Bank Of Japan's Bleak Economic Outlook: Impact Of Global Trade Conflicts

Table of Contents

The Bank of Japan's Concerns and Revised Forecasts

The Bank of Japan has expressed significant concern over the deteriorating economic landscape, primarily fueled by global trade uncertainties. This concern is reflected in their revised GDP growth forecasts and worries about inflation.

Slowing Economic Growth

The Bank of Japan has significantly downgraded its GDP growth projections for the current fiscal year.

- Revised Projections: The initial forecast of X% growth has been revised down to Y%, reflecting a considerable slowdown. (Replace X and Y with actual figures and cite the source).

- Reasons for Slowdown: This decline is primarily attributed to weakened global demand, dampened business investment due to trade tensions, and decreased consumer spending fueled by uncertainty.

- Impact on Key Indicators: This slowdown is evident in key economic indicators like a decline in capital expenditure, reduced industrial production, and softer-than-expected consumer spending figures. The export sector, a crucial driver of Japan's economy, is particularly vulnerable.

Weakening Yen and Inflation

The escalating global trade conflicts have also weakened the Japanese Yen.

- Yen Depreciation: The Yen's depreciation, while offering a short-term boost to export competitiveness, also increases import costs, impacting inflation.

- Inflationary Pressures: Rising import prices, coupled with subdued domestic demand, pose a challenge to the Bank of Japan's inflation targets. Achieving the desired 2% inflation rate becomes increasingly difficult in this environment.

- Monetary Policy Adjustments: The Bank of Japan may need to reconsider its monetary policy stance, potentially exploring further easing measures to stimulate growth and counter deflationary pressures. This could involve maintaining or even expanding its quantitative easing program.

The Impact of Global Trade Conflicts on the Japanese Economy

Global trade conflicts have severely impacted the Japanese economy through disrupted supply chains and reduced exports and investment.

Disrupted Supply Chains

Japan's highly integrated global supply chains are particularly vulnerable to trade disruptions.

- Impact on Industries: The automotive and electronics industries, heavily reliant on global supply chains, are experiencing significant disruptions, leading to production delays and increased costs.

- Increased Costs and Uncertainty: Businesses face increased uncertainty regarding future trade policies, leading to hesitancy in investment and expansion plans. This uncertainty creates ripple effects throughout the economy.

- Manufacturing Relocation: Some Japanese companies are considering relocating manufacturing facilities to mitigate risks associated with trade tensions. This could have long-term implications for Japan's economic landscape.

Reduced Exports and Investment

The ongoing trade conflicts have led to a decrease in Japanese exports and foreign direct investment.

- Export Decline: Data shows a decline in exports to key markets, reflecting the impact of trade tariffs and reduced global demand. (Cite data and sources here).

- Ripple Effect: This decline in exports impacts various sectors, from manufacturing to transportation and logistics, leading to job losses and reduced economic activity.

- Foreign Investment Slowdown: Uncertainty surrounding trade policies discourages foreign investment in Japan, further hampering economic growth.

Potential Consequences and Policy Responses

The persistence of global trade conflicts could lead to severe consequences for the Japanese economy and necessitates proactive policy responses.

Further Economic Slowdown

The continuation of these trade tensions could push the Japanese economy into a deeper recession.

- Vulnerability to External Shocks: Japan's export-oriented economy is highly vulnerable to external shocks, making it susceptible to further economic downturn if global trade conflicts persist.

- Economic Impact Scenarios: Various scenarios have been modeled, highlighting the potential for significant job losses, reduced consumer spending, and a prolonged period of low economic growth.

Bank of Japan's Policy Options

The Bank of Japan has limited policy options to address the challenges posed by externally driven trade conflicts.

- Monetary Easing: Further monetary easing, such as lowering already negative interest rates or expanding quantitative easing programs, may be considered to stimulate economic activity. However, the effectiveness of such measures in addressing trade-related issues is debatable.

- Fiscal Policy Coordination: Close coordination with the Japanese government on fiscal policy measures, such as infrastructure spending or tax cuts, could provide additional support to the economy.

- Limitations of Monetary Policy: Monetary policy alone may be insufficient to fully counteract the negative effects of trade conflicts.

Conclusion

The Bank of Japan's bleak economic outlook underscores the significant negative impact of global trade conflicts on the Japanese economy. The slowdown in economic growth, weakening Yen, and challenges in achieving inflation targets highlight the severity of the situation. The potential for a deeper recession if these conflicts persist is a real concern. The Bank of Japan’s policy options are limited, requiring a coordinated approach with fiscal policy to mitigate the damage. Staying updated on the Bank of Japan's response to the bleak economic outlook and the ongoing impact of global trade conflicts is crucial. Follow our news and analysis for further insights into Japan's economic future and the implications of global trade dynamics.

