Bank Of England: Is A Half-Point Interest Rate Cut The Right Move?

Table of Contents

Arguments for a Half-Point Interest Rate Cut

Proponents of a half-point interest rate cut argue that it's a necessary step to revitalize the UK economy and address current challenges.

Stimulating Economic Growth

A significant reduction in interest rates can act as a powerful economic stimulus. Lower borrowing costs incentivize businesses to invest in expansion projects and hire more employees. Consumers, too, benefit from cheaper loans, encouraging increased spending and bolstering consumer confidence. This injection of capital into the economy can lead to increased economic activity and job creation.

- Increased borrowing: Businesses can access cheaper credit for expansion, leading to more jobs and output.

- Boosting investment: Lower interest rates make investments more attractive, encouraging both domestic and foreign investment.

- Improved consumer spending: Cheaper loans make large purchases more affordable, stimulating demand.

- Keywords: economic stimulus, monetary policy, boosting investment.

Combating Inflation (in certain scenarios)

While typically interest rate cuts are associated with combating deflation, in specific scenarios, they might be considered. If deflationary pressures are significant, a rate cut could help to prevent a prolonged economic downturn by stimulating demand. However, this is a high-risk strategy that needs careful consideration of the potential inflationary consequences. The risk vs. reward needs careful analysis.

- Deflationary spiral prevention: A rate cut can prevent a deflationary spiral where falling prices lead to reduced spending and further price decreases.

- Risk assessment crucial: The Bank of England must carefully assess the current economic data to ensure a rate cut won't worsen inflation in the long run.

- Keywords: inflation control, deflationary pressures, risk assessment.

Supporting the Pound

A lower interest rate could, in theory, attract foreign investment, thus strengthening the Pound Sterling. Investors may seek higher returns in countries with lower interest rates, leading to increased demand for the currency.

- Attracting foreign investment: Lower rates could make UK assets more attractive to international investors.

- Improved foreign exchange reserves: An increase in foreign investment would lead to an increase in foreign exchange reserves.

- Limitations: This effect is not guaranteed, and other factors can significantly influence currency markets.

- Keywords: foreign exchange, currency markets, pound sterling.

Arguments Against a Half-Point Interest Rate Cut

Opponents of a half-point interest rate cut raise concerns about potential negative consequences for the UK economy.

