Bank Of Japan Cuts Growth Forecast Amidst Trade War Impact

Table of Contents

Trade War's Impact on Japanese Exports

The ongoing trade war, particularly between the US and China, has dealt a significant blow to Japanese exports. Japan, a major exporter of automobiles, electronics, and machinery, is acutely vulnerable to escalating tariffs and trade restrictions. The decreased demand for Japanese goods in key markets like the US and China has directly translated into a decline in export revenues.

- Decreased demand for Japanese goods in key markets: Tariffs imposed on Japanese goods have made them less competitive, impacting sales volumes. Uncertainty surrounding future trade policies further dampens buyer confidence.

- Rising costs due to tariffs and trade barriers: The imposition of tariffs increases the price of Japanese exports, reducing their competitiveness and eroding profit margins for Japanese businesses.

- Increased uncertainty impacting investment decisions: The ongoing trade conflict creates an environment of uncertainty, leading businesses to postpone investment decisions and reduce capital expenditure. This hesitancy contributes to slower economic growth.

For instance, the automotive industry, a cornerstone of the Japanese economy, has experienced a notable slowdown in exports to both the US and China, leading to production cuts and job losses in related sectors. Similarly, the electronics sector has also felt the pinch due to reduced demand and increased input costs. Statistics from the Ministry of Finance clearly indicate a substantial decline in exports over the past quarters, further supporting these observations.

Revised GDP Growth Projections and Their Implications

The BOJ's revised GDP growth forecast reflects the negative impact of the trade war and other economic headwinds. The bank has lowered its projection for [insert specific numbers and timeframe, e.g., fiscal year 2024] growth from [insert previous projection] to [insert revised projection]. This reduction carries significant implications across various sectors.

- Lower consumer spending due to economic uncertainty: The uncertainty surrounding the trade war and its impact on jobs and incomes is dampening consumer confidence, leading to reduced spending.

- Reduced business investment due to lack of confidence: Businesses are hesitant to invest in expansion or new projects due to the prevailing uncertainty, further slowing economic growth.

- Potential for further monetary easing measures: The downward revision in growth projections increases the likelihood of the BOJ implementing further monetary easing measures to stimulate the economy.

This lowered growth projection suggests a slower pace of economic expansion than previously anticipated, potentially leading to slower job creation and subdued wage growth. Inflationary pressures are also likely to remain muted in the near term.