Featured Posts

-

Kivinin Kabugu Yenir Mi Yenmez Mi Tam Bir Rehber

May 03, 2025

Kivinin Kabugu Yenir Mi Yenmez Mi Tam Bir Rehber

May 03, 2025 -

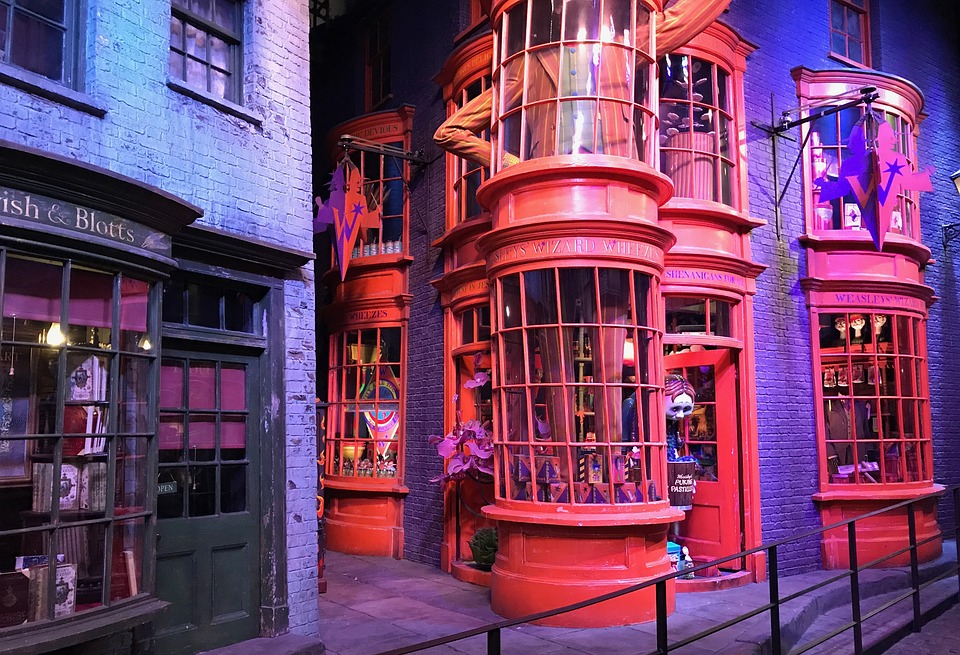

Naujas Hario Poterio Pramogu Parkas Sanchajuje Atidarymas 2027 Metais

May 03, 2025

Naujas Hario Poterio Pramogu Parkas Sanchajuje Atidarymas 2027 Metais

May 03, 2025 -

Eneco Inaugure Son Grand Parc De Batteries A Au Roeulx Un Projet Majeur Pour La Belgique

May 03, 2025

Eneco Inaugure Son Grand Parc De Batteries A Au Roeulx Un Projet Majeur Pour La Belgique

May 03, 2025 -

Could Boris Johnsons Comeback Save The Tory Party

May 03, 2025

Could Boris Johnsons Comeback Save The Tory Party

May 03, 2025 -

Amant Alastthmar Baljbht Alwtnyt Wrqt Syasat Aqtsadyt Jdydt

May 03, 2025

Amant Alastthmar Baljbht Alwtnyt Wrqt Syasat Aqtsadyt Jdydt

May 03, 2025

Latest Posts

-

Nc Supreme Court Election Appeal Implications Of The Gop Candidates Action

May 03, 2025

Nc Supreme Court Election Appeal Implications Of The Gop Candidates Action

May 03, 2025 -

Analyzing Voter Turnout In Florida And Wisconsin Implications For The Current Political Moment

May 03, 2025

Analyzing Voter Turnout In Florida And Wisconsin Implications For The Current Political Moment

May 03, 2025 -

North Carolina Supreme Court Race Gop Candidate Appeals Latest Orders

May 03, 2025

North Carolina Supreme Court Race Gop Candidate Appeals Latest Orders

May 03, 2025 -

Maines Post Election Audit Pilot Transparency And Accountability

May 03, 2025

Maines Post Election Audit Pilot Transparency And Accountability

May 03, 2025 -

Recent Survey 93 Of Respondents Trust South Carolina Elections

May 03, 2025

Recent Survey 93 Of Respondents Trust South Carolina Elections

May 03, 2025