BBAI Stock: Analyzing The Recent Analyst Downgrade And Implications For Growth

Table of Contents

Understanding the Analyst Downgrade

Reasons Behind the Downgrade

Several factors contributed to the recent negative assessment of BBAI stock by analysts. Concerns primarily revolve around several key areas:

-

Increased Competition: The AI market is fiercely competitive. Analysts cited the emergence of stronger competitors with potentially superior technologies as a major headwind for BBAI's growth. This intensified competition is squeezing profit margins and slowing revenue growth.

-

Slower-than-Expected Revenue Growth: Financial reports revealed revenue growth figures that fell short of analyst expectations. This shortfall raised concerns about BBAI's ability to maintain its market share and achieve its projected growth targets.

-

Market Saturation and Shifting Demand: The analyst reports also pointed towards a potential saturation of the specific market segment BBAI currently dominates. Shifting consumer preferences and evolving technological trends are also contributing factors.

-

Analyst Quotes & Target Price Reductions: Several prominent analysts issued statements expressing concerns, with specific quotes highlighting the aforementioned issues. The consensus among these analysts led to a significant reduction in the target price for BBAI stock. For instance, Analyst X stated "[insert direct quote expressing concern about BBAI's growth prospects]", resulting in a [percentage]% reduction in their target price. This action directly reflects the negative sentiment surrounding the company.

Impact on BBAI Stock Price

The analyst downgrade triggered an immediate and substantial drop in BBAI's stock price.

-

Percentage Change: Following the announcement, the stock price experienced a [insert percentage]% decrease within [timeframe], a significant indicator of negative investor sentiment.

-

Trading Volume Fluctuations: Trading volume spiked dramatically following the downgrade, reflecting increased trading activity and heightened investor interest (both positive and negative).

-

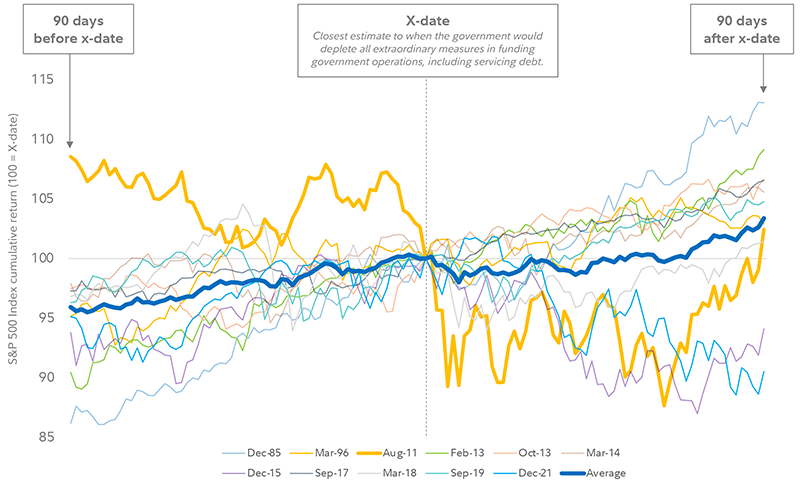

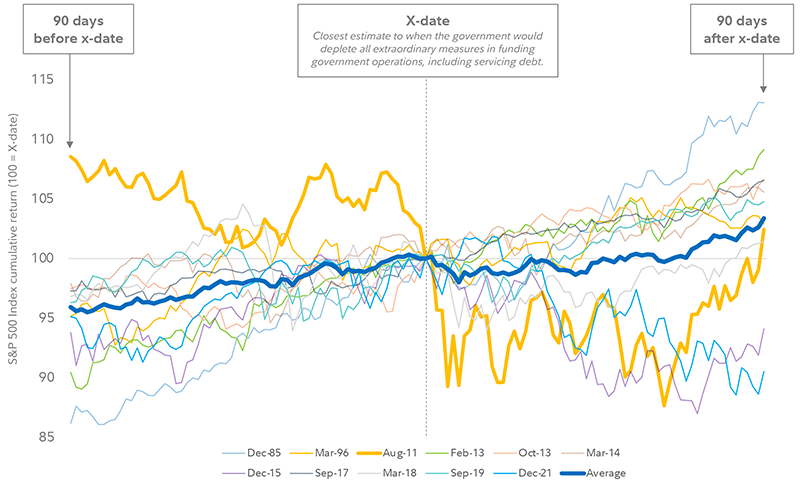

Investor Sentiment Indicators: Various investor sentiment indicators, such as short interest and options trading activity, showed a marked increase in negative sentiment, further reinforcing the impact of the downgrade. [Include relevant chart showing price movement].

Evaluating BBAI's Long-Term Growth Potential

BBAI's Competitive Landscape

BBAI operates in a highly competitive AI landscape. Key competitors include [list key competitors] each possessing unique strengths and weaknesses.