Bank of Japan's Response and Potential Monetary Policy Adjustments

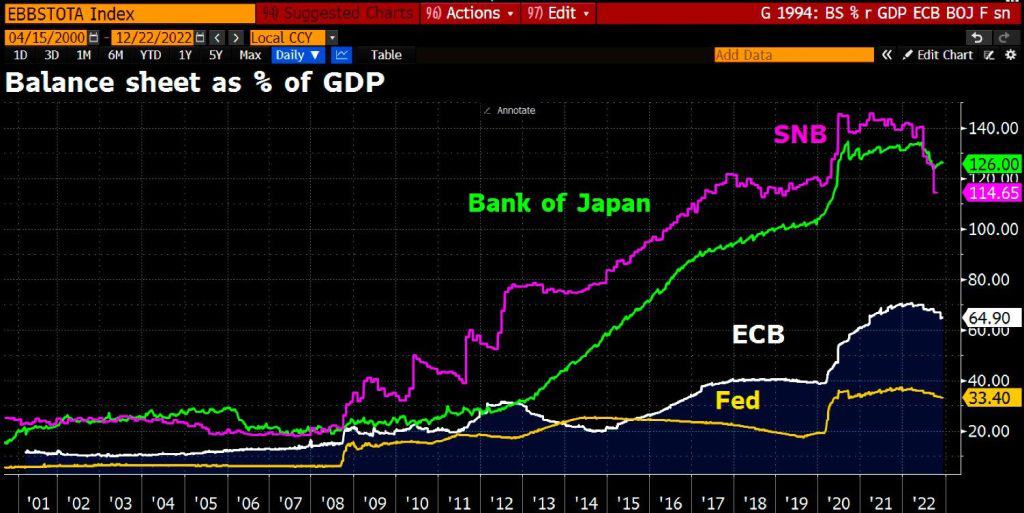

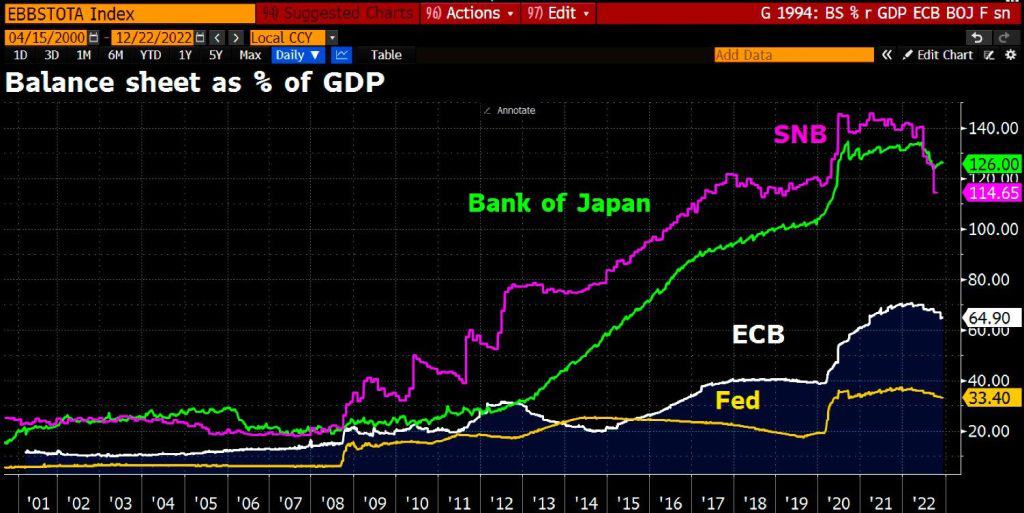

In response to the weakening economic outlook, the BOJ is likely to consider various policy adjustments. These could include further expansion of its quantitative easing (QE) program, possibly extending its already negative interest rate policy, or even exploring alternative monetary policy tools.

- Further expansion of quantitative easing programs: The BOJ may increase its asset purchases to inject more liquidity into the financial system and lower long-term interest rates.

- Potential adjustments to negative interest rate policy: While negative interest rates have faced criticism, the BOJ might consider further lowering them to stimulate borrowing and investment.

- Exploration of alternative monetary policy tools: Given the limitations of conventional monetary policy tools, the BOJ might explore alternative options such as yield curve control or forward guidance.

However, these measures have limitations. Further expansion of QE may lead to diminishing returns, while negative interest rates can squeeze bank profitability and hinder lending.

Global Economic Outlook and its Influence on Japan

The global economic outlook remains uncertain, further impacting Japan's economic forecast. The interconnectedness of global economies means that trade disputes and slowdowns in other major economies directly affect Japan's growth prospects.

- Slowdown in global growth affecting demand for Japanese exports: A global economic slowdown reduces demand for Japanese goods, irrespective of trade disputes.

- Uncertainty in global financial markets impacting investor confidence: Global market volatility increases uncertainty and dampens investor sentiment, impacting investment in Japan.

- Geopolitical risks further complicating the economic outlook: Global geopolitical risks further add to the uncertainty, making economic forecasting more challenging.

Conclusion: Understanding the Bank of Japan's Growth Forecast Reduction and its Implications

The Bank of Japan's recent reduction in its growth forecast highlights the significant negative impact of the ongoing trade war on the Japanese economy. The lowered projection, primarily driven by decreased exports and weakened investor confidence, has considerable implications for various sectors, potentially affecting employment, inflation, and consumer spending. The BOJ's likely policy response, including further monetary easing, will be crucial in mitigating these negative effects. However, the effectiveness of these measures remains to be seen, given the complex global economic environment and the limitations of conventional monetary policy tools. Staying informed about the ongoing developments and the Bank of Japan's future policy decisions regarding the Bank of Japan's growth forecast is crucial for understanding the future trajectory of the Japanese economy. Further research into the impact of trade wars on specific Japanese industries and the effectiveness of different monetary policy tools will provide a more comprehensive understanding of this complex economic situation.

Featured Posts

-

Newsround Viewing Guide Bbc Two Hd Channel Information

May 02, 2025

Newsround Viewing Guide Bbc Two Hd Channel Information

May 02, 2025 -

Obituary For Lisa Ann Keller East Idaho News

May 02, 2025

Obituary For Lisa Ann Keller East Idaho News

May 02, 2025 -

Rolls Royce 2025 Forecast Tariffs Pose No Significant Threat

May 02, 2025

Rolls Royce 2025 Forecast Tariffs Pose No Significant Threat

May 02, 2025 -

Six Nations 2024 Frances Victory Over Italy Irelands Challenge Awaits

May 02, 2025

Six Nations 2024 Frances Victory Over Italy Irelands Challenge Awaits

May 02, 2025 -

Is This Christina Aguilera New Pictures Fuel Photoshop Controversy

May 02, 2025

Is This Christina Aguilera New Pictures Fuel Photoshop Controversy

May 02, 2025