadian economy are significant, demanding careful monitoring and potential future adjustments in monetary policy. Navigating global trade relations continues to present both challenges and opportunities for Canada. To stay informed about future Bank of Canada's interest rate decisions and their impact on the economy, regularly check the Bank of Canada's official website for updates and analysis. Understanding these decisions is crucial for Canadians to make informed financial and economic decisions.

Featured Posts

-

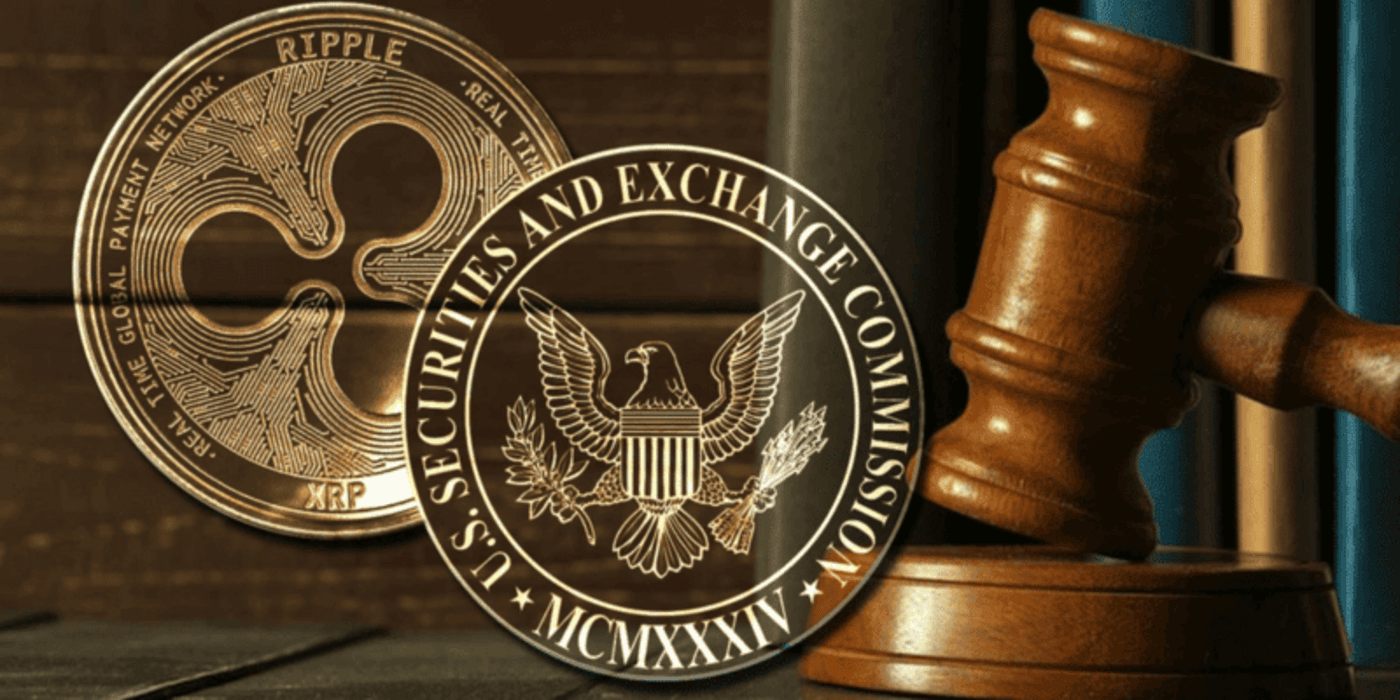

Xrp Price Prediction Will Xrp Reach 5 After Sec Lawsuit Dismissal

May 02, 2025

Xrp Price Prediction Will Xrp Reach 5 After Sec Lawsuit Dismissal

May 02, 2025 -

2025 Outlook Remains Unchanged For Rolls Royce Company Addresses Tariff Concerns

May 02, 2025

2025 Outlook Remains Unchanged For Rolls Royce Company Addresses Tariff Concerns

May 02, 2025 -

April 9th Wednesday Lotto Results Have You Won

May 02, 2025

April 9th Wednesday Lotto Results Have You Won

May 02, 2025 -

New Engagement Ring Daisy May Cooper Confirms Speculation

May 02, 2025

New Engagement Ring Daisy May Cooper Confirms Speculation

May 02, 2025 -

Become A Play Station Beta Tester Requirements And Registration Details

May 02, 2025

Become A Play Station Beta Tester Requirements And Registration Details

May 02, 2025