-

Market Share Analysis: BBAI currently holds an estimated [insert percentage]% market share, facing challenges from competitors with aggressive expansion strategies and innovative product offerings.

-

Technological Innovation: BBAI's competitive advantage lies in [describe BBAI's key technological advantages]. However, competitors are rapidly closing the gap, necessitating continued innovation from BBAI.

BBAI's Financial Health and Fundamentals

Analyzing BBAI's financial statements is crucial for understanding its long-term viability.

-

Key Financial Ratios: Examining key ratios like the debt-to-equity ratio, revenue growth rates, and profit margins is essential to assess financial health. [Insert relevant data from financial statements – if possible].

-

Cash Flow Analysis: A strong and consistent cash flow is vital for sustained growth. Analyzing BBAI’s cash flow statement will reveal its ability to fund operations, invest in R&D, and manage debt effectively.

Future Growth Catalysts

Despite the challenges, BBAI possesses several potential growth catalysts.

-

New Product Launches: Upcoming product launches in [mention specific product areas] could significantly boost revenue and market share.

-

Market Expansion: Expanding into new geographical markets and targeting new customer segments can unlock significant growth opportunities.

-

Strategic Partnerships: Collaborations with established players in the industry could provide access to new technologies, resources, and markets.

Risk Assessment and Investment Considerations

Potential Risks and Challenges

Investing in BBAI stock involves significant risks.

-

Market Volatility: The AI sector is inherently volatile, subject to rapid technological advancements and shifts in market sentiment.

-

Competitive Pressures: Intense competition necessitates continuous innovation and efficient resource allocation to maintain market share.

-

Regulatory Changes: Government regulations and policies governing AI technology can significantly impact BBAI's operations and profitability.

Investment Strategies for BBAI Stock

Given the recent downgrade and future growth prospects, investors must carefully consider their risk tolerance.

-

Buy-and-Hold Strategy: This strategy is suitable for long-term investors with a high risk tolerance who believe in BBAI's long-term growth potential despite current challenges.

-

Value Investing: This strategy focuses on identifying undervalued companies. If BBAI's stock price is deemed undervalued compared to its intrinsic value, it could represent a buying opportunity.

Conclusion

The recent analyst downgrade of BBAI stock reflects legitimate concerns regarding competition, revenue growth, and market dynamics. However, a thorough assessment of BBAI's financial health, competitive landscape, and potential growth catalysts reveals a mixed picture. While risks are substantial, the potential for long-term growth remains. Before investing in BBAI stock, conducting thorough due diligence, understanding your risk tolerance, and staying informed about future developments are crucial. Follow reputable financial news sources and conduct independent research to make informed decisions regarding your BBAI stock investment. Remember, this is not financial advice; always consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Gaza Food Crisis Israel Announces First Food Shipments In Months

May 20, 2025

Gaza Food Crisis Israel Announces First Food Shipments In Months

May 20, 2025 -

Hl Syueyd Aldhkae Alastnaey Ktabt Rwayat Ajatha Krysty

May 20, 2025

Hl Syueyd Aldhkae Alastnaey Ktabt Rwayat Ajatha Krysty

May 20, 2025 -

Meurtre D Aramburu Enquete Sur Un Crime D Extreme Droite

May 20, 2025

Meurtre D Aramburu Enquete Sur Un Crime D Extreme Droite

May 20, 2025 -

Huuhkajien Avauskokoonpano Naein Se Muuttuu

May 20, 2025

Huuhkajien Avauskokoonpano Naein Se Muuttuu

May 20, 2025 -

Robert Pattinson And Suki Waterhouse A Look At Twilight Star Relationships

May 20, 2025

Robert Pattinson And Suki Waterhouse A Look At Twilight Star Relationships

May 20, 2025

Latest Posts

-

Pasxa Kai Protomagia Sto Oropedio Evdomos Enas Oneirikos Proorismos

May 20, 2025

Pasxa Kai Protomagia Sto Oropedio Evdomos Enas Oneirikos Proorismos

May 20, 2025 -

Oropedio Evdomos Protomagia Drastiriotites And Protaseis

May 20, 2025

Oropedio Evdomos Protomagia Drastiriotites And Protaseis

May 20, 2025 -

Prokrisi Ston Teliko Champions League I Kroyz Azoyl Toy Giakoymaki

May 20, 2025

Prokrisi Ston Teliko Champions League I Kroyz Azoyl Toy Giakoymaki

May 20, 2025 -

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 20, 2025

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 20, 2025 -

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn Tin Prokrisi Ston Teliko

May 20, 2025

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn Tin Prokrisi Ston Teliko

May 20, 2025