Fueling Inflation

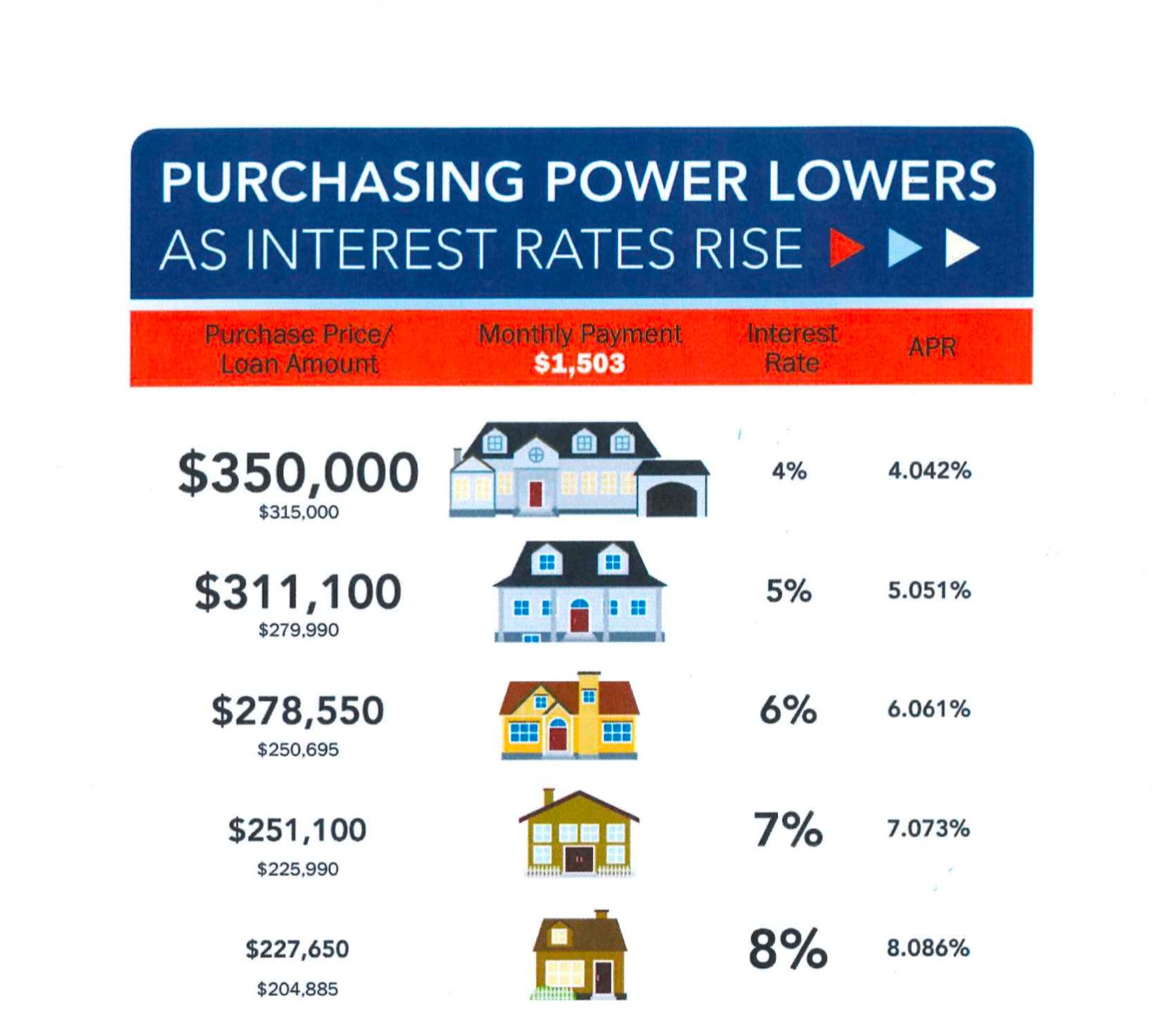

Lowering interest rates can fuel inflation by increasing consumer spending and borrowing. Increased demand without a corresponding increase in supply can push prices upward, eroding purchasing power. Uncontrolled inflation can have severe long-term consequences.

- Increased consumer spending: Cheaper borrowing encourages spending, pushing up demand.

- Higher import costs: A weaker pound (a potential consequence of lower interest rates) makes imports more expensive.

- Price instability: Uncontrolled inflation erodes savings and creates uncertainty.

- Keywords: inflationary pressures, consumer spending, price stability.

Eroding Savings

Lower interest rates directly impact savers, reducing the returns on their savings accounts and investments. This can significantly affect retirement planning and financial security for many individuals.

- Reduced savings rates: Lower interest rates mean lower returns on savings accounts and bonds.

- Impact on retirement planning: Reduced returns can affect the ability to save enough for retirement.

- Financial instability for savers: Reduced income from savings can create financial instability for vulnerable individuals.

- Keywords: savings rates, return on investment, financial stability.

Weakening the Pound

Lower interest rates can make the Pound less attractive to foreign investors, potentially leading to a devaluation of the currency. This can increase the cost of imports and negatively impact the UK's trade balance.

- Reduced foreign investment: Lower rates can reduce the attractiveness of UK assets to foreign investors.

- Currency devaluation: A weaker Pound increases import costs and reduces the competitiveness of UK exports.

- Negative impact on trade balance: Increased import costs and reduced export competitiveness can worsen the UK's trade balance.

- Keywords: currency devaluation, import costs, export competitiveness.

Analyzing the Current Economic Landscape

To effectively evaluate the potential impact of a half-point interest rate cut, it’s crucial to analyze the current economic landscape. Examining the latest inflation figures, unemployment rates, and GDP growth data, alongside global economic factors impacting the UK, is essential. The Bank of England must consider these factors carefully when making its decision.

- Inflation rate: The current inflation rate is a key factor to consider.

- Unemployment figures: Employment levels indicate the health of the labor market.

- GDP growth: The rate of GDP growth provides insight into the overall economic performance.

- Global economic factors: Global events and economic trends can also influence the UK economy.

- Keywords: GDP growth, inflation rate, unemployment figures, economic outlook.

Conclusion: The Bank of England's Decision on Interest Rate Cuts - What's Next?

The decision regarding a half-point interest rate cut by the Bank of England is fraught with complexity. While a cut could stimulate economic growth and potentially support the Pound, it also risks fueling inflation, eroding savings, and weakening the currency. The Bank must carefully weigh the potential benefits against the considerable risks involved. Alternative monetary policy tools, such as quantitative easing, could also be considered.

Share your thoughts on the Bank of England's interest rate policy and its impact on the UK economy in the comments section below. Understanding the implications of a Bank of England interest rate cut is crucial, as it affects the UK economy and individual finances significantly. The Bank of England interest rate decision will shape the future economic outlook, influencing everything from borrowing costs to the value of the Pound.

Featured Posts

-

Stream Andor Season 1 Episodes 1 3 Hulu And You Tube Availability

May 08, 2025

Stream Andor Season 1 Episodes 1 3 Hulu And You Tube Availability

May 08, 2025 -

El Psg Vence Al Lyon En Un Partido Disputado En Casa

May 08, 2025

El Psg Vence Al Lyon En Un Partido Disputado En Casa

May 08, 2025 -

Impact Of Dwp Reforms On Universal Credit Recipients

May 08, 2025

Impact Of Dwp Reforms On Universal Credit Recipients

May 08, 2025 -

Ethereums Path To 2 700 A Deep Dive Into Wyckoff Accumulation

May 08, 2025

Ethereums Path To 2 700 A Deep Dive Into Wyckoff Accumulation

May 08, 2025 -

Brookfield Capitalizes On Market Dislocation Opportunistic Investment Strategy

May 08, 2025

Brookfield Capitalizes On Market Dislocation Opportunistic Investment Strategy

May 08, 2025